- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Generative AI In Internal Audit: A Complete Guide For 2025

Revolutionizing Audit Processes with AI: Key Insights and Strategies for 2025

As we move into 2025, generative AI is rapidly transforming the landscape of internal auditing, offering new opportunities for efficiency, accuracy, and enhanced decision-making. By leveraging advanced AI technologies, internal audit teams can streamline processes, automate routine tasks, and uncover valuable insights from vast data sets. This guide explores the key ways generative AI is reshaping internal audits, from improving risk management and compliance to enhancing fraud detection and reporting. With AI’s ability to generate real-time data analysis, auditors can make more informed decisions faster, reducing human error and increasing the effectiveness of audits.

However, the integration of AI comes with challenges such as data privacy concerns, the need for skilled professionals, and the evolving regulatory landscape. In this guide, we’ll break down the practical applications, tools, and best practices for implementing generative AI in internal audits, ensuring organizations stay ahead of the curve in a rapidly changing environment. Whether you’re a seasoned auditor or new to the field, this resource will provide the essential knowledge for embracing AI’s transformative potential.

Table of Content

Understanding Generative AI

What is Generative AI In Internal Audit?

Growth and Market Dynamics of GenAI in Auditing

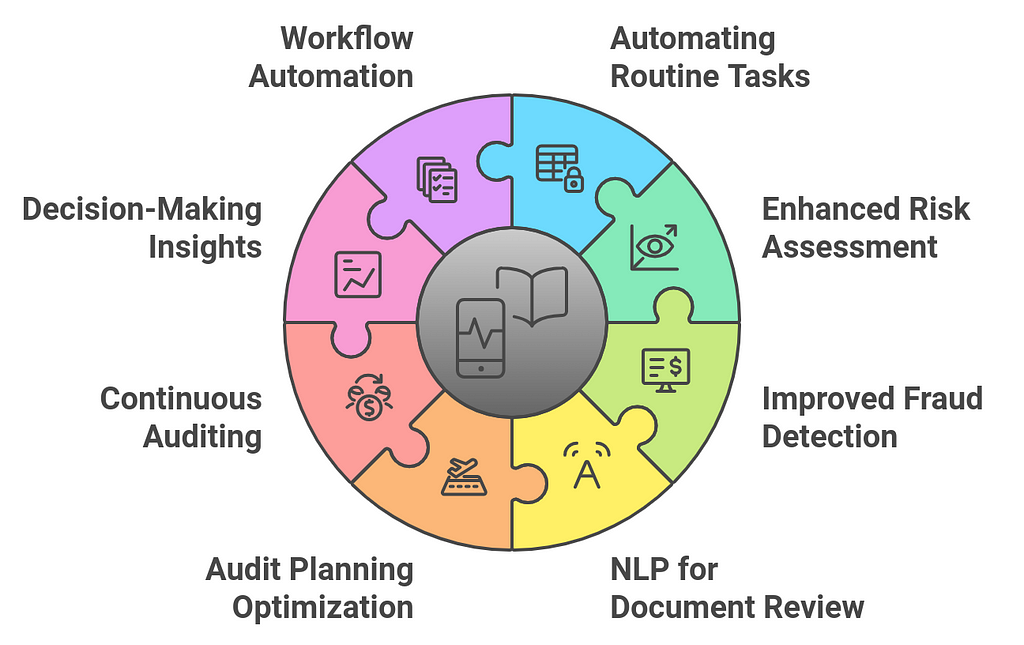

How Generative AI is Transforming Internal Audit?

Benefits of Integrating Generative AI in Internal Audit

Generative AI Use Cases for Internal Audits

Challenges of Implementing Generative AI in Internal Audit

The Future of Internal Audit in 2025 and Beyond

Conclusion

Understanding Generative AI

Generative AI refers to a class of artificial intelligence models designed to generate new, original content based on input data. Unlike traditional AI, which relies on predefined rules or patterns, generative AI can create text, images, audio, and even video, mimicking human creativity. It works by learning from vast amounts of existing data to understand the underlying patterns and relationships, which it then uses to generate new outputs that are contextually relevant and coherent. Popular examples include language models like GPT, image generators like DALL·E, and deep learning-based music composition tools. In various industries, generative AI is being leveraged for content creation, problem-solving, design innovation, and process automation. Its ability to generate novel ideas and solutions makes it a powerful tool for businesses, researchers, and creative professionals alike.

What is Generative AI In Internal Audit?

Generative AI in internal audit refers to the application of advanced AI technologies that enable auditors to automate, enhance, and streamline various aspects of the auditing process. By leveraging machine learning algorithms, generative AI can analyze large volumes of data, generate insights, and even predict potential risks or irregularities, improving the accuracy and efficiency of audits. It helps auditors move beyond traditional methods of sample testing and manual analysis, enabling real-time, data-driven decision-making.

For instance, AI can generate financial reports, identify discrepancies, and detect patterns indicative of fraud or non-compliance. It can also automate repetitive tasks such as data entry, reducing human error and allowing auditors to focus on higher-level tasks like strategic risk assessment and policy improvement. Additionally, generative AI aids in continuous auditing by providing ongoing insights into operational performance, compliance, and internal controls.

