- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Developed by Japanese technician Goichi Ichimoku in the 1930s, the Ichimoku Kinko Hyo, which translates to “equilibrium chart at a glance,” is a multifaceted indicator that incorporates multiple timeframes into a single chart. This holistic approach paints a clear picture of the prevailing trend, potential support and resistance zones, and underlying buying or selling pressure.

Imagine having a personal market whisperer constantly feeding you valuable insights – that’s the essence of the Ichimoku indicator for MT5 users.

A Glimpse into the History of the Ichimoku Indicator

The Ichimoku indicator boasts a rich history, rooted in the world of Japanese candlestick analysis. While the exact origins remain shrouded in some mystery, it’s widely acknowledged that Goichi Ichimoku spent years meticulously crafting this indicator to capture the essence of market behavior. His focus on incorporating elements from multiple timeframes into a single visual representation revolutionized technical analysis for generations of traders.

Why Embrace the Ichimoku Indicator in MT5?

In the fast-paced world of forex trading, having a reliable and versatile tool at your disposal is paramount. The Ichimoku indicator seamlessly integrates with the MT5 platform, offering several distinct advantages:

- Multi-Timeframe Analysis: By factoring in data from different time horizons, the Ichimoku indicator provides a comprehensive view of the market, helping you identify long-term trends while pinpointing potential entry and exit points on lower timeframes.

- Confirmation Signals: The Ichimoku indicator doesn’t rely solely on a single line or data point. Instead, it generates confirmation signals through interactions between its various components, fostering a more robust trading strategy.

- User-Friendly Integration: The MT5 platform boasts a user-friendly interface, making it easy to add and customize the Ichimoku indicator. With a few clicks, you can have this powerful tool at your fingertips, ready to analyze any currency pair or asset class.

Unveiling the Components of the Ichimoku Indicator

The Ichimoku indicator might appear complex at first glance, but understanding its components is key to unlocking its full potential. Here’s a breakdown of the five key elements that form the core of this versatile tool:

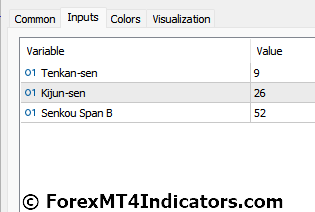

- Tenkan-sen (Conversion Line): This line represents the average of the highest and lowest prices over a specific period, typically 9 days. Think of it as a snapshot of the short-term market sentiment.

- Kijun-sen (Base Line): The Kijun-sen acts as a mid-term trend indicator, calculated as the average of the Tenkan-sen and the closing price over the past 26 days. It provides a smoother line compared to the Tenkan-sen, offering a clearer view of the prevailing trend direction.

- Senkou Span A (Leading Span A): This leading indicator is constructed by taking the average of the Tenkan-sen and Kijun-sen, projected forward 26 days into the future. Imagine it as a sneak peek into where the price might be headed based on current market conditions.

- Senkou Span B (Leading Span B): Formed by taking the closing price of the past 52 days and projecting it forward 26 days, the Senkou Span B forms the bottom half of the Ichimoku Cloud. Together with Senkou Span A, they create a visual representation of potential support and resistance zones.

- Chikou Span (Lagging Span): This line reflects the closing price of a specific period (typically 26 days) but is plotted 26 days behind the actual price action.

