- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

GraphShift: Empowering Arbitrum Migration

Seamlessly Moving to Layer 2 with Long Awaited Transfer Tools 🔄

Available in other languages:

- 🇩🇪 Deutsch

The Graph’s transition to Arbitrum Layer 2 (L2) marks a strategic move towards addressing scalability and efficiency challenges. With The Graph Protocol gaining widespread adoption and witnessing an influx of data, the need for faster transaction processing and reduced costs has become paramount. This migration to Arbitrum L2 aligns with the Graph’s commitment to providing developers and users with seamless and cost-effective experiences, ultimately contributing to the continued growth and sustainability of decentralized applications and data indexing on a global scale. 💪🌐

The cost of operating on Ethereum L1 is unpredictable and can be hard to manage for indexers to remain profitable. Delegators, and even projects trying to deploy subgraphs, also have a difficult time managing ETH gas costs. The move to L2 helps everyone operate within the Graph Protocol for a fraction of the cost. With L2, indexers can focus more on which allocation is most attractive and beneficial for the protocol and delegators, instead of worrying about the ETH gas costs. This move also lowers the barrier to entry because smaller indexers can now turn a profit, with less overhead cost due to gas.

Feel free to read over our previous guide on the move to Arbitrum:

The Graph is moving to Arbitrum: the complete guide for Delegators

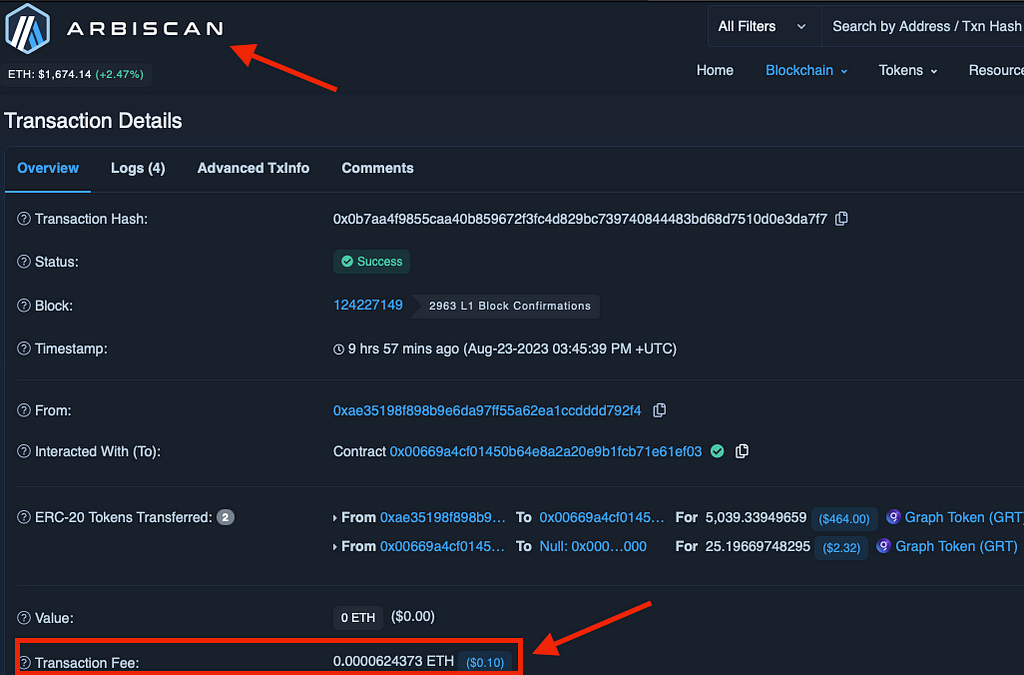

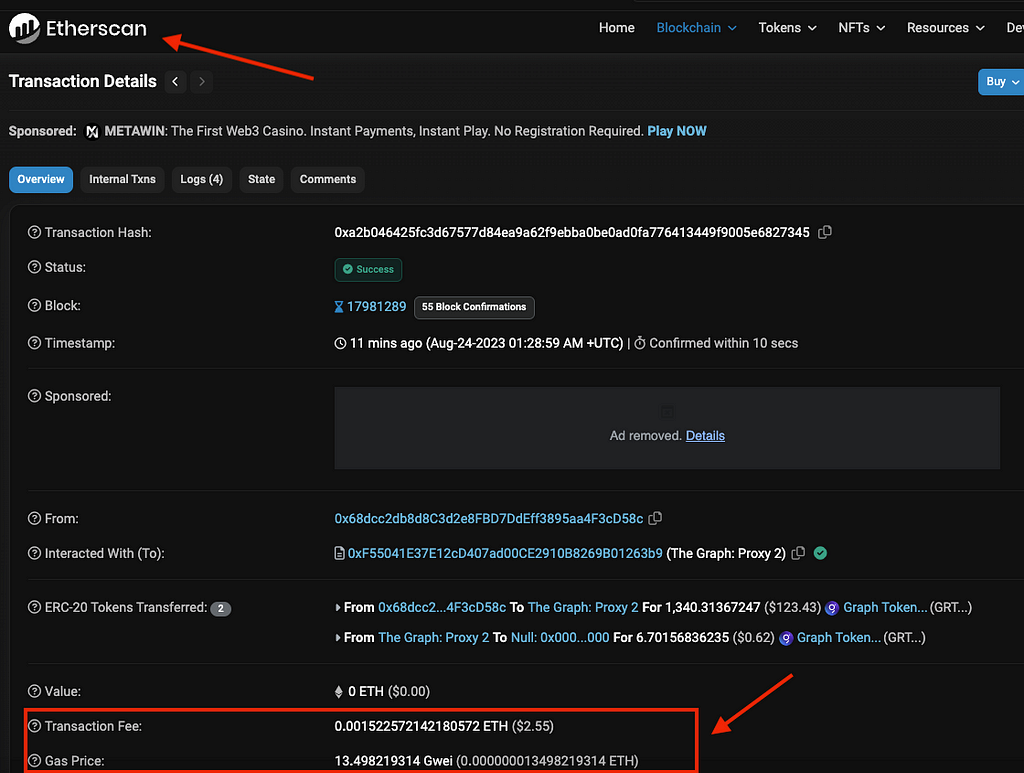

To give you an idea of how much cheaper the costs are on Arbitrum for delegation, check out the most recent delegation transaction hash found on Arbiscan.io HERE, which shows the cost was $0.10

For a point of comparison, a delegation on Ethereum with very low gas rate of 13 GWEI shows a cost of $2.55. Another transaction found cost $6.09 at 30 GWEI, so you can imagine how the costs raise exponentially when gas spikes to 100 GWEI or higher. There have been times where gas (due to a new project or NFT mint) has been high for weeks at a time. This could have prevented someone from delegating, or other transactions within the Graph due to costs.

