- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I have just finished the first book, “Red Mars,” in a trilogy by Kim Stanley Robinson. One of the characters, a Japanese scientist named Hiroko Ai, routinely utters “shikata ga nai” or “it cannot be helped” when referring to situations out of the Mars colonists’ control.

As I thought about a title for the “short” essay, which will focus on deadbeat Japanese banks that have fallen victim to the monetary policies of Pax Americana, this phrase materialised in my consciousness. What did these banks do? Well, to earn a decent yield on their yen deposits, they engaged in a dollar-yen carry trade. They borrowed from domestic Japanese geriatric savers, looked around Japan and saw near-zero yields on all “safe” government and corporate bonds, and concluded that lending money to Pax Americana via the US Treasury (UST) market was a better use of capital as these bonds yielded many percentage points more even when fully FX-hedged.

But then, when inflation showed up in the US bigly due to cash bribes paid to mollify the public so that they would accept being locked in their homes and jab themselves with experimental drugs to fight the boomer flu, the US Federal Reserve (Fed) had to act. The Fed raised interest rates at the fastest pace since the 1980’s. As a result, it was bad news bears for anyone who held USTs. From 2021 to 2023, the rising yields produced the worst bond round since the War of 1812. Shikata Ga Nai!

The first banking casualties to percolate up through the financial system substrate occurred in the US starting in March 2023. In under a fortnight, three major banks failed, which resulted in the Fed providing a blanket backstop for all USTs held on any US bank or US branch of a foreign bank’s balance sheet. As expected, Bitcoin surged higher over the ensuing months after the bailout was announced.

Bitcoin is up over 200% since the bailout was announced on 12 March 2023.

To cement the roughly $4 trillion bailout (this is my estimation of the total amount of USTs and mortgage-backed securities held on US banking balance sheets), this March, the Fed proclaimed that using the discount window was no longer the kiss of death. Said window should be used without delay if any financial institution needs a quick injection of cash to plug a pesky hole in its balance sheet due to underwater “safe” government bonds. What do we utter when the banking system is inevitably bailed out by debasing the currency and impinging on the dignity of human labour? Shikata Ga Nai!

The Fed did right by US financial institutions, but what about foreigners who also gorged on USTs from 2020 to 2021 as global money rocketed higher? Which nation’s banks’ balance sheets are most likely to be deaded by the Fed? The Japanese banking system, of course.

Hot off the press, we learn why the 5th largest Japanese bank by deposits will dump $63 billion worth of foreign bonds, the majority of which are USTs.

Japan’s Norinchukin Bank to sell $63bn of U.S. and European bonds

“Interest rates in the U.S. and Europe have risen, and bond prices are down. This reduced the value of high-priced (low-yielding) foreign bonds that Norinchukin purchased in the past, causing its paper losses to swell.”

Norinchukin “Nochu” is the first bank to capitulate and announce it must sell bonds. Every other bank is engaged in the same trade, which I will explain below. The Council on Foreign Relations gives us an idea of the possible gargantuan size of bonds that Japanese commercial banks will sell.

They [Japanese commercial banks] held about $850 billion in foreign bonds going into 2022, according to a coordinated survey of portfolio investment by the International Monetary Fund (IMF). That included almost $450 billion in U.S. bonds and $75 billion or so in French debt—a number that far exceeds their holdings of the bonds issued by the other large countries in the euro area.

Why is this important? Because Bad Gurl Yellen will not allow these bonds to be sold on the open market and spike UST yields. She will demand that the Bank of Japan (BOJ) purchase these bonds from Japanese banks it supervises. Then the BOJ will utilise the Fed’s Foreign and International Monetary Authorities (FIMA) repo facility established in March 2020. The FIMA repo facility allows central bank members to pledge USTs and receive overnight freshly printed dolla bills.

