- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Givonly SnR SnD R2 and Woodies CCI Arrows Oscillator Forex Trading Strategy

The Givonly SnR SnD R2 and Woodies CCI Arrows Oscillator Forex Trading Strategy combines two powerful tools in the world of forex trading to help traders identify optimal entry and exit points. The strategy merges the Givonly SnR SnD R2, a unique indicator that highlights key support and resistance levels along with supply and demand zones, and the Woodies CCI Arrows Oscillator, a refined version of the Commodity Channel Index (CCI) that gives traders a clear picture of market momentum. Together, these tools create a dynamic approach that helps traders take advantage of price fluctuations by confirming trends and spotting potential reversals.

At its core, this strategy helps traders navigate the complexities of the forex market by integrating both technical and momentum-based indicators. The Givonly SnR SnD R2 is designed to pinpoint critical levels of support, resistance, and supply and demand, giving traders a clear understanding of where the market might reverse or continue its trend. On the other hand, the Woodies CCI Arrows Oscillator adds a layer of precision by identifying overbought or oversold conditions, signaling potential trend reversals or continuation based on momentum shifts. This synergy between price action and momentum is the key to making well-timed trading decisions.

By utilizing both indicators in tandem, traders can enhance their strategy by confirming trade signals and increasing their probability of success. The combination of support/resistance zones with CCI-driven momentum signals creates a well-rounded trading approach that is adaptable across various timeframes and forex pairs. Whether you’re a short-term scalper or a long-term swing trader, the Givonly SnR SnD R2 and Woodies CCI Arrows Oscillator Forex Trading Strategy can provide the tools necessary for making informed and strategic trading decisions.

Givonly SnR SnD R2 Indicator

The Givonly SnR SnD R2 Indicator is a sophisticated tool designed to pinpoint key support and resistance levels, as well as supply and demand zones in the forex market. Support and resistance are fundamental concepts in technical analysis, representing price levels where the market tends to reverse or consolidate. The SnR SnD R2 Indicator enhances this by incorporating dynamic supply and demand zones, which are areas where buying or selling pressure is strong enough to potentially drive the price in the opposite direction. These zones are crucial because they offer insight into where price is likely to either stall or change direction, giving traders valuable clues for potential entry and exit points.

What makes the Givonly SnR SnD R2 unique is its ability to automatically calculate and plot these key levels on the chart in real time, adjusting to the changing market conditions. This feature helps traders to quickly spot critical levels without having to manually mark support, resistance, or supply and demand zones. By utilizing this indicator, traders can make more informed decisions based on the market’s structure, increasing their chances of identifying profitable trades. The SnR SnD R2 is particularly effective for swing traders and trend-followers, as it provides a clear visual representation of market zones that are likely to influence price movement.

Moreover, the indicator’s adaptability across different timeframes and currency pairs makes it versatile for various trading strategies. Whether trading on short timeframes for scalping or longer timeframes for swing trading, the Givonly SnR SnD R2 Indicator acts as a reliable tool for assessing market conditions and helping traders make strategic decisions in line with the prevailing market trends.

Woodies CCI Arrows Oscillator Indicator

The Woodies CCI Arrows Oscillator is an advanced version of the widely used Commodity Channel Index (CCI), a popular momentum indicator in technical analysis. Developed by renowned trader Woodie, this oscillator is designed to measure the strength of a trend by identifying overbought or oversold conditions in the market. The Woodies CCI is unique because it applies a smoother calculation to the traditional CCI, allowing traders to receive clearer, more reliable signals about potential price reversals or trend continuations.

The main feature of the Woodies CCI Arrows Oscillator is its ability to provide visual cues through arrows on the chart. These arrows appear when the CCI crosses certain threshold levels, indicating whether the market is in an overbought or oversold condition. When the CCI moves above +100, it suggests an overbought market, signaling a potential sell opportunity. Conversely, when it moves below -100, it signals an oversold market, presenting a potential buying opportunity. These arrows act as clear buy or sell signals, helping traders to take advantage of momentum shifts with precision.

Additionally, the Woodies CCI Arrows Oscillator works well in both trending and ranging markets. In trending markets, the indicator can highlight when a trend is gaining strength, while in sideways markets, it can identify potential reversals or entry points based on shifts in momentum. Its versatility makes it suitable for various trading strategies, and it is especially valuable when used in conjunction with other indicators, like the Givonly SnR SnD R2, to confirm trade setups. The Woodies CCI Arrows Oscillator is an essential tool for traders who rely on momentum and market cycles to guide their decision-making.

