- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

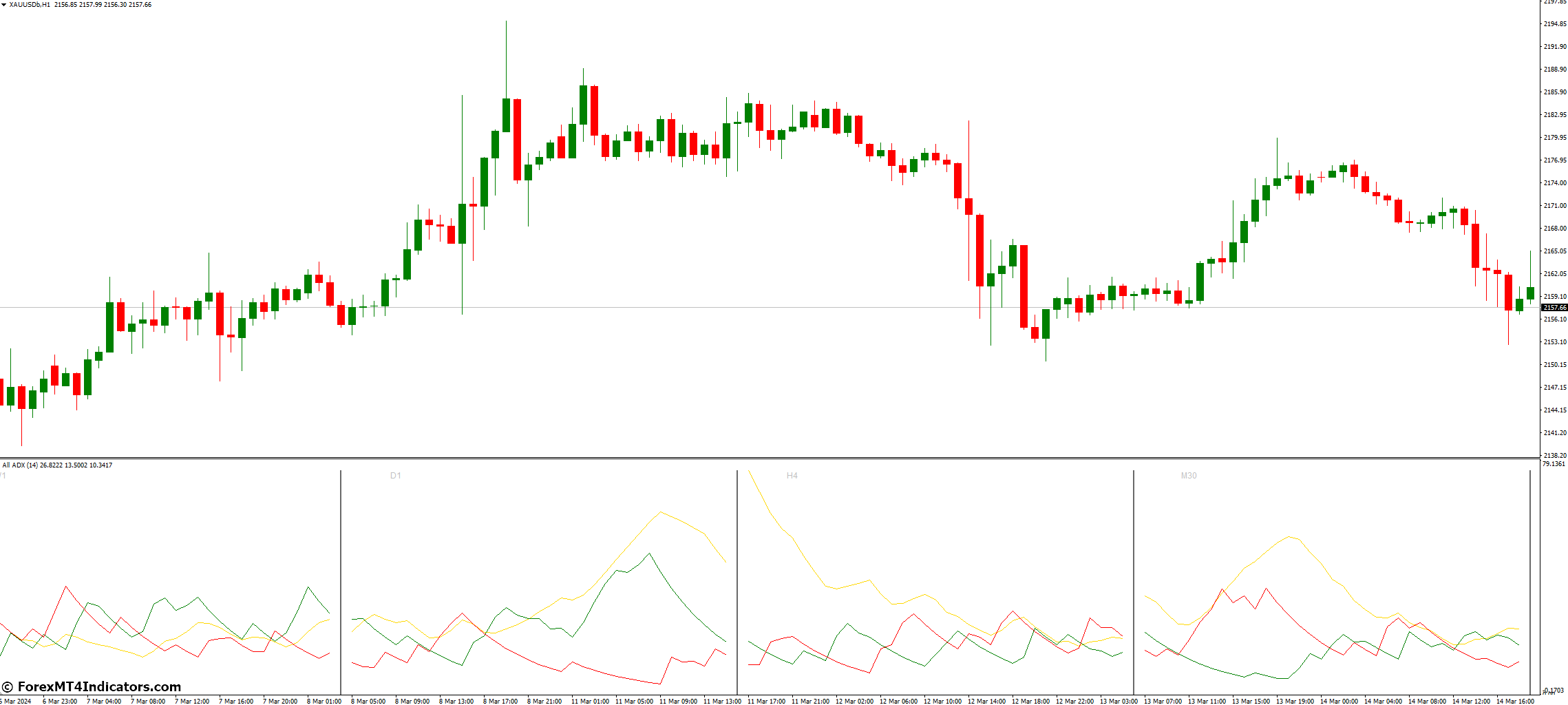

The Average Directional Index (ADX), originally developed by J. Welles Wilder, is a popular indicator used to gauge the strength of a trend in the market. The All ADX, a variation of the classic ADX, offers additional insights for traders using the MetaTrader 4 (MT4) platform. While the standard ADX focuses on a single timeframe, the All ADX can potentially provide trend strength readings across multiple timeframes, offering a more comprehensive view.

