- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

At its core, correlation refers to the interconnectedness between two variables. In the context of Forex, it signifies the directional tendency of two currency pairs to move in tandem or opposition to each other.

- Positive Correlation: When two currency pairs exhibit a positive correlation, they tend to move in the same direction. For instance, if the EUR/USD strengthens, the GBP/USD might also experience an upward movement.

- Negative Correlation: Conversely, a negative correlation indicates that the currency pairs move in opposite directions. A strengthening USD/JPY might be accompanied by a weakening EUR/JPY.

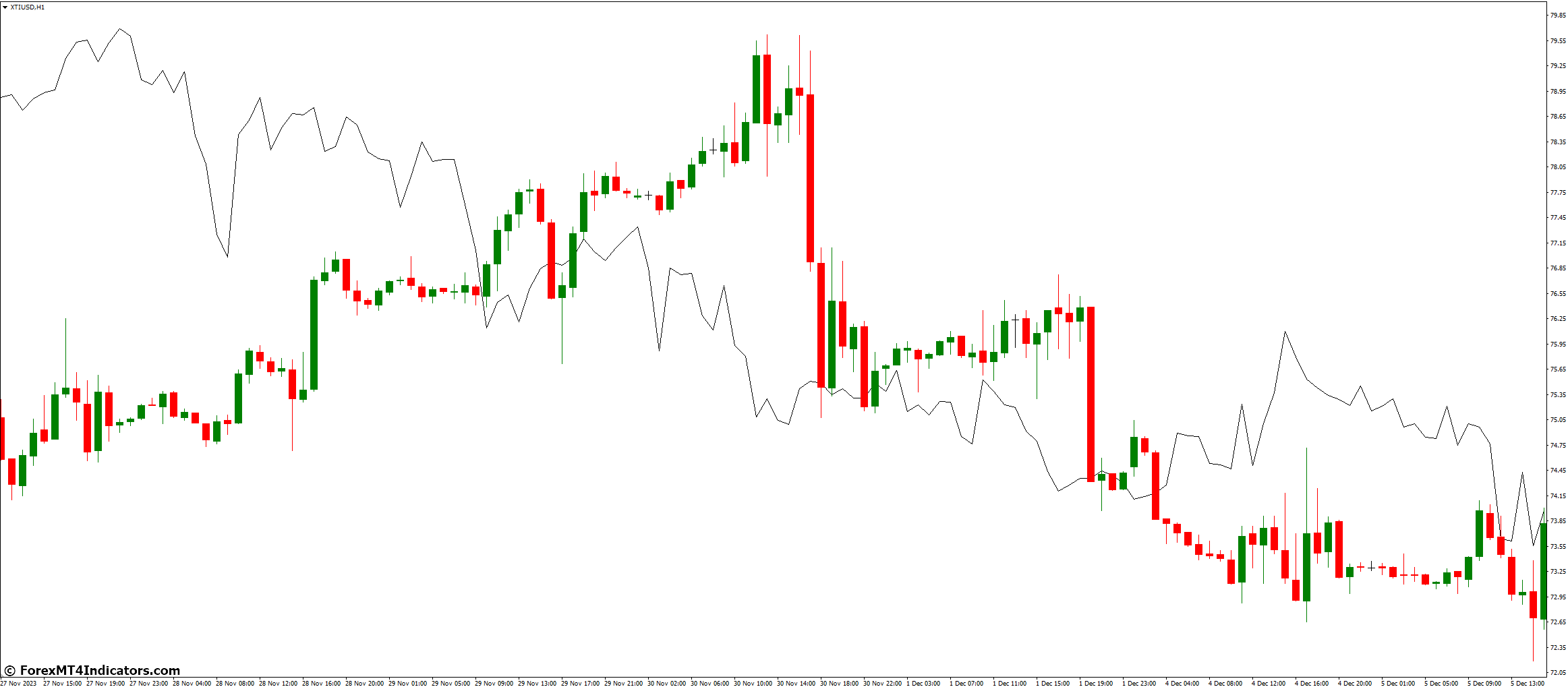

Understanding the Correlation MT4 Indicator

Types of Correlation MT4 Indicators

Several variations of the Correlation MT4 Indicator exist, each offering unique features:

- Simple Correlation Indicator: This basic version displays the correlation coefficient as a numerical value.

- Correlation Matrix Indicator: This advanced version presents a matrix showcasing the correlation coefficients between multiple currency pairs simultaneously.

- Visual Correlation Indicators: These indicators employ graphical representations, such as lines or bars, to depict the correlation between pairs.

Common Features and Functionalities

- User-friendly interface: Most indicators allow selecting the desired currency pairs for analysis.

- Adjustable timeframe: Traders can analyze correlations across various timeframes, like hourly, daily, or weekly charts.

- Alert settings: Some indicators provide options to receive alerts when the correlation coefficient reaches specific thresholds.

