- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I rounded out my northern hemispheric summer holiday by flipping the script and travelling to the southern hemisphere to ski for two weeks. I spent the majority of my time in the backcountry ski touring. For those of you who have not had the pleasure of engaging in this activity, it consists of sticking skins on the bottom of your skis that allow you to glide up the mountain. Once at your elevated destination, remove the skins, place your boots/skis into downhill mode, and shred succulent pow. The majority of the particular mountain range I visited can only be accessed in this way.

A typical four to five-hour day consists of 80% uphill skiing and 20% downhill skiing. As such, this activity is highly energy-intensive. Your body burns calories, heating itself to maintain homeostasis. Your legs, which contain the body’s largest muscle groups, are constantly working whether you are climbing or downhill skiing. My basal metabolic rate is almost 3,000 kcal; adding the energy needed to pump my legs brings my daily total to over 4,000 kcal.

Due to the insane energy needed to complete this activity, the mix of foods I consume throughout the day is essential. I start the morning with a massive breakfast of carbs, meat, and veggies; I call this “real food.” Breakkie fills me up, but this initial energy store quickly gets used up as I enter the cold forest and start the initial ascent. To manage my blood glucose levels, I pack snacks I would otherwise typically avoid, like Su Zhu and Kylie Davies avoid the BVI bankruptcy court-appointed liquidator. I consume Snickers bars and sugar goo every 30 minutes on average, even if I’m not hungry. I don’t want my blood sugar levels to run low and disrupt my flow.

Eating sugary processed food is not a long-term solution for my energy needs. I also need to eat “real food.” Every time I complete a lap, I usually stop for a few minutes, open my backpack, and chow down a portion of whatever “meal” I prepared. I prefer a Tupperware box filled with chicken or beef, stir-fried leafy greens, and a copious amount of white rice.

I combine periodic sugar highs with the consumption of longer-burning, cleaner “real food” fuel in order to maintain my performance throughout the day.

The purpose of this description of my ski touring meal prep is to segway into a discussion about the relative importance of the price vs. the quantity of money. To me, the price of money is like the Snickers bars and sugar goo I consume to get a quick glucose boost. The quantity of money is like the slow, long, burning “real food.” After the Powel Payroll Pivot announced at the Jackson Hole central wanker circlejerk last Friday, the US Federal Reserve (Fed) finally committed to cutting its policy rate. In addition, officials from the Bank of England (BOE) and European Central Bank (ECB) indicated that they would also continue cutting their policy rates.

Powell delivered the pivot at roughly 9 a.m. GMT-6, which corresponds to the red oval. Risky assets represented by the S&P 500 Index (white), gold (gold), and Bitcoin (green) all rose as the price of money declined. The dollar, which is not shown here, also ended the week weaker as well.

The initial positive market reaction is justified because investors believe that if money is cheaper, assets priced in fiat dollars of fixed supply should rise. I agree; however … we are forgetting that these future anticipated rate cuts by the Fed, BOE, and ECB reduce the interest rate differential between these currencies and the yen. The danger of the yen carry trade unwind will reappear and could derail the party unless “real food” in the form of central bank balance sheet expansion, aka money printing, raises the quantity of money.

Please read my essay “Spirited Away” for an in-depth discussion of this yen carry trade. I will refer to this phenomenon frequently through this essay.

