- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

BlackRock’s IBIT trading volume surges to $1.1 billion despite no inflows

Quick Take

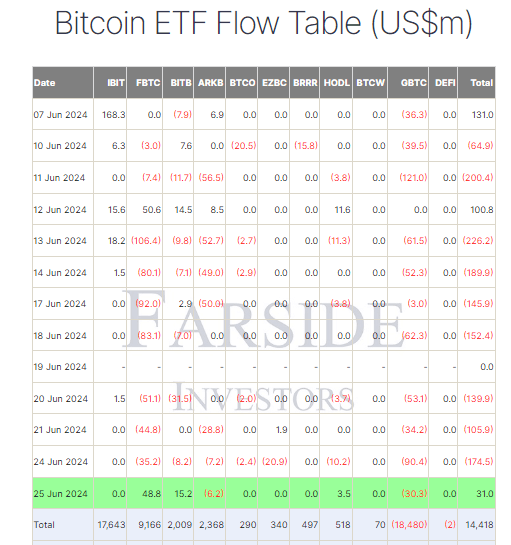

Farside data shows that on June 25, Bitcoin (BTC) exchange-traded funds (ETFs) experienced the first net inflow since June 12, with $31.0 million entering the market.

Fidelity’s FBTC led the charge with a $48.8 million inflow, raising its total net inflow to $9.2 billion. Bitwise’s BITB also saw a notable inflow, attracting $15.2 million and bringing its total net inflow to $2.0 billion. In contrast, Grayscale’s GBTC struggled with outflows, losing $30.3 million and pushing its total outflow to $18.5 billion. According to Farside data, the total net inflows to BTC ETFs now stand at $14.4 billion.

Interestingly, BlackRock’s IBIT ETF recorded no net inflows or outflows, yet its trading volume surged to $1.1 billion, according to Coinglass data. For comparison, GBTC only managed a volume of $341 million, placing IBIT at number 18 overall in trading volume among all US ETFs. This raises speculation about IBIT’s potential to become a key institutional basis trade Bitcoin ETF, given its robust trading activity despite the absence of net inflows or outflows.

The post BlackRock’s IBIT trading volume surges to $1.1 billion despite no inflows appeared first on CryptoSlate.

Recent Posts

Categories

Related Articles

Bitcoin hits record highs, but the next big profits could lie in these 5 cryptos

Bitcoin surges, but five emerging cryptos are gaining attention for their potential...

ByglobalreutersNovember 23, 2024Bitcoin’s MVRV Metric Signals Market Heating Up—Here’s What Investors Should Know

The ongoing Bitcoin bull market has sparked renewed interest in on-chain metrics...

ByglobalreutersNovember 23, 2024Ethereum vs. Solana: Who Will Emerge as the Top Altcoin This Cycle?

The dominance of Ethereum in defi makes it the top choice for...

ByglobalreutersNovember 23, 2024Dogecoin Whales Reactivate After Spending $214.5 Million To Buy 550 Million DOGE

Dogecoin whales are on a significant accumulation spree, as reports reveal that...

ByglobalreutersNovember 23, 2024

Leave a comment