- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

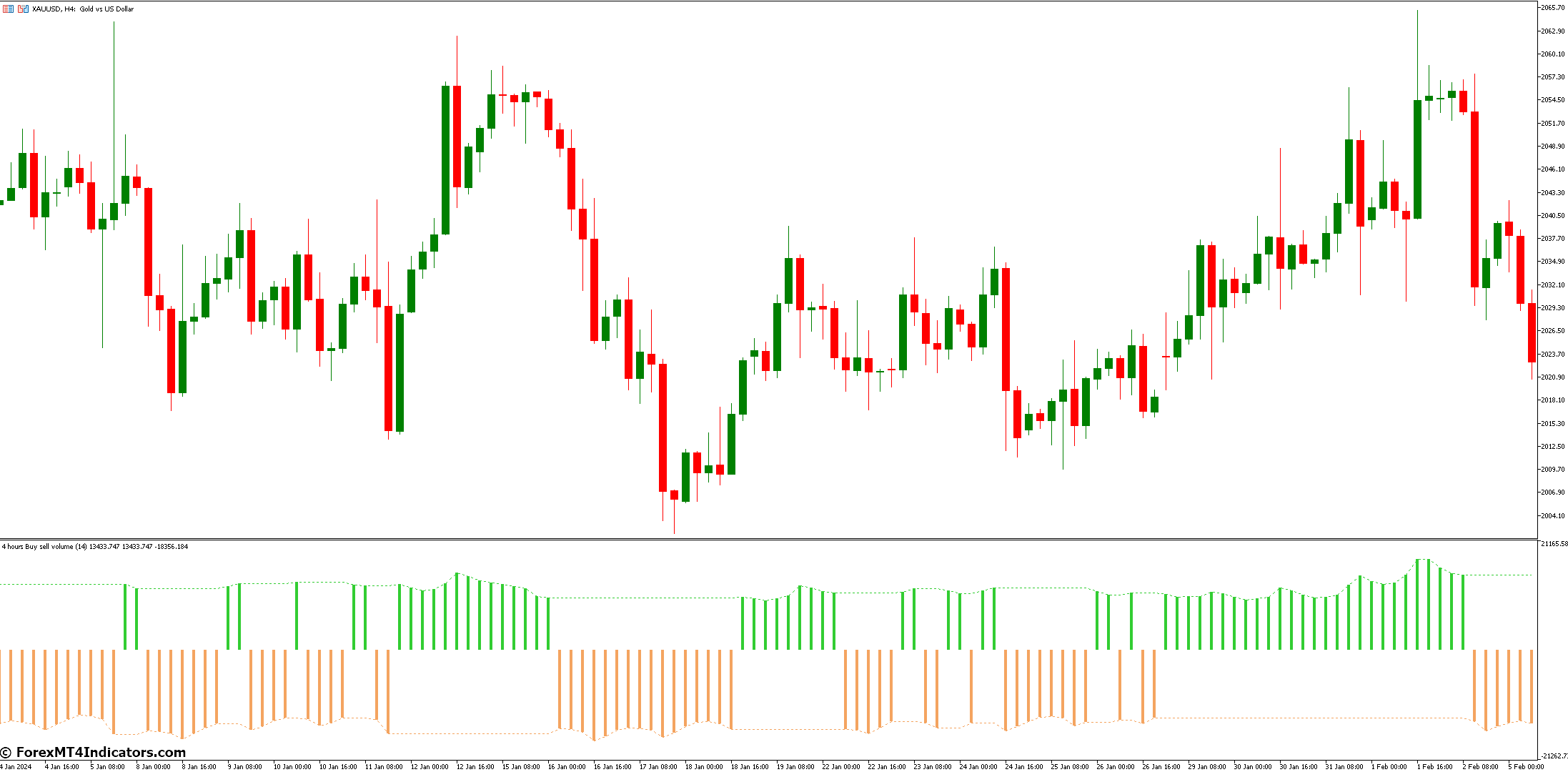

Price action is undeniably the focal point for most traders. However, a crucial element often gets sidelined: volume. In essence, volume represents the number of contracts or units traded for a specific security within a given timeframe. High-volume periods often signify heightened market activity and potential trend continuation, while low-volume periods can indicate consolidation or a lack of conviction behind price movements.

