- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

One of Kamino’s standout features is its concentrated liquidity strategy, which allows users to leverage liquidity positions as collateral. This is achieved through Kamino’s tokenized concentrated liquidity market maker (CLMM) positions, known as kTokens, which are fungible and easily tradable. Users can borrow against these positions or employ them in other strategies to maximise returns. The platform’s emphasis on automation and transparency provides users with detailed analytics and performance insights, empowering them to manage their liquidity positions more effectively.

Kamino’s borrowing mechanism is powered by its K-Lend system, a novel peer-to-pool infrastructure that integrates lending, liquidity, and leverage into a unified market. K-Lend introduces features such as “Elevation Mode” (eMode), which enhances capital efficiency by allowing users to borrow highly correlated assets with higher leverage. This system is further supported by a poly-linear interest rate curve, allowing for more gradual interest rate changes and reducing the risk of sharp liquidity shocks.

Overall, Kamino Finance represents a significant leap in DeFi automation and accessibility, offering users a seamless way to manage and optimise their on-chain liquidity strategies. Its unified approach, coupled with advanced risk management tools like auto-deleveraging and dynamic liquidation penalties, positions Kamino as a key player in the evolving landscape of decentralised finance.

What is the KMNO Token

The KMNO token is the native utility and governance token for the Kamino Finance ecosystem. It plays a crucial role in powering the platform’s Decentralised Finance (DeFi) services, which include lending, liquidity provision, and leveraging strategies. KMNO is used to incentivize participation in the Kamino protocol, rewarding users who contribute liquidity, stake their assets, or participate in the governance of the platform.

Holders of KMNO can stake their tokens to earn rewards, participate in governance proposals, and influence the future direction of the protocol. This allows the community to have a say in key decisions such as the introduction of new features, adjustments to fee structures, and other protocol upgrades. Additionally, the token may be used to boost liquidity rewards or access special features and benefits within the Kamino ecosystem.

As Kamino Finance expands its suite of DeFi products, the KMNO token will continue to play an essential role in ensuring the platform’s growth and sustainability.

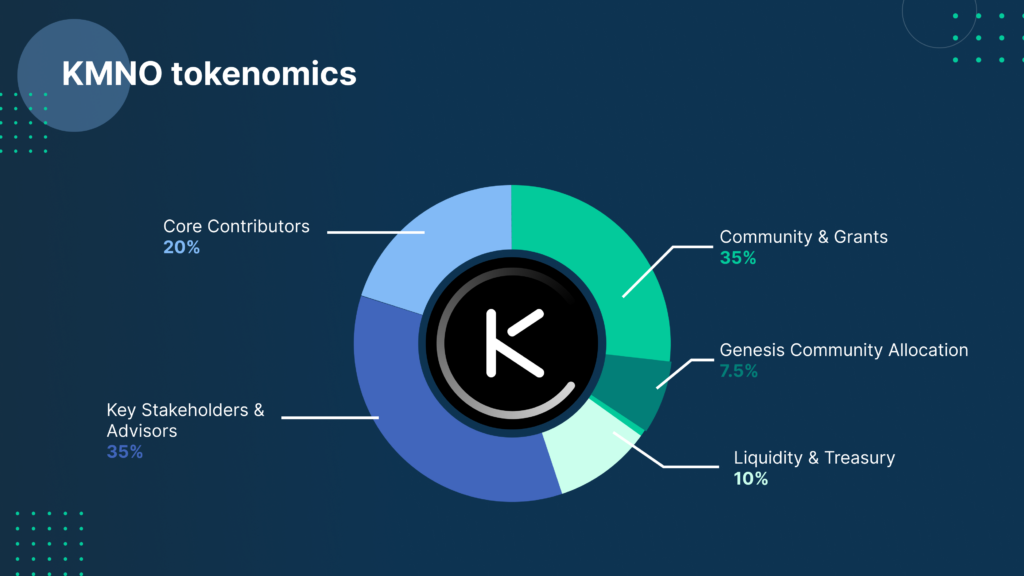

KMNO Tokenomics

How to buy KMNO with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy KMNO with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them forKMNO. Learn how to trade on Bitfinex here.

How to buy KMNO with fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy KMNO..

Also, we have Bitfinex on mobile, so you can easily buy KMNO currency while on-the-go.

[AppStore] [Google Play]

KMNO Community Channels

Website | X (Twitter) | Discord

The post What is Kamino (KMNO)? appeared first on Bitfinex blog.

Recent Posts

Categories

Related Articles

Bitcoin hits record highs, but the next big profits could lie in these 5 cryptos

Bitcoin surges, but five emerging cryptos are gaining attention for their potential...

ByglobalreutersNovember 23, 2024Bitcoin’s MVRV Metric Signals Market Heating Up—Here’s What Investors Should Know

The ongoing Bitcoin bull market has sparked renewed interest in on-chain metrics...

ByglobalreutersNovember 23, 2024Ethereum vs. Solana: Who Will Emerge as the Top Altcoin This Cycle?

The dominance of Ethereum in defi makes it the top choice for...

ByglobalreutersNovember 23, 2024Dogecoin Whales Reactivate After Spending $214.5 Million To Buy 550 Million DOGE

Dogecoin whales are on a significant accumulation spree, as reports reveal that...

ByglobalreutersNovember 23, 2024

Leave a comment