- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Prerit Das & Prateek Goorha

In two previous articles that one of us co-wrote in 2018(1,2), we embarked on an exploration of Bitcoin’s potential to serve as a robust platform for comprehensive contract governance, beyond its primary function as a digital currency. We called the idea Bitcoin Contract Governance (BCG).

In the first article, we suggested that, “Bitcoin’s overwhelming value proposition is as a complete contract governance platform. As such, its unique transactional properties allow the creation of Bitcoin powered SaaS platforms that fundamentally disrupt many aspects of traditional contract theory, far beyond “smart contracts” alone.”

We took the idea further in the second article, by showing how BCG might be implemented. Front and center to that mechanism was the use of multisig Bitcoin accounts, in which a mediator took a key role in overcoming classic principal-agent problems that are routinely faced in all sorts of contractual relationships. The article imagined a plethora of applications for BCG, from firms and international trade to estate planning and philanthropy.

Frankly, the giddy optimism we felt back in 2018 is yet to yield significant progress towards BCG. Sure, post-Taproot, there was some renewal of that hope, but nothing that would make us feel now that anything like a BCG platform is around the corner.

What are the holdups?

First, it is certainly not inherently a structural issue. The inherent limitations of the Bitcoin blockchain for deploying a generalized contractual mechanism — particularly its low transaction throughput and the simplicity of the smart contracts it supports out of the box — are simply no longer applicable.

The use of the Lightning Network as a means to circumvent scalability issues is now a properly entrenched solution. With its higher throughput and capability for executing more sophisticated smart contracts, such as Hashed TimeLock Contracts (HTLCs) (3), it represents a layer that allows for the creation of a more advanced contract governance system.

The issue, we think, remains what was identified in those articles: The inability to manage incomplete contracts. Incomplete contracts dominate the space of all possible real-world contracts, and they are called incomplete because they simply cannot be perfectly articulated in advance for all possible contingencies that may arise in the future. Indeed, some contingencies may simply be unforeseeable in the present, even if we assume away the staggering costs to enumerate every eventuality. Besides, it may even be desirable to leave a degree of incompleteness in contracts so as to anchor expectations for the parties while permitting them a degree of latitude in realizing the contract’s payoff.

Clearly, incomplete contracts are nigh impossible to enforce on a traditional blockchain architecture, which is designed to be deterministic and algorithmic by nature. Adding yet another entity as an explicit mediator in a Bitcoin contractual transaction can end up allowing the mediator to arrogate far too much power in the relationship. This would prevent a BCG platform from being attractive as a generalized solution to several parties.

All incomplete contracts suffer from counterparty risk. This is because such contracts require ex ante investments by at least one of the contracting parties before payoffs are generated. However, a range of opportunistic behaviors by one party can result in inefficient investments or place the entire investment at risk. This becomes a strong motivator for the contract to be avoided in the first place. When active, an incomplete contract needs to rely on costly renegotiation by the parties under the shadow of a brick-and-mortar legal system. And, if that isn’t feasible, then additional litigation costs need to be incurred to resolve a dispute through legal means.

This leaves open a critical role for third-party intermediaries from the traditional legal system, such as lawyers and judges, who interpret and enforce incomplete contracts.

The point is that, without a truly decentralized mechanism that replicates such intermediaries, a Bitcoin-based contract governance platform can only, at best, be partial. It cannot really become a transnational all-encompassing contracting platform.

So what’s the solution?

Integrating AI for Contract Creation and Dispute Resolution

The fact is that we are in a different time now from when those articles were written in 2018.

In July of 2023, Lightning Labs made things interesting. They announced a suite of developer tools aimed at integrating the Lightning Network and Bitcoin with AI applications, particularly for working with Large Language Models (LLMs). These tools are built around the L402 protocol, a payment system for APIs that uses the Lightning Network, and LangChain, a library for enhancing AI agents with external data. Crucially, the release included LangChainBitcoin for Bitcoin and Lightning Network interactions, Aperture for turning APIs into pay-per-use services, and a Bitcoin Lightning Improvement Proposal (bLIP) for the L402 protocol. Together these innovations addressed issues related to the high costs of LLM development and deployment and, in one fell swoop, made AI more accessible and inclusive.(4)

And, so, we can now begin to improve upon the foundation of a BCG by integrating AI into the ecosystem. This presents a groundbreaking avenue for overcoming the identified limitations. AI can play a transformative role in two key areas: contract creation and dispute resolution. Doing this effectively increases the breadth of the sort of contracting possible on a Bitcoin platform while maintaining a trust-minimized approach to the greatest extent possible.