Traditionally, Forex trading platforms haven’t offered native volume data due to limitations in how interbank transactions are reported. However, the Buy Sell Volume indicator in MT5 bridges this gap by providing an estimate of buying and selling pressure based on price movements. While not a perfect substitute for true volume data, it offers valuable insights nonetheless.

Demystifying the Types of Buy-Sell Volume Indicators

Not all Buy Sell Volume indicators are created equal. Here’s a breakdown of the two main categories:

- Price-Based Buy-Sell Volume Indicators: These indicators estimate volume based on the relationship between price movement and a chosen moving average. For example, if the price closes above the moving average, it’s assumed buying pressure is dominant, and vice versa. Popular examples include the Volume Oscillator and the Chaikin Oscillator.

- Volume-Based Buy Sell Volume Indicators: These indicators, while less common within MT5’s native selection, attempt to incorporate actual tick volume data (the number of individual price changes) into their calculations. This can offer a more nuanced picture of buying and selling activity, but keep in mind that tick volume doesn’t always translate directly to traded volume.

How Does the Buy-Sell Volume Indicator Work?

Understanding how to read the Buy Sell Volume indicator is critical for its effective use. Typically, the indicator displays two lines: one representing buy volume and the other representing sell volume. Here’s a breakdown of what to look for:

- Divergence: When the price action diverges from the Buy Sell Volume lines, it can signal a potential reversal. For instance, if the price keeps rising, but the buy volume line starts to decline, it might suggest a weakening uptrend and a possible price correction.

- Confirmation: The Buy Sell Volume indicator is most valuable when used in conjunction with other technical indicators like support and resistance levels or trend indicators like moving averages. When the Buy Sell Volume confirms a signal from another indicator, it strengthens the overall trading thesis.

- Volume Discrepancies: Pay close attention to sudden spikes or dips in volume. High volume during a breakout from a support or resistance level can indicate strong buying or selling pressure, potentially leading to a sustained trend. Conversely, low volume during a breakout might suggest a lack of conviction and a possible false breakout.

Optimizing Your Trading Arsenal

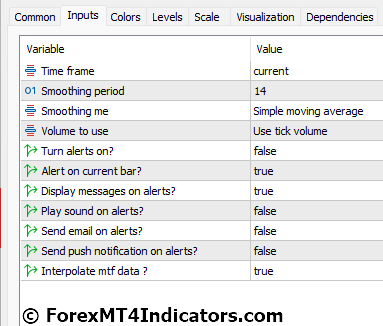

Most Buy Sell Volume indicators offer some degree of customization. Here are some key settings to consider:

- Choosing the Right Moving Average: For price-based Buy Sell Volume indicators, the moving average used plays a significant role. Consider experimenting with different moving average periods (e.g., 50-period, 200-period) to see what best suits your trading timeframe and strategy.

- Adjusting Volume Thresholds: Some indicators allow you to set thresholds for buy and sell volume. This can help filter out minor fluctuations and focus on more significant volume changes.

Crafting Winning Strategies

The true power of Buy Sell Volume indicators lies in their ability to enhance your existing trading strategies. Here are some ways to integrate them seamlessly:

- Identifying Trend Strength: During an uptrend, look for sustained buying volume alongside rising prices. This reinforces the uptrend’s validity and can indicate potential buying opportunities. Conversely, a downtrend accompanied by declining buy volume and increasing sell volume suggests a weakening trend and possible short-selling opportunities (remember, short-selling involves borrowing an asset to sell it at a higher price and then repurchasing it later at a lower price to return it, profiting from the price difference).