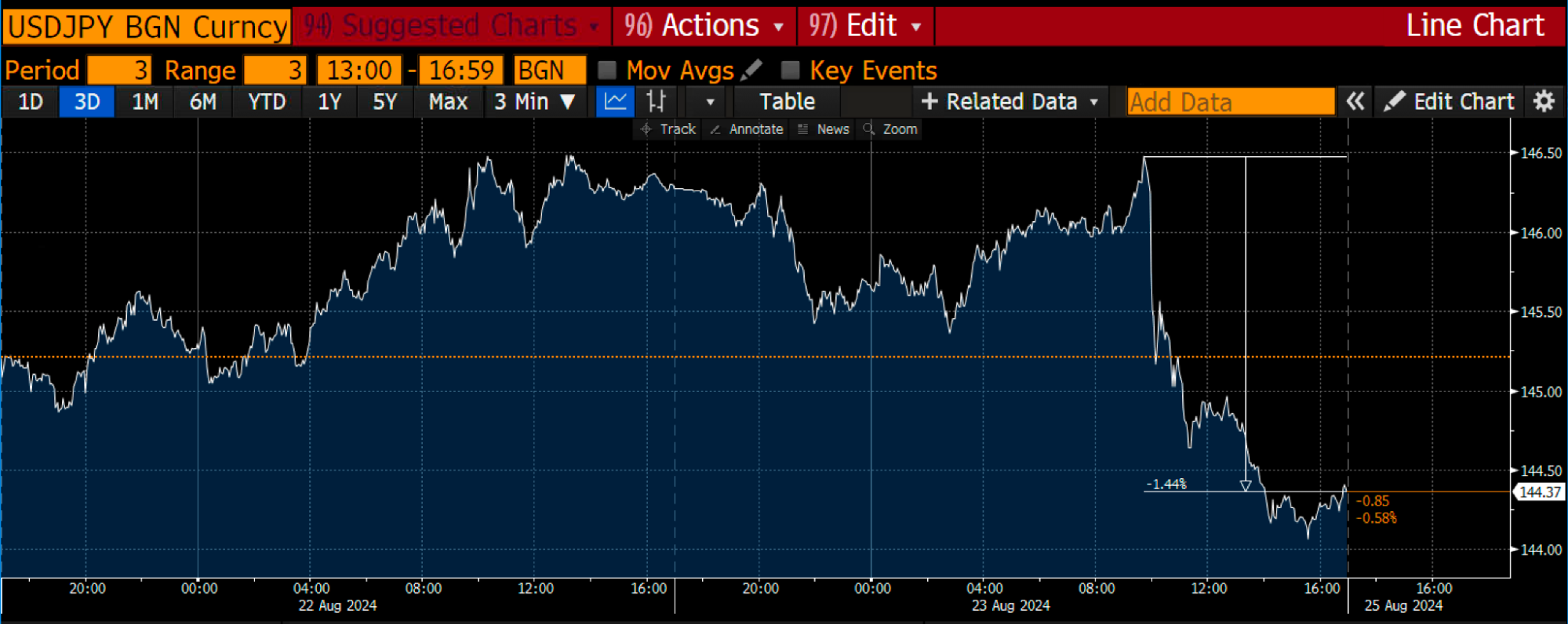

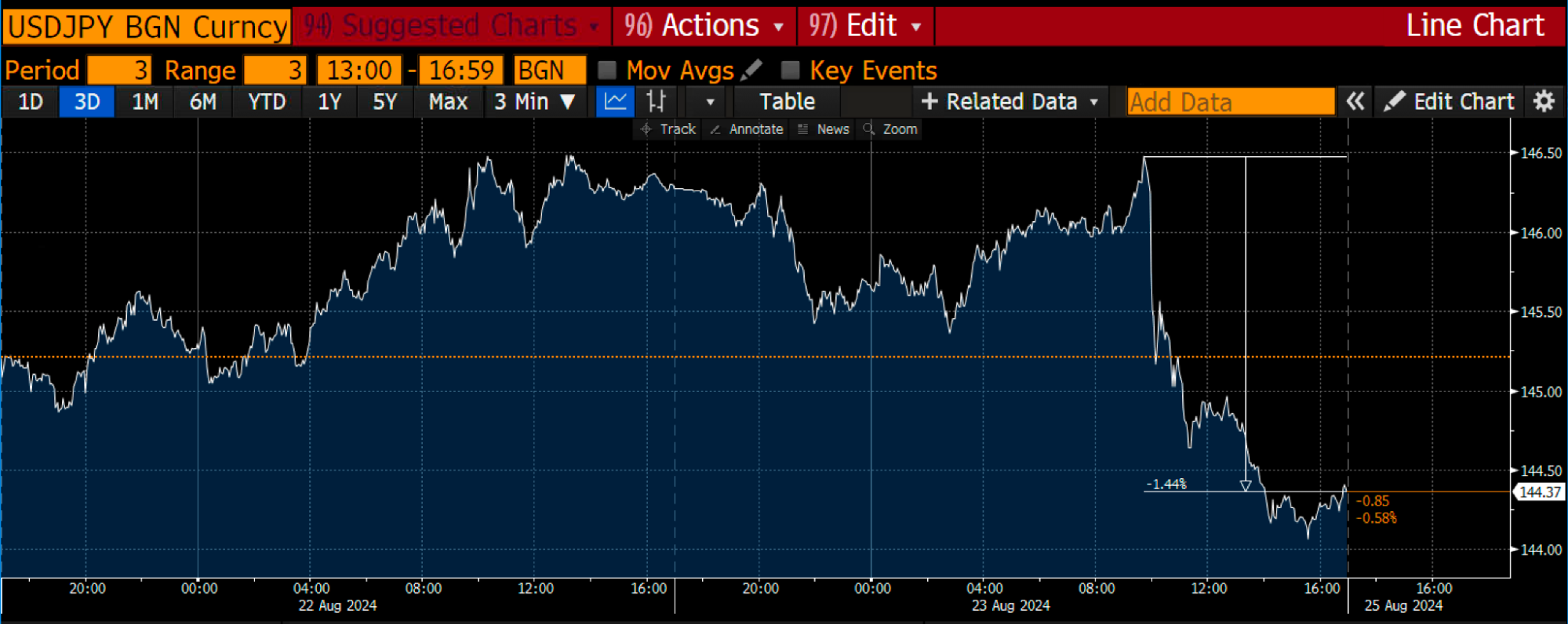

Dollar-yen strengthened by 1.44%, while USDJPY fell immediately after the Powell pivot. This was expected because the forward-looking dollar-yen interest rate differential will narrow due to falling dollar rates and flat to rising yen rates.

The rest of this essay aims to hammer home this point and present my outlook for the next few critical months before the apathetic American voter elects The Orange Man or the Kameleon.

Bull Thesis Assumption

As we witnessed in August this year, a rapidly strengthening yen spells REDRUM for global financial markets. If cutting rates of three of the largest global economies strengthens the yen vs. their domestic currencies, then we should expect a negative market reaction. We have a battle between the positive (rate cuts) vs. the negative (yen strengthening) forces. Given that the amount of global financial assets financed in yen is in the tens of trillions of dollars, I believe the negative market reaction of a rapid yen carry trade unwind due to a quickly strengthening yen will overwhelm any benefit to be had from minor USD, GBP, or EUR rate cuts. Furthermore, I believe that the witches and warlocks heading the Fed, BOE, and ECB recognise that they must be willing to ease and expand their balance sheets to counter the adverse effects of a strengthening yen.