While the adoption of AI in auditing requires addressing challenges like data privacy, regulatory compliance, and AI training, it holds significant promise for transforming the internal audit function, making it more proactive, effective, and agile in responding to emerging risks.

Growth and Market Dynamics of GenAI in Auditing

The growth and market dynamics of generative AI (GenAI) in auditing are being driven by the increasing demand for automation, efficiency, and data-driven insights in financial and operational auditing. As businesses face mounting pressure to enhance transparency, reduce costs, and comply with complex regulations, AI technologies are playing a pivotal role in transforming audit functions. GenAI offers capabilities like real-time data analysis, anomaly detection, and the generation of predictive insights, which significantly improve audit accuracy and decision-making.

The market for GenAI in auditing is expanding as more firms recognize its potential to automate routine tasks, uncover hidden risks, and enhance compliance monitoring. With the rise of cloud computing and AI-as-a-Service models, the accessibility of these technologies has further accelerated adoption, even among smaller organizations. Moreover, the increasing focus on continuous auditing, fraud detection, and risk management is pushing the market forward. As AI adoption matures, businesses will continue to refine and integrate these technologies to create more effective, scalable, and resilient audit processes.

How Generative AI is Transforming Internal Audit?

Generative AI is revolutionizing internal audit functions by enhancing efficiency, accuracy, and the overall quality of audits. Traditional internal auditing often involves manually reviewing vast amounts of data, conducting interviews, and performing checks across various systems and documents, which can be time-consuming and prone to human error. Generative AI, with its ability to process and analyze massive datasets, provides significant improvements in this space. Here’s how generative AI is transforming internal audit:

1. Automating Routine Tasks

- Data Analysis and Reporting: Generative AI can automate the process of analyzing large volumes of financial and operational data, reducing the time auditors spend on data gathering and review. For instance, AI can quickly scan through financial transactions, tax records, compliance reports, and other documents to identify anomalies or inconsistencies.

- Example: AI tools can be used to automatically generate audit reports based on pre-set parameters, thus reducing the time auditors spend on manual documentation.

2. Enhanced Risk Assessment

- Predictive Analytics: Generative AI can analyze historical audit data and business trends to help predict areas of potential risk. By detecting patterns or trends in past audit findings, AI can proactively identify high-risk areas that require more intensive scrutiny.

- Example: An AI system might flag potential fraud or compliance issues by recognizing deviations from usual transaction patterns, helping auditors to focus on areas that pose the highest risk to the business.

3. Improved Fraud Detection

- Anomaly Detection: AI can identify unusual patterns in transactions or financial records that human auditors might miss. It can cross-reference data from multiple sources to spot discrepancies, such as fraudulent transactions, duplicate payments, or unauthorized activities.

- Example: Generative AI models can scan financial transactions in real-time, highlighting anomalies or patterns indicative of fraud (e.g., large payments made at unusual times, or transactions occurring outside of normal operational behavior).

4. Natural Language Processing (NLP) for Document Review

- Contract and Policy Analysis: Internal auditors often need to review contracts, policy documents, and other textual materials to ensure compliance. Generative AI, especially with NLP capabilities, can read and interpret complex documents, flagging key clauses or areas that require attention.

- Example: AI can analyze contracts to ensure that terms and conditions are consistent with corporate policies or regulatory standards, making the review process faster and more accurate.

5. Audit Planning and Strategy Optimization

- Dynamic Audit Planning: Generative AI can help auditors design more effective and adaptive audit plans by analyzing the organization’s risk profile, historical data, and regulatory changes. AI can suggest areas to focus on, ensuring that resources are allocated efficiently and audit objectives are met.

- Example: AI tools can automatically recommend which departments, systems, or processes should be prioritized during an audit based on historical risk factors and trends.

6. Continuous Auditing and Monitoring

- Real-Time Auditing: Generative AI allows for continuous auditing, where AI systems monitor transactions and activities in real-time, rather than waiting for periodic audits. This enables businesses to detect issues more quickly and take corrective actions promptly.

- Example: AI systems integrated into financial systems can continuously track spending and flag transactions that deviate from the expected norms, enabling auditors to intervene immediately when potential issues are identified.

7. Enhanced Decision-Making and Insights

- Advanced Reporting and Dashboards: Generative AI can generate in-depth reports and interactive dashboards that provide auditors with actionable insights. These tools can visualize complex data in an easy-to-understand manner, helping auditors identify trends, risks, and performance gaps more effectively.

- Example: AI-powered dashboards can summarize audit findings, highlight emerging risks, and suggest next steps, aiding auditors in decision-making and reporting to stakeholders.

8. AI-Assisted Workflow Automation

- Task Management: AI can automate administrative tasks related to audit management, such as scheduling meetings, sending reminders, tracking progress, and managing documentation. This improves overall productivity and reduces manual coordination efforts.

- Example: AI-driven workflow tools can automatically track the progress of audits, assign tasks to team members, and ensure that deadlines are met without manual oversight.