A rise in the FIMA repo facility indicates an addition of dollar liquidity to the global money markets. Y’all know what that means for Bitcoin and crypto … which is why I thought it necessary to alert readers about another avenue of stealth money printing. It took me reading a dry Atlanta Fed report entitled “The Offshore Dollar and US Policy” to understand how Yellen could keep these bonds from hitting the public markets.

Why Now

USTs began their meltdown in late 2021 as the Fed signalled that it would raise its policy rate starting in March of 2022. It’s been over two years; why would a Japanese bank crystalise its losses after suffering two years of pain? Another strange fact is the consensus view amongst economists you are supposed to listen to: the US economy is on the precipice of a recession. Thus, the Fed is a few meetings away from cutting rates. A rate cut would boost the price of bonds. Again, why sell now if all the “smart” economists tell you relief is just around the corner?

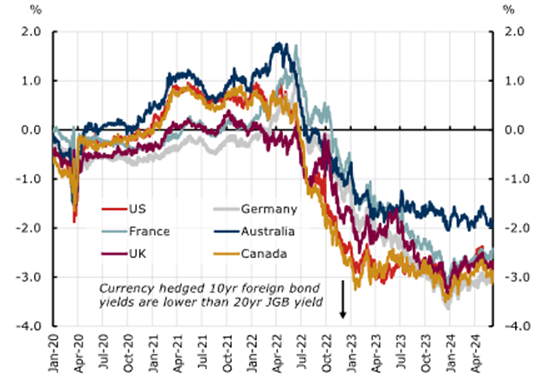

The reason is that Nochu’s FX-hedged purchase of USTs went from a slight positive to a massive negative carry. Before 2023, the differential between dollar and yen rates was negligible. Then, the Fed diverged from the BOJ by hiking rates while the BOJ stood firm at -0.1%. As the differential widened, the cost of hedging the dollar exposure embedded in a UST outweighed the higher yield offered.

Here is how it works. Nochu is a Japanese bank with yen deposits. It must pay for this bond in dollars if it wants to buy a higher-yielding UST. Nochu will sell yen and buy dollars today to purchase the bond; this is done in the spot market. If that’s all Nochu did, and the yen appreciated between now and the bond’s maturity, Nochu would lose money when it sold dollars back into yen. For example, you bought dollars at USDJPY 100 today and sold USDJPY tomorrow at 99; the dollar weakened, and the yen strengthened. Therefore, Nochu will sell dollars and buy yen, usually on a three-month forward basis, to hedge this risk. It will roll this forward every three months until the bond matures.

Typically, the 3m tenor is the most liquid. That is why a bank like Nochu would use a rolling 3m forward to hedge a 10-yr currency purchase.

The forward points went negative as the dollar-yen interest rate differential widened because the Fed’s policy rate was greater than the BOJ’s. For example, if the spot USDJPY is 100, and the dollar yields 1% more than the yen over the next year, the USDJPY 1-yr forward should trade around 99. This is because if I borrowed 10,000 JPY at 0% to buy 100 USD today, then deposited the 100 USD to earn 1%, I will have 101 dollars in one year. What is the USDJPY 1-yr forward price that nullifies the 1 USD of interest income? ~99 USDJPY, this is the no-arbitrage principle. Now imagine that I did all of that to purchase a UST that only paid 0.5% more yield than a JGB of similar maturity. I am essentially paying 0.5% in negative carry to put on this position. If this is the case, Nochu or any other bank would not make this trade.

Back to the chart, as the differential widened, the 3m forward points got so negative that a UST bond FX-hedged back into yen yielded less than just buying a yen-denominated JGB. That is what you see starting in mid-2022 as the red line representing USD crossed below the 0% on the X-axis. Remember, a Japanese bank that buys a JGB in yen has no currency risk and, therefore, has no reason to pay for a hedge. The only reason to put on this trade is when the FX-hedged yield is >0%.