In line with my skiing analogy, the Fed is reaching for the rate cut sugar high before hunger arrives. From a purely economic perspective, the Fed should be raising, not cutting, rates.

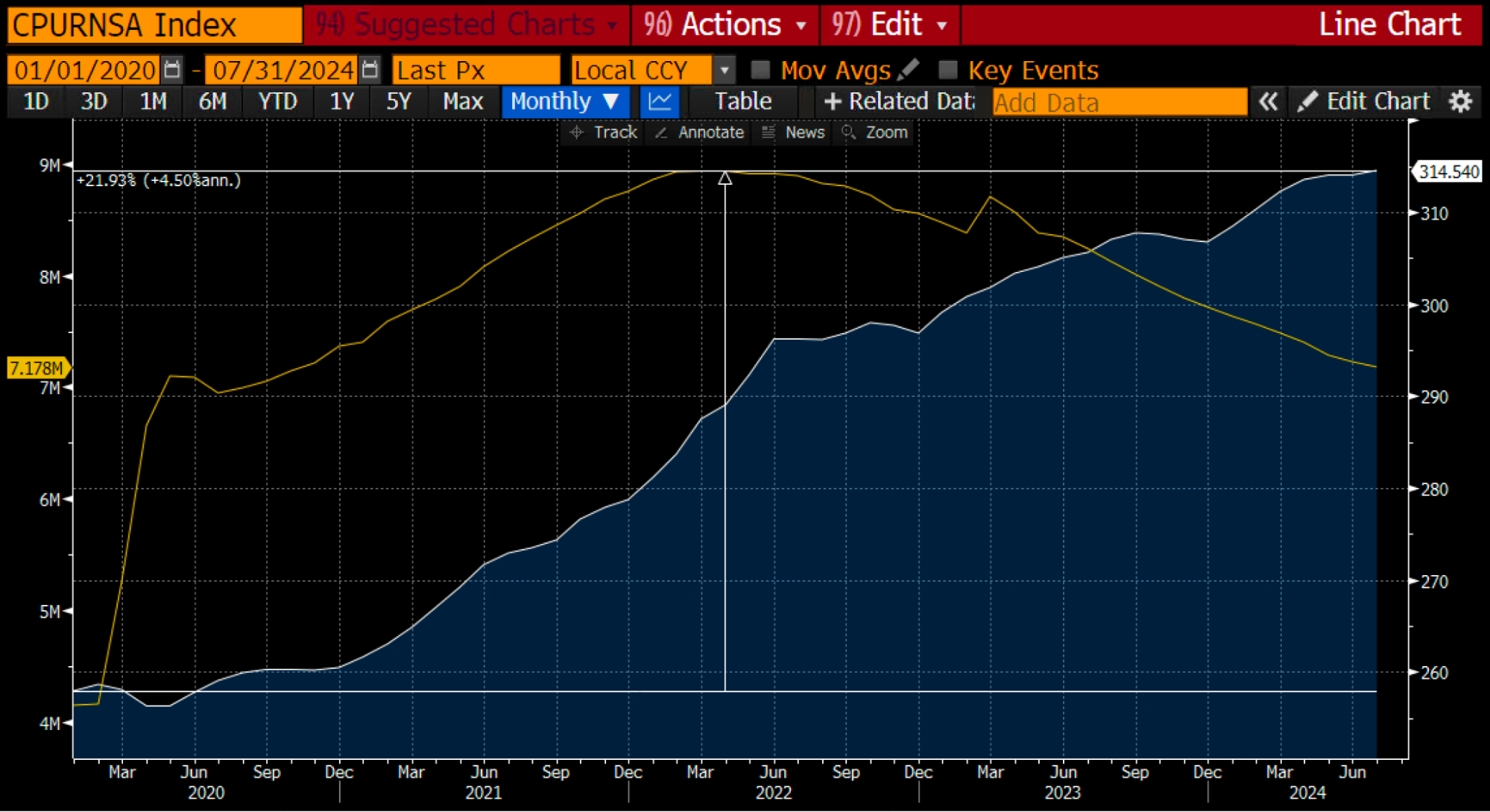

Since 2020, the manipulated US Consumer Price Index (white) is up 22%. The Fed’s balance sheet (gold) is up over $3tn.

