- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Welcome to the new frontier of finance, where digital assets and the physical world finally shake hands. Imagine a world where you can stake your real-world assets like real estate or commodities and earn passive income, just like staking your favorite cryptocurrency. Sounds like science fiction, right? But it’s not — it’s the exciting reality of RWA (Real-World Asset) staking platforms.

In recent years, decentralized finance (DeFi) has taken the crypto world by storm, disrupting traditional finance systems with innovative solutions. Yet, the fusion of real-world assets with blockchain technology is taking things a step further, blending the stability of tangible assets with the agility of the digital economy. The result? A new financial ecosystem that’s more accessible, more secure, and, let’s be honest, a lot more exciting.

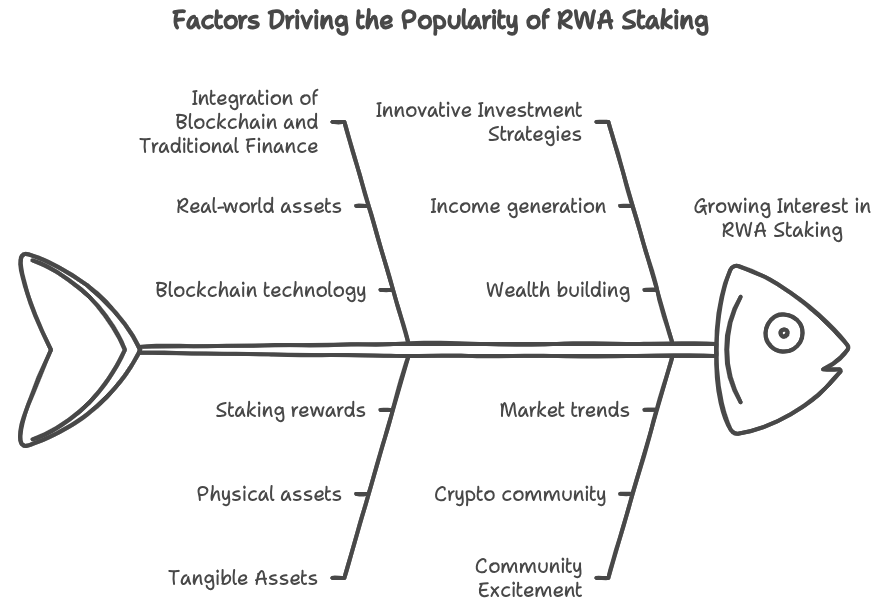

Why RWA Staking is Capturing the Crypto World’s Attention?

If you’ve been following the crypto space, you’ve probably noticed the buzz around RWA staking platforms. But what’s driving this hype? Well, it’s simple — RWA staking is where the promise of blockchain meets the reality of traditional finance. We’re not just talking about theoretical value anymore; we’re talking about real, tangible assets that you can touch, feel, and even live in. And now, thanks to blockchain, you can stake these assets to earn rewards, just like you would with digital tokens.

RWA staking platforms are more than just the latest trend — they’re a revolutionary approach to managing and leveraging real-world assets. They’re transforming how we think about investing, offering new ways to generate income and build wealth. It’s no wonder the crypto community is buzzing with excitement.

Creating an RWA staking platform is a brilliant move that bridges the gap between traditional finance and the crypto world, unlocking new investment opportunities with real-world value. It’s an innovative way to bring stability and growth potential to the ever-evolving blockchain space.

The Rise of RWA Platforms

The journey of RWA platforms didn’t happen overnight. It’s been a gradual evolution, fueled by advancements in blockchain technology and a growing appetite for decentralized solutions. Initially, the focus was on tokenizing digital assets, but as the technology matured, the possibilities expanded. Real-world assets, once considered too complex or too traditional for the crypto space, began to enter the fold.