Nochu is getting spit-roasted harder than an FTX / Alameda polycule participant. On a mark-to-market basis, the USTs bought most likely in 2020-2021 are down 20% to 30%. In addition, the FX hedge cost has gone from negligible to over 5%. Even if Nochu believes that the Fed will cut, a 0.25% cut isn’t going to reduce the hedging costs or elevate the bond prices enough to staunch the bleeding. Therefore, they must dump USTs.

Any schemes that allow Nochu to pledge USTs for fresh dollars don’t solve the negative cash flow problem. The only thing that puts Nochu back into the black from a cash flow perspective is a significant closure of the policy rate gap between the Fed and BOJ. Therefore, using any of the Fed’s programs, like the Standing Repo Facility, which allows US branches of foreign banks to repo USTs and mortgage-backed securities for freshly printed dollars, is not helpful in this circumstance.

As I write this, I’m racking my brain trying to think of any other financial chicanery Nochu could engage in that would allow it to avoid selling the bonds. But as I mentioned above, the schemes in place to help banks lie about their unrealised losses are loans and swaps of some sort. As long as Nochu owns the bond in some way, shape, or form, the currency risk remains and must be hedged. Only once the bond is sold can Nochu unwind the FX hedge, which is costing it dearly. That is why I’m confident that Nochu’s management explored all other options, and selling bonds is the last resort.

I will get to why Bad Gurl Yellen is upset about this situation, but for now, let’s close Chat GPT and use our imagination. Is there a Japanese public institution that could buy bonds from these banks and warehouse the USD interest rate risk without fear of going bankrupt?

Ding Dong

Who’s there?

It’s the Bank of Mother Fucking Japan

Bailout Mechanics

The BOJ is one of the few central banks that can use the FIMA repo facility. This allows it to obscure UST price discovery in the following fashion:

- The BOJ softly “suggests” that instead of selling USTs on the open market, any Japanese commercial bank that needs to get out dumps these bonds directly onto the BOJ’s balance sheet instead and receives the current last traded price with no market impact. Imagine you could dump all your FTT tokens at the market price because Caroline Elison was there to support the market in any size necessary. Obviously, that didn’t work out well for FTX, but she ain’t a central bank with a money printer. Her money printer only went up to $10 billion of customer funds. Whereas the BOJ deals in the infinite.

- The BOJ then exchanges USTs for dollar bills the Fed prints out of thin air courtesy of the FIMA repo facility.

One, two, buckle my shoe. It’s just that easy to sidestep the free market. Man, that’s some freedom worth fighting for!

Let’s ask a few questions to understand the implications of said policy.

Someone must be losing money here; the losses on the bonds due to a rise in interest rates are still there. Who is the mug?

The Japanese banks still crystallise the losses on the bonds because they sell them to the BOJ at current market prices. The BOJ now has UST duration risk going forward. If the price of these bonds falls, the BOJ will have an unrealised loss. However, this is the same risk the BOJ is currently running on its trillions of yen-sized Japanese Government Bond portfolio. The BOJ is a quasi-government entity that cannot go bankrupt and does not have to adhere to capital adequacy ratios. Neither does it have a risk management department that forces a reduction in positions if its Value-at-Risk rises due to massive DV01 risk

As long as the FIMA repo facility exists, the BOJ can roll the repo every day and hold the USTs until maturity.

How does the supply of dollars increase?

The repurchase agreement requires the Fed to hand dollars to the BOJ in exchange for USTs. This loan is rolled out daily. The Fed obtains these dollars by using its printing press.