- Spotting Potential Reversals: Divergence between price and volume is a valuable clue for identifying potential trend reversals. For example, if the price continues to make new highs but the buy volume starts to taper off, it might be a sign that the uptrend is losing momentum and a potential reversal could be imminent. Conversely, if the price dips but the buy volume picks up, it could suggest a buying opportunity at a potential support level.

- Combining with Other Technical Indicators: Don’t rely solely on the Buy Sell Volume indicator. Consider using it alongside other technical indicators you trust, such as momentum indicators (like the Relative Strength Index or RSI) or oscillators (like the Stochastic Oscillator). When the Buy Sell Volume confirms signals from these indicators, it strengthens the overall trading case and provides more confidence for entry or exit points.

Advanced Techniques and Considerations

While the basic principles of Buy Sell Volume indicators are straightforward, there are some advanced techniques and considerations to keep in mind:

- Volume Spike Strategies: Some traders employ strategies based on sudden spikes in volume. For instance, a high volume breakout from a consolidation zone could signal a strong trend move. However, be cautious of “false breakouts” that occur with low volume and can quickly reverse.

- Market Noise and False Signals: No indicator is perfect, and the Buy Sell Volume indicator is no exception. Choppy market conditions or sudden news events can create “noise” in the volume of data, leading to false signals. Always consider the broader market context when interpreting the indicator’s readings.

- Confirmation Bias: Be wary of confirmation bias, the tendency to seek out information that confirms your existing beliefs. Don’t use the Buy Sell Volume indicator to justify trades you already wanted to make. Instead, use it objectively to assess market conditions and identify potential opportunities.

