- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

What Does FOMC Mean For Bitcoin Price? Will Crypto Keep Going Up?

The Federal Reserve quarter-point rates cut has strengthened crypto market, but what does FOMC crypto impact mean for Bitcoin FOMC rally?

The Fed’s FOMC quarter-point rate cut has ignited a speculative wildfire, especially among cryptocurrencies. With a new federal funds rate target nestled between 4.5% and 4.75%, the Fed is aiming to navigate a cooling labor market and mitigate inflation without causing economic shockwaves.

Here’s what the recent Federal Open Market Committee meeting will mean for the future Bitcoin price.

FOMC Rate Cut Sparks Crypto Market Volatility

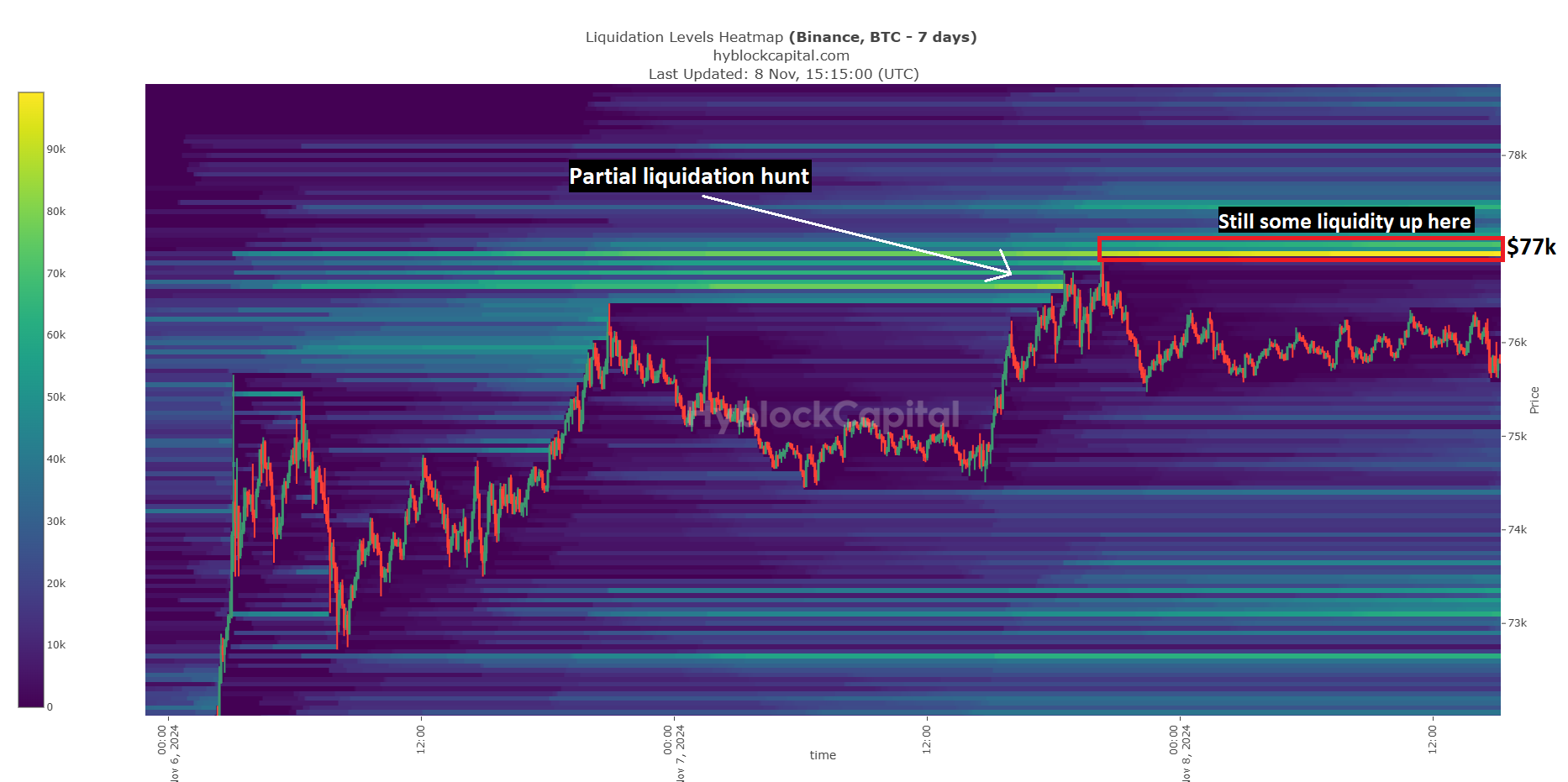

The air was thick with anticipation as the FOMC’s decision approached on Thursday, with Bitcoin recently hitting new highs above $75,0000. Analysts predicted heightened volatility driven by the impending rate cut—seen as a near-certainty at 97.4% by CME Group’s FedWatch Tool.

The thing is, Bitcoin’s price didn’t soar as traders hoped, leaving us mired in a stagnant crab market. Instead, most of the crypto gains resulted from Donald Trump’s Wednesday morning presidential victory.

Everyone’s eyes are on Bitcoin’s shot at reaching that elusive $100,000. Even though the FOMC turned into a ‘sell the news‘ event, we’re primed for a six figure Bitcoin by year’s end.

JUST IN:

Federal Reserve Chair Jerome Powell says he would not resign if President-elect Trump asked him to. pic.twitter.com/wQLNU7AN0D

— Watcher.Guru (@WatcherGuru) November 7, 2024

Why did this happen? Well, everyone knew the FOMC was going to happen, and it was already priced.

Moreover, assets typically stagnate or tank after a presidential election—and this one was only different because Trump is likely to cut taxes and deregulate crypto for developers and traders.

Analysts at 99Bitcoin are eyeing the possibility of Bitcoin reaching $100,000 soon, thanks to a stablecoin market surge. Significant whale activity is also driving Bitcoin’s price movements, with two major players scooping up large BTC amounts post-FOMC. These whales, or big-time investors, are key influencers in market trends.

