- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Forex Education for Professional Traders | Learn More

Are you a professional trader finding it hard to keep up in the fast-paced forex market? The world of currency trading is always changing. Even experienced traders can fall behind without constant learning. But there’s a way to stay ahead.

Forex education for professional traders can help. It sharpens your skills and keeps you up-to-date with market changes. You can find affordable online courses or invest in more in-depth training.

The forex market is open 24 hours a day, 5½ days a week. It offers both challenges and chances. With leverage up to 100:1, the rewards and risks are huge.

Professional forex courses are available for all levels. They focus on important currency pairs and advanced strategies. Prices vary from $50 for online courses to $11,495 for detailed programs like XLT-Forex Trading.

Key Takeaways

- Continuous education is key for professional forex traders.

- Forex market operates 24/5.5, with unique trading chances.

- Leverage in forex can reach 100:1, boosting profits and risks.

- Professional courses teach advanced strategies and risk management.

- Educational options range from affordable online courses to high-end training.

Understanding the Fundamentals of Currency Trading

Currency trading is at the heart of the forex market, the biggest financial place in the world. It trades $7.5 trillion daily, much bigger than stock markets.

Key Differences Between Forex and Stock Markets

Forex and stocks are different. The forex market is open 24/5. It starts in Asia and ends in New York. Unlike stocks, forex doesn’t involve owning something; it’s all about guessing.

Basic Market Structure and Participants

The forex market has central banks, commercial banks, and retail traders. The U.S. dollar is in 88% of all trades. Big pairs include USD, EUR, JPY, and GBP.

| Participant Type | Role in Market | Trading Volume |

|---|---|---|

| Central Banks | Monetary Policy | High |

| Commercial Banks | Liquidity Providers | Very High |

| Retail Traders | Speculative Trading | Low to Medium |

Currency Pair Classifications

Forex pairs are called majors, minors, and exotics. Traders use different strategies, like following trends or scalping. Leverage can make profits bigger, but also losses. With a 50:1 ratio, you can control $50,000 with just $1,000.

Knowing these basics is key for both new and seasoned traders. It helps them move through this fast-changing financial world.

Forex Education for Professional Traders

Professional forex training is more than just the basics. It dives into advanced trading and risk management. Traders looking to improve can find special education for the forex market.

Professional Training Methodologies

Forex education for pros includes deep workshops and mentorship, which provide detailed knowledge and hands-on experience.

Advanced Trading Techniques

Pro traders learn complex strategies to outdo the market. These include:

- Algorithmic trading.

- High-frequency trading.

- Advanced chart pattern recognition.

- Multiple time frame analysis.

Risk Management Strategies for Professionals

Good risk management is key for forex trading success. Pro traders use:

- Position sizing techniques

- Portfolio diversification

- Hedging techniques

| Training Component | Description | Value |

|---|---|---|

| Professional Forex Trader Course | Comprehensive training program | $5,995 |

| XLT-Forex Trading | Advanced trading techniques | $11,495 |

| Combined Forex and XLT | Complete professional package | $11,990 |

Professional forex training gives traders the skills for the 24-hour market. With up to 100:1 leverage and the chance to trade long and short, learning advanced techniques is vital for success.

Types of Forex Trading Education Programs

Forex education programs are made for everyone. They help beginners and experts alike. Each program is designed to fit different learning styles and schedules.

Online Course Platforms

Online forex courses are popular for their ease and flexibility. There are 83 courses to pick from. Some last just 1-4 weeks, while others go up to 3 months.

These courses cover many topics. You can learn about finance, capital markets, and trading strategies. It’s a great way to start or improve your trading skills.

Essential Trading Tools and Resources

Professional forex traders use many tools to stay ahead. The MetaTrader 4 (MT4) platform is a top choice. It has strong features for daily trading. TradingView has become popular in the last 9 years, with traders spending thousands of hours on it.

Risk management is very important in forex trading. Experts say to limit position sizes to 1% per trade. Some even choose 0.5% to keep losses small. Tools like Forex Tester help refine strategies.

Staying informed is key to success in forex. The Forex Factory calendar is a daily resource. It tracks important news that affects prices. Traders avoid trading during big news times because spreads are wider.

For those wanting to trade without personal risk, funding companies are a good option. They give capital to traders who pass their challenges. Many offer free trial periods for new traders to practice.

Professional trading resources go beyond tools. Traders check financial news sites like the Wall Street Journal and The Economist. These resources help traders make better decisions and improve their trading.

