- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

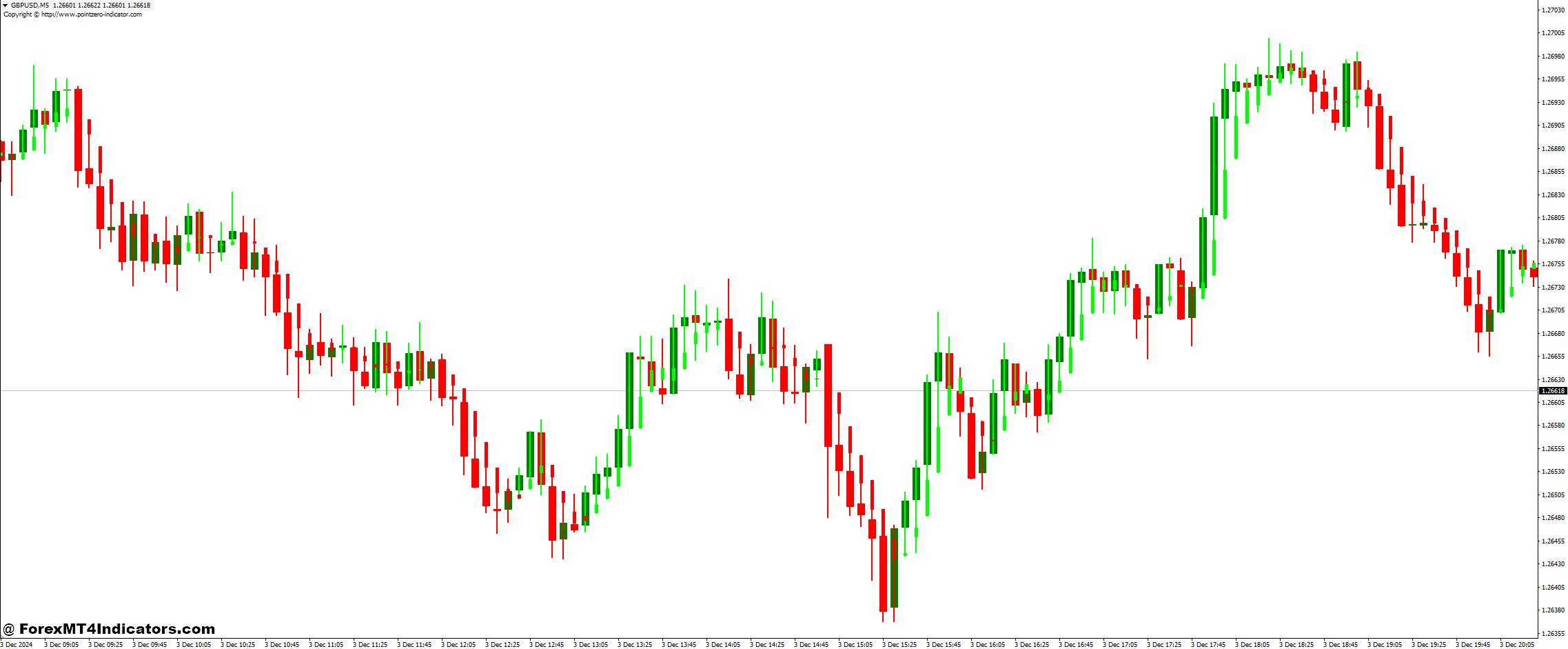

Heikin Ashi Candle and Sideways Detector Forex Trading Strategy

The Heikin Ashi Candle and Sideways Detector Forex Trading Strategy is a powerful approach designed to help traders navigate the complexities of the Forex market with precision. This strategy leverages the unique properties of Heikin Ashi candles to identify clear trends while using a sideways market detector to pinpoint periods of consolidation. By combining these two tools, traders can effectively adapt their tactics to market conditions, avoiding false signals and maximizing profit opportunities.

Heikin Ashi candles are widely valued for their ability to smooth out market noise, providing a clearer picture of trend directions. Unlike traditional candlesticks, which can be volatile and sometimes misleading, Heikin Ashi candles use average price data to filter out insignificant market fluctuations. This helps traders stay focused on the bigger picture, making it easier to spot bullish or bearish trends and reducing the likelihood of reacting prematurely to minor retracements.

On the other hand, the sideways detector is an indicator designed to identify non-trending or consolidating market phases. These periods of low volatility can be challenging for traders as they often result in whipsaw movements and unclear signals. By incorporating the sideways detector into their strategy, traders can avoid entering the market during indecisive conditions and focus their attention on high-probability opportunities when a breakout or trend emerges.

This strategy is particularly useful for both novice and experienced traders who wish to strike a balance between identifying trends and avoiding choppy, range-bound markets. In the following sections, we will delve into the step-by-step process of using this strategy, including how to set up your charts, interpret signals, and execute trades with confidence.

Heikin Ashi Candle Indicator

The Heikin Ashi Candle Indicator is a unique charting tool that modifies traditional candlestick charts to provide a clearer perspective of market trends. Derived from the Japanese term “average bar,” Heikin Ashi calculates average price data to filter out market noise, making trends easier to identify. This indicator is particularly valuable for traders who seek to minimize confusion caused by rapid price fluctuations and focus on the underlying market direction.

