- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Ethiopia is emerging as Africa’s most promising bitcoin mining hub, poised to claim a significant share of the global hashrate as the hum of miners reverberates across the globe.

– Jaran Mellerud & Kal Kassa

Recent attention from a Bloomberg article and the announcement of a bitcoin mining investment by the Ethiopian Government signals a newfound global spotlight on the Ethiopian bitcoin mining sector.

The potential of Ethiopia as a bitcoin mining hub resides in the promise of a mutually beneficial relationship between the nation and the industry. In this article, we delve into the transformative power of bitcoin mining to uplift Ethiopian society, unveiling five compelling avenues for prosperity in this East African gem.

Bitcoin mining monetizes Ethiopia’s surplus electricity

Bitcoin mining allows Ethiopia to transform excess electricity into a valuable commodity, fostering economic growth while maximizing the utilization of its abundant hydropower reserves.

Ethiopia’s allure for bitcoin miners is undeniably anchored in its abundant hydropower resources. Nestled within the country’s mountainous terrain lies the source of the Blue Nile, accounting for a staggering 85% of the Nile’s water. This abundant water wealth translates into the immense potential for hydropower generation, making Ethiopia a prime destination for electricity-intensive industries like bitcoin mining.

With the potential to harness an estimated 60 GW of hydropower, geothermal, wind, and solar, Ethiopia stands as a powerhouse that could theoretically become capable of generating more than three times the electricity consumed by the entire bitcoin mining network. Presently, the nation has tapped into a fraction of this potential, having an electricity generation capacity of 5.3 GW.

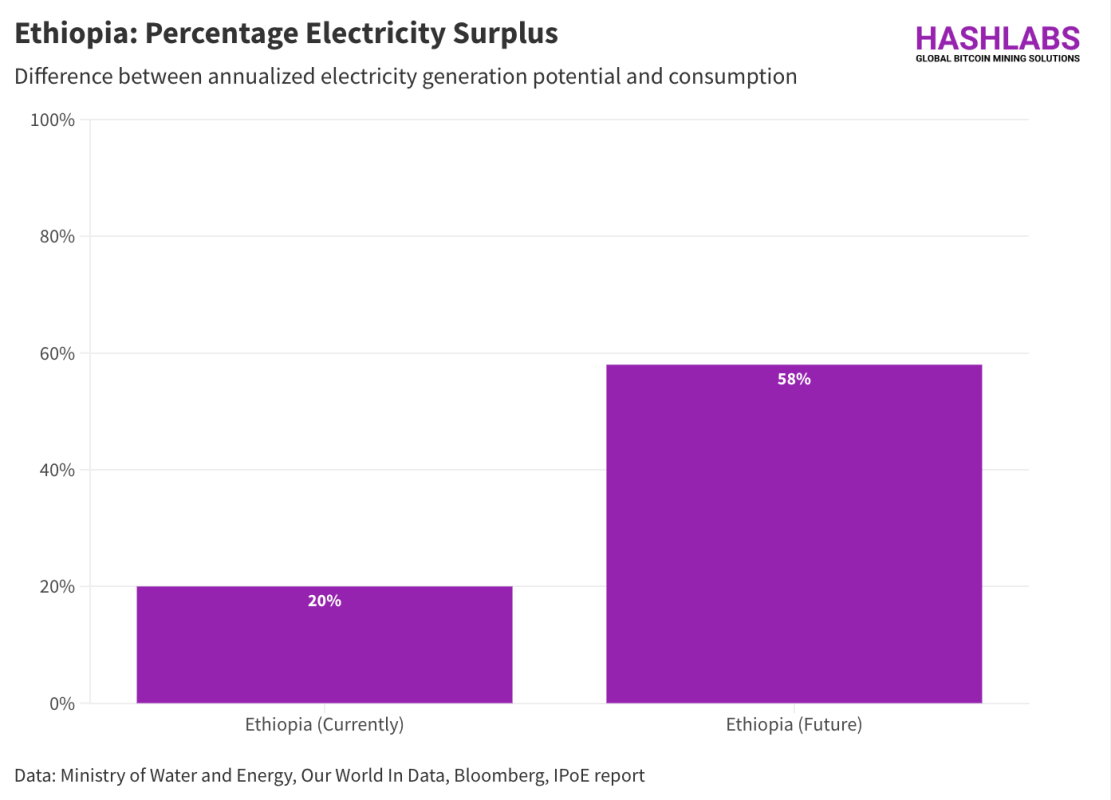

Assuming a capacity factor of 40%, Ethiopia’s current electricity generation capacity translates to a potential of 18.6 terawatt-hours (TWh) per year under normal rainfall conditions. Comparatively, in 2022, the country’s electricity consumption amounted to only 14.7 TWh, leaving approximately 20% of the electricity generation potential unutilized. This number will be even higher during particularly wet years.