9. Enhanced Data Integrity and Consistency

- Data Reconciliation: Generative AI can assist with data reconciliation by comparing financial records from different systems and highlighting inconsistencies. This ensures that discrepancies are identified early, improving the reliability and consistency of audit results.

- Example: AI can automatically compare bank statements with internal transaction records to detect discrepancies or errors that might suggest accounting issues or fraud.

10. Training and Knowledge Management

- AI-Driven Training: Generative AI can help in training auditors by generating real-world scenarios, creating simulations, and providing feedback based on audit experiences. AI-powered training tools can adapt to an individual’s learning style and pace.

- Example: AI can generate simulated audit cases for training auditors, helping them to better understand complex audit scenarios, regulatory requirements, and risk assessment techniques.

11. Improved Collaboration and Communication

- Collaboration Tools: AI-powered collaboration platforms can streamline communication between internal audit teams, departments, and external auditors, ensuring that all stakeholders are aligned and informed throughout the audit process.

- Example: AI tools can summarize key findings from meetings, track action items, and automatically update audit documentation, making collaboration between team members more efficient.

Generative AI is significantly transforming the field of internal auditing by automating data analysis, improving risk detection, and enhancing audit efficiency. Its ability to handle large datasets, identify patterns, and provide real-time insights is making audits more accurate, faster, and cost-effective. As AI technology continues to evolve, internal auditors will have even more powerful tools at their disposal to ensure thorough, proactive audits that can help organizations mitigate risks, stay compliant, and optimize performance.

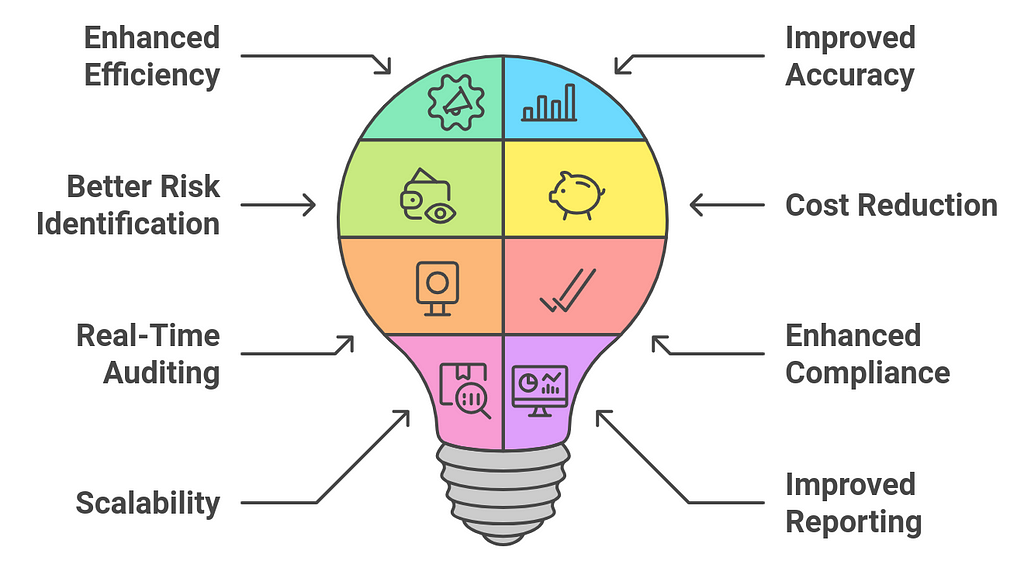

Benefits of Integrating Generative AI in Internal Audit

Integrating Generative AI into the internal audit process provides several key benefits, transforming traditional audit practices and enabling organizations to achieve greater efficiency, accuracy, and scalability. Below are the main benefits of incorporating Generative AI into internal auditing:

1. Enhanced Efficiency

- Automation of Repetitive Tasks: Generative AI can automate routine audit tasks such as data collection, reconciliation, and report generation. This reduces the manual effort involved in these processes, allowing auditors to focus on more strategic activities like risk assessment and decision-making.

- Faster Audits: AI’s ability to analyze large datasets in a fraction of the time it would take a human auditor accelerates the audit process. For example, AI can quickly process and analyze financial transactions, internal controls, and compliance documents.

2. Improved Accuracy and Consistency

- Data Accuracy: AI systems can analyze large volumes of data without human error, improving the accuracy of audit findings. By using advanced algorithms, AI can detect discrepancies, fraud, and other anomalies that might be overlooked during manual audits.

- Consistency Across Audits: AI ensures that the same standards and procedures are applied uniformly across multiple audits. This helps maintain consistency in findings and reporting, reducing the risk of oversight or bias.

3. Better Risk Identification and Mitigation

- Proactive Risk Assessment: Generative AI can analyze historical data and trends to predict potential risks, allowing auditors to identify areas of concern before they become major issues. AI can continuously monitor financial activities and flag emerging risks in real-time, making audits more proactive.