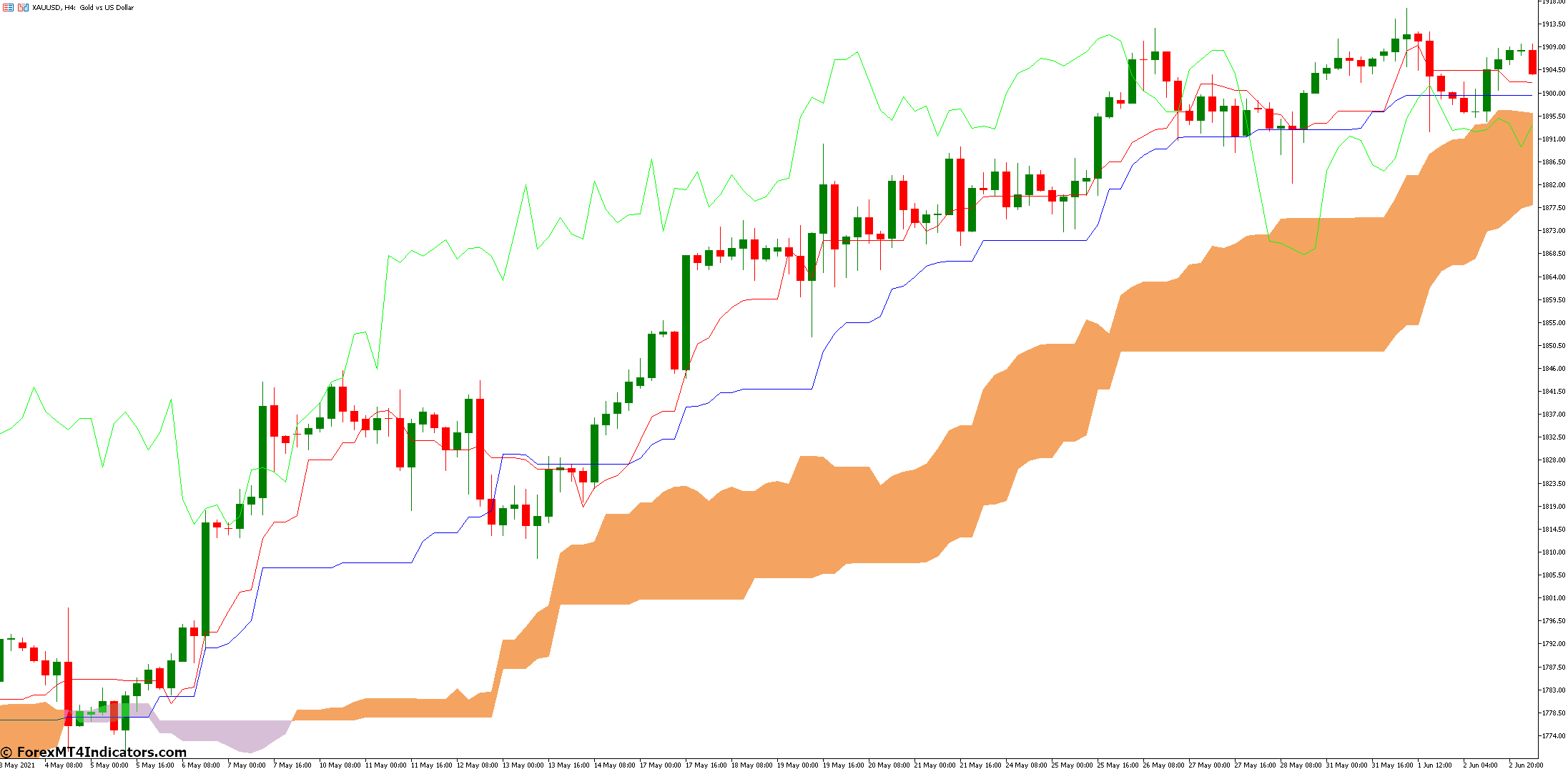

The Power of the Cloud: Decoding the Ichimoku Cloud

One of the most distinctive features of the Ichimoku indicator is the Ichimoku Cloud, formed by the intersection of Senkou Span A and Senkou Span B. This dynamic cloud offers valuable insights into market trends and potential support/resistance zones.

- Cloud Construction: The thickness of the cloud is directly related to the volatility of the market. A thick cloud indicates high volatility, while a thin cloud suggests a more stable market environment.

- Trend Direction: The slope of the cloud is a crucial indicator of the prevailing trend. An upward-sloping cloud suggests a bullish trend, while a downward-sloping cloud signifies a bearish bias.