As if Ethiopia’s electricity surplus wasn’t already substantial, the nation is on the brink of nearly doubling its generation capacity with the commissioning of The Grand Ethiopian Renaissance Dam. This awe-inspiring project will claim the title of Africa’s largest hydropower plant, boasting an impressive nameplate capacity of 6.5 GW.

With an anticipated capacity factor of 29%, sustained by the continuous influx of water to the dam, the power plant is projected to yield approximately 16.5 terawatt-hours (TWh) of electricity annually. This output is equal to 10% of the consumption of the Bitcoin mining network, underscoring Ethiopia’s potential to become a dominant force in both energy production and bitcoin mining.

The forthcoming Grand Ethiopian Renaissance Dam’s anticipated 16.5 TWh of electricity production will propel Ethiopia’s total potential generation to a staggering 35.1 TWh annually under typical rainfall conditions. With current consumption at 14.7 TWh, the surplus electricity generation will amount to an impressive 20.4 TWh, corresponding to a percentage electricity surplus of 58%.

Ethiopia is one of the world’s fastest-growing economies and is set to see a surge in electricity demand, necessitating the expansion of its hydropower infrastructure. However, the non-modular nature of hydropower plants often leads to overbuilt capacity, resulting in surplus generation until demand catches up.

The flexibility inherent in bitcoin mining makes it the perfect match for Ethiopia’s surplus electricity, offering a means to monetize until residential, commercial, and industrial consumption catches up. Once demand increases, miners can adapt by relocating or contributing to the financing of new power plants.

Without Bitcoin mining, Ethiopia faces the prospect of significant electricity wastage until demand aligns. By seizing the opportunity to leverage its abundant energy resources, Ethiopia positions itself for sustained economic growth, with initiatives like Bitcoin mining serving as a catalyst for optimizing resource utilization and driving prosperity.

Bitcoin mining increases Ethiopia’s exports and access to foreign currency

Ethiopia grapples with a daunting challenge: a staggering trade deficit. With more dollars flowing out than in, the nation faces mounting difficulties in importing vital goods and services. Compounded by a struggling currency, ironically named the Birr, Ethiopia’s citizens are vulnerable to soaring inflation rates.