- Fraud Detection: AI’s ability to detect anomalies is crucial in identifying potential fraud. By recognizing patterns of fraudulent behavior, AI can alert auditors to suspicious transactions, even those that might not be obvious to human auditors.

4. Cost Reduction

- Lower Operational Costs: By automating manual processes, AI can significantly reduce the time and effort required for internal audits, ultimately lowering operational costs. This is particularly valuable for businesses with complex or large-scale audit requirements.

- Efficient Resource Allocation: Generative AI helps auditors prioritize high-risk areas, ensuring that resources are allocated effectively and that audits focus on the most critical aspects of an organization’s operations.

5. Real-Time Auditing and Continuous Monitoring

- Real-Time Insights: Generative AI enables continuous auditing by monitoring transactions and activities in real time, rather than relying on periodic audits. This provides organizations with up-to-date insights into their financial health and compliance status, enabling quicker corrective action when issues arise.

- 24/7 Monitoring: AI systems can be set to monitor financial activities and business operations around the clock, ensuring that potential issues are flagged as soon as they occur, rather than during the next scheduled audit.

6. Enhanced Compliance and Regulatory Adherence

- Automated Compliance Checks: Generative AI can automatically check compliance with regulatory standards, policies, and internal controls. By comparing audit data against compliance guidelines, AI can help ensure that businesses are consistently adhering to laws and industry regulations.

- Real-Time Alerts: AI can alert auditors and compliance officers to potential regulatory violations in real time, reducing the likelihood of non-compliance and associated fines or penalties.

7. Scalability and Flexibility

- Handling Large Volumes of Data: AI can easily handle vast amounts of data from multiple departments, systems, and business units, making it ideal for auditing large organizations or enterprises with complex financial structures.

- Adapting to Changing Needs: As business environments evolve, AI can be retrained to adjust to new types of data, risks, and audit requirements. This adaptability makes it easier for businesses to scale their auditing processes to meet changing regulatory or operational demands.

8. Improved Reporting and Data Visualization

- Automatic Report Generation: AI can automatically generate audit reports based on the analysis of transaction data, financial records, and compliance status. This reduces the time auditors spend on documentation and allows them to focus on interpreting findings and advising management.

- Data Visualization: Generative AI tools can create intuitive dashboards and visualizations that help auditors better understand trends, anomalies, and areas of concern. These visual insights make it easier for stakeholders to grasp audit results and make informed decisions.

9. Enhanced Decision-Making and Strategic Insights

- Actionable Insights: By analyzing large volumes of data and identifying patterns, AI provides auditors with actionable insights that can guide strategic decision-making. Auditors can quickly identify inefficiencies, cost-saving opportunities, and areas for improvement in business operations.

- Scenario Analysis: Generative AI can simulate different scenarios based on historical data, helping auditors assess the potential impact of various business decisions and recommend the best course of action to minimize risk.

10. AI-Powered Knowledge Management and Training

- Continuous Learning: AI systems can continuously learn from past audit data, improving their ability to detect anomalies, patterns, and risks over time. This knowledge can be applied to future audits to enhance their effectiveness.

- Training and Skill Enhancement: AI tools can be used to simulate real-world audit scenarios for training purposes. Auditors can learn and practice auditing techniques through AI-generated simulations, improving their skills and expertise without the need for extensive hands-on experience.

11. Greater Transparency and Audit Trails

- Audit Trail Integrity: AI can maintain a transparent and immutable audit trail by automatically recording every step of the audit process. This ensures that the audit process is well-documented and can be reviewed if necessary for compliance or investigative purposes.

- Reducing Bias: By relying on algorithms rather than human judgment, AI helps reduce biases in the audit process, ensuring that findings are based on objective data rather than subjective opinions.

12. Customization and Adaptation

- Tailored Audit Processes: Generative AI can be customized to fit the specific needs and risk profiles of different organizations or industries. It can adapt to various auditing standards, internal policies, and regulatory frameworks, providing a tailored approach to auditing.

- Continuous Improvement: As AI tools are exposed to more audit data, they can evolve and improve over time, becoming more accurate and insightful with each iteration.

Integrating Generative AI into internal audit functions offers significant advantages, including improved efficiency, accuracy, and the ability to proactively identify risks. By automating routine tasks, enhancing fraud detection, ensuring compliance, and providing real-time insights, AI is transforming how audits are conducted. This allows auditors to focus more on strategic decision-making and value-added activities, ultimately improving the effectiveness of the internal audit process and reducing operational costs. AI is not only enhancing traditional auditing but is setting the stage for more adaptive, scalable, and data-driven audit practices in the future.