Unveiling the All ADX

There are various versions of the All ADX available for MT4. Some display the ADX for different timeframes directly on the chart, while others offer a more customizable approach, allowing you to select the timeframes you want to analyze. Regardless of the specific variation, the core functionality of the All ADX remains the same: to assess the strength of the prevailing trend.

Understanding the Components of the All ADX

The All ADX builds upon the foundation of the standard ADX by incorporating two additional lines: the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI).

Measure of Trend Strength

The ADX line itself is a smoothed average of the +DI and -DI values. It oscillates between 0 and 100, with higher readings indicating a stronger trend (either up or down). Generally, readings above 25 suggest a strong trend, while values below 20 suggest a weak or ranging market.

Directional Movement Revealed

The +DI and -DI lines depict the strength of price movements in the upward and downward directions, respectively. When the +DI is higher than the -DI, it suggests a potential uptrend, and vice versa. The All ADX, by displaying these lines alongside the ADX itself, provides a more nuanced picture of trend direction and strength.

Interpreting the All ADX Signals

Identifying Trending Markets with the ADX

As mentioned earlier, a rising ADX line above 25 indicates a strong trend. You can use this as a confirmation signal for existing trends identified through price action analysis or other technical indicators.

Confirmation Strategies

The All ADX is most effective when used in conjunction with other trading strategies. For instance, during a suspected uptrend, look for bullish candlestick patterns like a hammer or engulfing bars alongside a rising ADX for a stronger confirmation signal. Similarly, during a downtrend, look for bearish patterns like shooting stars or bearish engulfing bars with a rising ADX.

Advanced Techniques

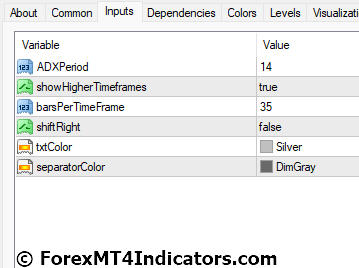

Optimizing the All ADX for Different Markets

The All ADX, like most technical indicators, is customizable. You can adjust the timeframe settings to suit your trading style and the market you’re analyzing. For example, a shorter timeframe might be more suitable for scalping strategies, while a longer timeframe might be more appropriate for swing trading.

Exploring Additional Features of the All ADX

Some ADX variations offer additional features like alerts or different smoothing methods. Experiment with these features to find what works best for you. Remember, backtesting your strategies is crucial before deploying them with real capital.