Here’s a brief description of both before we consider each in a little more detail below.

1. AI-Powered Contract Creation

Through the application of Natural Language Processing (NLP), AI can bridge the gap between the legal formality required for contracts and the natural language used by individuals. This is no longer a hypothetical; Spellbook, as one example, is fairly popular in legal circles, and is built on top of the OpenAI API. Using such an implementation would allow for the conversion of transaction descriptions into legal code that can be executed on chain. Such a system democratizes the process of contract creation, enabling individuals and businesses without deep legal expertise to draft complex agreements that are both legally binding and enforceable through the blockchain. This approach significantly expands the types of contracts that can be created, moving beyond the basic smart contracts currently supported.

2. AI in Dispute Resolution

The introduction of AI as a decentralized entity for dispute resolution addresses the challenge of incomplete contracts. By leveraging historical data, legal precedents, and context-specific information, AI can make informed decisions on disputes arising from blockchain transactions. This system could operate autonomously, providing a fair, transparent, and efficient mechanism for resolving contractual disagreements without the need for traditional legal intermediaries. Such an AI-driven dispute resolution platform could handle the nuances and complexities of real-world contracts, ensuring that agreements are adaptable and can accommodate unforeseen events.

Enhancing Contract Creation with NLP and Verification

The integration of Natural Language Processing (NLP) represents a pivotal advancement in bridging the gap between human communication and formal legal agreements. NLP enables the conversion of transaction descriptions, as articulated by individuals, into legal terminology. However, this process, while revolutionary, introduces the need for an additional, crucial step: the verification and translation of this legal terminology into executable code compatible with the Bitcoin programming environment.

This verification function would involve a sophisticated AI-driven process within the BCG ecosystem. We envision a comprehensive suite of AI agents, each designed to perform specific functions that collectively ensure the seamless translation of contracts from natural language into executable blockchain code. Initially, one subset of these AI agents focuses on aligning the parties’ intentions, expressed in natural language, with the applicable legal codes and precedents. This is achieved by training these agents on a vast corpus of vetted legal documents, enhancing their understanding through precedent examples, and fine-tuning their outputs to match legal requirements accurately. This process ensures that the contractual agreements not only adhere to the relevant legal frameworks but also reflect the original intentions of the contracting parties as closely as possible.

Following this legal alignment, another set of AI agents takes over to ensure that the now legally vetted contracts are technically executable on Bitcoin’s blockchain, including both its base layer and Layer 2 solutions. These agents iteratively translate the legal agreements into the blockchain’s protocol code, employing advanced tools to verify edge cases and ensure semantic and syntactical accuracy. The final contract code is then rigorously tested in a Bitcoin testnet or sandbox environment, simulating a wide range of outcomes to assess stability and reliability. This multifaceted approach, combining legal precision with technical executability, epitomizes the role of sophisticated AI in bridging the complex divide between contract creation for the real world and the Bitcoin ecosystem.

Introducing AI as a Decentralized Entity for Legal Arbitration

To address the introduction of AI as a decentralized entity capable of managing legal issues on the Bitcoin blockchain, we could envision the development of a sophisticated API that interfaces between the blockchain and AI-driven legal arbitration mechanisms. This API could serve as a gateway, allowing smart contracts on the blockchain to access a repository of legal code and precedent relevant to specific jurisdictions or regulatory frameworks.

For instance, an API sanctioned by a country’s regulatory body, such as the SEC in the United States for contracts involving private equity, would greatly enhance the legal robustness and regulatory compliance of blockchain transactions. The SEC currently does provide an API for its EDGAR service, and so their ability to extend its functionality for legal issues is not a flight of fancy. This sanctioned API would, at minimum, allow smart contracts to dynamically incorporate applicable legal rules and regulatory guidelines into their execution, thereby aligning blockchain-based transactions with real-world legal requirements.