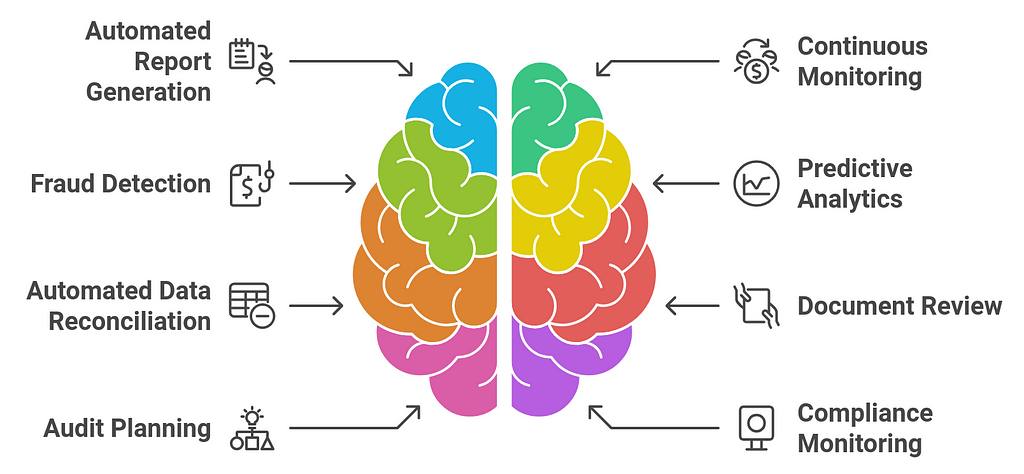

Generative AI Use Cases for Internal Audits

Generative AI offers a wide range of use cases that can significantly enhance the effectiveness and efficiency of internal audits. By automating repetitive tasks, providing insights through predictive analytics, and enabling real-time monitoring, generative AI is transforming how internal auditors operate. Below are several key use cases for generative AI in internal audits:

1. Automated Report Generation

- Use Case: Generative AI can automate the process of generating audit reports by analyzing financial transactions, compliance data, and audit findings. AI can pull relevant data from various sources and automatically create reports that highlight key findings, risks, and compliance status.

- Benefit: This automation reduces the time auditors spend on manual documentation and allows them to focus on interpreting results and providing strategic advice to management.

- Example: AI can generate daily or weekly audit summaries for management, highlighting key risks or changes in compliance status.

2. Continuous Monitoring and Real-Time Auditing

- Use Case: AI tools can continuously monitor financial transactions, business processes, and internal controls to detect anomalies, fraud, or compliance breaches in real time. AI algorithms can track data from multiple systems simultaneously, identifying issues as soon as they arise.

- Benefit: Continuous monitoring provides real-time alerts, reducing the time between detecting an issue and taking corrective action, which improves the overall agility and effectiveness of the audit process.

- Example: AI systems can flag irregular transactions in real time, such as unexpected payments or unusual cash flow patterns, allowing auditors to investigate before problems escalate.

3. Fraud Detection and Risk Mitigation

- Use Case: Generative AI can be used to detect patterns of fraud or financial discrepancies by analyzing historical transaction data. AI models can be trained to recognize the signs of fraudulent activity, such as duplicate payments, misappropriations of funds, or unusual transactions.

- Benefit: By proactively identifying potential fraud or operational risks, AI helps internal auditors focus on high-risk areas and minimize the impact of fraudulent activities.

- Example: AI can detect hidden relationships between transactions or unusual spending patterns that may indicate fraud, alerting auditors to investigate further.

4. Predictive Analytics for Risk Assessment

- Use Case: Generative AI can analyze historical audit data to forecast potential future risks. By identifying trends and patterns, AI can predict areas that may require more intense scrutiny during audits, allowing auditors to allocate resources more effectively.

- Benefit: Predictive analytics helps internal auditors anticipate risks before they occur, improving the proactive management of audits and reducing the likelihood of issues going unnoticed.

- Example: AI could predict the likelihood of financial misstatements or regulatory compliance failures based on past audit data and emerging trends, enabling auditors to take preventive action.

5. Automated Data Reconciliation

- Use Case: AI-powered tools can automatically reconcile financial data from multiple sources, such as bank statements, general ledgers, and invoices. By matching transactions across different systems, AI ensures that discrepancies are identified and resolved faster.

- Benefit: Automating data reconciliation reduces the potential for human error and speeds up the audit process, enabling auditors to focus on higher-value tasks.

- Example: AI can automatically compare accounts payable and accounts receivable data across different financial systems and flag discrepancies for auditors to investigate.

6. Document Review and Contract Analysis

- Use Case: Generative AI, particularly Natural Language Processing (NLP), can be used to review contracts, legal documents, and other textual data to ensure compliance with internal policies, regulatory standards, or financial agreements. AI can scan large volumes of text and identify key clauses, risks, and non-compliance issues.

- Benefit: This reduces the time auditors spend manually reading and interpreting documents and increases the accuracy of contract reviews.

- Example: AI could automatically flag clauses in supplier contracts that do not comply with the company’s procurement policies, alerting auditors to potential compliance issues.

7. Audit Planning and Resource Allocation

- Use Case: AI can assist in the creation of audit plans by analyzing historical data, current risk factors, and business operations. AI can recommend areas for deeper investigation and determine the necessary resources for different audit activities.

- Benefit: This helps internal audit teams create more targeted and efficient audit plans, ensuring that resources are focused on the highest-risk areas.

- Example: AI could suggest focusing on a specific business unit or operational area based on changes in transaction volumes or financial behavior, helping auditors prioritize their efforts.