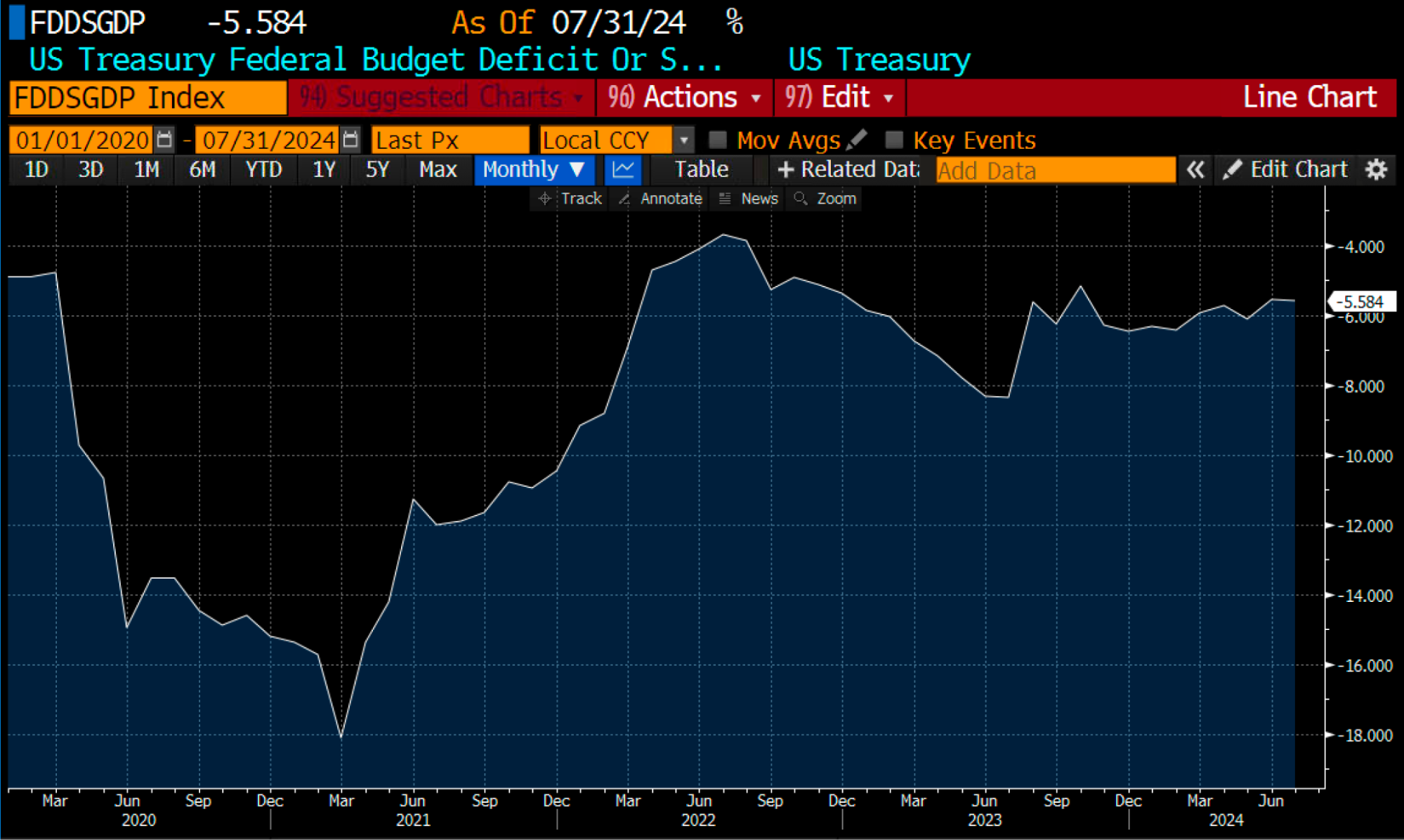

The US government deficit is at record levels partly because the cost of issuing debt is not yet restrictive enough to force politicians to raise taxes or reduce handouts to balance the budget.

If the Fed were serious about maintaining confidence in the dollar, it would raise rates to curtail economic activity. This would bring prices down for everyone, but some people would lose their jobs. It would also reign in government borrowing as the cost to issue debt would rise.