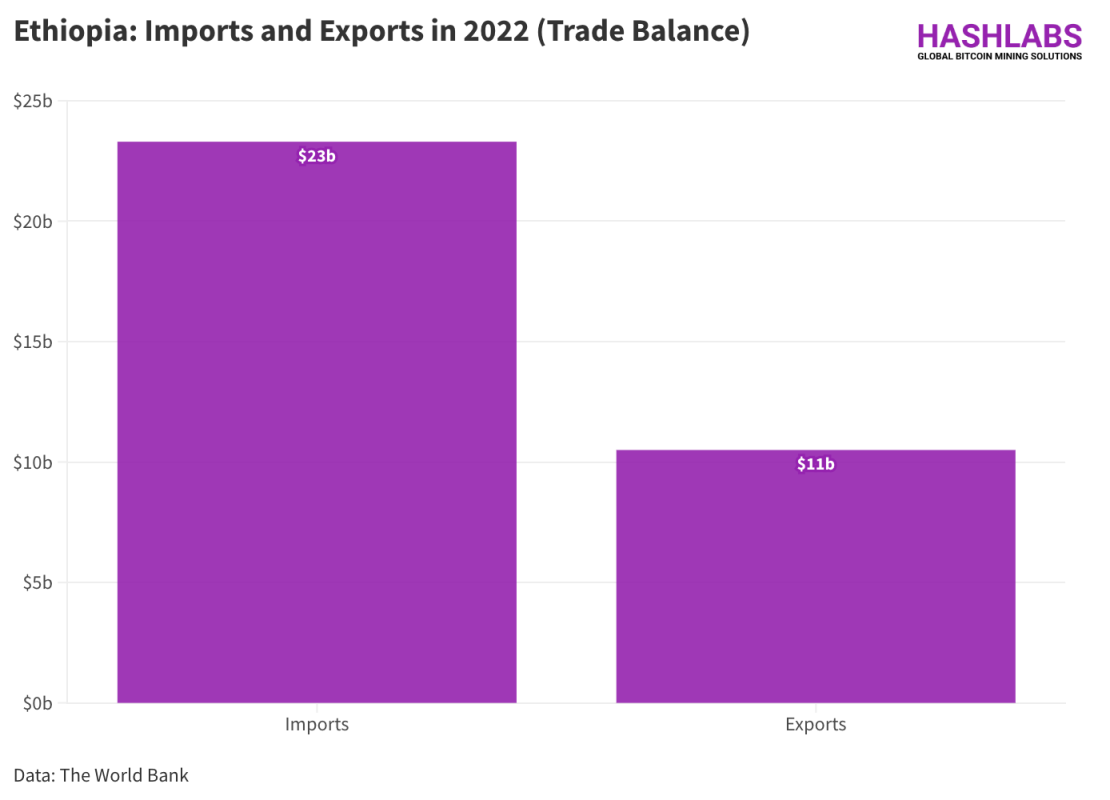

In 2022, Ethiopia imported $23 billion worth of products and services while exporting just $11 billion, leaving a cavernous trade deficit of $12 billion. This deficit is straining the nation’s ability to meet debt obligations, showcased by the ongoing negotiations with the International Monetary Fund (IMF) for a potential bailout.

Luckily, Ethiopia’s abundant electricity surplus presents a promising opportunity for foreign currency generation through exports. However, traditional avenues like selling electricity to neighboring countries have been limited due to low demand and weak economies in the region, yielding modest returns of around $70 million annually.

Enter Bitcoin mining, a revolutionary solution that transcends geographical constraints by allowing electricity to be converted directly into digital currency. With minimal investment in transmission infrastructure, Ethiopia can tap into the global Bitcoin network as a lucrative consumer of its surplus energy.

By embracing Bitcoin mining, Ethiopia diversifies its export income and reduces reliance on neighboring countries for electricity sales. With the ability to export electricity through the Internet, the nation gains a stronger negotiating position and can demand higher prices for its exported power.

In a recent interview with Bloomberg, Yodahe A. Zemichael of the Information Network Security Administration (INSA) highlighted the government’s motivation of legalizing the bitcoin mining industry, citing that companies pay in foreign currency for the electricity they consume in data center operations.