How To Trade With Buy Sell Volume Indicator

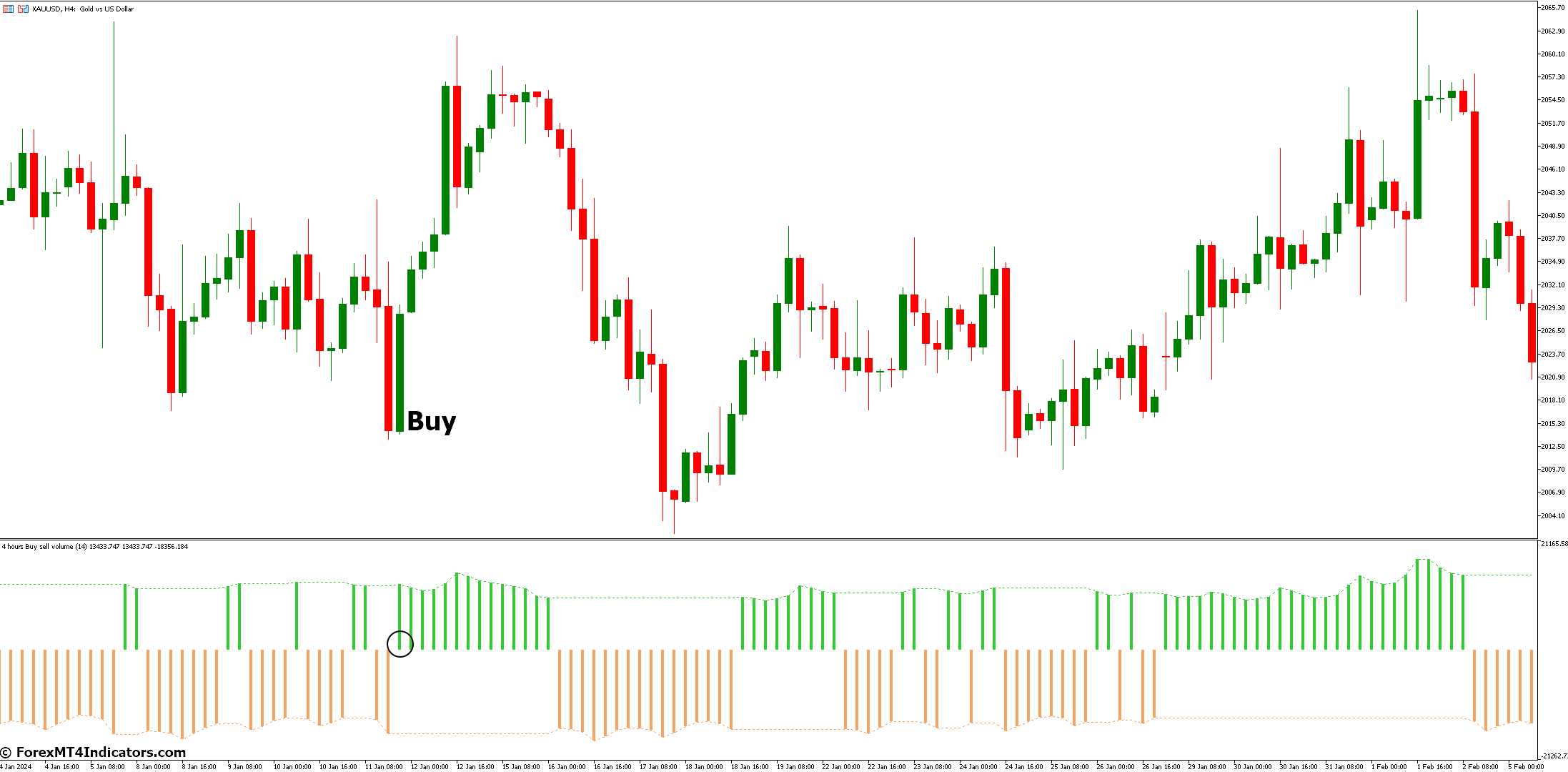

Buy Entry

- Price action is in a confirmed uptrend (e.g., above a rising moving average).

- The buy volume line on the Buy Sell Volume indicator increases alongside rising prices.

- Entry: Consider buying near the close of a bullish candlestick pattern (e.g., hammer, engulfing bullish).

- Stop-Loss: Place a stop-loss order below the recent swing low or support level.

- Take-Profit: Target a profit level based on your risk-reward ratio (e.g., twice your stop-loss distance).