8. Continuous Compliance Monitoring

- Use Case: AI can monitor an organization’s operations for ongoing compliance with regulations, standards, and internal policies. It can track financial transactions, contracts, and communications to ensure adherence to regulatory requirements such as GDPR, SOX, or FCPA.

- Benefit: Continuous compliance monitoring helps organizations stay ahead of regulatory changes and minimize the risk of non-compliance, reducing fines and reputational damage.

- Example: AI tools can be set up to automatically flag any transactions that do not meet compliance criteria, such as those that violate data protection rules or conflict-of-interest policies.

9. Advanced Data Visualization and Insights

- Use Case: Generative AI can provide advanced data visualization capabilities, transforming complex audit findings into easy-to-understand graphs, charts, and dashboards. These tools can help auditors and management quickly spot trends, anomalies, and areas requiring attention.

- Benefit: Enhanced data visualization enables more effective communication of audit results and facilitates decision-making by providing insights in an accessible format.

- Example: Interactive dashboards can display audit progress, risk levels, and findings across multiple departments, allowing auditors to quickly drill down into specific issues and prioritize their efforts.

10. Scenario Analysis and Stress Testing

- Use Case: AI can generate “what-if” scenarios and simulate the effects of various risk factors on an organization’s financial health. This allows internal auditors to assess how different risk scenarios, such as economic downturns, supply chain disruptions, or regulatory changes, could impact operations.

- Benefit: Scenario analysis helps auditors understand potential vulnerabilities in the business and develop strategies to mitigate those risks.

- Example: AI could model the impact of a significant drop in revenue on cash flow and liquidity, helping auditors assess the organization’s ability to withstand financial stress.

11. Enhancing Audit Quality with Machine Learning

- Use Case: Machine learning algorithms can be used to analyze audit data and identify any inconsistencies or errors in audit methodologies, improving the overall quality of audits. Over time, these models can “learn” from previous audits, becoming better at detecting outliers and improving audit precision.

- Benefit: Machine learning ensures that audits are more consistent and accurate, reducing human error and increasing trust in audit results.

- Example: An AI system could evaluate past audit decisions and suggest improvements in audit techniques or highlight areas where errors were common in earlier audits.

12. Enhancing Auditor Productivity and Workflow

- Use Case: Generative AI can optimize the workflow of internal audit teams by automating task management, scheduling, and collaboration. AI tools can help track deadlines, assign tasks, and provide real-time updates to keep audit teams on track.

- Benefit: By streamlining administrative tasks, AI frees auditors to focus on more critical aspects of the audit, boosting productivity.

- Example: AI-powered platforms can automatically schedule meetings, track progress on action items, and update audit documentation, making it easier for auditors to manage their workload.

Generative AI is revolutionizing the internal audit function by automating repetitive tasks, enhancing risk detection, improving compliance, and providing advanced insights. By leveraging AI, auditors can focus on strategic activities, such as advising management and providing deeper insights into operational efficiency and risk management. These advancements in AI and automation are likely to drive more efficient, accurate, and proactive internal audits, ensuring organizations can stay ahead of risks and continue to optimize performance.

Challenges of Implementing Generative AI in Internal Audit

Implementing generative AI in internal audit comes with several challenges that organizations must address to ensure successful adoption. One of the primary obstacles is data quality and accessibility AI models require large, accurate, and diverse datasets to function effectively. Poor or incomplete data can lead to inaccurate insights, undermining the audit process. Another significant challenge is ensuring compliance with data privacy and security regulations. As AI systems process sensitive financial and operational data, organizations must be vigilant in protecting this information from breaches or misuse.

Additionally, integrating AI tools with existing audit systems can be complex, requiring significant investment in technology, infrastructure, and training. Auditors need to develop new skills to interpret AI-driven insights and ensure that AI models remain transparent and explainable to meet regulatory and ethical standards. There’s also the challenge of overcoming resistance to change within audit teams, as traditional audit methods have long been relied upon. Finally, organizations must navigate the evolving legal and ethical frameworks surrounding AI usage, ensuring that the adoption of generative AI aligns with industry best practices and regulatory guidelines.