How to Trade with All ADX Indicator

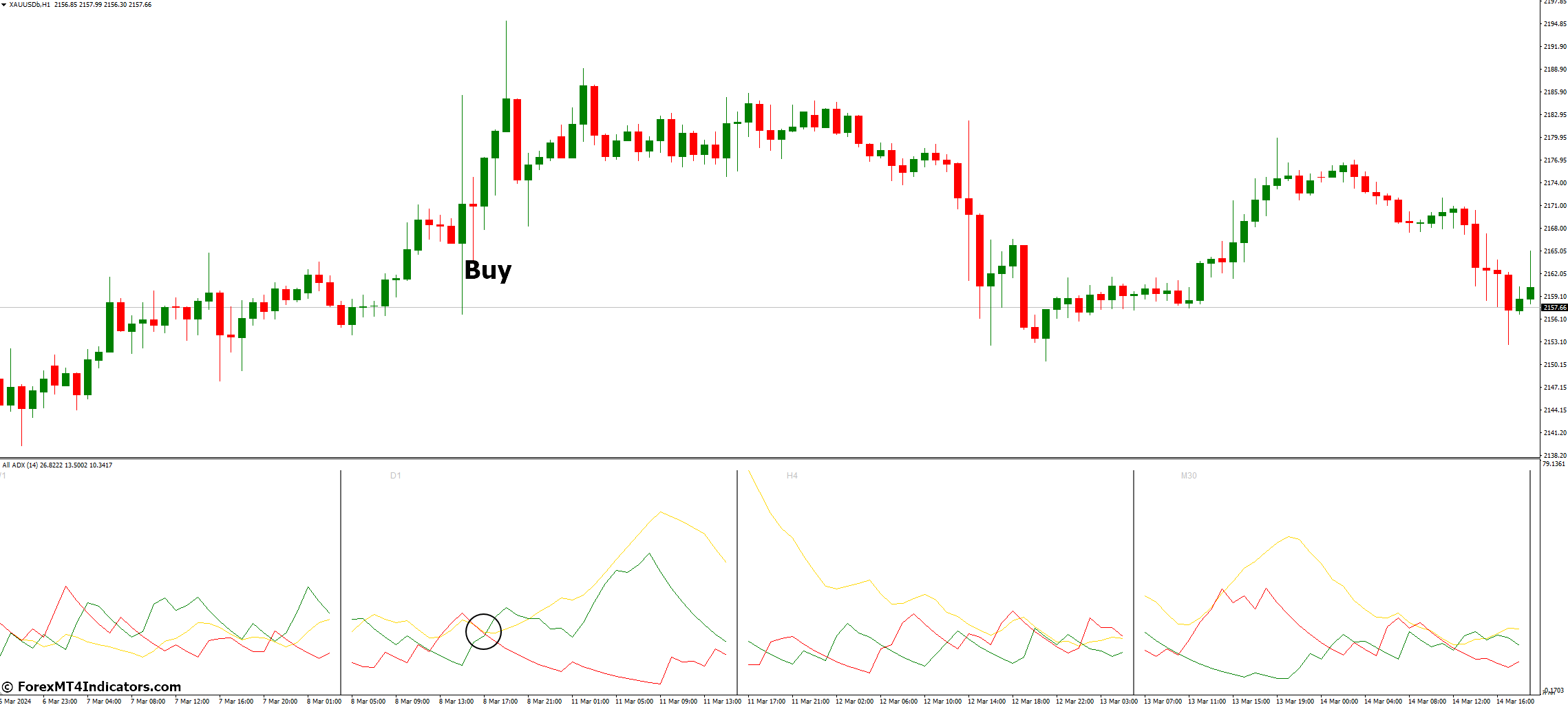

Buy Entry

- ADX Above 25: This indicates a strong trend, making trend-following strategies more viable.

- +DI Crosses Above -DI: This signals a potential uptrend. Consider a buy.

- Price action confirms the uptrend: Look for higher highs and higher lows on the chart.

- Price breaks above a resistance level: This suggests a potential breakout and continuation of the uptrend.

- ADX with RSI (Relative Strength Index): Combine ADX for trend strength with RSI for potential overbought/oversold conditions. You might consider a buy.

- When RSI dips below 30 (oversold) and ADX remains above 25: This suggests a potential buying opportunity in a strong uptrend.

- Place a stop-loss order below the recent swing low before the potential buy point.

- A fixed profit target: Set a specific price level to take profits (e.g., 50 pips, 100 pips).