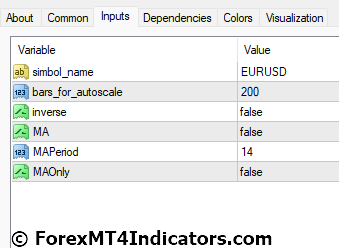

Customization Options and Parameters

The level of customization varies depending on the specific indicator. Common parameters include:

- Moving Average length: This smoothing out the correlation coefficient for better trend visualization.

- Calculation method: Different methods, like Pearson correlation, can be chosen to suit individual needs.

Interpreting the Correlation MT4 Indicator

Understanding Correlation Coefficient Values

As mentioned earlier, the correlation coefficient provides valuable insights:

- Values closer to +1: Indicate a strong positive correlation, suggesting potential for following trends in one pair based on the movement of the other.

- Values closer to -1: Signal a strong negative correlation, potentially enabling hedging strategies by capitalizing on opposing movements.

- Values close to 0: Imply minimal correlation, indicating the movements of the chosen pairs are largely independent.

Positive Correlation and Trading Strategies

- Identifying Trends: A strong positive correlation can help traders capitalize on prevailing trends. If EUR/USD strengthens and exhibits a high positive correlation with GBP/USD, a potential long trade on GBP/USD might be considered.

Negative Correlation and Trading Applications

- Hedging: When two pairs exhibit a strong negative correlation, traders can employ hedging strategies. For instance, buying EUR/USD while simultaneously selling USD/JPY can potentially mitigate losses in a volatile market.

Benefits of Using the Correlation MT4 Indicator

- Improved Risk Management in Trading Decisions: By understanding the relationships between currency pairs, traders can make more informed decisions regarding position sizing and potential stop-loss placement.

- Identifying Potential Hedging Opportunities: Hedging involves taking offsetting positions in two markets to mitigate risk. The Correlation MT4 Indicator can help identify currency pairs with a strong negative correlation, enabling traders to implement effective hedging strategies.

- Developing a Multi-Pair Trading Strategy: By analyzing correlations, traders can explore multi-pair trading strategies. This involves capitalizing on the coordinated movements of multiple currency pairs to potentially enhance returns.

Limitations and Considerations

- Market Noise and False Signals: Short-term fluctuations in the market, often termed market noise, can generate misleading signals from the Correlation MT4 Indicator. Focusing solely on the underlying trend and filtering out short-term volatility is essential.

- Over-Reliance on the Indicator: While the Correlation MT4 Indicator provides valuable insights, over-reliance on this tool can be detrimental. Combining correlation analysis with other technical analysis tools and fundamental factors is crucial for well-rounded trading decisions.

- Importance of Combining with Other Technical Analysis Tools: The Correlation MT4 Indicator serves as a complementary tool within a broader technical analysis framework. Indicators like moving averages, Relative Strength Index (RSI), and support/resistance levels should be used in conjunction to confirm signals and refine trading strategies.

Advanced Applications of the Correlation MT4 Indicator

- Correlation Across Different Time Frames: The Correlation MT4 Indicator allows analyzing correlations across various timeframes, such as daily, weekly, and monthly charts. This provides a multidimensional perspective on the relationship between currency pairs.

- Customizing the Indicator for Specific Trading Strategies: As mentioned earlier, some indicators offer customization options like adjustable moving average lengths and calculation methods. Tailoring these settings to align with individual trading strategies can enhance the indicator’s effectiveness.

- Combining Correlation with Other Technical Indicators: Integrating the Correlation MT4 Indicator with other technical indicators like trend lines, Fibonacci retracements, and volume analysis can provide a comprehensive view of the market and strengthen trade signals.

Correlation Indicator Settings

Conclusion

The Correlation MT4 Indicator is a valuable tool for Forex traders, enabling them to uncover hidden relationships between currency pairs. By understanding correlation coefficients and their interpretations, traders can gain insights into potential trends, hedging opportunities, and multi-pair trading strategies.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

(Free MT4 Indicators Download)

Click here below to download:

Recent Posts

Categories

Related Articles

Newsquawk Week Ahead: US PCE, FOMC Minutes, RBNZ rate decision, EZ HICP, and Aussie CPI

Mon: German Ifo (Nov), US National Activity Index (Oct)Tue: FOMC Minutes (Nov);...

ByglobalreutersNovember 24, 2024Weekly Market Outlook (25-29 November)

UPCOMING EVENTS:Monday: PBoC MLF, German IFO.Tuesday: US Consumer Confidence, FOMC Minutes.Wednesday: Australia...

ByglobalreutersNovember 24, 2024ECB Villeroy says falling inflation allows the Bank to lower interest rates

Villeroy heads up the Bank of France. He spoke with Ouest-France newspaper,...

ByglobalreutersNovember 24, 2024CCI Histogram Volume MT5 Indicator

The world of financial markets can feel like a whirlwind of charts,...

ByglobalreutersNovember 23, 2024

Leave a comment