- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

BlackRock’s IBIT trading volume surges to $1.1 billion despite no inflows

Quick Take

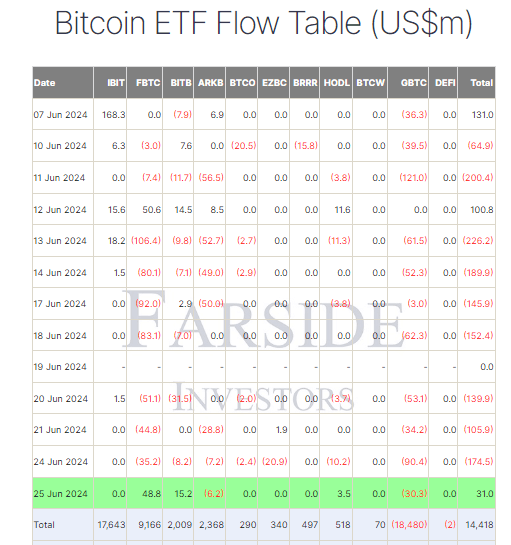

Farside data shows that on June 25, Bitcoin (BTC) exchange-traded funds (ETFs) experienced the first net inflow since June 12, with $31.0 million entering the market.

Fidelity’s FBTC led the charge with a $48.8 million inflow, raising its total net inflow to $9.2 billion. Bitwise’s BITB also saw a notable inflow, attracting $15.2 million and bringing its total net inflow to $2.0 billion. In contrast, Grayscale’s GBTC struggled with outflows, losing $30.3 million and pushing its total outflow to $18.5 billion. According to Farside data, the total net inflows to BTC ETFs now stand at $14.4 billion.

Interestingly, BlackRock’s IBIT ETF recorded no net inflows or outflows, yet its trading volume surged to $1.1 billion, according to Coinglass data. For comparison, GBTC only managed a volume of $341 million, placing IBIT at number 18 overall in trading volume among all US ETFs. This raises speculation about IBIT’s potential to become a key institutional basis trade Bitcoin ETF, given its robust trading activity despite the absence of net inflows or outflows.

The post BlackRock’s IBIT trading volume surges to $1.1 billion despite no inflows appeared first on CryptoSlate.

Recent Posts

Categories

Related Articles

4 reasons why soaring Mantra price may crash soon

Mantra price has gone parabolic since 2024, becoming one of the best-performing...

ByglobalreutersFebruary 23, 2025Shiba Inu Whale Activity Plunges 79% In Three Months — What’s Happening?

The meme coin market has seen a remarkable transformation in the past...

ByglobalreutersFebruary 23, 2025As Gold Prices Approach $3K, Why Is Bitcoin Failing to Keep Up?

Gold prices hit a new all-time high on Thursday.

ByglobalreutersFebruary 23, 2025Michael Saylor signals Strategy’s new Bitcoin purchase after one-week break

Strategy's renewed Bitcoin purchases could signal increased market confidence, potentially influencing other...

ByglobalreutersFebruary 23, 2025

Leave a comment