RWA staking platforms represent the next logical step in this evolution. By bringing real-world assets onto the blockchain, these platforms are bridging the gap between traditional finance and the digital economy. This isn’t just a shift in how we invest; it’s a fundamental transformation of the financial landscape. Traditional finance systems are being challenged, and the power dynamics are shifting. RWA platforms are not just participants in this change — they’re the catalysts.

What is RWA Staking?

So, what exactly are real-world assets, and how do they fit into the crypto world? Think of anything you own that has value — real estate, precious metals, art, or even a classic car. These are real-world assets. Now, imagine taking these assets and converting them into digital tokens that represent their value on the blockchain. This process, known as tokenization, is the cornerstone of RWA staking.

Tokenization essentially turns physical assets into digital tokens that can be easily traded, staked, or used as collateral within the blockchain ecosystem. These tokens are backed by the actual value of the assets, which means they’re not just speculative — they’re grounded in something real. It’s like holding a digital certificate of ownership that you can use in the crypto world.

How Staking Meets the Real World: The Mechanics Behind RWA Staking

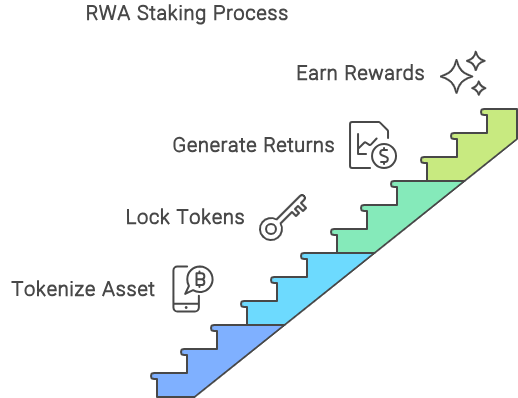

Now that we’ve got the basics down, let’s talk about how staking works in this context. In the crypto world, staking usually involves locking up digital assets to support the operations of a blockchain network, earning rewards in return. With RWA staking, the concept is similar, but instead of digital assets, you’re staking real-world assets.

Here’s how it works: Once your asset is tokenized, you can lock these tokens into a staking platform. The platform uses your staked assets to generate returns, typically through lending, liquidity provision, or other financial activities. In return, you earn rewards — often in the form of additional tokens or a share of the platform’s revenue. It’s a way to make your real-world assets work for you, generating passive income without having to sell them.

Why It Matters: The Unique Benefits of RWA Staking for Investors and Crypto Enthusiasts

RWA staking isn’t just a new way to earn; it’s a game-changer for investors and crypto enthusiasts alike. For starters, it brings a new level of stability to the often-volatile world of crypto. Real-world assets tend to be more stable in value compared to digital tokens, providing a safer option for those looking to hedge against market fluctuations.

Moreover, RWA staking opens up new opportunities for diversification. Investors can now add real-world assets to their crypto portfolios, spreading risk across different asset classes. This not only enhances the potential for returns but also reduces the overall risk.

But perhaps the most exciting benefit is accessibility. Traditionally, investing in real-world assets required significant capital and was often reserved for the wealthy. RWA staking platforms democratize this process, allowing anyone with a tokenized asset to participate. It’s a true leveling of the playing field, opening up opportunities for wealth creation to a broader audience.