Furthermore, this decentralized AI entity could be designed to continuously update its understanding and interpretation of legal precedents and regulatory changes. By doing so, it ensures that the arbitration and enforcement of contracts on the blockchain remain in compliance with current laws, even as they evolve. This system not only provides a mechanism for legal arbitration without central authority but also offers a scalable, jurisdictionally aware framework for legal compliance in blockchain transactions.

This approach addresses the critical need for blockchain transactions and contracts to be legally sound and compliant with existing regulations, while still benefiting from the efficiency, transparency, and decentralization that blockchain technology offers. By providing a clear, compliant pathway for the creation and execution of contracts, and by introducing an AI-driven mechanism for legal arbitration, we pave the way for a new era of blockchain utilization — one where complex, real-world contracts can be efficiently managed and enforced on a decentralized platform.

Illustrative Examples for Private Equity

To show the power of the approach we have outlined above, we now develop two examples that implement the process.

1. Replicating Legacy Private Equity

Consider an example of a private equity contractual transaction in the US utilizing an SEC-sanctioned API. Let’s outline a scenario that incorporates the integration of AI, the Bitcoin blockchain, and regulatory compliance. This example will illustrate how the components interact to facilitate a legally compliant, secure, and efficient private equity transaction.

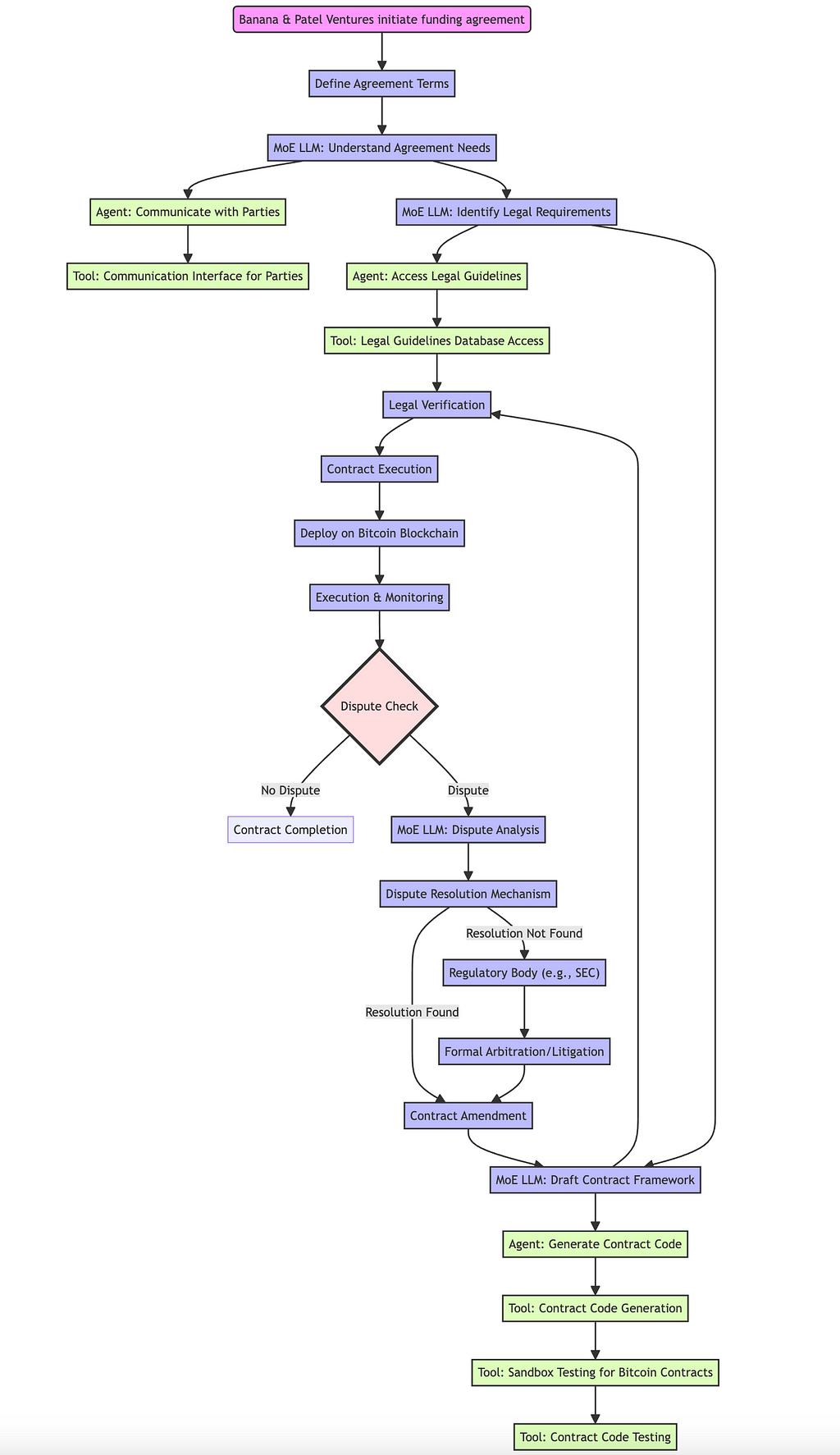

So, imagine that a startup, Banana, is seeking private equity investment to fund its expansion. Banana manages to attract the interest of Patel Ventures, a private equity firm looking to invest in promising technology startups. To streamline the investment process and ensure regulatory compliance, both parties decide to execute the transaction using a smart contract on the Bitcoin blockchain, leveraging an SEC-sanctioned API for legal arbitration and regulatory compliance.

Step 1: Contract Creation

Banana and Patel Ventures agree on the terms of the investment, including the amount of capital to be invested, equity to be exchanged, and conditions for funding. Using an AI-driven platform with NLP capabilities, they describe their agreement in natural language. The AI interprets this description, verifies the legality and feasibility of the terms, and translates them into a draft smart contract, executable on Bitcoin.

Step 2: Verification