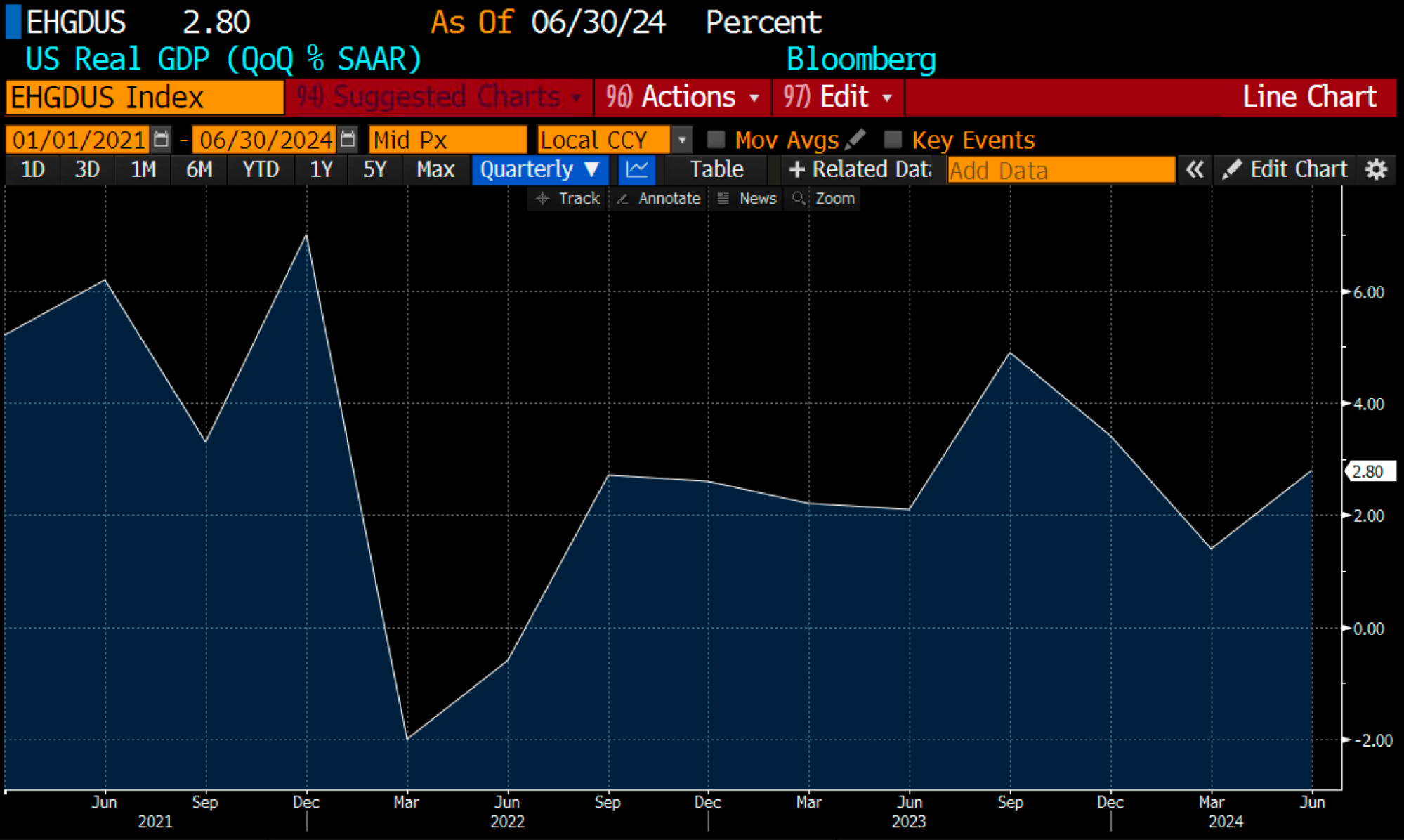

The US economy post-COVID has only experienced two-quarters of negative real GDP growth. This is not a weak economy in need of rate cuts.

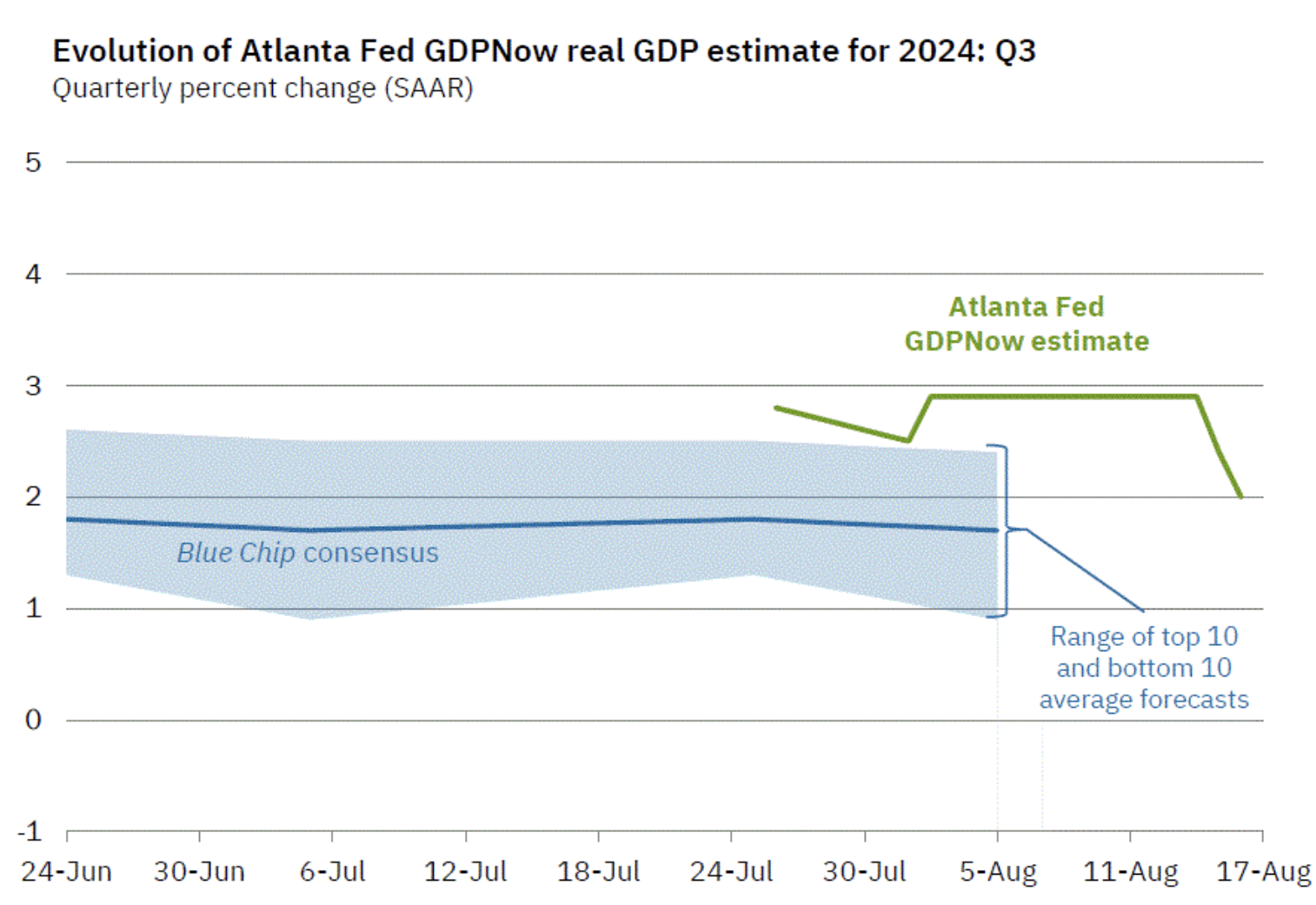

Even the most recent estimation of 3Q2024 real GDP is a solid +2.0%. Again, this is not an economy suffering from overly restrictive interest rates.