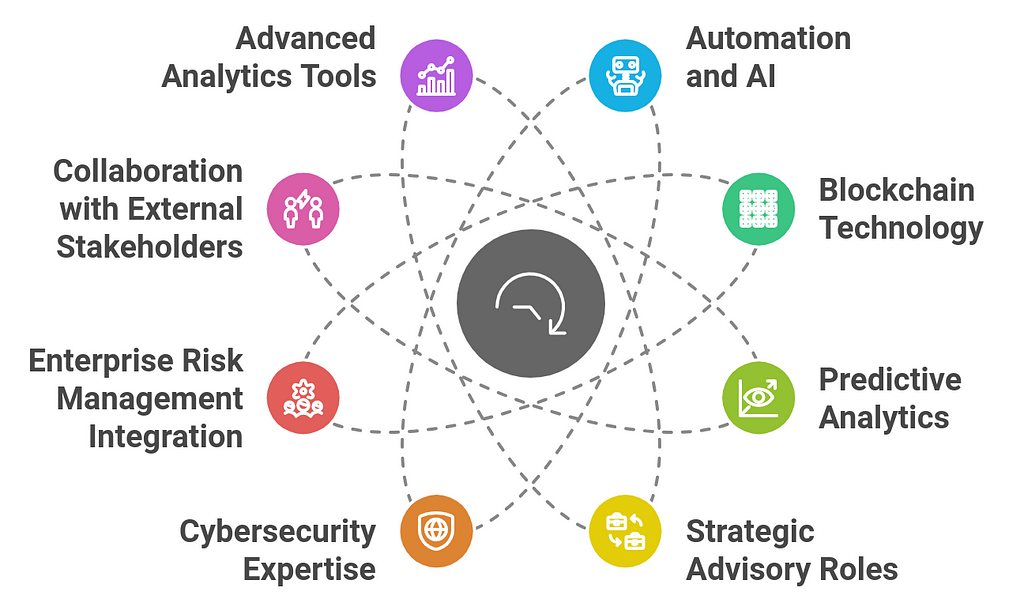

The Future of Internal Audit in 2025 and Beyond

The future of internal audit in 2025 and beyond will be shaped by advancements in technology, evolving regulatory landscapes, and the increasing need for businesses to manage complex risks and stay competitive. As organizations face greater challenges in terms of security, compliance, and operational efficiency, the role of internal auditors will evolve significantly. Here are key trends and transformations expected in the internal audit function over the next few years:

1. Increased Automation and AI Integration

- AI-Powered Audits: By 2025, internal audits will be largely automated, leveraging artificial intelligence (AI) and machine learning (ML) for continuous monitoring, data analysis, and risk assessment. AI tools will enable auditors to analyze vast amounts of data in real time, identify anomalies, and even predict potential risks based on historical trends.

- Automation of Routine Tasks: Auditors will spend less time on manual tasks such as data collection, reconciliation, and report generation. Automation will allow for real-time auditing, reducing reliance on periodic audit cycles.

- Example: Auditors will use AI tools to automatically generate audit reports, detect fraud, and monitor financial transactions continuously.

2. Expanded Use of Blockchain and Distributed Ledger Technology

- Enhanced Transparency and Security: Blockchain technology will play a larger role in enhancing transparency and traceability in financial transactions. Internal auditors will use distributed ledger technology to verify transactions, ensure the integrity of financial data, and reduce the risk of fraud.

- Smart Contracts: Auditors will increasingly use smart contracts to automatically trigger and verify actions based on predefined conditions. This will streamline compliance audits and make contract management more efficient.

- Example: Auditors will use blockchain to confirm the accuracy of inventory records or validate the transfer of assets in real time.

3. Data-Driven and Predictive Auditing

- Real-Time Data Analysis: The future of internal audit will rely heavily on big data analytics and predictive models. AI and advanced analytics will allow auditors to continuously monitor financial transactions, business processes, and operational risks. Predictive analytics will help anticipate emerging risks before they materialize.

- Risk Forecasting: Internal auditors will be able to proactively identify risks, including fraud, regulatory changes, and financial discrepancies, by analyzing data trends and historical patterns. This will allow auditors to take preemptive action rather than merely reacting to issues.

- Example: Predictive analytics can help auditors forecast financial misstatements or compliance risks based on transactional patterns and historical data.

4. Focus on Strategic Value and Advisory Roles

- Shifting from Compliance to Strategic Insight: As automation and AI handle more of the traditional audit functions, internal auditors will focus more on providing strategic insights to help organizations make informed decisions. They will move from a traditional compliance-focused role to becoming trusted advisors to management, contributing to decision-making and organizational strategy.

- Operational Efficiency and Risk Mitigation: Auditors will focus on helping businesses optimize operations, improve internal controls, and identify cost-saving opportunities while mitigating risks. They will increasingly work alongside business leaders to advise on performance improvement.

- Example: Internal auditors may be called upon to advise on the integration of new technologies, such as cloud computing or IoT, to ensure operational efficiency and security.

5. Cybersecurity and Data Privacy Expertise

- Cybersecurity as a Key Focus: As cyber threats become more sophisticated, internal auditors will play a critical role in ensuring that organizations’ cybersecurity protocols are up to date and that sensitive data is properly protected. Auditors will need to develop expertise in cybersecurity and data privacy laws to evaluate the effectiveness of security measures.

- Continuous Security Audits: With increasing reliance on digital platforms, auditors will use automated tools to conduct continuous cybersecurity assessments, identify vulnerabilities, and evaluate security frameworks in real time.

- Example: Auditors will review organizations’ data breach response protocols, cybersecurity defenses, and ensure compliance with data privacy regulations such as the GDPR.

6. Integration of Internal Audit with Enterprise Risk Management (ERM)

- Holistic Risk Management: The line between internal audit and enterprise risk management (ERM) will continue to blur. In 2025 and beyond, internal auditors will work more closely with risk management teams to address risks across the entire enterprise, from financial and operational to strategic and compliance-related risks.