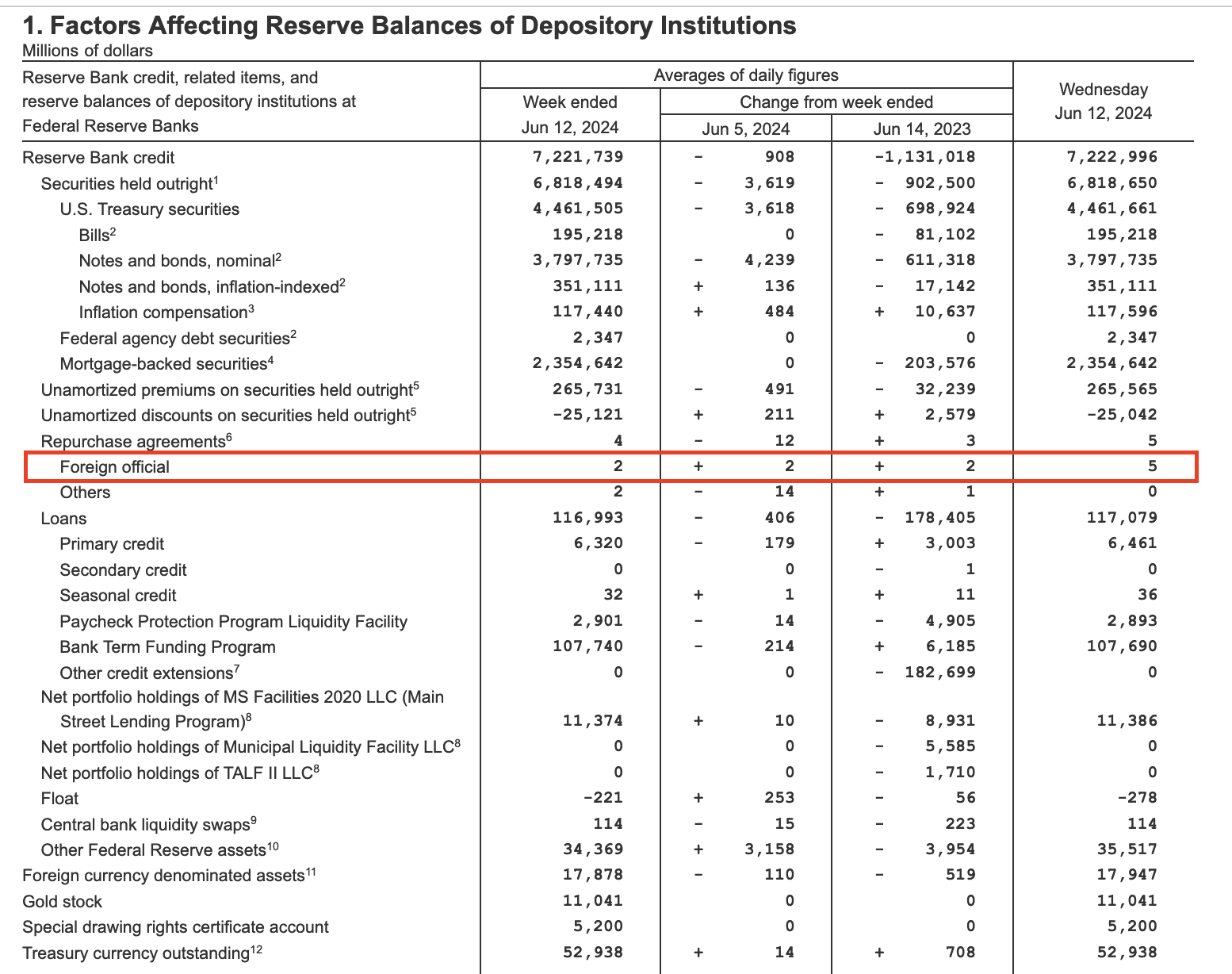

We can monitor the dollars injected into the system weekly. The line item is “Repurchase agreements—Foreign Official.”

As you can see, the FIMA repo is very small currently. But the selling hasn’t started yet, and I imagine there will be some interesting phone calls between Yellen and Ueda, the BOJ governor. If I’m right, this number will rise.

Why Help Others

Americans aren’t known to be very sympathetic to foreigners, especially ones that don’t speak English and look funny. Funny looking is a matter of perspective, but for your deplorable, fly-over state living, farmer tan sporting, confederate flag waving, hillbilly, a Japanese person doesn’t look right. And guess what? These uncouth individuals will decide who the next emperor will be this November. Ain’t that some shit.