Recent data shows that two whales bought 1,910 BTC worth $145.16 million on Binance in the past 24 hours. With patience, things are about to get wild for crypto.

DISCOVER: The Easiest Way to Buy Ethereum in November 2024

Navigating the Crypto Market Amid Rate Cuts

As the Fed tweaks interest rates, the crypto market can’t dodge the fallout. The spotlight is on Bitcoin, holding its ground and eyeing new peaks. With the economy in flux and big players making calculated moves, Bitcoin’s future seems bright, though not without hurdles.

The key will be to hold out even if we don’t see an immediate pump. Shouldn’t be too hard, yeah?

Fed moves and Trump’s cabinet picks will dictate Bitcoin’s price story in the coming months. However, the current setup hints at Bitcoin breaking $100,000 before 2025.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post What Does FOMC Mean For Bitcoin Price? Will Crypto Keep Going Up? appeared first on .

Recent Posts

Categories

Related Articles

Bitcoin falls to $88,000 in a quick fall

Bitcoin has seen some bids early in US trading in the past...

ByglobalreutersNovember 14, 2024Peter Brandt Spots Dogecoin-Bitcoin Chart Similarities: Is a Big DOGE Move Brewing?

Veteran trader Peter Brandt sees dogecoin mirroring bitcoin’s 2016 price pattern, signaling...

ByglobalreutersNovember 14, 2024Bitcoin spot buying outpacing futures despite leverage hitting ATH

Bitcoin (BTC) perpetual contracts denominated in Tether USD (USDT) show signs of...

ByglobalreutersNovember 14, 2024Ethereum’s Rally Loses Steam: Analyst Foresee A Possible Brief Correction

Negative sentiment is gradually growing in the general crypto market once again,...

ByglobalreutersNovember 14, 2024

Federal Reserve Chair Jerome Powell says he would not resign if President-elect Trump asked him to.

Federal Reserve Chair Jerome Powell says he would not resign if President-elect Trump asked him to.

Leave a comment