- Risk-Based Auditing: Auditors will increasingly adopt a risk-based approach, where they focus on the most significant and highest-priority risks to the organization, based on a comprehensive understanding of business objectives and challenges.

- Example: Internal auditors may be involved in identifying and assessing risks related to new market expansion, supply chain disruptions, or reputational risks.

7. Collaboration with External Stakeholders

- Enhanced Collaboration with Third Parties: Internal audit functions will also extend their role in collaborating with external auditors, regulators, and stakeholders to provide a holistic view of organizational risk and compliance. This collaboration will help ensure that audits are aligned with industry standards and regulatory requirements.

- Third-Party Risk Management: As businesses rely more on third-party vendors and cloud-based services, internal auditors will assess the risks associated with these relationships, including vendor compliance, cybersecurity risks, and financial stability.

- Example: Auditors will assess the risk of outsourcing to third-party providers, particularly in areas like cloud computing, software as a service (SaaS), and supply chain management.

8. Use of Advanced Analytics and Visualization Tools

- Data Visualization: Auditors will increasingly use data visualization tools to present complex audit results in a more digestible and interactive format. This will enable stakeholders to quickly understand risks, audit findings, and areas of concern.

- Advanced Analytics: AI and machine learning will be used to detect hidden insights in large datasets, providing auditors with deeper insights into financial performance, operational efficiency, and risk exposure.

- Example: Interactive dashboards and visual tools will allow auditors and management to explore audit results dynamically, enabling more informed decision-making.

9. Increased Focus on Environmental, Social, and Governance (ESG) Auditing

- ESG Reporting and Compliance: Internal audit functions will take on a greater role in evaluating Environmental, Social, and Governance (ESG) risks and ensuring compliance with emerging ESG regulations. As organizations face increasing pressure from stakeholders to demonstrate sustainability and ethical practices, auditors will assess the effectiveness of ESG policies and reporting.

- Sustainability Audits: Internal auditors will be responsible for verifying the accuracy of ESG claims, assessing sustainability efforts, and ensuring that organizations are meeting their stated environmental and social objectives.

- Example: Auditors may assess the carbon footprint of business operations or evaluate supply chain practices to ensure compliance with sustainability standards.

10. Continuous Learning and Professional Development

- Upskilling Auditors: As technology and business environments evolve, internal auditors will need to continuously upgrade their skills to keep up with new tools, technologies, and regulatory changes. Organizations will invest in training auditors in areas like AI, cybersecurity, data analytics, and risk management.

- Multidisciplinary Teams: Internal audit teams will become more diverse, with expertise spanning multiple disciplines such as data science, cybersecurity, risk management, and business strategy.

- Example: Auditors will participate in training programs to learn about the latest advancements in AI, blockchain, and cybersecurity to remain effective in their roles.

By 2025 and beyond, internal audit functions will be transformed by advanced technologies, an increased focus on real-time monitoring, and a shift from compliance to strategic advisory roles. Auditors will play a critical role in helping organizations navigate complex risks, comply with regulations, and make data-driven decisions. The integration of AI, blockchain, predictive analytics, and other emerging technologies will make internal audits faster, more accurate, and more proactive, enabling businesses to stay ahead in an increasingly complex and fast-moving world.

Conclusion

In conclusion, generative AI is set to revolutionize internal audits in 2025, offering transformative solutions that improve efficiency, accuracy, and strategic decision-making. By automating repetitive tasks, enhancing data analysis, and uncovering insights from complex datasets, AI enables auditors to focus on higher-level decision-making and risk management. The ability to generate real-time, actionable data is a game-changer, allowing organizations to stay proactive in identifying and addressing potential issues.

However, successful AI adoption in internal audits requires careful consideration of challenges such as data security, regulatory compliance, and the need for skilled professionals who can manage and interpret AI-driven insights. As businesses embrace these advancements, they must also invest in training, ethical frameworks, and robust AI models to ensure the technology is used effectively and responsibly.

For auditors looking to stay competitive, understanding and integrating generative AI into audit processes will be crucial for staying ahead of industry trends. With the right tools and strategies in place, generative AI has the potential to reshape the internal audit function, creating more value for organizations in 2025 and beyond.

Generative AI In Internal Audit: A Complete Guide For 2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

Bitcoin or Ethereum?

Bitcoin or Ethereum: Which Crypto is the Better Investment in 2025?The Crypto...

ByglobalreutersFebruary 22, 2025From Vesting Plans to Binance Wallets: A Deep Dive into TRUMP Token’s Distribution

More than a month after Donald Trump, the 47th U.S. president, launched...

ByglobalreutersFebruary 21, 2025North Korea’s Lazarus Group now using crypto gifts to breach security defenses

The North Korean-linked Lazarus Group has adopted a new method of breaching...

ByglobalreutersFebruary 21, 2025Bybit crypto exchange hit by the largest theft of any kind, ever

It was a tough day in the market but that's nothing compared...

ByglobalreutersFebruary 21, 2025

Leave a comment