- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

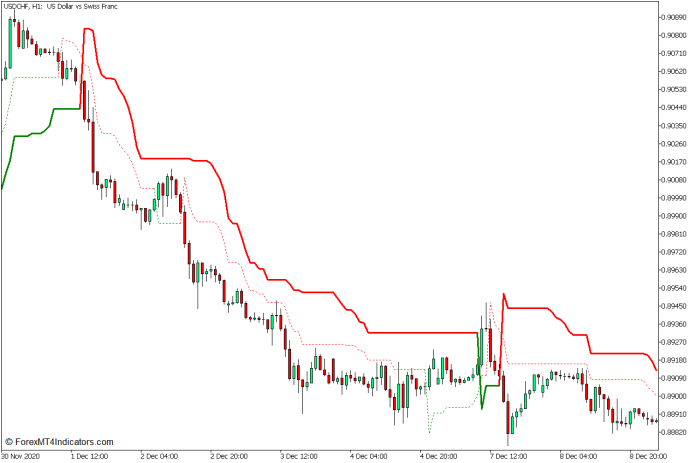

Double Super Trend Price Action Forex Trading Strategy for MT5

One way to trade high-probability trade setups is to trade with the trend. This is because trading with the trend means you are trading in the general flow of the market. As such, price tends to move in the direction of the trend which often translates to a higher chance of a trade ending in profit. This is why most trend continuation strategies tend to result in higher win rates over the long term. Although this does not happen often, at times a trade could also result in extremely high gains over the long term.

The key factor to trading with the trend is to identify markets wherein the short-term trend points toward the same direction as the long-term trend. Having both short-term and long-term trends in confluence can significantly increase the likelihood of a winning trade as momentum is much stronger in such cases.

This strategy shows us an example of how to trade with the trend wherein the short-term and long-term trends are aligned using the Supertrend Indicator, Awesome Oscillator, and the Pin Bar Detector.

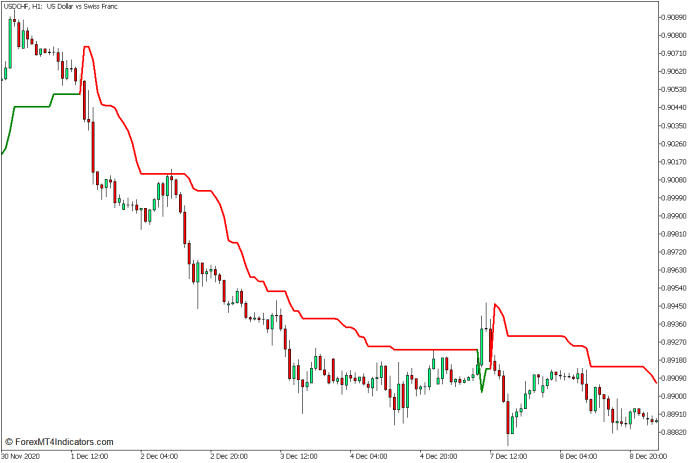

Supertrend Indicator

One of the ways traders identify trend reversals is based on price movements about an existing trend based on the Average True Range (ATR).

For example, traders may consider possible trend reversals whenever the price moves against the current trend by more than four times the current ATR. In an uptrend, if the price drops by more than four times the ATR coming from the highest high, then the market has reversed to a downtrend. The inverse is true with downtrends reversing to an uptrend.

The Supertrend Indicator is based on the same concept. It simply plots a line indicating the point where the price has to reach for the market to be considered to have reversed.

It plots a green line below price action during uptrends, and a red colored line above price action during downtrends. The lines shift and change color only when the price closes on the opposite side of the line.

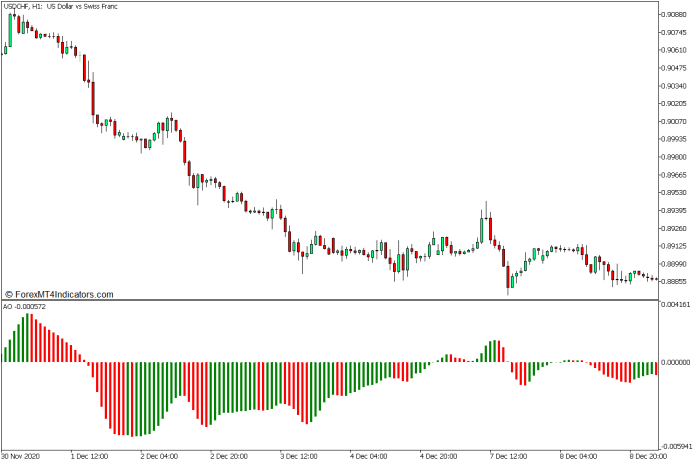

Awesome Oscillator

The Awesome Oscillator (AO) is a trend-following technical indicator that is based on the crossover of an underlying pair of moving average lines.