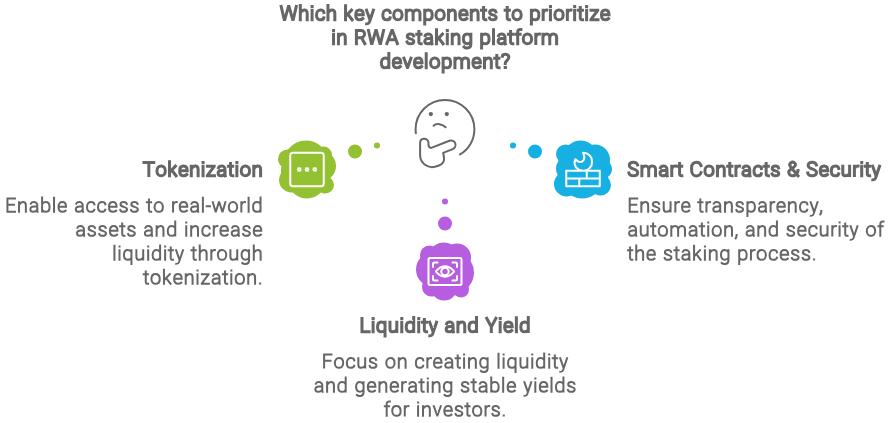

Key Components of RWA Staking Platforms

To truly appreciate the magic behind RWA staking platform development, it’s essential to understand the building blocks that make this innovation possible. These platforms aren’t just about slapping a few buzzwords together — they’re about creating a solid foundation that blends the tangible with the digital, the old with the new. So, let’s break down the key components that bring this fusion to life.

Tokenization of Assets: The First Step to Bringing Real-World Assets On-Chain

At the heart of any RWA staking platform lies tokenization, the process that converts real-world assets into digital tokens on the blockchain. Think of it as turning your property deed or a piece of art into a digital certificate that represents its value. This tokenization is crucial because it makes it possible to bring physical assets into the blockchain ecosystem, where they can be traded, staked, or used as collateral.

But why is tokenization so important? First off, it democratizes access to high-value assets. In the traditional world, owning a piece of a Picasso painting or a slice of prime real estate might be out of reach for most people. However, through tokenization, these assets can be broken down into smaller, more affordable units. It’s like crowdfunding, but for asset ownership.

Secondly, tokenization adds liquidity to otherwise illiquid assets. Real estate, for instance, can take months or even years to sell. But once it’s tokenized, it can be traded on the blockchain in seconds. This increased liquidity is a game-changer, making it easier to buy, sell, or stake assets without the traditional headaches.

Smart Contracts & Security: Ensuring Trust and Transparency in RWA Staking

Now, tokenization is just the beginning. To really make RWA staking work, you need a way to ensure that everything is above board — that’s where smart contracts come in. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce the rules, distribute rewards, and ensure that everyone plays by the same rules.

In the context of RWA staking, smart contracts are the glue that holds everything together. They ensure that the staking process is transparent, secure, and free from human error or interference. For instance, if you stake your tokenized real estate, the smart contract will automatically handle the distribution of rewards based on the terms you agreed to — no middlemen, no delays, just pure automation.

Security is another critical aspect that can’t be overlooked. When you’re dealing with real-world assets, ensuring that the underlying blockchain and smart contracts are secure is non-negotiable. The last thing anyone wants is for their tokenized assets to be vulnerable to hacking or fraud. That’s why top RWA staking platforms invest heavily in security measures, from rigorous code audits to advanced encryption techniques, to protect users and their assets.

Liquidity and Yield: How RWA Staking Generates Value and Rewards

One of the most appealing aspects of RWA staking platforms is their ability to generate value and rewards. But how exactly does this work? It all comes down to liquidity and yield.

Liquidity in the context of RWA staking refers to the ease with which tokenized assets can be bought, sold, or staked within the platform. The more liquid an asset, the easier it is to move it around, and the more attractive it becomes to investors. RWA staking platforms create liquidity by allowing users to stake their assets, which then become part of the platform’s ecosystem, supporting various financial activities such as lending, borrowing, or liquidity provision.

In return for staking their assets, users earn yield, which is essentially the income generated from these activities. This yield can come in various forms, such as interest payments, dividends, or additional tokens. The key here is that RWA staking allows investors to earn a return on their real-world assets without having to sell them, offering a new way to generate passive income.

What’s more, the yield from RWA staking is often more stable and predictable compared to the volatile returns from purely digital assets. This stability is a big draw for investors looking to diversify their portfolios and hedge against the unpredictable nature of the crypto market.