The verifying function of the Bitcoin contracting platform suggests that certain aspects of the contract are not directly executable in code on chain. Let us say that the sticking point is that the MVP has three metrics of which two are directly measurable and one is somewhat subjective. It suggests that a workaround would involve changing some of the contractual terms around the third metric to make it executable. Let us assume that these changes might mean that Patel Ventures assumes more risk, and, therefore, they ask for more equity. This passes muster and both parties proceed with the slightly revised terms.

Step 3: Regulatory Compliance Check

Before finalizing the contract, the AI platform utilizes the SEC-sanctioned API to review the draft smart contract against current SEC regulations and guidelines applicable to private equity transactions. This includes compliance checks for investor accreditation, anti-money laundering (AML) requirements, and the Securities Act exemptions under which the offering qualifies (e.g., Regulation D).

The API dynamically updates the draft contract to incorporate any necessary legal provisions or disclosures required for compliance. This ensures that the contract not only meets the parties’ agreement terms but also adheres to the latest regulatory standards.

Step 4: Contract Finalization and Execution

Once the draft contract passes the compliance check, both parties review the finalized smart contract. They provide their digital signatures, confirming their agreement to the terms and compliance with SEC regulations. The smart contract is then deployed on the Bitcoin blockchain, where it is executed according to the predefined conditions. The investment transaction is processed, with Bitcoin transferred securely to a multisig account, and equity shares allocated to Patel Ventures.

Step 5: Dispute Resolution and Arbitration

Should a dispute arise from the contractual agreement, the AI-driven platform can serve as an initial arbitration mechanism, interpreting the contract’s terms and the context of the dispute. If necessary, the SEC-sanctioned API can guide the arbitration process, ensuring decisions align with regulatory frameworks and legal precedents. This decentralized dispute resolution process reduces reliance on traditional legal systems, streamlining resolution and maintaining compliance.

2. Democratizing Venture Capital through Bitcoin Syndicates

We can go further and envision a maximally decentralized private equity model that utilizes the Bitcoin network and AI technologies to replicate and enhance the traditional roles played by venture capitalists. The role of the SEC as a trusted intermediary is minimized to the greatest extent possible, while still ensuring that, once a funded project operates and transacts in traditional markets, it remains a legitimate legal entity.

This model relies on the organic creation of Bitcoin Syndicates to function as VCs, which democratize private equity as they leverage Bitcoin’s blockchain infrastructure for enhanced efficiency and transparency.