The AO calculates the difference between a 5-bar Simple Moving Average (SMA) line and a 34-bar Simple Moving Average (SMA) line. These underlying SMAs are not based on the usual close of each candle, but rather based on the midpoints of each bar. It then plots the difference as bars on a histogram.

Trend direction or bias may be identified based on whether the bars are positive or negative, while the strength of the trend may be identified based on the color of the bars.

Positive green bars indicate a strong bullish trend, while positive red bars indicate a weak bullish trend. Negative red bars indicate a strong bearish trend, while negative green bars indicate a weak bearish trend.

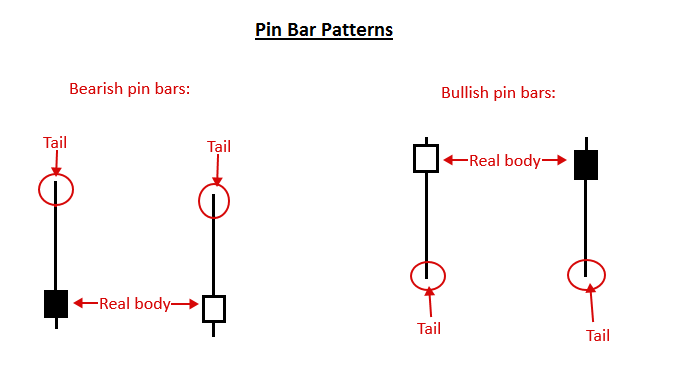

Pin Bar Detector

The pin bar pattern is one of the most effective reversal candlestick patterns. It is a candlestick pattern that is formed by one candle with a small body, a small wick on one side, and a long wick on the other side. The long wick is formed in the direction where price action is reversing from and signifies price rejection. A bullish pin bar pattern has a long wick on the lower portion of the candle, while a bearish pin bar pattern has a long wick on the upper portion of the candle.

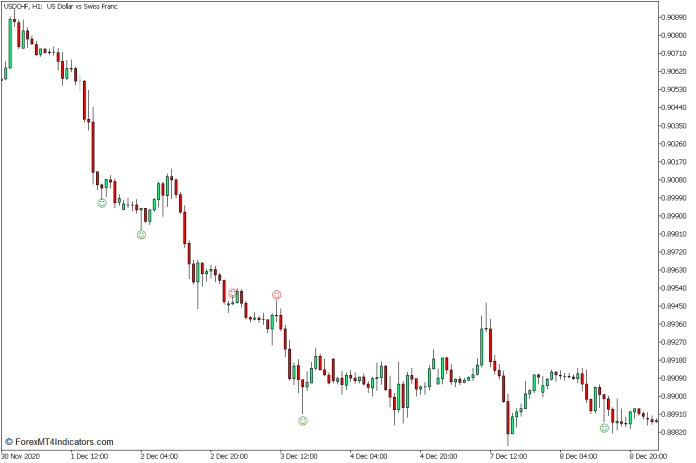

The Pin Bar Detector is a custom technical indicator that automatically detects and indicates a pin bar pattern. It plots a smiley below the candle whenever it detects a bullish pin bar pattern, and a smiley above the candle whenever it detects a bearish pin bar pattern.

Trading Strategy Concept

This strategy is a trend continuation strategy that uses the confluence of Supertrend lines, the Awesome Oscillator, and the Pin Bar Detector to identify potential trend continuation setups.

The Super Trend indicator can be modified by adjusting the multiplier of the ATR or the period of the ATR.

We will be using two Super Trend lines. The main line is a solid line based on four times the ATR, which indicates the long-term trend. The short-term trend is then represented by a dotted line based on two times the ATR.

Trades are considered only when the two Supertrend lines are in confluence. These lines are used as trend direction filters, while the dotted line is used as a dynamic support and resistance level.

The Awesome Oscillator on the other hand is also an effective trend direction indicator. As such, we will use the AO as an additional confirmation of trend direction.