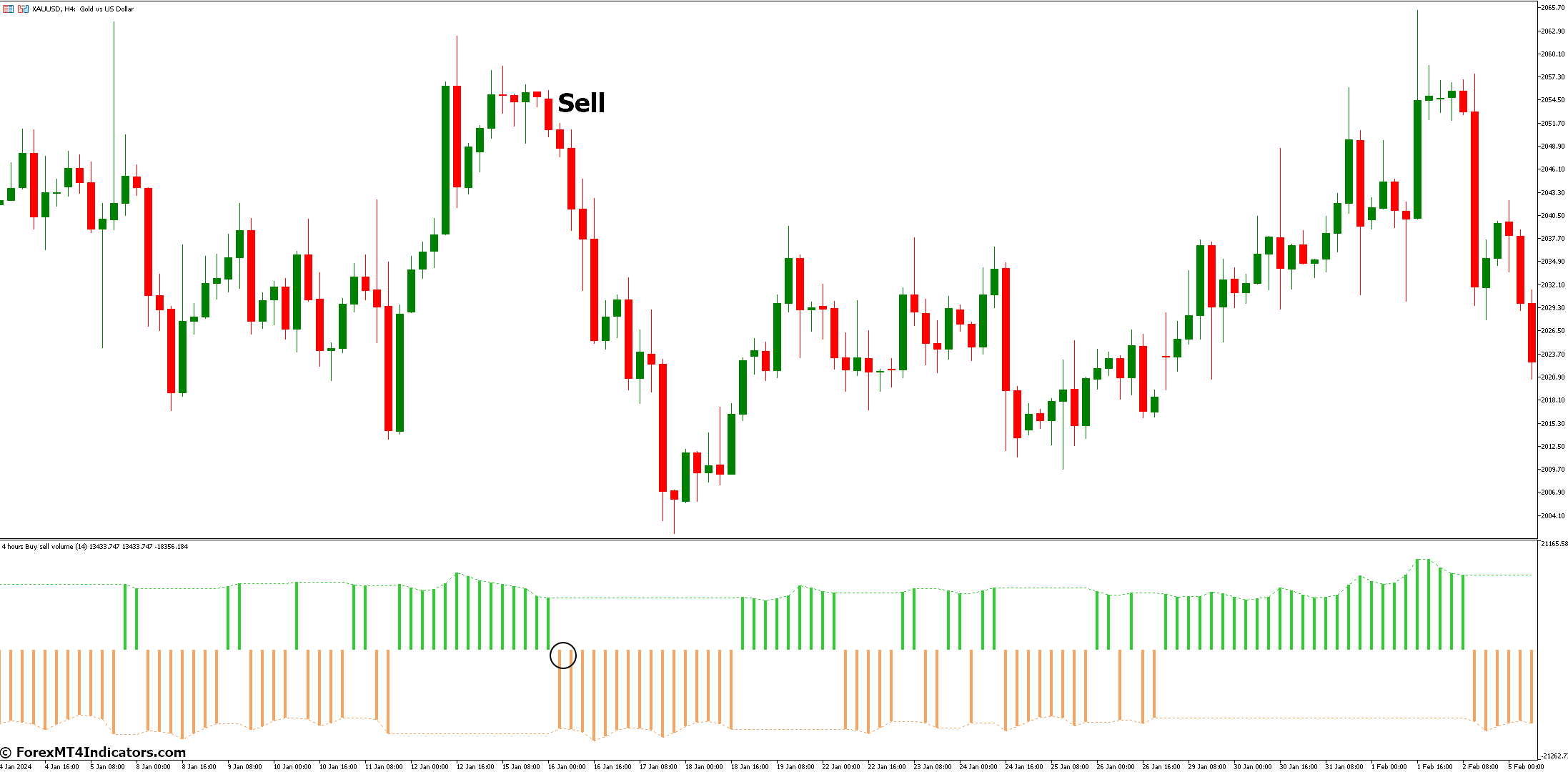

Sell Entry

- Price action is in a confirmed downtrend (e.g., below a falling moving average).

- The sell volume line on the Buy Sell Volume indicator increases alongside falling prices.

- Entry: Consider selling short (borrowing to sell and repurchasing later) near the close of a bearish candlestick pattern (e.g., shooting star, bearish engulfing).

- Stop-Loss: Place a stop-loss order above the recent swing high or resistance level.

- Take-Profit: Target a profit level based on your risk-reward ratio (e.g., twice your stop-loss distance).

Buy Sell Volume Indicator Settings

Conclusion

When used thoughtfully and strategically, can be a powerful asset in your MT5 trading toolbox. By understanding how to interpret its signals, customizing it to your preferences, and integrating it with other technical analysis tools, you can gain valuable insights into market sentiment and make more informed trading decisions.

However, remember that success in Forex trading requires a multi-faceted approach. Always prioritize proper risk management, maintain a healthy skepticism of any single indicator, and continuously refine your trading skills through practice and education. With dedication and the right tools, you can navigate the ever-changing waters of the Forex market with greater confidence and potentially achieve your trading goals.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download:

Recent Posts

Categories

Related Articles

Weekly Market Outlook (25-29 November)

UPCOMING EVENTS:Monday: PBoC MLF, German IFO.Tuesday: US Consumer Confidence, FOMC Minutes.Wednesday: Australia...

ByglobalreutersNovember 24, 2024ECB Villeroy says falling inflation allows the Bank to lower interest rates

Villeroy heads up the Bank of France. He spoke with Ouest-France newspaper,...

ByglobalreutersNovember 24, 2024CCI Histogram Volume MT5 Indicator

The world of financial markets can feel like a whirlwind of charts,...

ByglobalreutersNovember 23, 2024Global Market Weekly Recap: November 18 – 22, 2024

Global markets rallied despite heightened Russia-Ukraine tensions, with gold and oil gaining...

ByglobalreutersNovember 22, 2024

Leave a comment