- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Abbott Laboratories Stock Forecast: Anticipating Modest Growth

Abbott Laboratories is a global healthcare leader that discovers, develops, manufactures, and sells a diverse range of healthcare products. Their operations span across four main segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. Abbott Laboratories is committed to improving health and well-being through innovative products and technologies.

Abbott Laboratories Finance

The Company has a strong financial performance. As of the latest data, Abbott Laboratories’ stock price is $116.54 with a market cap of $202.77 billion. The company reported a net income of $1.65 billion for the most recent quarter, with a net profit margin of 15.48%. The company continues to show robust growth and profitability, making it a significant player in the healthcare sector.

Abbott Laboratories Stock Performance

Abbott Laboratories’ (NYSE: ABT) stock has shown consistent performance over the years. The stock price has a 52-week high of $121.64 and a low of $91.64. The company’s earnings per share (EPS) is $3.30, and it has a price-to-earnings (P/E) ratio of 35.45. The Company’ stock has been performing well, with recent earnings reports beating expectations and the company raising its profit forecast.

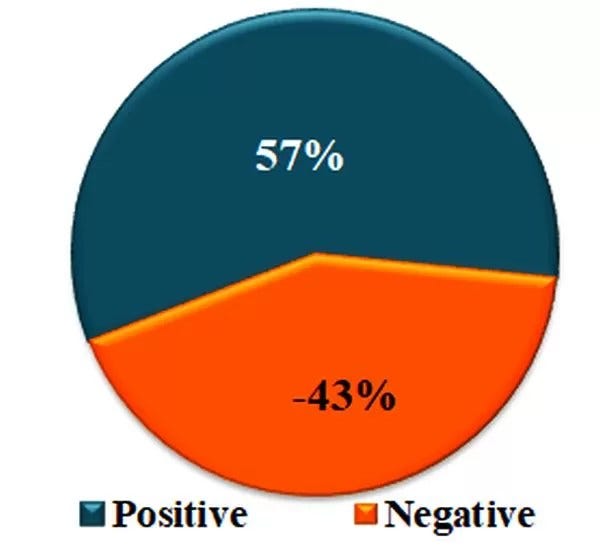

Investment Insight

The company’s investment rating is relatively weak due to a decline in revenue and profit in 2023, coupled with a significant rise in commercial and administrative expenses. Furthermore, the intensely competitive environment prevents any complacency, prompting the company to invest heavily in its operations, often utilizing borrowed funds. Despite these challenges, the company remains a robust cash flow generator and consistently creates value for shareholders. Over the past decade, it has returned approximately 1.30 EPS on average to its investors.

Price forecast**

When to buy?

As of now, the company’s stock price is consolidating within the $89.67 to $121.64 price range following a correction, showing no immediate signs of rising. The optimal time to enter a position would be when the price breaks through the upper boundary of this channel. Once that happens, it would be wise to continue adding to the position as the price trend strengthens.

Abbott Laboratories Dividend Policy

Abbott Laboratories has a solid dividend policy. The company offers a dividend yield of 1.89%, with a forward dividend of $2.20. The company is committed to returning value to its shareholders through regular dividend payments and has a history of consistent dividend growth — about 14% annually.

Conclusion

Abbott Laboratories showcases solid fundamentals and a strong dividend policy. However, given the recent decline in revenue and profit, alongside rising expenses and heavy investments funded by borrowed capital, the stock price is unlikely to grow at an average annual rate exceeding 10%. While the company remains a consistent cash flow generator and continues to create value for shareholders, caution is advised for prospective investors.

A cup of coffee from you for this excellent analysis.

Company’s Site.

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on October 25, 2024.

Abbott Laboratories Stock Forecast: Anticipating Modest Growth was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

Ethereum’s Price Faces $3,000 Risk Amid Bearish Pressure

Ethereum is under heavy selling pressure, with its price dipping by 3%...

ByglobalreutersNovember 25, 2024Axie Infinity developer cuts 21% workforce: report

Axie Infinity creator Sky Mavis lays off 50 employees as part of...

ByglobalreutersNovember 25, 2024Is This The ‘Next Dogecoin’? Top Crypto Analyst Thinks So

In a new analysis, prominent crypto analyst Miles Deutscher unveiled his thesis...

ByglobalreutersNovember 25, 2024Cardano Founder Breaks His Silence On Wyoming Stablecoin

In a livestream on November 25, Charles Hoskinson, the founder of Cardano...

ByglobalreutersNovember 25, 2024

Leave a comment