Just like how I eat candy bars and sugar goo when I’m not hungry to avoid a drop in blood glucose levels, the Fed is committed to never letting financial markets stop their upward ascent. The US is a hyper-financialised economy that requires up-only fiat asset prices so that the population feels rich. In real terms, stocks are flat to down, but most people don’t look at their real returns. Nominally rising stocks in fiat terms also drive capital gains tax receipts. In short, a falling market is bad for the financial health of Pax Americana. Therefore, Bad Gurl Yellen began subverting the Fed’s interest rate-raising cycle in September 2022. Powell, I believe, under instructions of Yellen and the Democrat party leaders, is falling on his sword and cutting rates when he knows he should not be.

I present the below chart as an illustration of what happened to stonks once the US Treasury, under the thumb of Yellen, began issuing a fuck-ton of Treasury Bills (T-bills) which sucked sterilised funds out of the Fed’s Reverse Repo Program (RRP) and into the broader financial markets.

To understand what the fuck I just said in the previous paragraph, please read my essay “Water, Water, Every Where.”

All prices are indexed at 100 as of 30 September 2022; this was the peak of the RRP at ~$2.5tn. The RRP (green) fell 87%. The nominal fiat dollar return of the S&P 500 (gold) rose 57%. I continue to state, the US Treasury is more powerful than the Fed. The Fed kept raising the price of money until March 2023, but the Treasury engineered a way to simultaneously increase the quantity of money. The result was a booming stock market in nominal terms. Priced in gold real terms, gold is the oldest form of real money (everything else is credit), The S&P 500 (white) only rose 4%. Priced in Bitcoin, the new realest hardest money around, the S&P 500 (magenta) fell 52%.

The US economy is not hungry for rate cuts, but Powell will provide the sugar high anyway. Because the monetary authorities are hypersensitive to any disruption in up-only nominal fiat stock prices, Powell and Yellen will provide “real food” in some form of Fed balance sheet expansion very shortly to counter the effects of a strengthening yen.

Before I discuss the strengthening yen, I want to quickly address Powell’s spurious justification for cutting rates and how it further raises my confidence in rising risky asset prices.

