- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Gemini Crypto Exchange Expands To France Following VASP License Approval

US-based cryptocurrency exchange, Gemini has officially launched operations in France after securing a Virtual Asset Service Provider (VASP) registration earlier this year.

Founded by the Winklevoss twins, Gemini’s expansion coincides with the European Union’s comprehensive Markets in Crypto-Assets (MiCA) regulatory framework, set to take full effect later this year

Gemini crypto exchange expands into France after being granted VASP license https://t.co/QYr1hMfBGl

— The Block (Meet Us at Emergence) (@TheBlock__) November 19, 2024

The expansion aligns with France’s supportive regulatory environment and increasing adoption of digital assets, striving to be hub for crypto innovation.

France As Strategic Market For Gemini

France ranks among the most pro-crypto nations in Gemini’s 2024 Global State of Crypto report. The entry into the French market highlights the country’s growing prominence in the global cryptocurrency landscape.

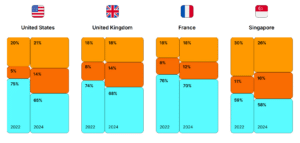

The report indicates a 2% increase in crypto ownership in France since 2022, with 18% of the population now holding digital assets—making it one of the fastest-growing markets post-crypto winter.

The European boss of @Gemini details their arrival in France in @TheBigWhale_

“We believe that achieving a leading position in the French market is achievable within 12 to 18 months”

Free access article

https://t.co/TcZTscdOp8

— Grégory Raymond

(@gregory_raymond) November 19, 2024

By capitalizing on this momentum, Gemini aims to bridge the gap between institutional-grade crypto solutions and retail adoption in France.

Emphasizing on the significance of the launch Gillian Lynch, Gemini’s CEO for U.K. and Europe said “Our research into the French market shows Gemini’s growing interest in digital assets.

Further adding, “Along with a robust regulatory framework, the expansion presents a unique opportunity to introduce our platform to the trading community and extend our presence in the European market over the coming months.”

EXPLORE: France To Block Access To Polymarket After Surge In Crypto Betting On US Election

Leveraging MiCA And Local Market Trends

With the implementation of the EU’s MiCA regulations in the near future, the launch in France could well be strategically timed as MiCA aims to streamline operations for crypto firms across the 27-nation trading bloc.

Once fully implemented, MiCA will allow companies approved in one member state to operate across the EU, reducing regulatory hurdles and fostering cross-border innovation.

The exchange will offer local users access to over 70 digital assets with payment options including Euros, British pounds, Debit cards and Apple Pay.

The proactive regulatory stance of France, coupled with the wider MiCA framework, has reduced the percentage of French crypto users citing regulatory concerns—from 37% at the height of the bear market two years ago to 32% today.

This decline reflects the growing trust in crypto’s legitimacy within the country, paving the way for further adoption and innovation.

It is significant to note that 62% of respondents from France consider cryptocurrency to be a long-term investment, and 46% reported acquiring their initial cryptocurrency within the last three to five years.

Furthermore, 49% of individuals who have previously owned cryptocurrency indicated that they are likely to re-enter the market in the coming year, while 28% expressed their intention to allocate 5% of their investment portfolios to cryptocurrency.

Building Robust Crypto Ecosystem In France

France’s supportive environment for crypto firms is not only attracting companies like Gemini but is also fostering the development of a robust ecosystem.

The country is home to a quite a few influential crypto projects including Ledger, a leading hardware wallet manufacturer and DeFi platform Morpho.

By aligning its operations with local regulatory standards and consumer preferences, the exchange is set to play a pivotal role in shaping the future of digital assets in the region.

“We believe in empowering individuals through crypto, and our expansion into France marks a significant milestone in our mission to make crypto accessible to everyone,” Gillian Lynch highlighted.

As France continues to lead in crypto adoption and regulatory clarity, Gemini’s expansion can be seen as a benchmark for other firms looking to tap into the European market.

The post Gemini Crypto Exchange Expands To France Following VASP License Approval appeared first on .

Recent Posts

Categories

Related Articles

Franklin Templeton Files for Solana ETF With Staking—Is SOL Set for Institutional Adoption?

Franklin Templeton has filed for a Solana ETF, aiming to track SOL’s...

ByglobalreutersFebruary 22, 2025Can we escape DeFi’s Ouroboros? Bridging real-yield in 2025

The following is a guest article from Mike Wasyl, CEO at Bracket....

ByglobalreutersFebruary 22, 2025Microsoft’s New Chip Could Speed Up Bitcoin’s Quantum-Resistance Timeline

Microsoft’s latest quantum computing chip, Majorana 1, might accelerate the need to...

ByglobalreutersFebruary 22, 2025Bitcoin Surges Past $99,000 Following Dovish Remarks From Atlanta Fed President Bostic

After spending more than two weeks trading in the mid-$90,000 range, Bitcoin...

ByglobalreutersFebruary 22, 2025

(@gregory_raymond)

(@gregory_raymond)

Leave a comment