- Trading with the Cloud: The price interaction with the cloud provides valuable trading signals. When the price is trading above the cloud, it often indicates an uptrend, while a price trading below the cloud suggests a downtrend.

Taking Your Trading to the Next Level

The Ichimoku indicator shines when combined with other technical analysis tools. Here are some advanced strategies to consider:

- Combining Ichimoku with Other Indicators: The Ichimoku indicator can be effectively combined with other popular indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator to generate more comprehensive signals.

- Utilizing Ichimoku on Different Timeframes: The Ichimoku indicator’s versatility allows you to analyze charts on various timeframes. For instance, you can use weekly and daily charts to identify long-term trends and then switch to lower timeframes like the 4-hour chart to pinpoint potential entry and exit points.

- Backtesting Ichimoku Strategies: Before deploying your Ichimoku-based strategies with real capital, consider backtesting them on historical data using the MT5 platform’s built-in strategy tester. This allows you to refine your approach and gain confidence before risking real money.

Understanding the Limitations

While the Ichimoku indicator is a powerful tool, it’s essential to acknowledge its limitations:

- Lagging Nature: The Ichimoku indicator, by its design, incorporates past price data. This inherent lag can sometimes cause it to miss out on capturing very fast market movements.

- False Signals in Ranging Markets: In periods of consolidation or ranging markets, where price fluctuates within a specific zone, the Ichimoku cloud can flatten, potentially generating false signals.