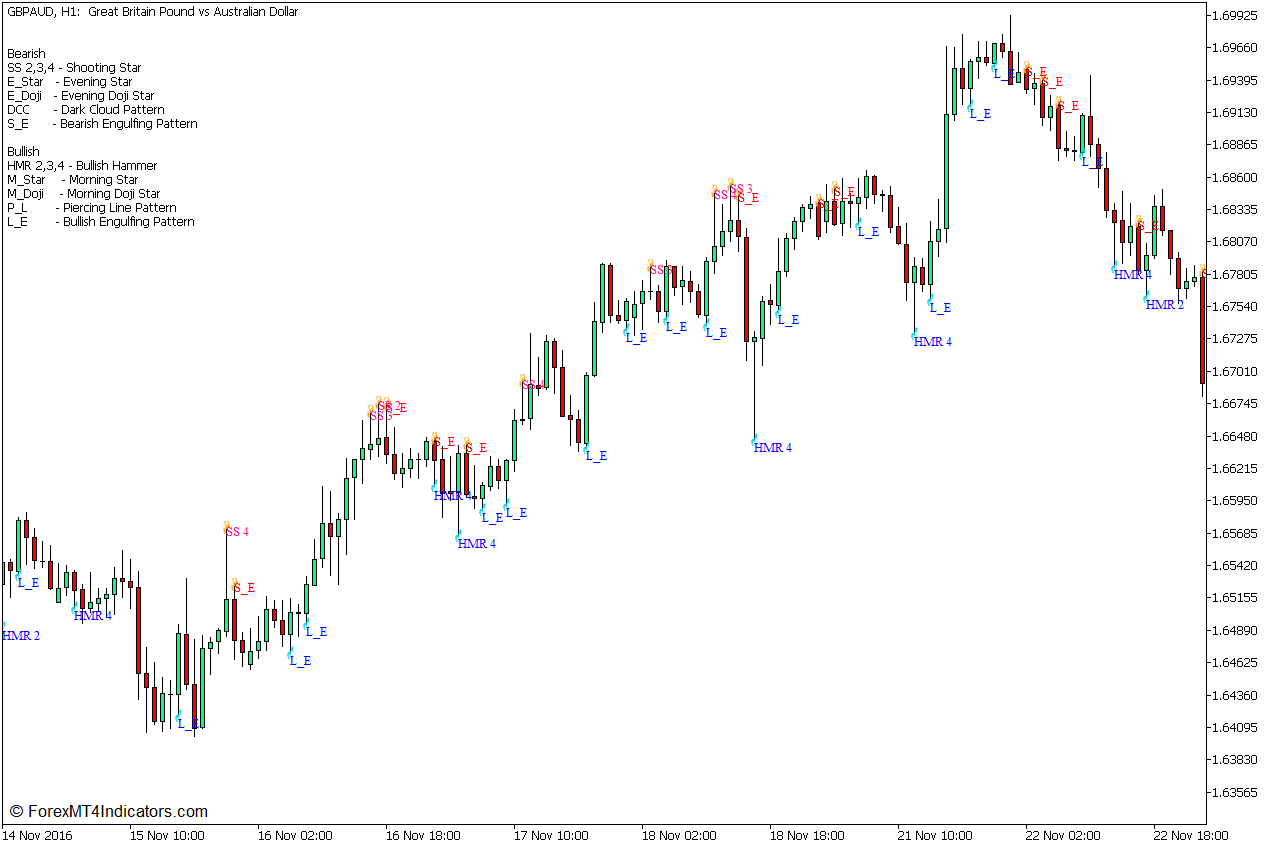

Advanced Technical Analysis Strategies

Professional forex traders use advanced technical analysis to get ahead. They look at chart patterns, trading indicators, and price action. This helps them make smart choices.

Chart Pattern Recognition

Spotting complex chart patterns is key to predicting market moves. Traders search for patterns like head and shoulders and double tops. These help guess when prices might change.

Indicator Combinations

Using many indicators together gives clearer signals. For example, moving averages with the Relative Strength Index (RSI) show trend strength and possible reversals.

Price Action Trading Methods

Price action trading looks at raw price movements. Traders study support and resistance levels, pivot points, and order flow. This way, they make decisions without relying on indicators too much.

| Strategy | Key Components | Application |

|---|---|---|

| Chart Patterns | Head and Shoulders, Double Tops/Bottoms | Trend Reversal Prediction |

| Indicator Combinations | Moving Averages, RSI, MACD | Trend Confirmation, Overbought/Oversold Conditions |

| Price Action | Support/Resistance, Pivot Points | Entry/Exit Points, Stop Loss Placement |

Many trading schools teach these advanced strategies. For example, Online Trading Academy has helped over 85,000 students. Their Core Strategy course, priced at $5,000 for part one, dives deep into these techniques.

Regulatory Compliance and Certification

Forex regulations shape the world of currency trading. Traders must follow many rules to meet local and international standards. The global nature of the forex market means traders need to know about different rules and bodies.