Leading RWA Staking Platforms Shaping the Market

As with any new and exciting technology, there are always a few key players that lead the charge. RWA staking is no different. In this section, we’re going to shine a spotlight on the platforms that are not only shaping the market but also pushing the boundaries of what’s possible.

The Trailblazers: Meet the Pioneers Who Brought RWA Staking to Life

Every great movement has its pioneers, and RWA staking is no exception. These trailblazers were among the first to recognize the potential of combining real-world assets with blockchain technology. They saw an opportunity to bridge the gap between traditional finance and the crypto world, and they ran with it.

One such pioneer is Polymath, a platform that has been instrumental in bringing security tokens into the mainstream. By enabling the tokenization of real-world assets, Polymath paved the way for the development of RWA staking platforms. Another key player is Harbor, which focuses on compliance and regulatory frameworks, ensuring that tokenized assets meet legal standards — a crucial factor in gaining the trust of investors.

A Look at the Competition: Key Platforms Driving Innovation and Adoption

While the pioneers laid the groundwork, a new wave of platforms is driving innovation and adoption in the RWA staking space. These platforms are building on the foundations set by their predecessors, adding new features, enhancing security, and making the staking process more user-friendly.

One of the frontrunners is Tinlake, a platform by Centrifuge that focuses on bringing real-world assets like invoices and real estate into the DeFi ecosystem. Tinlake has made significant strides in creating liquidity pools backed by tokenized assets, offering attractive yields to investors.

Another key player is RealT, a platform that tokenizes real estate properties, allowing investors to buy fractional ownership in income-generating properties. RealT has simplified the process of investing in real estate, making it accessible to anyone with a few dollars and an internet connection.

What Sets Them Apart: Unique Features and Differentiators of Top RWA Staking Platforms

So, what makes these platforms stand out from the crowd? It’s all about the unique features and differentiators that each platform brings to the table.

Polymath, for instance, is renowned for its focus on security and compliance, which is critical when dealing with real-world assets. Their platform ensures that every tokenized asset adheres to regulatory requirements, providing peace of mind to investors.

Tinlake stands out for its integration with DeFi protocols, allowing tokenized assets to be used in various DeFi activities like lending and borrowing. This integration creates a seamless experience for users who want to maximize their returns by leveraging the full potential of the DeFi ecosystem.

Meanwhile, RealT has gained popularity for its simplicity and accessibility. By focusing on real estate, a tangible and easily understood asset class, RealT has made it easy for everyday investors to dip their toes into the world of RWA staking. Their platform’s user-friendly interface and low entry barriers have attracted a diverse range of investors, from crypto enthusiasts to traditional real estate investors looking to explore the blockchain space.

How RWA Staking is Changing the Game?

RWA staking is more than just a new feature in the crypto space; it’s a transformative force reshaping how we think about finance, investment, and wealth generation. From making high-value assets accessible to everyday investors to creating new income streams, RWA staking is poised to disrupt the financial world in ways we’ve only just begun to explore.

Bridging the Gap: Connecting Traditional Finance with the Crypto World

For years, the world of traditional finance and the crypto universe seemed like two parallel realities — each with its own set of rules, opportunities, and challenges. But what if these two worlds could intersect? That’s exactly what RWA staking is doing: it’s acting as a bridge between the old and the new, the physical and the digital.

Imagine being able to stake a piece of real estate or a chunk of gold and earn returns just like you would with Bitcoin or Ethereum. This isn’t just a hypothetical scenario; it’s the new reality of RWA staking. By bringing real-world assets onto the blockchain, these platforms are enabling investors to benefit from the best of both worlds: the stability and familiarity of traditional assets combined with the innovation and potential of the crypto space.

This bridge between traditional finance and crypto isn’t just about convenience — it’s about creating new opportunities. It’s about allowing someone who’s never owned a piece of real estate to invest in property, or someone who’s never touched gold to own a share of it, all through a simple, accessible platform. This kind of accessibility is game-changing, opening up new doors for investors of all backgrounds.