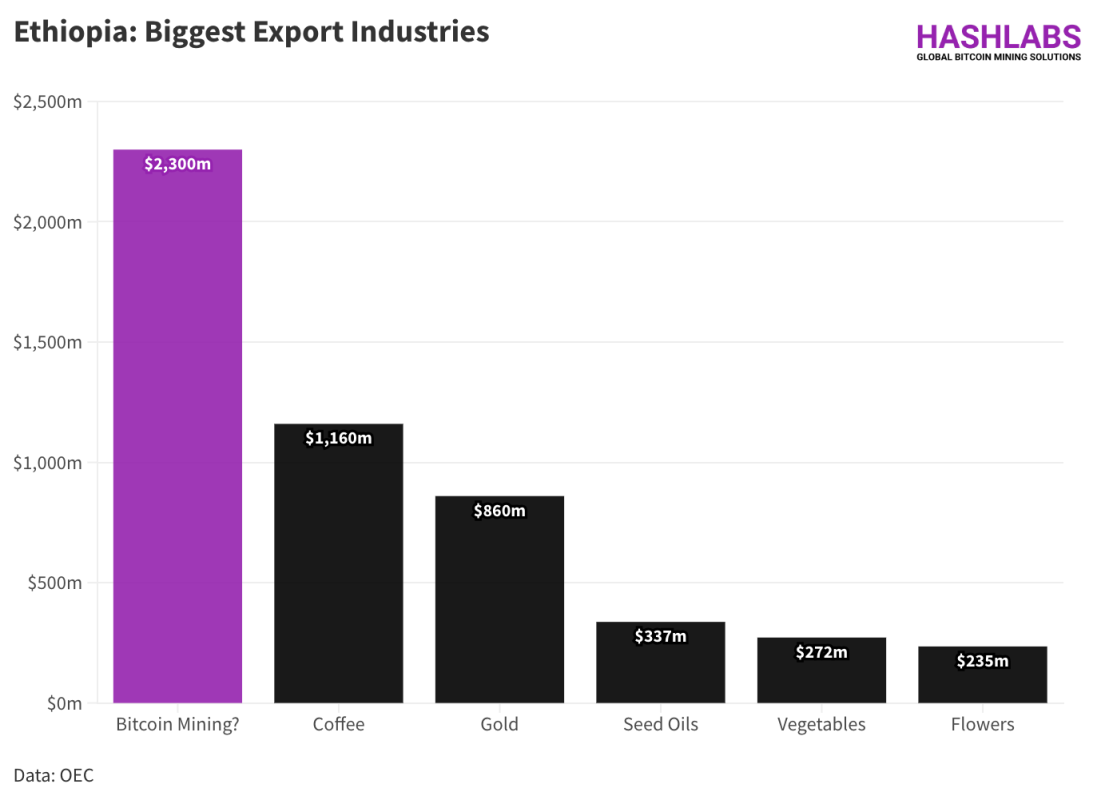

Considering the official bitcoin mining tariff of $0.0314/kWh, Ethiopia stands to generate a substantial export income of $640 million if it sells all its excess electricity to Bitcoin miners. Furthermore, by self-mining with the most efficient machines available, the country could potentially yield an export income of $3.9 billion, making Bitcoin mining a transformative force in Ethiopia’s economy and potentially its largest export industry. This tantalizing prospect underscores the transformative potential of Bitcoin mining for Ethiopia’s economic landscape.

Indeed, it’s prudent to adjust our expectations to account for real-world factors such as the Bitcoin halving and Ethiopia’s likely utilization of a portion of its electricity surplus for other purposes. A more realistic estimate of Ethiopia’s export income from Bitcoin mining would likely fall somewhere between $640 million and $3.9 billion, settling in the middle at around $2.3 billion.This figure still positions Bitcoin mining as the largest export industry in Ethiopia, representing a significant economic opportunity for the nation.

A $2.3 billion boost in export income would indeed wield transformative power for the Ethiopian economy, providing a vital injection of foreign currency to strengthen the national currency and facilitate easier access to essential imports. Moreover, reducing dependency on foreign lenders would enhance Ethiopia’s sovereignty and bolster its economic resilience.

At this pivotal moment, Ethiopia faces the imperative of addressing its trade imbalance and charting a course for economic prosperity. Embracing bitcoin mining as a means to export surplus electricity through the internet offers a groundbreaking opportunity to unlock Ethiopia’s economic potential.

Indeed, it could represent the greatest economic opportunity of this generation for the country.

Bitcoin miners can build out electrical infrastructure in Ethiopia

The challenge of electrification in Ethiopia is stark: only 54% of the population currently has access to electricity, with rural areas significantly lagging behind urban centers. While cities boast a 94% electrification rate, rural areas struggle at just 43%. The Ethiopian Government has set an ambitious goal of achieving near-universal electrification by 2030, but this endeavor faces significant hurdles.

The electrification challenge in Ethiopia, particularly in rural areas, underscores the urgent need for innovative solutions. While the country boasts significant electricity generation capacity, the main hurdle lies in transmitting and distributing this energy to remote communities.

Bitcoin miners offer a potential solution by financing and constructing substations in rural areas with surplus electricity, such as those near The Grand Ethiopian Renaissance Dam. These substations could serve not only miners but also nearby residents, potentially providing electricity to entire towns.

This approach, akin to efforts by Gridless in Kenya, could complement Ethiopia’s goal of near-universal electrification by 2030. Unlike in Kenya, where Gridless focuses on building power plants with bitcoin mining as an anchor customer, Ethiopia already has sufficient power plants. Thus, Ethiopian miners could focus on building out substations to improve the population’s access to electricity.

Moreover, the increased revenue from selling electricity to miners could enable Ethiopia to invest in new electrical infrastructure, including substations, transmission lines, and distribution networks. As a result, bitcoin miners could indirectly finance the expansion of electrical infrastructure in Ethiopia, contributing to electrification for Ethiopians and fostering socio-economic development nationwide.

Bitcoin mining brings tech jobs to Ethiopia

Ethiopia, boasting the second-largest population in Africa with 122 million inhabitants, predominantly comprises a youthful demographic. Regrettably, the nation faces a significant challenge of high unemployment rates among its youth.

Introducing the bitcoin mining industry could potentially provide avenues for accessing tech jobs, not limited to mining facilities but also encompassing the broader bitcoin economy poised to develop alongside the foundational growth of the bitcoin mining industry.

Bitcoin mining will bring a significant amount of jobs to Ethiopians across many talents and skills. On this, Advisor at Hashlabs Mining Ethiopia, Kal Kassa says:

“500 jobs per bitcoin miner is a high goal to meet and I doubt this rumor we’ve been hearing is an honest reflection of the government’s intent to regulate and add thresholds to investment. That being said, facilities with investment over $100 million are very likely to require more than 500 personnel, contractors, vendors, and local suppliers. In fact, we see more than double that in interest from technicians and electrical engineers. Training and certifying skilled talent will be a pillar of our objectives in Ethiopia and I have no doubt we will inspire a generation forward.”