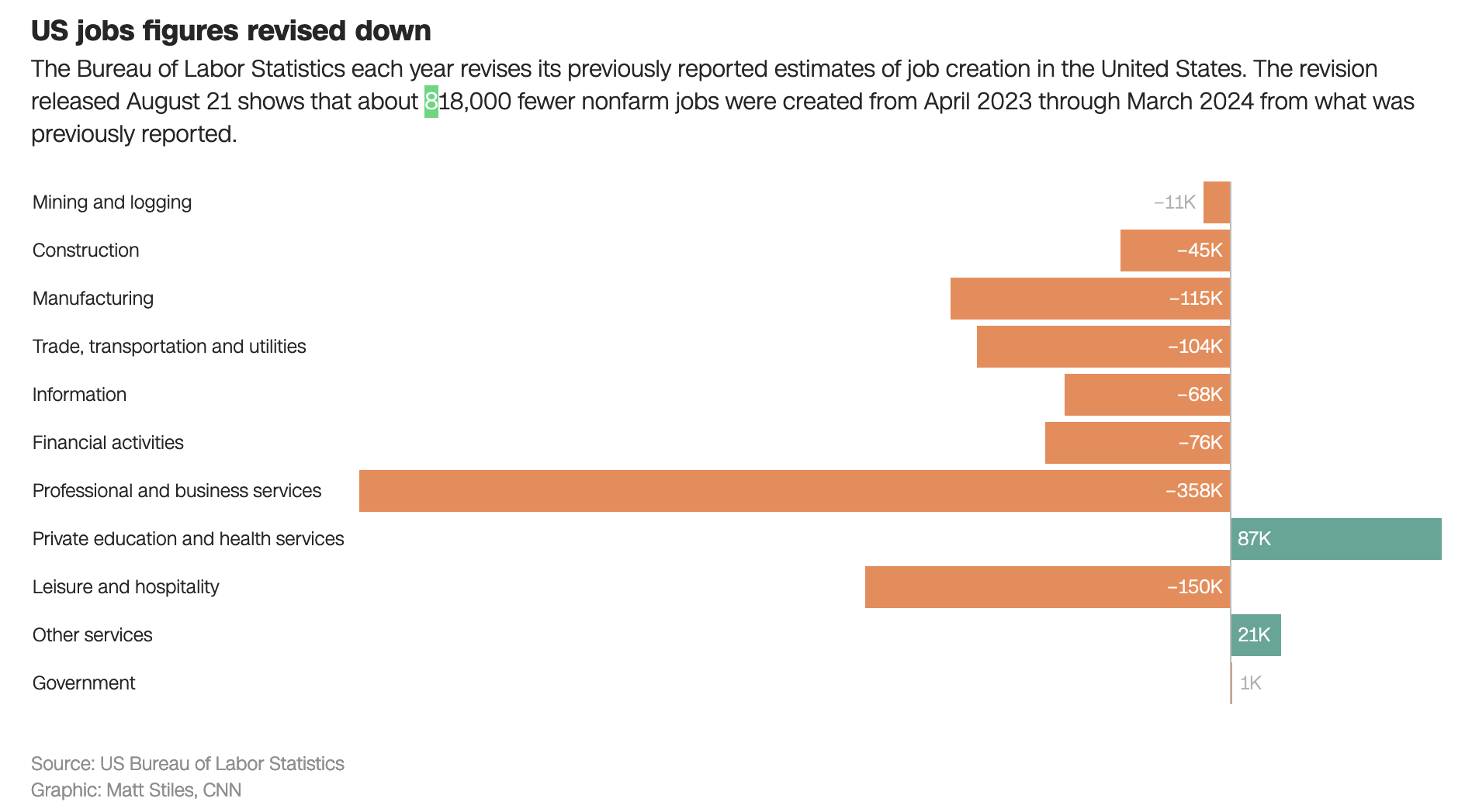

Powell pivoted based on a nasty jobs report. US President Biden’s Bureau of Labour Statistics (BLS) released a shockingly negative revision of prior jobs data just days before Powell gave his speech at Jackson Hole. They noted that jobs estimates were ~800,000 too high.

Biden and his intellectually dishonest economist boosters have been touting the strength of the labour market under his reign. This strength put Powell in an awkward position as high-ranking Democrat Senators such as Elizabeth “Pocahontas” Warren called on him to cut rates and boost the economy so that the big bad Orange Man doesn’t win the election. Powell was in a bind. With inflation above the Fed’s 2% target, Powell cannot cut rates based on falling inflation. Powell also can’t cut rates, citing a weak labour market. But let’s sprinkle a little political misdirection fairy dust on the situation and see if we can’t help our beta cuck towel bitch boy out.

Biden got the boot from the Obamas after performing like an incoherent catatonic vegetable hopped up on prescription drugs in his debate with Trump. In came Kameleon Harris, who, if you believe the mainstream media propaganda, had nothing to do with any policies enacted during the last four years of the Biden / Harris administration. Therefore, the BLS can admit its oopsie without impacting Harris because she was never really involved in the administration of which she was the Vice President. Wah – such political Jedi magic.

Powell had the green light to blame the poor labour market for the rate cut but failed to use it. Now that he has announced that the Fed will begin cutting rates in September, the only question is the magnitude of the first cut.

When politics precedes economics, I become more confident in my predictions. That is because of Newtonian Political Physics – a politician in power wishes to stay in power. They will do whatever is necessary, regardless of the economic conditions, to get re-elected. This means that whatever happens, the incumbent Democrats will use all monetary levers to ensure a rising stock market before the November election. The economy shall not want for cheap and plentiful filthy fiat money.

Yen Wrecking Ball

A large driver of an exchange rate between currencies is the differential in interest rates and the expectation for how that will change in the near future.

The above chart shows the USDJPY exchange rate (yellow) vs. the dollar-yen interest rate differential (white). The interest rate differential is the Fed Funds effective rate minus the BOJ overnight deposit rate. When the USDJPY rises, the yen weakens, and the dollar strengthens; when it falls, the reverse occurs. The yen weakened massively when the Fed began its tightening cycle in March 2022. Peak yen weakness was reached in July of this year as the differential was near its widest.

The yen strengthened violently after the BOJ raised its policy rate by 0.15% to 0.25% at the end of July. The BOJ was clear that it would begin to raise rates at some point in the future. The market just didn’t know when they would begin in earnest. Like an unstable snowpack, you never know which snowflake or which turn of the ski will cause the avalanche. A 0.15% reduction in the large differential should have been inconsequential, but it was not. The yen-strengthening avalanche began, and now the market is hyper-focused on the future path of the dollar-yen interest rate differential. As expected, after the Powell pivot, the yen gained strength as the differential is forecasted to narrow even more.

Here is the same USDJPY chart from earlier. I want to highlight again that the yen strengthened after Powell confirmed a September rate cut is in the bag.

The Fed rate cut sugar high might be short-lived if traders resume unwinding dollar-yen carry trade positions if the yen surges in value. Doing more rate cuts to stop the fall in various financial markets will only accelerate the pace of the narrowing of the dollar-yen interest rate differential, which in turn will strengthen the yen and cause more positions to be unwound. The market requires “real food” in the form of printed money supplied by a rising Fed balance sheet to staunch the bleeding.

If the yen accelerates its strengthening, the first step will not be a resumption of quantitative easing money printing. The first step will be for the Fed to reinvest the cash from maturing bonds on its portfolio back into US Treasuries and mortgage-backed securities. That will be announced as a cessation of its quantitative tightening (QT) program.