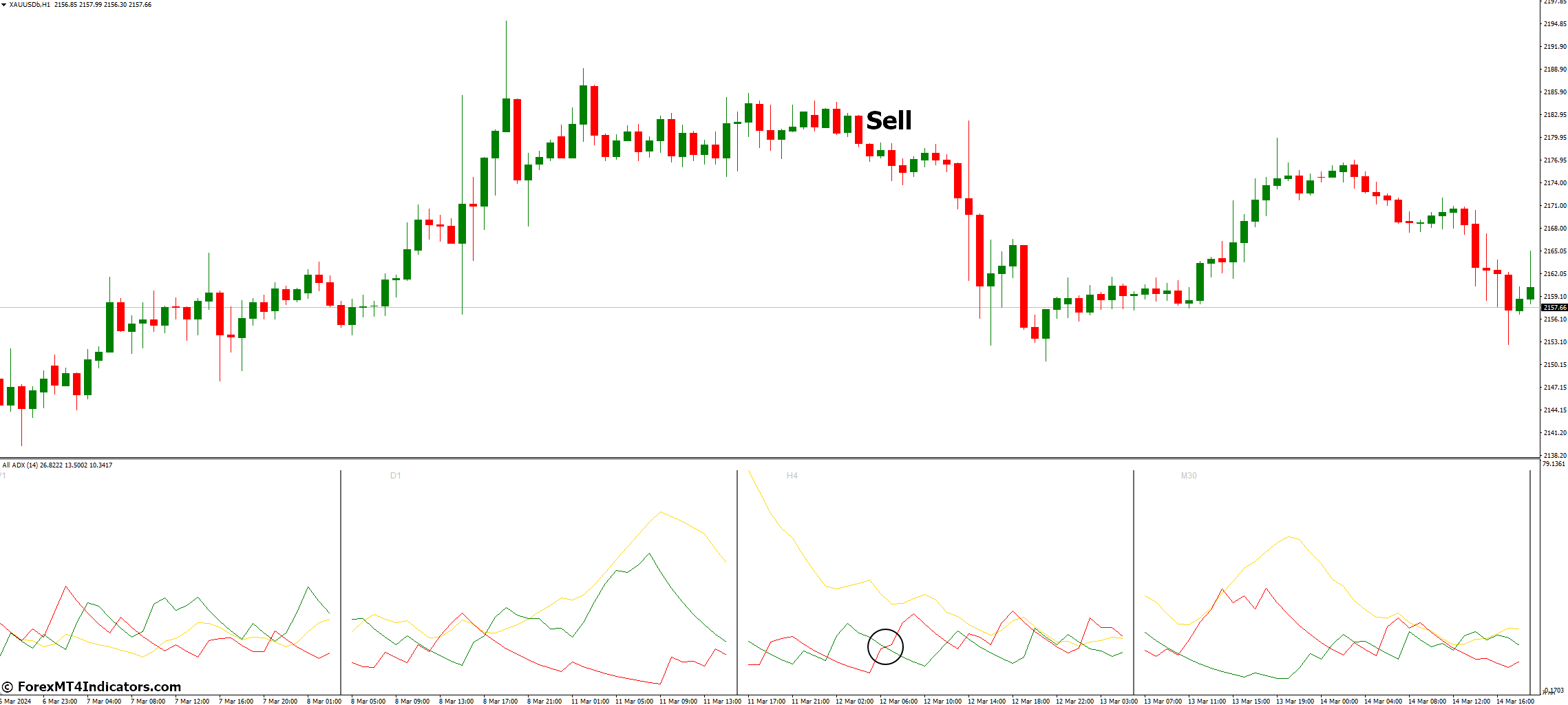

Sell Entry

- ADX Above 25: As with buy signals, a strong trend is present.

- -DI Crosses Above +DI: This signals a potential downtrend. Consider a sell.

- Price action confirms the downtrend: Look for lower lows and lower highs on the chart.

- Price breaks below a support level: This suggests a potential breakdown and continuation of the downtrend.

- ADX with RSI: Combine ADX for trend strength with RSI for potential overbought/oversold conditions. You might consider a sale.

- When RSI climbs above 70 (overbought) and ADX remains above 25: This suggests a potential selling opportunity in a strong downtrend.

- Place a stop-loss order above the recent swing high before the potential sell point.

- Trailing take-profit: Trail your take-profit downwards as the price falls, locking in profits.

All ADX Indicator Settings

Conclusion

ADX indicator can be a powerful tool in your trading arsenal. By understanding its strengths and limitations, you can leverage it to identify trends, gauge market momentum, and make informed entry and exit decisions. Remember, successful trading is a marathon, not a sprint.

Combine the ADX with other technical analysis tools, develop a solid trading plan, and practice disciplined risk management to navigate the ever-evolving forex market with confidence. So, put the ADX to the test, refine your strategies, and get ready to conquer the trend!

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download:

Recent Posts

Categories

Related Articles

Newsquawk Week Ahead: US PCE, FOMC Minutes, RBNZ rate decision, EZ HICP, and Aussie CPI

Mon: German Ifo (Nov), US National Activity Index (Oct)Tue: FOMC Minutes (Nov);...

ByglobalreutersNovember 24, 2024Weekly Market Outlook (25-29 November)

UPCOMING EVENTS:Monday: PBoC MLF, German IFO.Tuesday: US Consumer Confidence, FOMC Minutes.Wednesday: Australia...

ByglobalreutersNovember 24, 2024ECB Villeroy says falling inflation allows the Bank to lower interest rates

Villeroy heads up the Bank of France. He spoke with Ouest-France newspaper,...

ByglobalreutersNovember 24, 2024CCI Histogram Volume MT5 Indicator

The world of financial markets can feel like a whirlwind of charts,...

ByglobalreutersNovember 23, 2024

Leave a comment