How to Trade with Ichimoku Indicator

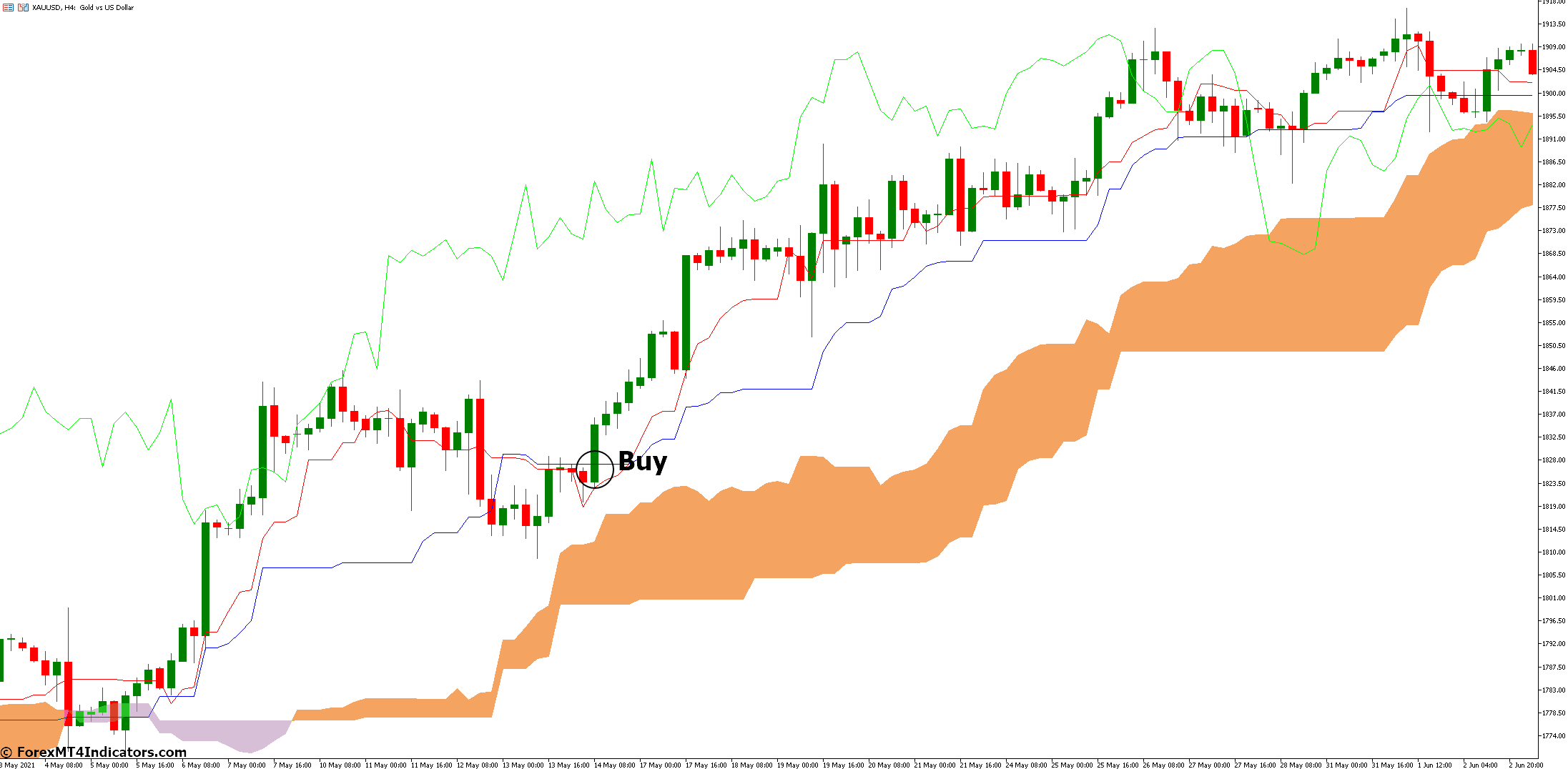

Buy Entry

- Confirmation: Price is trading above the Ichimoku Cloud.

- Entry: Price breaks above the Tenkan-sen (conversion line) and Kijun-sen (baseline) with a bullish crossover (Tenkan-sen crosses above Kijun-sen).

- Stop-Loss: Place below the recent swing low or the Kijun-sen, whichever is stricter.

- Take-Profit: Consider taking profit at the top of the Ichimoku Cloud or a predetermined profit target based on your risk-reward ratio.