If the pain train continues to choo choo, the Fed will then resort to using central bank liquidity swaps and or a resumption of QE money printing. In the background, Bad Gurl Yellen will add dollar liquidity by selling more T-bills and running down the Treasury General Account. Neither of these market manipulators will cite the destabilising effects of the yen carry trade unwind as the reason for the resumption of aggressive money printing. It would not be very American to admit that any other nation has any effect upon the glorious empire of freedom and democracy!

If the dollar-yen smashes through 140 on the downside in short order, I don’t believe they will hesitate to provide the “real food” that the filthy fiat financial markets require to exist.

Trading Setup

The fiat liquidity conditions could not be more favourable going into the final stretches of the third quarter. We have the following tailwinds at our backs as crypto hodlers:

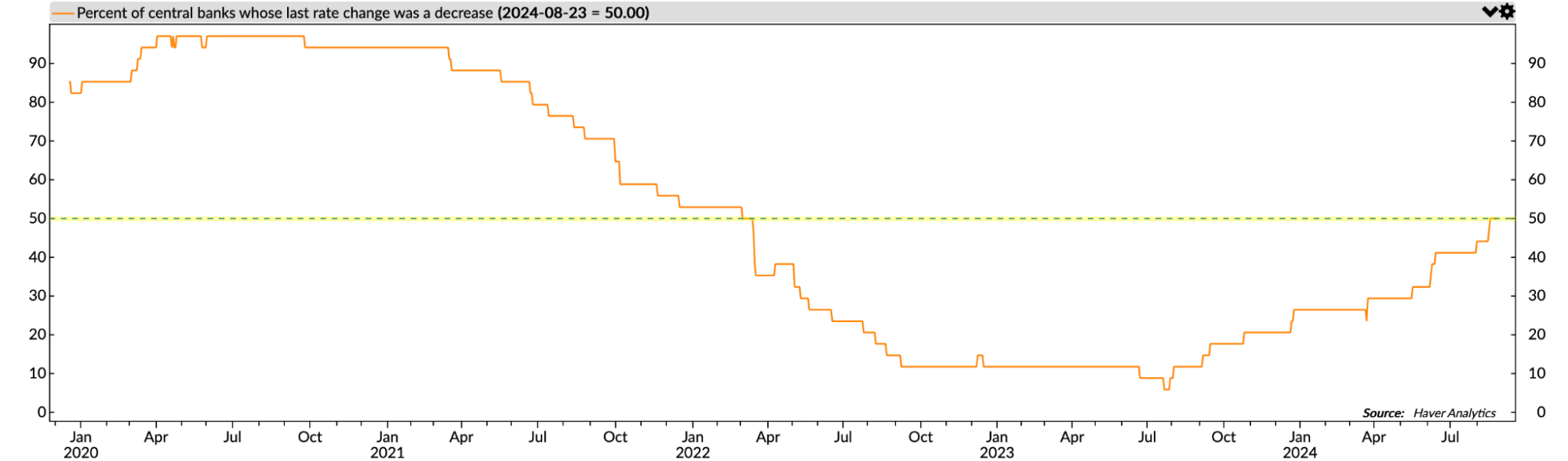

- Central banks globally, now led by the Fed, are reducing the price of money. The Fed is cutting rates while inflation is above their target, and the US economy continues to grow. The BOE and ECB will likely continue cutting rates at their upcoming meetings.

2. Bad Gurl Yellen pledged to issue $271bn of T-bills and conduct $30bn of buybacks between now and year-end. This will add $301bn of dollar liquidity to the financial markets.

3. The US Treasury has ~$740bn left in the TGA, which can and will be used to juice markets and assist a Harris victory.

4. The BOJ was so terrified of the pace of yen strengthening after its 31 July 2024 meeting, when it hiked rates 0.15%, that it publicly stated that future rate hikes would take market conditions into account. That is a euphemism for “if we think the market will fall, we won’t raise rates.”

I’m a crypto bro; I don’t do stonks. Therefore, I don’t know if stocks will go up or not. Some point to historical situations where the stock market fell as the Fed cut rates. Some fear that the Fed cutting rates is a leading indicator of a US and, by extension, developed market recession. That might be true, but if the Fed is cutting rates when inflation is above target and growth is strong, imagine what they will do if there actually is a US recession. They will ramp up the money printer and dramatically increase the money supply. That leads to inflation, which could be bad for certain types of businesses. But for assets in finite supply like Bitcoin, it will provide a trip at lightspeed 2 Da Moon!

Want More? Follow the Author on Instagram and X

The post Sugar High appeared first on BitMEX Blog.

Recent Posts

Categories

Related Articles

Franklin Templeton Files for Solana ETF With Staking—Is SOL Set for Institutional Adoption?

Franklin Templeton has filed for a Solana ETF, aiming to track SOL’s...

ByglobalreutersFebruary 22, 2025Can we escape DeFi’s Ouroboros? Bridging real-yield in 2025

The following is a guest article from Mike Wasyl, CEO at Bracket....

ByglobalreutersFebruary 22, 2025Microsoft’s New Chip Could Speed Up Bitcoin’s Quantum-Resistance Timeline

Microsoft’s latest quantum computing chip, Majorana 1, might accelerate the need to...

ByglobalreutersFebruary 22, 2025Bitcoin Surges Past $99,000 Following Dovish Remarks From Atlanta Fed President Bostic

After spending more than two weeks trading in the mid-$90,000 range, Bitcoin...

ByglobalreutersFebruary 22, 2025

Leave a comment