Getting certified as a trader is now key. It makes traders more credible and opens up new chances. Many places offer special courses for these certifications. For instance, some programs give 9 CERP (Certified Enterprise Risk Professional) credits from the American Bankers Association.

For forex pros, following the rules is very important. Courses focus on this, giving 2 CRCM (Certified Regulatory Compliance Manager) credits. These show a trader’s dedication to fair play and following regulations in the forex world.

| Certification Details | Value |

|---|---|

| CERP Credits | 9 |

| CRCM Credits | 2 |

| CPDs Awarded | 10 |

| Course Duration | 10 hours |

| Passing Grade | 80% |

Forex education programs are tough. They have exams with 56 questions, needing an 80% score to pass. This makes sure certified traders know the rules and best ways to trade.

Trading Psychology and Risk Management

Mastering trading psychology and risk management is key for forex traders. These skills can turn success into failure in the volatile currency markets.

Emotional Control in Trading

Emotional intelligence is vital for success. Traders who control their emotions make better choices. Mark Douglas says accepting risks builds mental strength.

Position Sizing Techniques

Effective position sizing is essential for risk management. Using stop-loss orders limits losses and keeps capital safe. Traders should use leverage wisely to balance gains and losses.

Portfolio Management Strategies

Diversifying across asset classes makes portfolios stable and reduces risk. Making decisions based on thorough market analysis is critical. Traders who accept market unpredictability make better, detached decisions.

| Cognitive Bias | Description | Mitigation Strategy |

|---|---|---|

| Confirmation Bias | Favoring information that confirms existing beliefs | Seek contrarian viewpoints |

| Illusion of Control | Overestimating control over market outcomes | Recognize market unpredictability |

| Loss Aversion | Strong preference for avoiding losses | Implement strict stop-loss rules |

| Overconfidence | Overestimating abilities and knowledge | Regular self-assessment and learning |

By tackling these psychological issues and using good risk management, traders can do better in the forex market.

Market Analysis and Research Methods

Forex market analysis is key for traders. It covers three main areas: fundamental, technical, and weekend analysis. Each area gives different views on market trends and trading chances.

Fundamental analysis looks at economic signs like interest rates and GDP. For example, traders watch Eurozone interest rates when analyzing the EUR/USD pair. Technical analysis, though, uses past price movements to guess future trends.

Weekend analysis helps set up trading plans. It lets traders see the market’s big picture when it’s closed. Many use this time to study Fibonacci retracement levels. These levels show support and resistance to currency moves.

Traders use different research methods. Some use automated systems for trades. Others mix technical and fundamental analysis for a full view. The choice depends on the trader’s time frame and data access.

| Analysis Type | Key Focus | Typical Users |

|---|---|---|

| Fundamental | Economic indicators | Long-term traders |

| Technical | Price patterns | Short-term traders |

| Weekend | Market Overview | All traders |

Professional traders use strategies with a proven edge. These include momentum, mean-reversion, and trend-following. Each needs thorough backtesting and updates to keep working in the fast-changing forex market.

Conclusion

Professional forex education is key to success in the world’s biggest financial market. The forex market trades over $7 trillion daily. It offers big chances and big challenges.

Learning never stops in this fast-changing world. Traders need to know about leverage, which can be up to 50:1. This means big rewards and big risks.

Forex trades 24/5, so traders need a strong education. They must understand margin, liquidity, and volatility. FX Academy helps traders learn at their speed.

This is important because traders face big institutions alone. They need to learn fast and well.

Good forex education teaches more than just theory. It helps traders develop good habits and plans. It teaches them how to manage risks well.

These skills are essential in a market with big price swings. With professional education, traders make better choices. They become more confident and accurate, leading to success.

Recent Posts

Categories

Related Articles

China inflation data: February CPI comes in at -0.7% y/y (expected -0.5%)

China inflation data for February 2025:Consumer Price Index -0.7% y/y, falling back...

ByglobalreutersMarch 9, 2025China Producer Price Index (YoY) registered at -2.2%, below expectations (-2.1%) in February

China Producer Price Index (YoY) registered at -2.2%, below expectations (-2.1%) in...

ByglobalreutersMarch 9, 2025China Consumer Price Index (YoY) below forecasts (-0.5%) in February: Actual (-0.7%)

China Consumer Price Index (YoY) below forecasts (-0.5%) in February: Actual (-0.7%)

ByglobalreutersMarch 9, 2025China Consumer Price Index (MoM) registered at -0.2%, below expectations (-0.1%) in February

China Consumer Price Index (MoM) registered at -0.2%, below expectations (-0.1%) in...

ByglobalreutersMarch 9, 2025

Leave a comment