- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Bitcoin Surges Past $99,000 Following Dovish Remarks From Atlanta Fed President Bostic

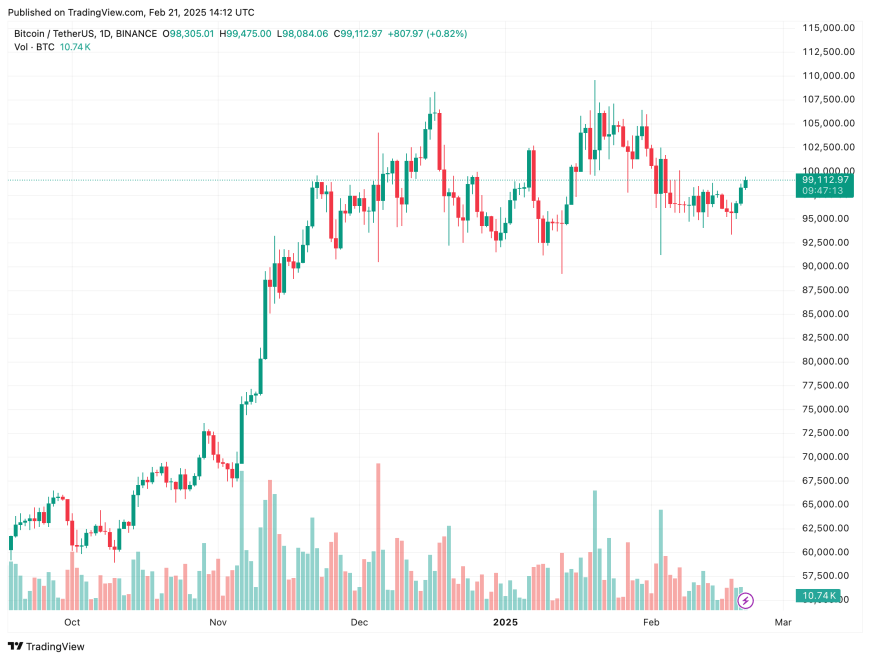

After spending more than two weeks trading in the mid-$90,000 range, Bitcoin (BTC) is starting to climb toward the psychologically significant $100,000 mark. The flagship cryptocurrency surged past $99,000 following dovish remarks from Atlanta Federal Reserve Bank (Fed) President Raphael Bostic.

Bostic’s Dovish Remarks Propel Bitcoin Beyond $99,000

Recently, Federal Reserve Chair Jerome Powell’s hawkish comments dampened investor sentiment, effectively signaling that interest rate cuts may not happen for the rest of the year due to persistent inflation and a resilient job market.

However, Bostic’s latest remarks contrast with Powell’s stance. The Atlanta Fed president noted that while overall employment remains stable, signs of a slowdown are beginning to emerge.

He pointed out that it has become increasingly difficult for unemployed individuals to find jobs compared to a few months ago, with the probability of securing employment now lower than pre-pandemic levels. Additionally, he highlighted that the average duration of unemployment has extended by approximately three weeks since August 2024.

Bostic also emphasized the decline in the “quits rate” – the percentage of workers who voluntarily leave their jobs each month – which has fallen to levels last seen in 2015, excluding the pandemic years. Given these indicators, he expressed support for easing monetary policy, stating that “the balance of risks to our dual mandate of price stability and maximum employment has shifted.”

He further pointed to rising geopolitical tensions, particularly in light of US President Donald Trump’s proposed trade tariffs. Bostic argued that reducing monetary policy restrictiveness would help prevent excessive deterioration in the labor market.

Finally, he projected that the Fed would implement two rate cuts in 2025. Following his dovish remarks, the U.S. 10-year Treasury yield and the US Dollar Index (DXY) declined, while risk-on assets like BTC gained.

BTC Coming Of Age In 2025?

Despite the shaky start to the year due to global macroeconomic uncertainties, BTC has performed relatively well. The top cryptocurrency held its own despite the stock market turmoil due to the Fed’s cautious stance on rate cuts.

As Bitcoin continues to trade around the pivotal $100,000 mark with a total market cap of almost $2 trillion, future price pullbacks are likely to be shallower compared to those witnessed during past market cycles.

Bitcoin’s adoption continues to grow, with an increasing number of US states exploring ways to incorporate it into their treasury reserves. Recently, Kansas, Kentucky, and Utah have taken significant steps toward recognizing BTC as a mainstream digital asset.

This trend aligns with a recent Fidelity Digital Assets report, which suggests that the next wave of crypto adoption will likely be driven by nation-states and government treasuries. At press time, BTC is trading at $99,112, up 2% in the past 24 hours.

Recent Posts

Categories

Related Articles

Franklin Templeton Files for Solana ETF With Staking—Is SOL Set for Institutional Adoption?

Franklin Templeton has filed for a Solana ETF, aiming to track SOL’s...

ByglobalreutersFebruary 22, 2025Can we escape DeFi’s Ouroboros? Bridging real-yield in 2025

The following is a guest article from Mike Wasyl, CEO at Bracket....

ByglobalreutersFebruary 22, 2025Microsoft’s New Chip Could Speed Up Bitcoin’s Quantum-Resistance Timeline

Microsoft’s latest quantum computing chip, Majorana 1, might accelerate the need to...

ByglobalreutersFebruary 22, 20254 reasons Pi Network price crashed after mainnet launch

Pi Network crashed after the mainnet launch, leading to a $6 billion...

ByglobalreutersFebruary 22, 2025

Leave a comment