- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

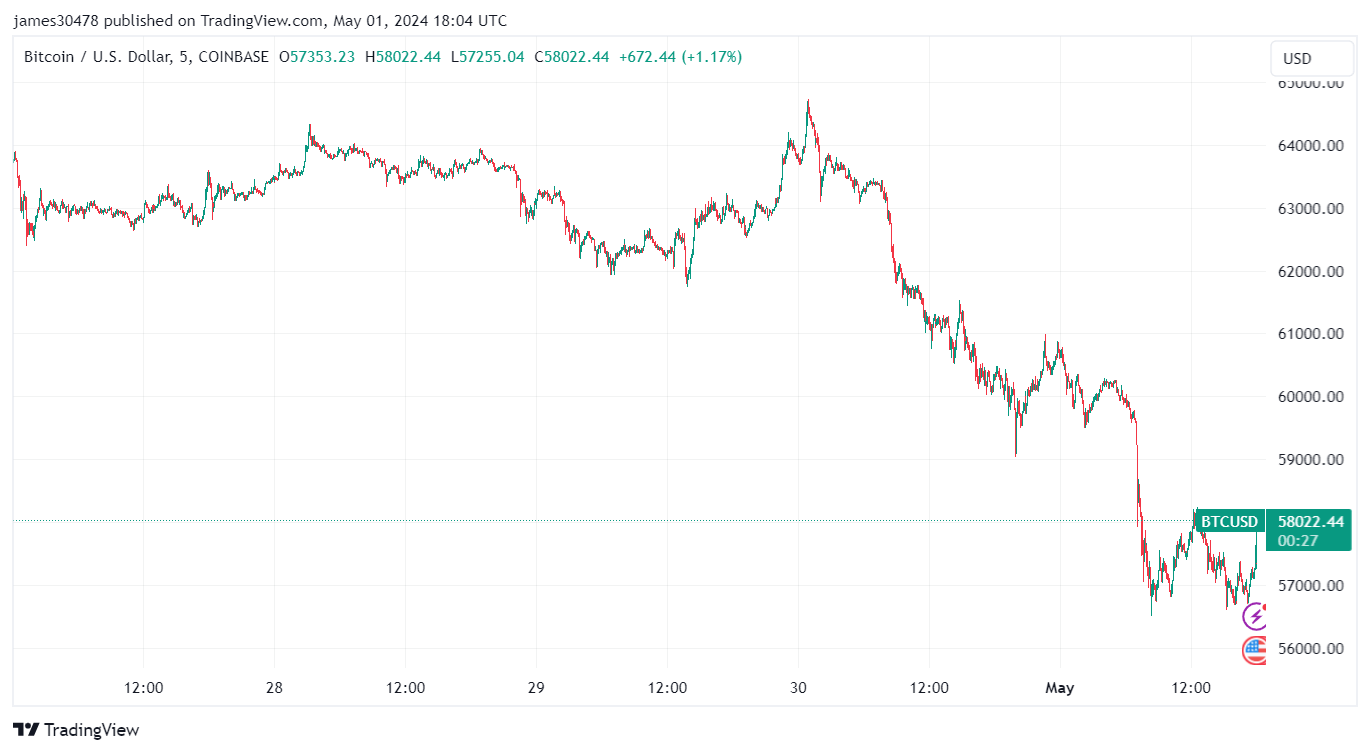

Bitcoin fights to get above $58,000 as Fed maintains unchanged rates

Quick Take

The Federal Reserve has opted to maintain the fed funds rate within the range of 5.25% to 5.50%. Preceding this decision, Bitcoin experienced a decline from approximately $64,000 to a low of around $56,500. Presently, Bitcoin is trading at approximately $58,000.

Following the decision, notable movements have been observed in crypto equities. Coinbase shows a rise of over 3%, while Marathon Digital Holdings sees an increase of above 2%.

Additionally, the Ethereum to Bitcoin ratio stands firmly above 0.051, over 3% higher on the day. Concurrently, the DXY index has gradually declined to just above 106.

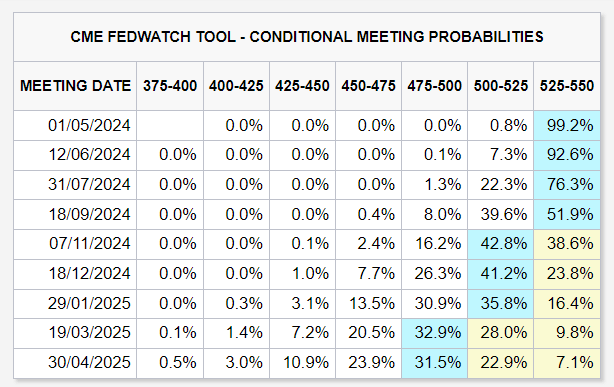

Based on the CME Fed Watch tool, it is now anticipated that the Federal Reserve will maintain its current stance until September, with the first rate cut projected for November.

The post Bitcoin fights to get above $58,000 as Fed maintains unchanged rates appeared first on CryptoSlate.

Recent Posts

Generative AI breakout: Three reasons why Nvidia shares are climbing higher

September 25, 2024Categories

Related Articles

Franklin Templeton Files for Solana ETF With Staking—Is SOL Set for Institutional Adoption?

Franklin Templeton has filed for a Solana ETF, aiming to track SOL’s...

ByglobalreutersFebruary 22, 2025Can we escape DeFi’s Ouroboros? Bridging real-yield in 2025

The following is a guest article from Mike Wasyl, CEO at Bracket....

ByglobalreutersFebruary 22, 2025Microsoft’s New Chip Could Speed Up Bitcoin’s Quantum-Resistance Timeline

Microsoft’s latest quantum computing chip, Majorana 1, might accelerate the need to...

ByglobalreutersFebruary 22, 2025Bitcoin Surges Past $99,000 Following Dovish Remarks From Atlanta Fed President Bostic

After spending more than two weeks trading in the mid-$90,000 range, Bitcoin...

ByglobalreutersFebruary 22, 2025

Leave a comment