- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Heiken Ashi Keltner Channel Breakout Forex Trading Strategy for MT5

Trend-following traders attempt to trade in the direction of the trend knowing that the general flow of the market would dictate where the price would usually move. Momentum traders also assume that prices will continue in the direction of market momentum.

These two styles of trading tend to produce high win probabilities. This is because trades are taken in the direction of the flow of the market. But these two individually effective trading styles can also be combined. Having a confluence of a trend direction bias and a strong momentum can significantly increase the likelihood that the price would move in a certain direction. Traders only need to time their trade entries and exit right.

In this strategy, we will be looking at how we could trade with a confluence of a trend direction bias and momentum using the Heiken Ashi Smoothed indicator and a Keltner Channel.

Heiken Ashi Smoothed

The word “Heiken Ashi” literally means “average bars” when translated from Japanese.

The Heiken Ashi Smoothed indicator is somewhat related to the Heiken Ashi Candlesticks. These two indicators use average bars to indicate the direction of trend and momentum. The Heiken Ashi Smoothed indicator is geared towards identifying trend direction as well as potential trend reversals, while the Heiken Ashi Candlesticks identify momentum. However, their similarities end.

The Heiken Ashi Candlesticks plot average bars with similar highs and lows as with regular Japanese candlesticks but modify the opening and closing of each candle. This creates an average bar that is somewhat similar to a candlestick but changes color only when the direction of the short-term momentum changes.

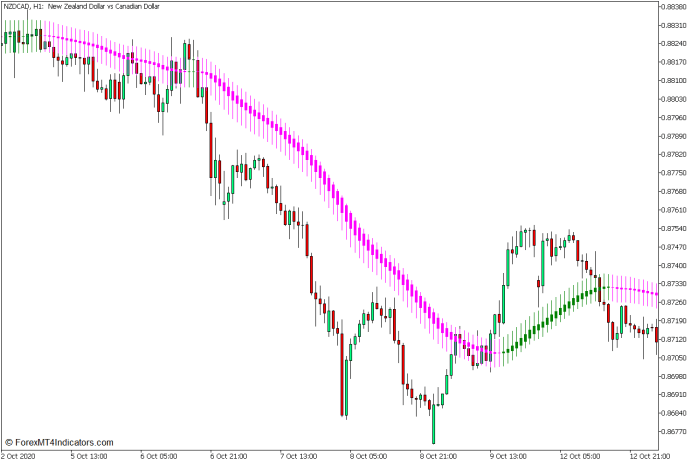

The Heiken Ashi Smoothed indicator has a smoothing effect and plots bars that can be quite farther from regular candlesticks. The characteristics of the Heiken Ashi Smoothed indicator is somewhat similar to a moving average line. It plots bars that seem to follow the trajectory of some moving average lines only that it plots bars. The color of these bars also changes depending on the direction of the trend.

In this template of the Heiken Ashi Smoothed indicator, the color of the bars is green whenever the direction of the trend is bullish, and magenta whenever the direction of the trend is bearish. Color changes can also indicate a possible trend reversal.

Keltner Channel

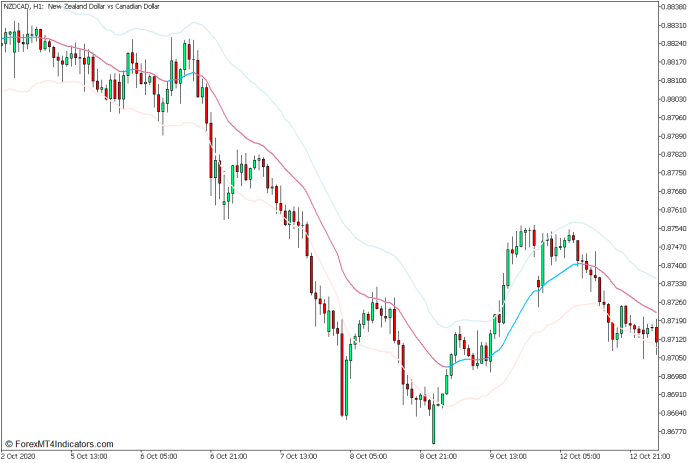

The Keltner Channel is a band-based technical indicator that can be used to identify momentum breakouts and overbought or oversold price levels.

The Keltner Channel plots three lines that form a channel-like structure. The middle line is an Exponential Moving Average (EMA) line of price. The outer lines are based on the Average True Range (ATR) set above and below the middle line. These two lines are typically displaced by two times the ATR. This creates a channel that expands whenever volatility is high and contracts when volatility is low based on the ATR.

The Keltner Channel can be used for identifying momentum breakouts and mean reversal scenarios, much like other band-based technical indicators.

The area outside of the Keltner Channel can be considered as an overextended price level. Price levels above the upper line can be considered overbought, while price levels below the lower line can be considered oversold. Reversal candlestick patterns forming in these areas can be indicative of a potential mean reversal.

On the other hand, traders can also identify momentum breakouts based on how the price moves through the outer lines. A strong momentum candle breaking above the upper line can be indicative of a bullish momentum breakout, while a strong momentum candle breaking below the lower line can be indicative of a bearish momentum breakout.

