- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Onchain Highlights

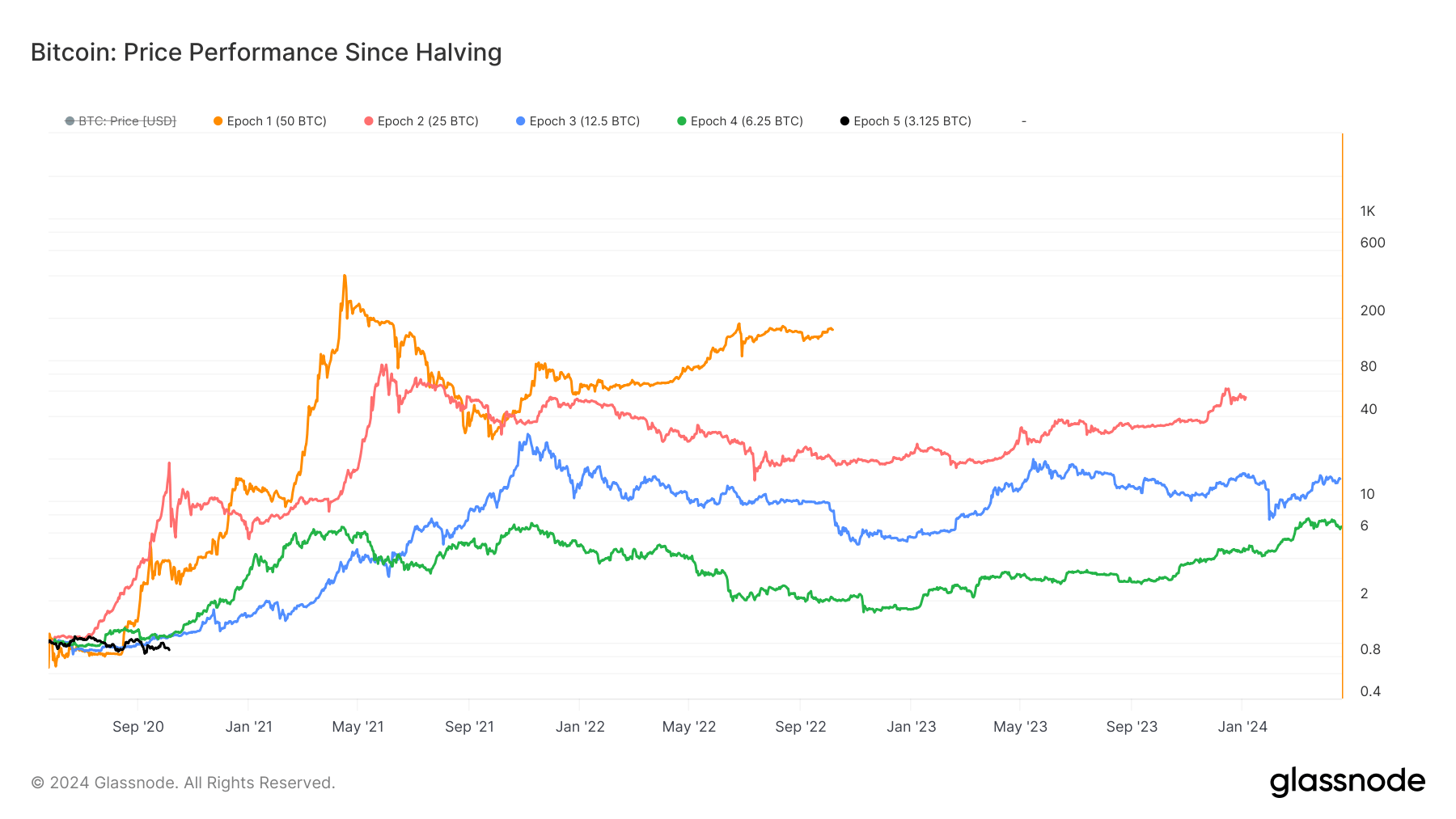

DEFINITION: Bitcoin price performance since halving cycles

Bitcoin’s price trajectory across its five halving epochs highlights the influence of supply shocks on long-term market behavior.

Epoch 1, where block rewards were 50 BTC, saw exponential growth, setting an early benchmark for the asset’s potential. Subsequent epochs, particularly Epoch 2 (25 BTC) and Epoch 3 (12.5 BTC), also experienced significant rallies, peaking at progressively higher levels before entering periods of consolidation.

Notably, Epoch 4 (6.25 BTC) displayed more subdued price action, reflecting a maturing market with increased liquidity and institutional participation. As Bitcoin enters Epoch 5 (3.125 BTC), the price appears to be stabilizing within a narrower range compared to previous cycles, suggesting a possible transition to lower volatility.

However, historical patterns indicate that a major price breakout could still be on the horizon as the supply reduction continues to exert upward pressure over time. The comparison of these epochs highlights the evolving nature of Bitcoin’s market responses to its programmed scarcity.

The post Bitcoin’s fifth epoch heralds potential for major price breakout amid stabilizing market appeared first on CryptoSlate.

Recent Posts

Categories

Related Articles

Bitcoin or Ethereum?

Bitcoin or Ethereum: Which Crypto is the Better Investment in 2025?The Crypto...

ByglobalreutersFebruary 22, 2025From Vesting Plans to Binance Wallets: A Deep Dive into TRUMP Token’s Distribution

More than a month after Donald Trump, the 47th U.S. president, launched...

ByglobalreutersFebruary 21, 2025North Korea’s Lazarus Group now using crypto gifts to breach security defenses

The North Korean-linked Lazarus Group has adopted a new method of breaching...

ByglobalreutersFebruary 21, 2025Bybit crypto exchange hit by the largest theft of any kind, ever

It was a tough day in the market but that's nothing compared...

ByglobalreutersFebruary 21, 2025

Leave a comment