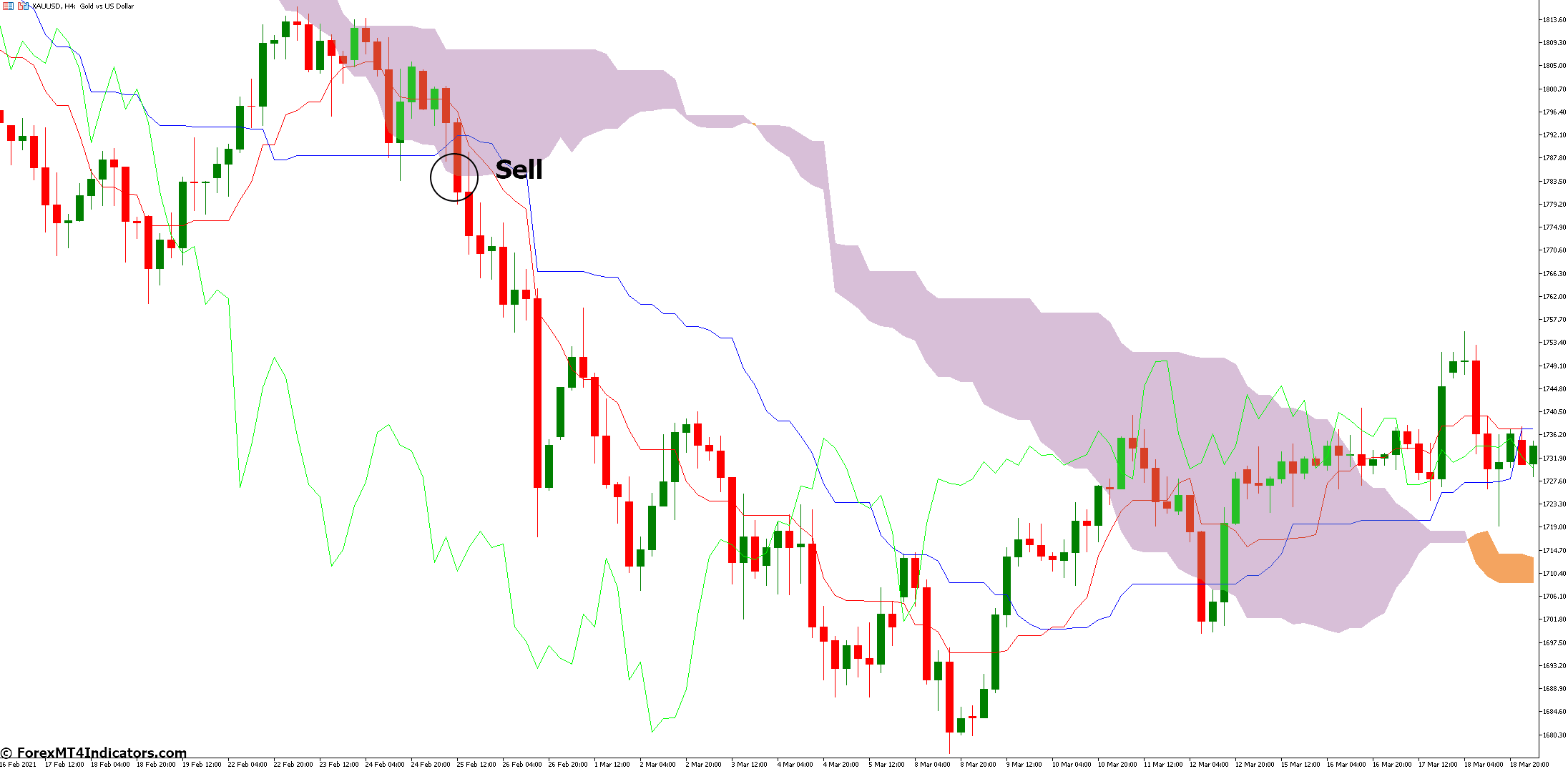

Sell Entry

- Confirmation: Price is trading below the Ichimoku Cloud.

- Entry: Price breaks below the Tenkan-sen and Kijun-sen with a bearish crossover (Tenkan-sen crosses below Kijun-sen).

- Stop-Loss: Place above the recent swing high or above the Kijun-sen, whichever is stricter.

- Take-Profit: Consider taking profit at the bottom of the Ichimoku Cloud or a predetermined profit target based on your risk-reward ratio.

Ichimoku Indicator Settings

Conclusion

The Ichimoku Kinko Hyo indicator, seamlessly integrated with the MT5 platform, empowers you to become a more informed and confident forex trader. By understanding its components, interpreting the generated signals, and employing it strategically, you’ll gain a valuable edge in navigating the ever-changing forex market landscape.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

(Free MT4 Indicators Download)

Click here below to download:

Recent Posts

Categories

Related Articles

Trade ideas thread – Monday, 25 November, insightful charts, technical analysis, ideas

Good morning, afternoon and evening all. Any charts, technical analysis, trade ideas,...

ByglobalreutersNovember 24, 2024Monday morning open levels – indicative forex prices – 25 November 2024

As is usual for a Monday morning, market liquidity is very thin...

ByglobalreutersNovember 24, 2024Newsquawk Week Ahead: US PCE, FOMC Minutes, RBNZ rate decision, EZ HICP, and Aussie CPI

Mon: German Ifo (Nov), US National Activity Index (Oct)Tue: FOMC Minutes (Nov);...

ByglobalreutersNovember 24, 2024Weekly Market Outlook (25-29 November)

UPCOMING EVENTS:Monday: PBoC MLF, German IFO.Tuesday: US Consumer Confidence, FOMC Minutes.Wednesday: Australia...

ByglobalreutersNovember 24, 2024

Leave a comment