How to Trade with Givonly SnR SnD R2 and Woodies CCI Arrows Oscillator Forex Trading Strategy

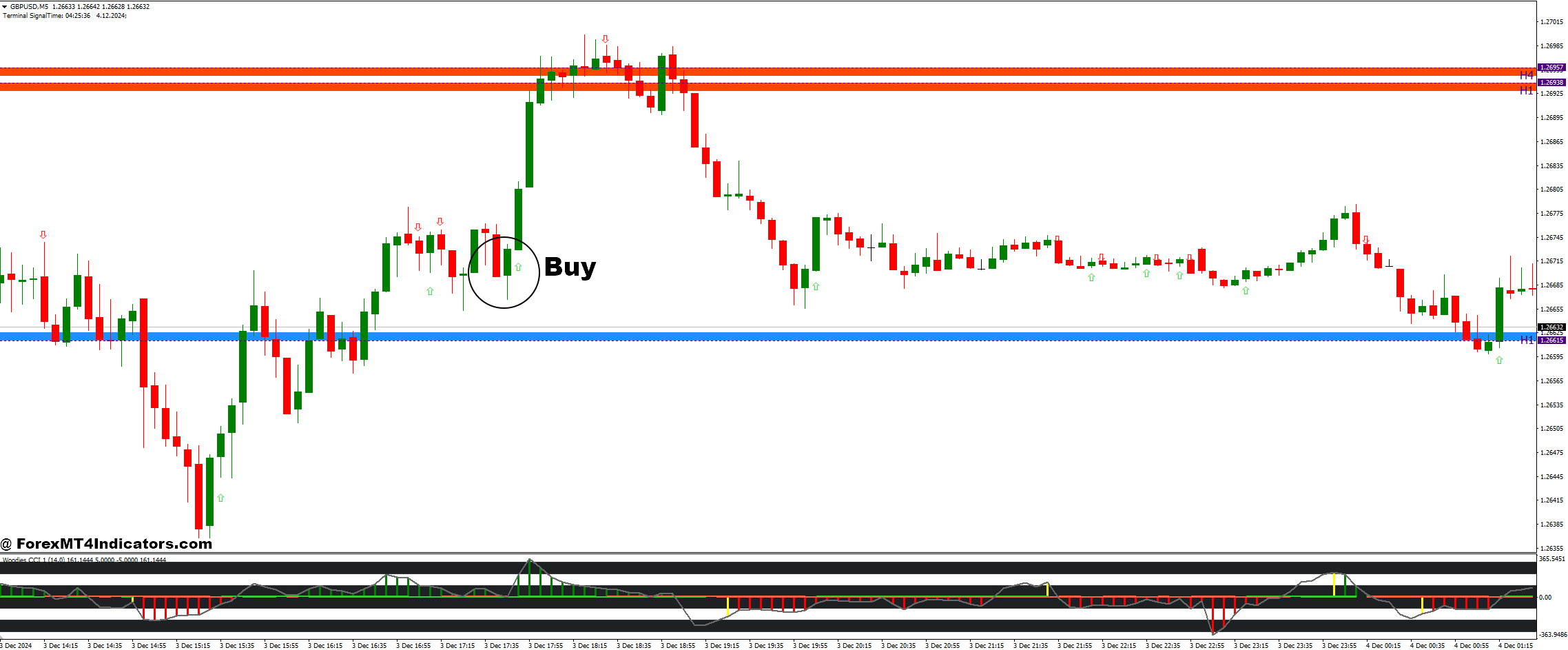

Buy Entry

- Step 1: Look for price to approach a support zone marked by the Givonly SnR SnD R2 indicator.

- Step 2: Check the Woodies CCI Arrows Oscillator:

- Ensure the CCI is below -100, indicating oversold conditions.

- Step 3: Wait for the CCI to cross back above -100, signaling a potential upward reversal.

- Step 4: Enter the buy trade once the CCI arrow confirms the signal, and price begins to move away from the support level.

