- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

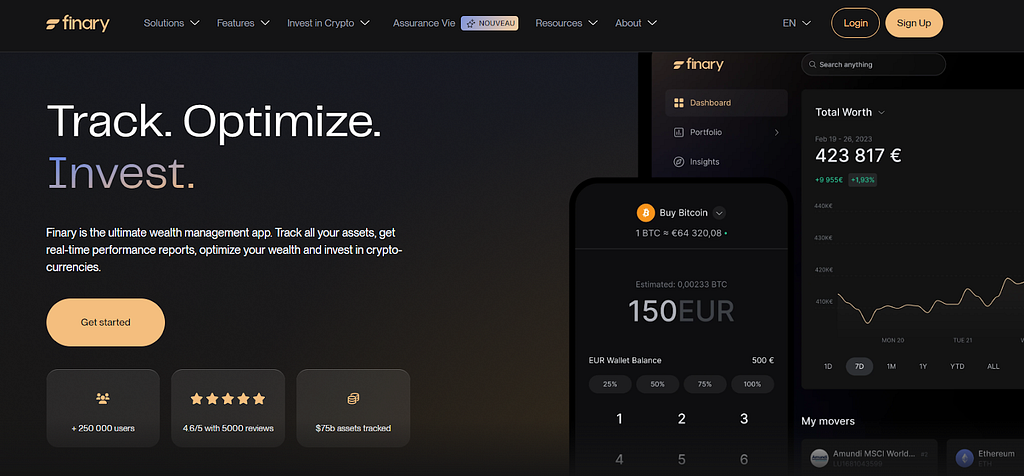

As inflation is rising in the world, we all want to grow our money, and the best way to invest money is by investing in different commodities such as stocks, crypto, startups, etc. The biggest problem for investors is managing their money; monitoring every investment and market is often complex. This is where Finary, based in Paris, steps in as the growing investment platform that provides relief for investors. It helps them monitor their every investment, making the process less stressful. So, in this article, we will review the tool, check the features it offers, and all the necessary checkpoints.

What is Finary?

Founded in 2020, Finary is a financial management platform that helps investors and traders track their portfolios and investments in real-time. These investments include bank accounts, stocks, cryptos, life insurance, real estate, etc. Finary has tracked a corpus of more than $75 billion, with more than 250K users around the globe. It is also a crypto platform that allows users to buy and sell cryptocurrencies. Finary offers financial tools, such as a wealth simulator, loan calculator, etc., to manage your finances. The company is backed by well-known venture capitalists such as Y Combinator, Kima Ventures, Speedinvest, etc.

Key Features of Finary

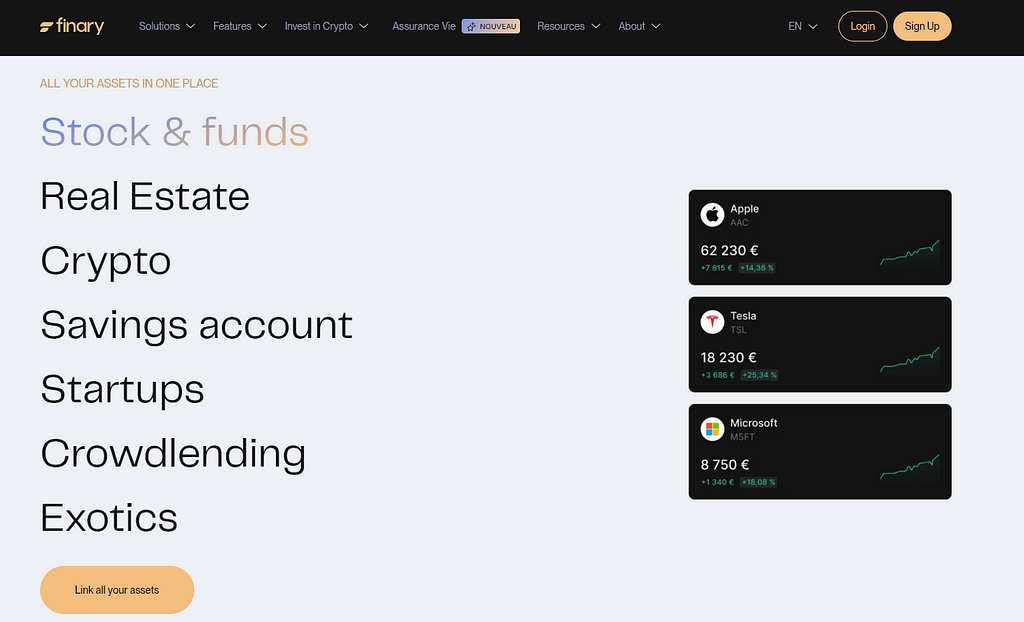

- Portfolio Tracking: Finary allows users to track their investments and assets in real-time, such as bank accounts, stocks and funds, tangible assets, exotics, crowdlending, etc. It gathers all the information from your databases and helps users manage cash flow and organize their finances. It gives users scores based on their diversification and provides better suggestions for efficient management. It also uncovers all the hidden fees in your investment, tracks the dividends of investment, and helps users plan their financial journey.

