- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

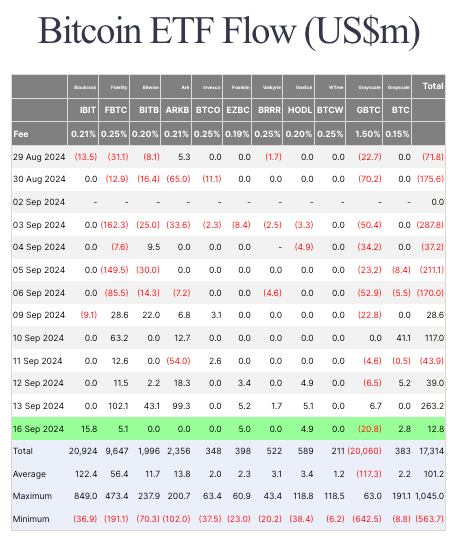

Bitcoin ETF inflows plummet from $263.2 million to $12.8 million

On Sept. 16, Bitcoin ETFs saw net positive flow of $12.8 million. This is a significant drop from the $263.2 million net inflow observed on Friday, Sept. 13.

Such a sharp drop is due to five of the nine tracked spot ETFs having a zero net flow on Monday. Bitwise, Ark, Invesco, Valkyrie, and Wisdom Tree all saw zero flows on Sep. 16. Grayscale’s $20.8 million outflow also contributed to the drop. While BlackRock’s IBIT saw zero flows on Friday, it recovered with a $15.8 million inflow on Monday. Fidelity and VanEck saw modest inflows.

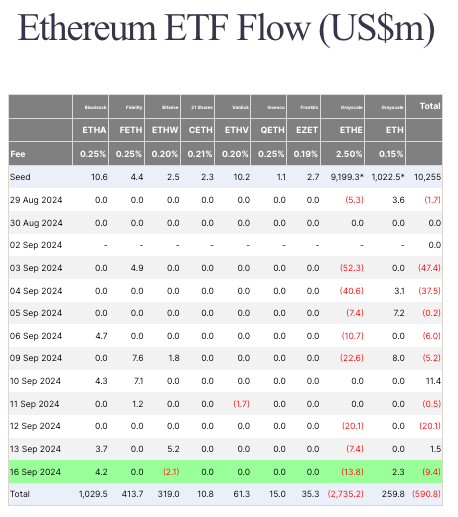

Ethereum ETFs recorded a negative flow once again after seeing net inflows of $1.5 million on Friday. Throughout September, Ethereum ETFs only had two days of positive flows. On Sept. 16, the $13.8 million outflow from Grayscale’s ETHE pushed flows deep into the red with a net outflow of $9.4 million. This brings the total outflows to $590.8 million.

The post Bitcoin ETF inflows plummet from $263.2 million to $12.8 million appeared first on CryptoSlate.

Recent Posts

Categories

Related Articles

From Vesting Plans to Binance Wallets: A Deep Dive into TRUMP Token’s Distribution

More than a month after Donald Trump, the 47th U.S. president, launched...

ByglobalreutersFebruary 21, 2025North Korea’s Lazarus Group now using crypto gifts to breach security defenses

The North Korean-linked Lazarus Group has adopted a new method of breaching...

ByglobalreutersFebruary 21, 2025Bybit crypto exchange hit by the largest theft of any kind, ever

It was a tough day in the market but that's nothing compared...

ByglobalreutersFebruary 21, 2025The Leading Crypto to Buy Before March? Analysts Say This Altcoin Could Lead the Market

Discover why RCO Finance (RCOF) is the best crypto to buy before...

ByglobalreutersFebruary 21, 2025

Leave a comment