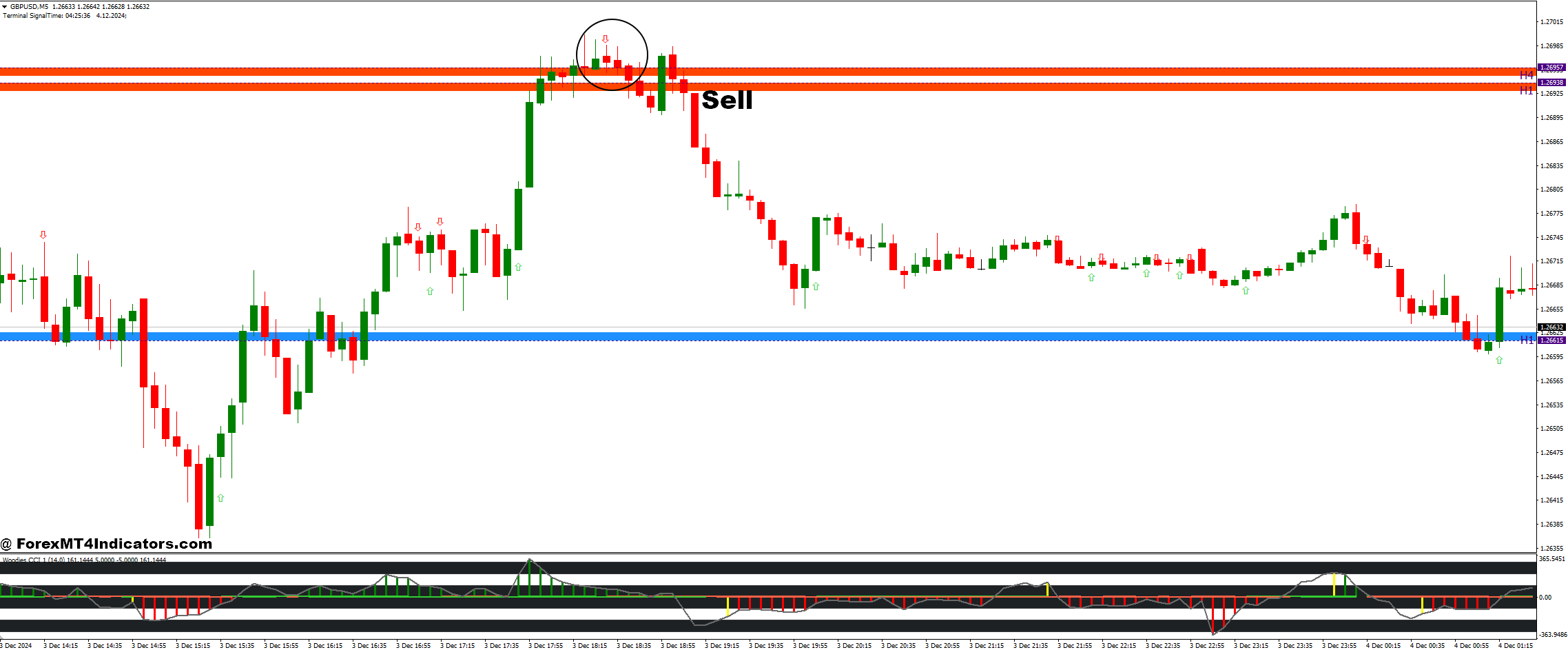

Sell Entry

- Step 1: Look for price to approach a resistance zone marked by the Givonly SnR SnD R2 indicator.

- Step 2: Check the Woodies CCI Arrows Oscillator:

- Ensure the CCI is above +100, indicating overbought conditions.

- Step 3: Wait for the CCI to cross back below +100, signaling a potential downward reversal.

- Step 4: Enter the sell trade once the CCI arrow confirms the signal, and price starts to drop from the resistance level.

Conclusion

The Givonly SnR SnD R2 with the Woodies CCI Arrows Oscillator, traders can develop a robust strategy that identifies key market levels and momentum shifts. This strategy offers a reliable framework for making informed trading decisions, whether you’re trading on short timeframes or longer time horizons. Properly executing this strategy requires patience, attention to detail, and disciplined risk management, but with practice, it can provide consistent, profitable opportunities in the forex market.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Save

Save

Recent Posts

Categories

Related Articles

Trade ideas thread – Tuesday, 31 December, insightful charts, technical analysis, ideas

It's another patchy week of holidays, official and unofficial. The best trade...

ByglobalreutersDecember 30, 2024Canadian Dollar catches thin bid on holiday-constrained market flows

The Canadian Dollar (CAD) caught a thin bid on Monday, rising a...

ByglobalreutersDecember 30, 2024Dow Jones Industrial Average sheds weight as tech rally fizzles

The Dow Jones Industrial Average (DJIA) shed over 300 points on Monday,...

ByglobalreutersDecember 30, 2024Rejecting the US Steel sale to Nippon Steel will mark the end of an era in US capitalism

A dark day is looming.Some time in the coming week, US President...

ByglobalreutersDecember 30, 2024

Leave a comment