- Integrations: Finary connects with over 20,000 banks, brokers, and investment platforms globally. It allows users to connect easily their saved accounts, stocks, and crypto platforms, making tracking funds and investments easy.

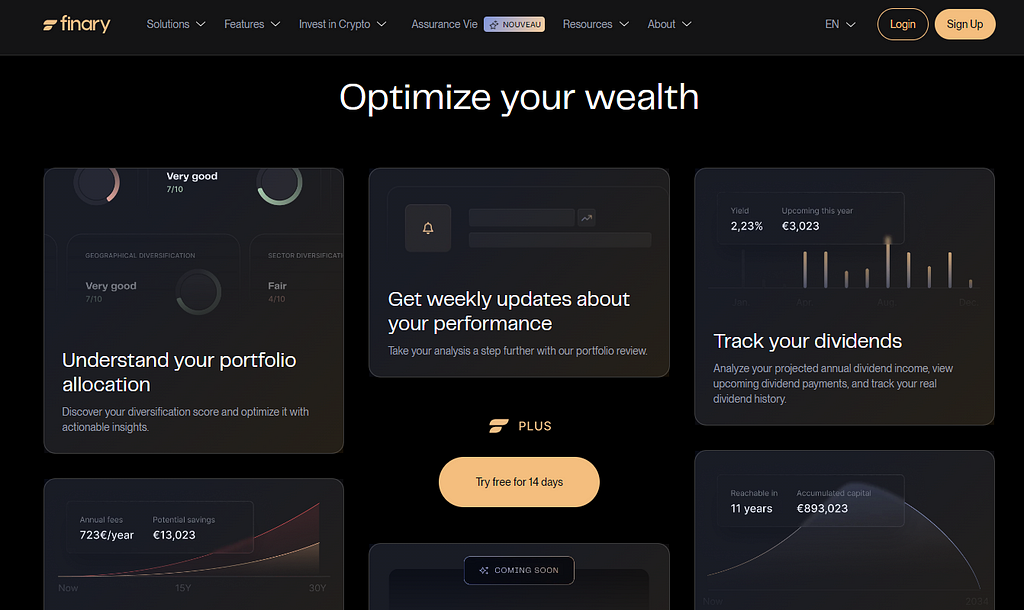

- Performance Reports: Finary makes it easy for users to track their investments by providing detailed and visually appealing graphs. It also provides the users with weekly updates about their investments. In addition, it understands situations and optimizes investments with insights.

- Tools: Finary offers financial tools such as a wealth calculator, budget calculator, compound interest calculator, and loan calculator. These tools make the financial journey smooth for the users.

- User Friendly: One of Finary’s key aspects is its user-friendly interface. It’s designed to be clean and intuitive, making it easy for anyone to use the platform. This emphasis on user experience aims to make potential users feel comfortable and at ease when using Finary.

Finary Review: Crypto Investment

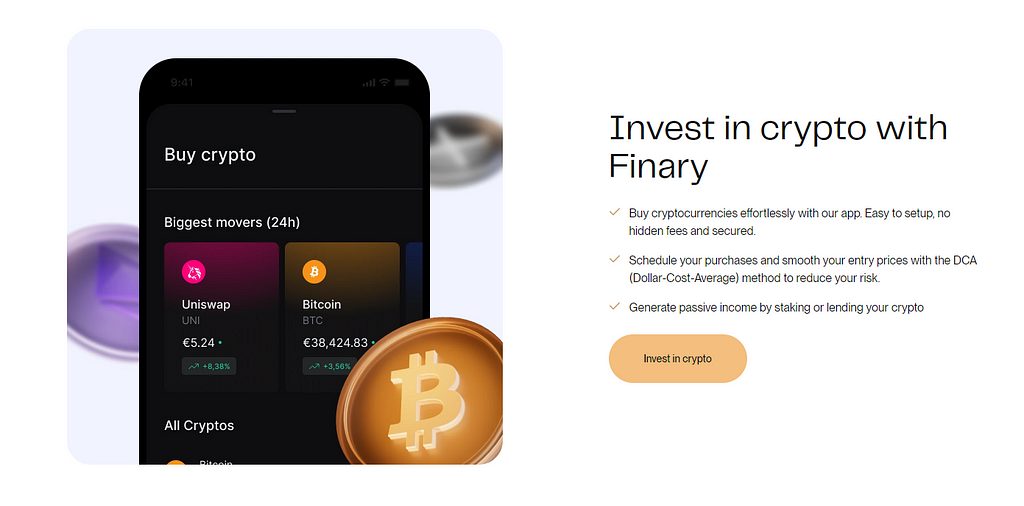

Finary also offers crypto investments on its platform. It has all the features that any crypto trader or investor needs.