The reason why Bad Gurl Yellen will come to the rescue in the face of latent xenophobia is that absent fresh dollars to soak up these dogshit bonds, all the Japanese megabanks will follow in the footsteps of Nochu and dump their UST portfolio to make the pain go away. That means $450 billion worth of USTs will hit the market quickly. That cannot be allowed as yields would spike higher and make funding the federal government extremely expensive.

In the Fed’s own words, this is why the FIMA repo facility was created:

In March 2020, during the “dash for cash,” central banks simultaneously sold US Treasuries

and parked the proceeds in overnight repos at the New York Fed. In response, the Fed at the

end of March offered to agree to provide overnight advances to central banks using US

Treasuries held in custody at the New York Fed as collateral at a rate above private repo rates.

Such advances would allow central banks to raise cash without forcing outright sales in an

already strained Treasury market.

Remember September to October 2023? During those two months, the UST yield curve steepened, causing the S&P 500 to drop 20% and 10-year and 30-year USTs to trade at yields north of 5%. In response, Bad Gurl Yellen shifted the majority of debt issuance to short-maturity T-bills to drain cash parked in the Fed’s Reverse Repo Program. This juiced the markets, and starting November 1st, it was off to the races for all risk assets, crypto included.

I have the utmost confidence that in an election year when her boss is staring down defeat at the felonious hands of the Orange Man, Yellen will do her duty to “democracy” and ensure that yields stay down to avert a financial market calamity. In this instance, all it requires is that Yellen phone Ueda and instruct him that public market sales by Japanese banks of USTs are not allowed and that he should use the FIMA repo facility instead to absorb the supply.

Trading Tactics

Everyone is laser focused on when the Fed will eventually start cutting rates. However, the dollar-yen interest rate differential is +5.5% or 550bps or 22 rate cuts, assuming the Fed cuts 0.25% at each of its next meetings. One, two, three, or four rate cuts over the next twelve months aren’t going to depress the differential materially. Also, the BOJ has shown no desire to raise its policy rates. At most, the BOJ might reduce the pace of its open market bond purchases. The reason why Japanese commercial banks must dump their FX-hedged UST portfolios is not being addressed.

This is why I’m confident in accelerating the pace at which I transition from Ethena staked USD (sUSDe), which is earning 20-30%, into crypto risk. Given this news, the pain has reached a level where Japanese banks have no choice but to exit the UST market. As I mentioned, in an election year, the last thing the ruling Democrats need is a massive rise in UST yields, which affect major things their median voter financially cares about. That is mortgage rates, credit card, and auto loan rates. These all rise if treasury yields climb.

This situation is precisely why the FIMA repo facility was established. All that is needed now is for Yellen to firmly insist that the BOJ use it.

Just as many began to wonder where the next jolt of dollar liquidity would come from, the Japanese banking system dropped Origami cranes composed of crisply folded dolla bills upon the laps of crypto investors. This is just another pillar of the crypto bull market. The supply of dollars must increase to maintain the current Pax Americana dollar-based filthy financial system.

Say it with me, “Shikata Ga Nai”, and buy the fucking dip!

The post Shikata Ga Nai appeared first on BitMEX Blog.

Recent Posts

Categories

Related Articles

Study: 76% of X Influencers Promoted Now-Defunct Meme Coins

A Coinwire study reveals that most crypto influencers on X promote worthless...

ByglobalreutersNovember 22, 2024XRP Army Rejoice Ripple’s 26% Daily Price Surge With Predictions of Up to $30 Per Coin

XRP is above $1.4 for the first time since May 2021.

ByglobalreutersNovember 22, 2024Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin has shattered expectations once again, surging past the critical $93,257 level...

ByglobalreutersNovember 22, 2024XRP jumps 25% as SEC may not pursue appeal after Gensler’s departure

Gensler's departure may lead to a more favorable regulatory environment for crypto,...

ByglobalreutersNovember 22, 2024

Leave a comment