Let us proceed by defining the roles for three types of nodes:

Evaluator

An individual or entity accredited by the U.S. Securities and Exchange Commission (SEC) to assess and select projects seeking investment on the Bitcoin blockchain. Evaluators are registered with the SEC, with their public keys made available on an SEC-maintained roster. They play a crucial role in the venture capital process by conducting due diligence, evaluating project potential, and initiating funding processes for promising projects through the use of Hashed TimeLock Contracts (HTLCs). Evaluators bridge the gap between Project Creators seeking funding and Investors willing to provide capital, while also potentially participating as investors themselves.

Project Creator

An individual or entity proposing a project or business idea seeking investment through the Bitcoin blockchain. Project Creators announce their projects on the Lightning Network, aiming to attract Evaluators and, through them, other Investors. They provide detailed project information and meet specified requirements during the evaluation phase. Successful projects enter into HTLCs with Evaluators and, subsequently, with a syndicate of Investors, facilitating funding and development under agreed-upon terms.

Investor

An individual or entity willing to provide capital to projects selected for investment within the Bitcoin blockchain ecosystem. Investors are part of the Syndicate, contributing funds to projects through HTLCs orchestrated by Evaluators. While Investors need to meet the SEC’s criteria for accredited investors, their public keys do not have to be listed on the SEC’s roster, allowing for a degree of privacy. Investors rely on the due diligence performed by Evaluators and participate in funding promising projects, earning potential returns based on the success of these ventures.

Here’s a streamlined version of how we might proceed:

Step 1: SEC Roster of Accredited Bitcoin Investors

The process begins with the U.S. Securities and Exchange Commission (SEC) maintaining a roster of Accredited Bitcoin Investors. Individuals or entities wishing to participate as Evaluators in the venture capital process through Bitcoin must register their nominated public keys with the SEC. This registration process involves demonstrating control over sufficient Bitcoin funds, meeting the SEC’s criteria for accredited investors. This public roster ensures transparency and accountability, allowing Project Creators and other Investors to verify the legitimacy of potential Evaluators. Crucially, the roster serves as a mechanism to protect against moral hazard by the Evaluator, ensuring the safety and security of Project Creators’ ideas.

Step 2: Creation of HTLCs by Evaluators

Accredited Evaluators initiate the investment process by creating multiple Hashed TimeLock Contracts (HTLCs) with several investor nodes (for example, with 10 nodes, each committing 10 Bitcoins for a 30-day lock period). This step allows potential investors to verify the Evaluator’s accredited status on the SEC’s roster before locking in their funds, ensuring trust and legitimacy in the transaction before the Evaluator provides information on the project and proposed terms.

Step 3: Evaluator and Project Creator Agreement

An Evaluator then creates an HTLC with a Project Creator for a shorter evaluation period, say 10 days. This allows the Project Creator to confirm the Evaluator’s accreditation on the SEC roster, safeguarding their intellectual property and ensuring that the Evaluator is a legitimate party interested in evaluating the project without the intent of appropriating the idea. Thereafter, information is shared.

Step 4: Formation of the Syndicate

Upon finding a promising project, the Evaluator proceeds to create HTLCs with a selected number (n) of the original investor nodes (m), locking in a stake that reflects his investment preference compared to the total available funding in each channel (from the 10 Bitcoin per node in the example). This allocation process establishes the Evaluator’s share and the contributing nodes’ shares in the Syndicate, ensuring the project receives the necessary funding. The remaining funds not allocated to the project revert back to the investor nodes at the end of the HTLC period.

Step 5: Syndicate Charter and Legal AI

With the Syndicate formed, a legal AI, utilizing an SEC-sanctioned API, assists in drafting the Syndicate’s charter. This charter outlines the management fees for the Evaluator, timelines for returns, and other essential terms governing the relationship between the Syndicate members and the Project Creator. This step ensures that all parties have a clear understanding of their obligations and expectations, further protected by the legal robustness and compliance facilitated by the SEC-sanctioned API.

Step 6: Dispute Resolution and Arbitration

Should a dispute arise from the contractual agreement in the Syndicate, as in the first example, the legal AI remains the first point of resolution. It guides the arbitration process, ensuring decisions align with regulatory frameworks and legal precedents. The aim remains to rely on the decentralized dispute resolution process rather than traditional legal systems to the greatest extent feasible, to minimize associated costs.