- Finary users can buy and sell more than 25 cryptocurrencies with instant transactions. It supports SEPA instant, allowing traders to deposit money to place orders quickly.

- Users can schedule their purchases and use the DCA(Dollar Cost Average) method to reduce the risk. Finary also offers themed collections of cryptocurrencies, or users can create their own crypto saving plan.

- Finary allows the investor to get up to 10% interest on their cryptocurrencies on yielding. Users can also transfer their crypto to others.

- Finary fees are low compared to others, such as Revolt and Coinbase. The DCA of Finary is 0.99%, with a free instant top-up compared to other platforms that take some commission.

- For Security, Finary is registered by the AMF and operates with strict regulations and policies. Furthermore, Finary never uses or lends the users’ assets without permission.

Finary Review: Solutions

To solve all the financial problems, Finary offers two plans; the first one is Finary Plus, which costs €149.99/year for individuals with an investment fee of 0.99%, and the second plan is Finary Pro, which costs €349.99/year for both businesses and individuals with same invest fee. Both these plans come with a free trial of 14 days. Some of the features include

- Insights: Finary uses advanced algorithms to understand the evolution of the user’s assets. It analyzes data from the past 30 years and prepares insights depending on the user’s objective.

- Linked Account: Finary allows users to add unlimited accounts such as bank accounts, stockbrokers, real estate, and many investment platforms.

- Dividend Tracker and VIP Support: Finary analyzes all the stocks and tracks all the dividends by every stock. Finary also has VIP support for their Plus and Pro customers, which helps users solve issues.

- Analyze Risk: Finary analyzes the investor’s profile and provides a detailed analysis of allocation, risk level, and debt ratio, which eventually helps users make better decisions.

- Community: Finary has a community of more than 25,000 investors. By joining this large community, users can gain insights and strategies from other investors and refine their strategy.

- Family Mode: Finary offers a Family Mode to its Pro users. It allows the users to keep track of their family assets and finances.

Finary Review: Security

One of the users’ most significant concerns is the platform’s security as they invest their money and provide their data. In the case of Finary, users provide their financial data to the company, so the platform’s security must be at a high level. Here are some security steps taken by Finary

- The company securely encrypts all the credentials managed by regulated partners such as Plaid, Powens, and Flanks. These partners are regulated by strict safety and security rules to ensure the safety of all users.

- Finary can only read the account transactions and never initiates any transaction on the user’s account.

- All the users’ data are deployed on the Google Cloud Platform, which ensures the safety and security of hosting.

- Finary does not access the user’s password. The company delegates all the authentication-related tasks to the Clerk, an authenticator tool.

- The company routinely conducts third-party code audits to identify and resolve system vulnerabilities.

- For crypto safety and security, the company joined Bitstamp, a crypto company registered with AMF(Autorité des marchés financiers) and located in Europe.

Finary Review: Conclusion

Finary is a comprehensive financial management platform that helps simplify the investment process for new and experienced investors to solve modern investors’ complex problems. It offers real-time portfolio tracking, diverse integrations, detailed performance reports, and user-friendly tools. The platform’s expansion into cryptocurrency trading and its emphasis on security and data protection demonstrate its commitment to evolving with the financial landscape. The features offered, especially in the Plus and Pro plans, provide significant value for optimising investment strategies. As the financial world becomes increasingly complex, tools like Finary are crucial in empowering investors to make informed decisions and manage their wealth effectively.

Read More Crypto Stories on Coinmonks(https://medium.com/coinmonks.

Disclaimer — This blog contains product affiliate links. We may receive a commission if you make a purchase after clicking on one of these links. There might be paid endorsements in this article.

Also Read

- Binance vs Bingx vs BTCC

- TOP 6 Play to Earn Crypto Games

- Ledger Stax Review

- Best Cryptocurrency Mining Platforms

- Best Crypto Lending Platform

- Top 8 Crypto Jewelry

- Free Crypto Signals | Crypto Trading Bots

- An ultimate guide to Leveraged Token

- Bingx vs Kucoin vs Mexc

- NFT Trading Signals

Finary Review was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

Senator Introduces Bill to Cement Texas as the First State With a Bitcoin Reserve

Texas aims to lead the digital revolution with a groundbreaking “Strategic Bitcoin...

ByglobalreutersJanuary 19, 2025Now Live: TRUMPOFFICIALUSDT Perpetual Swap Listings With Up to 25x Leverage

As of 18 Jan 2025 at 12:00 UTC, BitMEX users can long...

ByglobalreutersJanuary 19, 2025XRP Breakout Alert: Expert Predicts Potential Surge To $15 After Triangle Formation

As XRP recovers from a notable dip in mid-December, technical analysis signals...

ByglobalreutersJanuary 19, 2025DORA Regulations Kick In: A New Era For Crypto In The EU

Cryptocurrency firms operating in member states of the European Union will be...

ByglobalreutersJanuary 19, 2025

Leave a comment