Additionally, Hashlabs Mining has sponsored the onboarding of hundreds of wallets at ALX Ethiopia, DevFest’24, and the Information Network Security Administration (INSA) in keeping with this vision.

Kassa continues, “For programmers and devs building, I urge them to build a profile and open a free lightning wallet with sost.tech and similar initiatives to get paid in bitcoin. BTrust Builders may also be a solid destination for experienced computer engineers and enthusiasts. Hashlabs Mining Ethiopia, and various additional sponsors, will be supporting these educational and vocational efforts via the funded Hashlabs Education Fund and BitcoinBirr.”

BitcoinBirr, a community of educators and innovators, boasts a strong vision for providing bitcoin learning materials across several languages and regions. Telegram is the most popular platform for communication among its mods and members. Most recently Kal Kassa gave a presentation titled “Mining Bitcoin of the Nile River” at Bitcoin Oasis in Dubai. In the next few weeks, and with sponsors from across the world, BitcoinBirr would like to complete the bitcoin training of all 2,000 staff at INSA, in addition to other institutions and organizations that have requested bitcoin education.

Beyond hackathons and presentations, Hashlabs Mining is committed to the training of talent in tech. Private sector leaders like Mehrteab Leul and Associates (MLA), Yingke Consultants, Grant Thornton Advisory, MMCY Tech, Boseti Energy Exploration, Meedo Records, HabeshaView, Flawless Events, Education Matters Addis, Tryst Cafe, Ethiopian Airlines and Sheraton Addis are highly appreciated and we honor your friendship during our work in Ethiopia.

Ethiopia can leverage mining to build a bitcoin treasury

The Ethiopian Investment Holdings (EIH), the country’s sovereign wealth fund, has been rumored to partner with a Chinese bitcoin and data mining group. As per a LinkedIn post shared by EIH’s official account, we understand the project will consist of a multi-million dollar investment.

Given the natural series of events that occur with bitcoin miners, the accumulation of bitcoin may be a way for Ethiopia’s treasury to maintain a balance of BTC on behalf of its country. As methods for collateral and proof of reserves develop within the bitcoin “space”, these reserves may be used to prove creditworthiness.

The events surrounding Exchange Traded Funds (ETFs) and the Securities and Exchange Commission (SEC) may also be instructive to Ethiopians.

There is also a sentiment from some Bitcoiners that governments should not be involved in bitcoin mining. And that bitcoin is an experiment by cryptopunks and libertarians to create tools for the free market. Given Ethiopia’s recent communist history from 1974 to 1991, Ethiopia’s citizens and leaders may need a refresher course on the Austrian School of Economics.

Conclusion

We are witnessing significant development in real time. It’s difficult to point towards a singular event or catalyst. But we are at the center of a very serious and interesting moment in our history. The moment we are experiencing allows value to be generated from an open and free community of bitcoin miners. And this novel technology allows humanity to preserve value across time and space.

As we dive into the future, it may also be important to note the need for humility. It should be remembered that over the past few years, Ethiopians and East Africa have witnessed a haunting amount of death and destruction, often self-inflicted and many times manipulated on the world stage.

We can’t bring back our fallen friends. Like our dear brother Tekeste Sebhat Nega, an early bitcoiner and a visionary. He lost his life in the last few weeks of 2020. An energetic and smart young man died in a senseless civil war. And there are many more stories like him. The entire country is going through a syndrome of sorts, so let’s remain humble as we carry the burden.

Let’s move with purpose, passion, and dignity toward a future that values math and physics more than fiat and violence. That is our hope for ourselves and that’s the energy with which we will operate in Ethiopia.

This is a guest post by Jaran Mellerud & Kal Kassa. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Recent Posts

Categories

Related Articles

Half Way Through The 4 Year Bitcoin Cycle

Bitcoin’s Four-Year Rhythm: Mid-Cycle Insights and What Investors Should Expect

ByglobalreutersNovember 8, 2024Don’t Lose Sight Of The Bitcoin Mission

Fighting for transaction privacy needs to remain at the core of why...

ByglobalreutersNovember 8, 2024Democrats Must Embrace Bitcoin To Survive

If the Democratic Party is to have a future in US politics,...

ByglobalreutersNovember 8, 2024Trump Is Not Bitcoin’s Savior

Trump is not going to be a good thing for Bitcoin, he...

ByglobalreutersNovember 8, 2024

Leave a comment