The Pin Bar Detector then serves as the price rejection indication and entry signal as it forms on the dotted line.

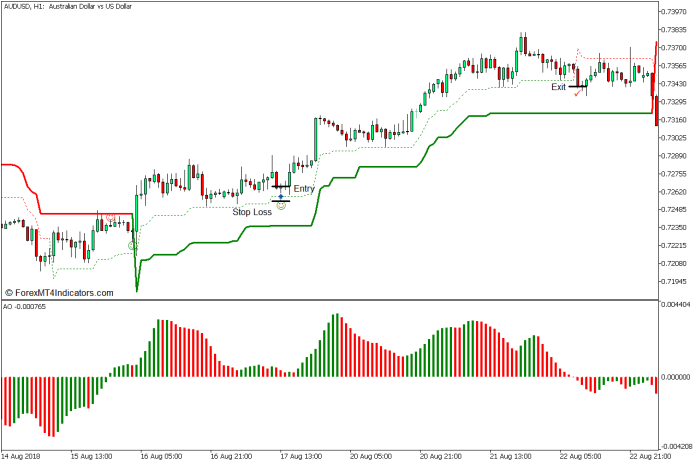

Buy Trade Setup

Entry

- The dotted and solid Super Trend lines should be green and should be below price action.

- The AO bars should be positive.

- Price action should pull back near the dotted Supertrend line.

- Enter a buy order as soon as the Pin Bar Detector identifies a bullish reversal pattern.

Stop Loss

- Set the stop loss below the dotted Supertrend line.

Exit

- Close the trade as soon as the price closes below the dotted Supertrend line.

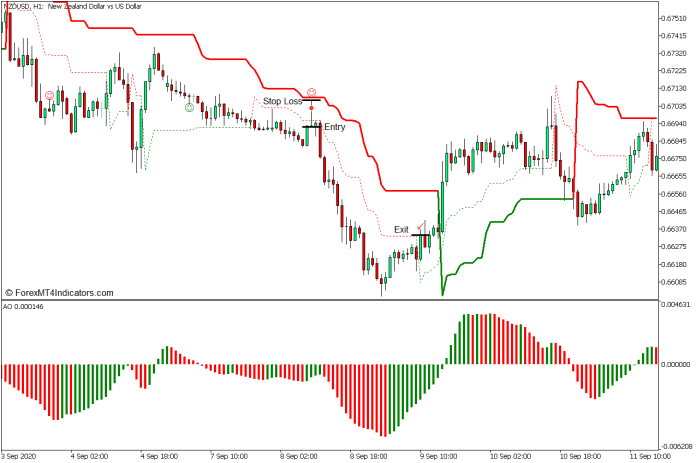

Sell Trade Setup

Entry

- The dotted and solid Super Trend lines should be red and should be above price action.

- The AO bars should be negative.

- Price action should pull back near the dotted Supertrend line.

- Enter a sell order as soon as the Pin Bar Detector identifies a bearish reversal pattern.

Stop Loss

- Set the stop loss above the dotted Supertrend line.

Exit

- Close the trade as soon as the price closes above the dotted Supertrend line.

Conclusion

The Supertrend line is mainly a great trend bias indicator. However, it can also act as an excellent dynamic support or resistance level.

This strategy uses a combination of modified Supertrend lines to identify a confluence of short-term and long-term trend directions. It then uses the short-term Supertrend line as a dynamic support or resistance level.

This strategy can produce trade setups with very high win probabilities when traded in the right trending market environment. However, it is also important for traders to manage their trades effectively when using this strategy to exit their trades with optimal profits.

Recommended MT5 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download:

Save

Save

Recent Posts

Categories

Related Articles

What technical levels are in play for some of the major currencies vs the USD for Nov 22

The European data was yucky (if I can use a favorite word...

ByglobalreutersNovember 22, 2024Why You Should Constantly Question the Market

While having discipline is a very important trait for a trader, we...

ByglobalreutersNovember 22, 2024Gold rallies to above $2,700 on Russia-Ukraine tensions

Gold (XAU/USD) rallies for the fifth day in a row, making it...

ByglobalreutersNovember 22, 2024GBP/USD: GBP has stabilized just above 1.25 – Scotiabank

UK data reports today were roundly disappointing, weighing on the Pound Sterling...

ByglobalreutersNovember 22, 2024

Leave a comment