- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Bitcoin ETFs experience 2 consecutive positive inflow days

Quick Take

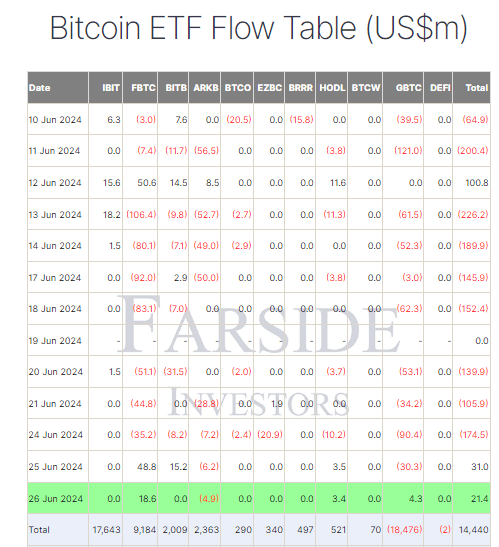

Recent data from Farside indicates a slight resurgence in Bitcoin (BTC) exchange-traded funds (ETFs), with a further inflow of $21.4 million on June 26. This marks consecutive days of positive inflows for these ETFs, suggesting renewed investor interest.

Fidelity’s FBTC led the pack, receiving an $18.6 million inflow, bringing its total inflows to an impressive $9.2 billion. Meanwhile, Grayscale’s GBTC saw a $4.3 million inflow, reducing its total outflows to $18.5 billion and marking its first inflow since June 5. BlackRock’s IBIT remained stable with no new inflows or outflows, maintaining its $17.6 billion inflow. Cumulatively, Bitcoin ETFs have attracted $14.4 billion in total inflows.

This trend may indicate that BTC continues consolidating around the $60,000 mark, leading to a resurgence in inflows that could signal the end of the current Bitcoin correction.

The implications of these inflows were discussed by the lead analyst at CryptoSlate, James Van Straten, senior editor Liam Wright, and Jim Bianco, head of Bianco Research, on the social platform X. The debate highlighted the significance of these inflows for the future trajectory of Bitcoin.

The post Bitcoin ETFs experience 2 consecutive positive inflow days appeared first on CryptoSlate.

Recent Posts

What happened as new signing Rio Ngumoha made his debut for Liverpool U18s

September 15, 2024Categories

Related Articles

Senator Introduces Bill to Cement Texas as the First State With a Bitcoin Reserve

Texas aims to lead the digital revolution with a groundbreaking “Strategic Bitcoin...

ByglobalreutersJanuary 19, 2025Now Live: TRUMPOFFICIALUSDT Perpetual Swap Listings With Up to 25x Leverage

As of 18 Jan 2025 at 12:00 UTC, BitMEX users can long...

ByglobalreutersJanuary 19, 2025XRP Breakout Alert: Expert Predicts Potential Surge To $15 After Triangle Formation

As XRP recovers from a notable dip in mid-December, technical analysis signals...

ByglobalreutersJanuary 19, 2025DORA Regulations Kick In: A New Era For Crypto In The EU

Cryptocurrency firms operating in member states of the European Union will be...

ByglobalreutersJanuary 19, 2025

Leave a comment