How Heikin Ashi Works

The Heikin Ashi candles are constructed differently from standard candlesticks. Each candle is derived from specific mathematical formulas:

- Open: The average of the open and close of the previous Heikin Ashi candle.

- Close: The average of the open, close, high, and low of the current period.

- High: The maximum value from the high, open, and close of the current period.

- Low: The minimum value from the low, open, and close of the current period.

This calculation results in a smoothed appearance that filters out minor price fluctuations, allowing traders to focus on the larger trend.

Key Features and Advantages

- Trend Clarity: Heikin Ashi simplifies the identification of bullish and bearish trends. Bullish trends are represented by consecutive green candles without lower wicks, while bearish trends show red candles without upper wicks.

- Noise Reduction: The smoothing effect removes choppy price action, helping traders avoid reacting to minor retracements.

- Entry and Exit Signals: Clear visual patterns make it easier to determine when a trend starts or ends, aiding in timely decision-making.

Best Use Cases

The Heikin Ashi Candle Indicator is ideal for swing traders and trend followers who prioritize long-term trends over short-term price movements. It works well on higher timeframes like H1, H4, or daily charts, where the smoothing effect is more pronounced.

Sideways Detector Indicator

The Sideways Detector Indicator is a technical analysis tool designed to identify periods of market consolidation or low volatility. These sideways phases, often characterized by range-bound price movements, can be challenging for traders as they typically lack clear directional signals. By detecting these conditions, the Sideways Detector Indicator helps traders avoid entering the market during periods of indecision and focus on more favorable trading opportunities.

How the Sideways Detector Works

This indicator uses mathematical algorithms and volatility measures to evaluate the strength of price movements. It identifies ranges by examining factors such as:

- Average True Range (ATR): Measures market volatility to detect periods of contraction.

- Price Movement Boundaries: Identifies support and resistance zones within a tight price range.

- Directional Movement Index (DMI): Determines if the market lacks a strong directional trend.

The indicator typically displays consolidation zones on the chart, often represented as shaded areas or horizontal lines.

Key Features and Advantages

- Early Warning Signals: Alerts traders to potential consolidation phases, helping them prepare for breakouts.

- Reduced False Signals: Filters out trades during low volatility periods, minimizing losses from whipsaw movements.

- Improved Timing: Helps traders wait for confirmed breakouts or trends before entering the market.

Best Use Cases

The Sideways Detector Indicator is particularly useful for breakout traders who aim to enter the market as price escapes a consolidation zone. It works effectively on shorter timeframes like M15 or M30 for identifying potential setups and longer timeframes for detecting major accumulation or distribution phases.

How to Trade with Heikin Ashi Candle and Sideways Detector Forex Trading Strategy

Buy Entry

- Look for a series of green Heikin Ashi candles with small or no lower wicks, indicating a strong uptrend.

- Ensure the Sideways Detector Indicator does not highlight a consolidation zone.

- Enter the trade:

- At the close of the first green candle after a consolidation phase ends.

- Or as the trend strengthens (e.g., consecutive green candles).

- Confirmations (Optional): Use additional indicators like Moving Averages or RSI to verify the trend.

- Place a stop loss below the last red Heikin Ashi candle or recent swing low.

- Set a take profit based on key resistance levels or a risk-to-reward ratio of at least 1:2.

Sell Entry

- Identify a series of red Heikin Ashi candles with small or no upper wicks, signaling a strong downtrend.

- Confirm with the Sideways Detector Indicator that the market is trending and not consolidating.

- Enter the trade:

- At the close of the first red candle after a consolidation phase ends.

- Or as the downtrend gains momentum (e.g., consecutive red candles).

- Confirmations (Optional): Use tools like RSI or Bollinger Bands to strengthen the signal.

- Place a stop loss above the last green Heikin Ashi candle or recent swing high.

- Set a take profit at key support levels or according to a predefined risk-to-reward ratio.

Conclusion

The Heikin Ashi Candle and Sideways Detector Forex Trading Strategy provides traders with a comprehensive approach to navigating the Forex market effectively. By combining the trend-identifying capabilities of Heikin Ashi candles with the consolidation-spotting power of the Sideways Detector Indicator, this strategy enables traders to capitalize on trending markets while avoiding false signals during sideways phases.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Save

Save

Recent Posts

Categories

Related Articles

Honda and Nissan are set to announce launch of integration talks

Rumours of this from last week:Honda and Nissan to begin merger talksNissan...

ByglobalreutersDecember 23, 2024PBOC sets USD/ CNY reference rate for today at 7.1870 (vs. estimate at 7.2880)

The People's Bank of China set the onshore yuan (CNY) reference rate...

ByglobalreutersDecember 23, 2024Goldman Sachs have revised their US inflation forecast higher, citing Trump tariffs

This is via a Wall Street Journal interview with Goldman Sachs Chief...

ByglobalreutersDecember 23, 2024PBOC is expected to set the USD/CNY reference rate at 7.2880 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The...

ByglobalreutersDecember 23, 2024

Leave a comment