This decentralized model introduces a robust mechanism for venture funding, where the traditional roles of due diligence, monitoring, and legal compliance are effectively replicated and enhanced through AI and blockchain technologies. The use of HTLCs ensures transparency and commitment from all parties, while AI-driven tools for due diligence and legal drafting, supported by regulatory compliance via a SEC-sanctioned API, provide a solid foundation for secure and efficient investments. This approach not only democratizes access to venture capital but also introduces a level of flexibility, scalability, and efficiency unattainable in traditional private equity markets.

There are other worthwhile ways to reimagine contracts by exploiting the synergies possible between AI and the Bitcoin blockchain. For example, we might revisit the idea of decentralized private equity once Taro becomes part of the Bitcoin ecosystem. Currently being developed on the Bitcoin testnet, Taro is a proposed protocol aiming to allow the issuance of digital assets, both fungible and non-fungible, on the Bitcoin blockchain. It leverages Bitcoin’s Taproot upgrade for scalability and privacy, using a version of a Merkle tree for asset verification. Taro assets can be transferred on the Bitcoin network or via the Lightning Network for quicker and cheaper transactions.

We think that Taro could be used to decentralize crowdfunding and private equity markets in a manner that is even simpler than the second example we provide above. For example, it would be possible for an entrepreneur seeking funds to make his or her business idea an NFT (hidden in the root hash of the Taro asset script of an on-chain transaction) and, subsequently, list the unique asset identifier for the business plan in an off-chain listing, much like a crowdfunding site might do. Such a site would provide any interested investor with the ability to verify that the idea is indeed authentic using a block explorer.

Once fully funded, a company can be incorporated using a legal-AI agent on the Lightning Network, and its shares issued as as fungible Taro assets that can accommodate the rules on governance for the company. The shares would be represented within a dedicated Merkle tree, and owners would be able to trade their shares in full or in part using Lightning Network transactions, provided the new owners can provide evidence that they have knowledge of the governance rules for the shares.

Concluding Thoughts

We stand now more than ever on the cusp of a new era in contract governance. It seems clear that the integration of AI with Bitcoin’s blockchain technology is not just a futuristic dream but a burgeoning reality.

Developments from Lightning Labs and the potential applications of AI in contract creation and dispute resolution herald a transformative shift in how contracts are conceived, executed, and enforced. This evolution towards a more inclusive, efficient, and transparent contract governance system promises to democratize access to legal and financial services on a global scale.

By bridging the gap between the rigid, deterministic nature of traditional blockchain contracts and the nuanced, dynamic demands of real-world agreements, AI stands as the beacon of innovation, guiding us towards a future where Bitcoin Contract Governance (BCG) platforms could become the standard for global commerce.

The journey from concept to reality may be fraught with challenges, but the path we carve now by leveraging AI’s potential for Bitcoin holds the prospect of leading us toward a more equitable, accessible, and efficient world.

Works Cited

- Building the Bitcoin Economy: The Complete Contract Governance Platform, May 28, 2018. Prateek Goorha & ParabolicTrav

- Introducing Bitcoin Contract Governance, May 31, 2018. Prateek Goorha & ParabolicTrav

- The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments, January 14, 2016. Joseph Poon & Thaddeus Dryja

- AI for All: Powering APIs and Large Language Models with Lightning, July 6, 2023, Olaoluwa Osuntokun and Michael Levin

AI & Bitcoin: The Future of Contracts was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

Agant’s GBPA aims to transform UK’s digital finance landscape with regulatory-first approach

In a significant development for the UK’s digital asset ecosystem, Agant is...

ByglobalreutersNovember 21, 2024Countries Are Already Buying Bitcoin ‘In Huge Volumes’, Says Novogratz

Mike Novogratz, the founder and CEO of Galaxy Digital Holdings—a leading crypto...

ByglobalreutersNovember 21, 2024Logan Paul’s New Crypto Controversy: Youtuber Accused Of Profiting From Misleading Fans

American YouTuber and boxer Logan Paul is facing backlash again after being...

ByglobalreutersNovember 21, 2024Deutsche Bank’s AI Gamble: Partnership With Aleph Alpha Expected to Boost Innovation

Deutsche Bank has invested in German artificial intelligence (AI) startup Aleph Alpha....

ByglobalreutersNovember 21, 2024

Leave a comment