Democratizing Investment Opportunities: How RWA Staking Makes High-Value Assets Accessible

In the traditional financial world, high-value assets like real estate, art, or precious metals are often reserved for the wealthy. They’re seen as out of reach for the average investor, requiring significant capital, connections, and expertise. But RWA staking is flipping the script, making these assets accessible to anyone with a smartphone and an internet connection.

Tokenization is the key here. By breaking down high-value assets into smaller, more affordable tokens, RWA staking platforms democratize access to these investments. No longer do you need millions to own a piece of prime real estate or a famous painting — you can start with as little as a few dollars. This democratization of investment opportunities is not just leveling the playing field; it’s opening up new avenues for wealth creation that were previously inaccessible to most people.

And it’s not just about access; it’s about empowerment. RWA staking gives everyday investors the tools to diversify their portfolios, hedge against risk, and tap into the kinds of returns that were once the exclusive domain of the wealthy. It’s about putting the power of wealth generation into the hands of the many, not just the few.

Unlocking New Income Streams: Passive Income and Beyond in the RWA Space

In today’s world, everyone’s looking for ways to generate passive income. Whether it’s through dividends, interest, or rental income, the goal is the same: to make your money work for you, without having to actively work for it. RWA staking takes this concept to the next level, offering new and exciting ways to earn income from your assets.

When you stake your tokenized real-world assets, you’re essentially putting them to work within the blockchain ecosystem. This could involve lending them out, providing liquidity, or participating in other financial activities that generate returns. The best part? You don’t have to sell your assets to earn this income. You can continue to hold onto them, watching their value grow, while simultaneously earning rewards.

And these rewards aren’t just limited to one-time payouts. Depending on the platform and the assets you stake, you could be earning a steady stream of income over time. It’s like owning a rental property that pays you rent every month, without the hassle of managing tenants or maintaining the property. In the RWA space, passive income is just the beginning — you’re also unlocking the potential for long-term wealth creation.

Disrupting the Status Quo: The Potential to Transform Global Financial Markets

RWA staking isn’t just a trend — it’s a disruptive force with the potential to transform global financial markets. By bringing real-world assets onto the blockchain, these platforms are challenging the traditional financial systems that have been in place for centuries. They’re offering a new way to think about ownership, investment, and value.

One of the most significant ways RWA staking is disrupting the status quo is by decentralizing control over assets. In traditional finance, a few powerful institutions often control the flow of capital and the access to high-value investments. But with RWA staking, the power is shifting towards the individual. Investors can now directly control and manage their assets, without relying on banks, brokers, or other intermediaries.

This decentralization is also driving innovation. As more assets are tokenized and brought onto the blockchain, new financial products and services are being developed. These innovations are not only creating new opportunities for investors but also challenging traditional financial institutions to adapt or risk being left behind.

A Step-by-Step Guide to RWA Staking

Ready to dive into the world of RWA staking? It’s easier than you might think. Whether you’re a seasoned crypto investor or a complete beginner, this step-by-step guide will walk you through everything you need to know to start staking your real-world assets and earning rewards.

Step 1: Choose Your Platform: What to Look for in an RWA Staking Platform

The first step in your RWA staking journey is choosing the right platform. Not all platforms are created equal, so it’s essential to do your homework and find one that meets your needs. But what exactly should you be looking for?

First, consider the platform’s reputation and track record. Has it been around for a while? Does it have a solid user base and positive reviews? These are good indicators that the platform is reliable and trustworthy.

Next, look at the types of assets the platform supports. Some platforms specialize in specific assets like real estate or commodities, while others offer a broader range of options. Choose a platform that aligns with your investment interests and goals.

Security is another crucial factor. Make sure the platform uses robust security measures, such as smart contracts and encryption, to protect your assets. You’ll also want to check if the platform is compliant with relevant regulations, as this can affect the safety and legality of your investments.