This version of the Keltner Channel allows users to modify the type of moving average line used, either as a Simple Moving Average (SMA) or an Exponential Moving Average (EMA). It also allows users to modify the multiplier used on the ATR.

Trading Strategy Concept

This trading strategy is a momentum breakout trading strategy that trades in the direction of the trend using the Heiken Ashi Smoothed and the Keltner Channel indicators.

The Heiken Ashi Smoothed bars are used as a trade direction filter based on the general location of the price of the bars, as well as the color of the bars. It is also used as an area of dynamic support or resistance where the price should reverse from right after a retracement or pullback.

The Keltner Channel is then used as the momentum breakout signal indicator. We will modify the Keltner Channel to use a multiplier of 1.5 times the ATR. We will then wait for a market contraction phase wherein bars would stay within the channel. The momentum entry signal would be a strong momentum candle closing outside the channel in the direction of the trend.

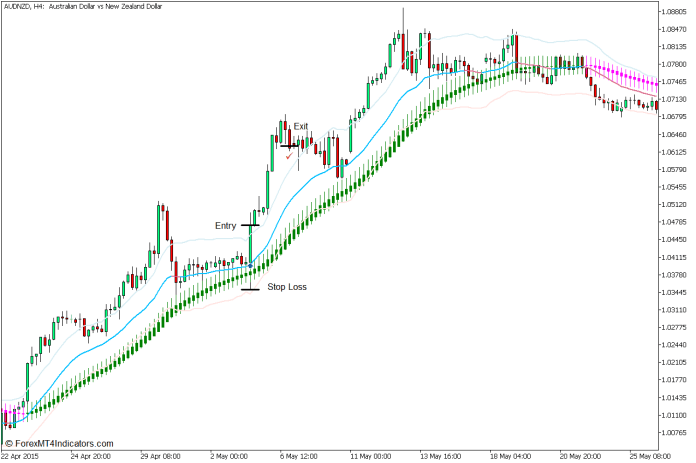

Buy Trade Setup

Entry

- Price action should generally be above the Heiken Ashi Smoothed bars.

- The Heiken Ashi Smoothed bars should be green indicating a bullish trend direction.

- Price should retrace near the Heiken Ashi Smoothed bars and contract sideways.

- A bullish momentum candle should break above the upper line of the Keltner Channel.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price action shows signs of a bearish reversal.

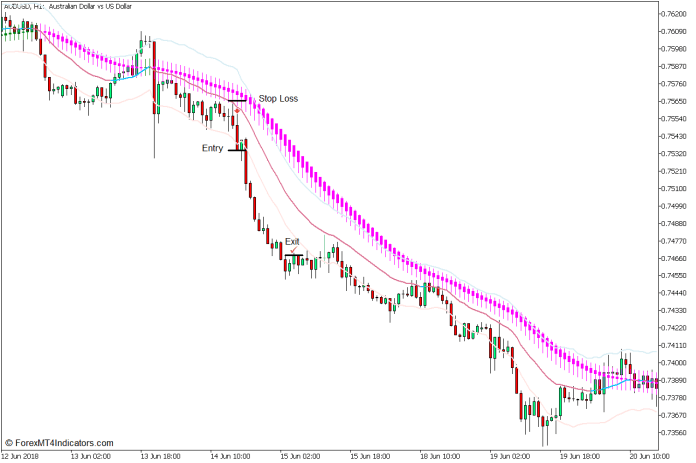

Sell Trade Setup

Entry

- Price action should generally be below the Heiken Ashi Smoothed bars.

- The Heiken Ashi Smoothed bars should be magenta indicating a bearish trend direction.

- Price should retrace near the Heiken Ashi Smoothed bars and contract sideways.

- A bearish momentum candle should break below the lower line of the Keltner Channel.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price action shows signs of a bullish reversal.

Conclusion

There are a couple of ways to trade with the trend. One is through pullbacks and the other is through breakouts from market congestions.

This strategy trades on breakouts of market congestion while moving in the direction of the trend. It would usually work well when the trend is not yet exhausted. Traders can expect the price to move towards the take-profit target when the trend is not too long, but these targets may not be hit when this is traded on a trend that is long overdue for a reversal.

Recommended MT5 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download:

Save

Save

Recent Posts

Categories

Related Articles

ECB Villeroy says falling inflation allows the Bank to lower interest rates

Villeroy heads up the Bank of France. He spoke with Ouest-France newspaper,...

ByglobalreutersNovember 24, 2024CCI Histogram Volume MT5 Indicator

The world of financial markets can feel like a whirlwind of charts,...

ByglobalreutersNovember 23, 2024Global Market Weekly Recap: November 18 – 22, 2024

Global markets rallied despite heightened Russia-Ukraine tensions, with gold and oil gaining...

ByglobalreutersNovember 22, 2024FX Weekly Recap: November 18 – 22, 2024

Major currencies saw wild swings as Russia-Ukraine tensions escalated. Safe havens rallied...

ByglobalreutersNovember 22, 2024

Leave a comment