Lastly, consider the platform’s user interface and customer support. A user-friendly interface can make your staking experience much smoother, especially if you’re new to the space. And having access to responsive customer support can be invaluable if you run into any issues.

Step 2: Asset Selection: How to Pick the Right Real-World Assets for Staking

Once you’ve chosen your platform, the next step is selecting the assets you want to stake. This decision will largely depend on your investment strategy and risk tolerance.

Start by thinking about the types of assets you’re most comfortable with. Do you prefer the stability of real estate or the potential high returns of commodities? Each asset class has its own risk and reward profile, so choose the one that best fits your financial goals.

It’s also important to consider the liquidity of the assets you’re staking. More liquid assets, like tokenized stocks or precious metals, can be easier to buy and sell, giving you more flexibility in managing your investments. On the other hand, less liquid assets, like real estate, might offer higher returns but could be harder to exit quickly.

Diversification is another key factor. Don’t put all your eggs in one basket. By spreading your investments across different types of assets, you can reduce your risk and increase your chances of earning consistent returns.

Step 3: Staking Your Assets: The Process Explained in Simple Terms

With your platform chosen and assets selected, it’s time to start staking. The good news is that the process is straightforward, even if you’re new to the world of crypto.

First, you’ll need to tokenize your assets if they haven’t been tokenized already. This typically involves converting your physical assets into digital tokens that can be staked on the platform. Your platform will guide you through this process, which usually involves providing documentation and verifying ownership.

Once your assets are tokenized, you can stake them by locking them into the platform’s smart contract. This smart contract will handle everything, from distributing rewards to ensuring that the terms of the staking agreement are met.

After staking, all you have to do is sit back and wait for your rewards to start rolling in. Depending on the platform and the assets you’ve staked, you might receive rewards daily, weekly, or monthly.

Step 4: Monitoring & Earning: Tracking Your Investments and Maximizing Returns

Staking your assets is just the beginning. To maximize your returns, it’s important to actively monitor your investments and make adjustments as needed.

Most RWA staking platforms provide dashboards where you can track the performance of your staked assets in real-time. Use these tools to keep an eye on your rewards, as well as the overall value of your assets.

If you notice that one of your assets isn’t performing as well as you’d like, consider rebalancing your portfolio. This might involve unstaking underperforming assets and staking new ones that offer better returns.

Finally, stay informed about the latest developments in the RWA staking space. New platforms, assets, and staking opportunities are constantly emerging, so staying up-to-date can help you make smarter investment decisions and maximize your earnings.

Conclusion

In the fast-paced world of crypto, RWA staking is quickly emerging as the hottest trend, offering investors a unique blend of stability, innovation, and potential for high returns. By tokenizing real-world assets and bringing them onto the blockchain, RWA staking platforms are not just changing the way we invest — they’re redefining the future of finance. Whether you’re a seasoned investor or just starting, embracing this trend could be your key to unlocking new opportunities and staying ahead in the ever-evolving financial landscape.

RWA Staking Platform Development: The Hottest Trend in Crypto Right Now! was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

ICYMI – Cboe to launch cash-settled Bitcoin ETF options from next week

In brief from the Cboe announcement on Friday afternoon US time:The first...

ByglobalreutersNovember 24, 2024Shiba Inu’s 650% Value Rally Looks Imminent, SHIB Alternative Hints at a 41x Jump in the Coming Weeks

Popular currently up 37% in the last seven days, Shiba Inu has...

ByglobalreutersNovember 24, 2024Flat Tax Frenzy: Americans Debate Tax Code Overhaul on X

Conversations about adopting a flat tax in the United States are lighting...

ByglobalreutersNovember 24, 2024A Decade of BitMEX: Honouring Our Bitcoin OG Legacy

BitMEX turns 10 years old, celebrating a decade of Bitcoin OG legacy....

ByglobalreutersNovember 24, 2024

Leave a comment