Previously, a barrier to entry for delegation was the cost of ETH gas and the amount of time delegators had to wait in order to recoup those fees, as well as the tax of 0.05%, before becoming profitable. Due to the predictability, and costs that are fractions of what they once were, the time to recoup fees and gas is a negligible issue on L2. Depending on the size of your delegation, you should be able to recoup the tax fees relatively quick and start earning 8-15% APY. It will also be exciting to see if this could potentially increase earnings as a delegator, as indexers on L2 will only have to focus on the best allocations. Or perhaps some indexers will pass savings onto their delegators for a more competitive environment. Only time will tell. ⏰

So why can’t we just click a button and move everything over to L2?

The process is complicated and has many moving parts. A testament to this is the transition timeline was delayed from the initial expectation. The Graph wanted to ensure the process was as smooth as possible, especially for their customers using subgraphs. They wanted to ensure Decentralized applications — (also known as “dApps” or “dapps") did not have unexpected downtime where they were inoperable.

Introducing Transfer Tools 🔧

Transfer tools allow you to move your existing delegation over from ETH to Arbitrum with little to no interruption to your delegation. You do not have to undelegate, and you can even choose a new wallet that you have control over.

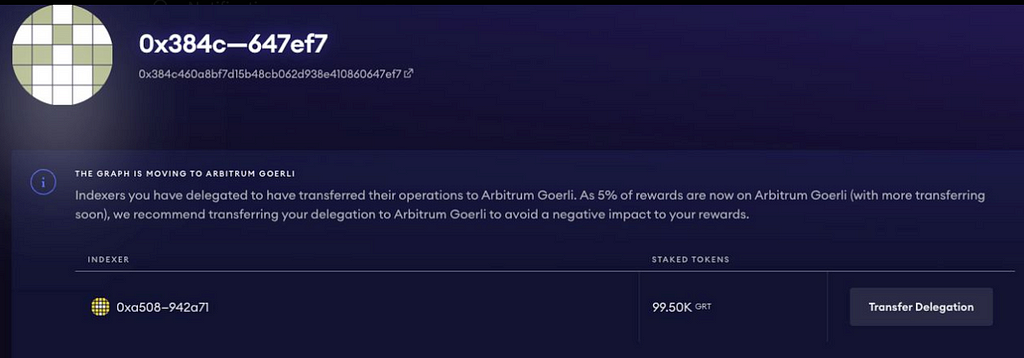

The indexers will first have to move some (or all) of their stake over to L2. Indexers must do 100k GRT at a time minimum. Once your indexer moves stake over to L2, you as a delegator will get a notification on Graph Explorer, as shown below:

The Graph has made several video tutorials on the process. Below are only just a few. There are also ones for those who have GRT on vested contracts, which can be found on their youtube channel here.

🚨Delegator Considerations Prior to Transfer of GRT 🤔

— You may want to check with your indexer to see if they have a big allocation, or many allocations, ready to close. This is when you as a delegator will get your rewards, so it could be advantageous to time your move accordingly.

— Contact your indexer if possible to see if/when they plan to move stake to L2, and if so how much, as well as their opinion of you migrating.

— Ensure your delegator has enough capacity to handle your additional delegation on Aribtrum. Many of the indexers are not moving their entire stake over so they can support both networks during the transition. If you have a larger delegation, you should definitely ensure you don’t cause your indexer to be over delegated on Arbitrum with your transfer.

— You must transfer all your delegation at a time. Cannot do half or a portion, then later do the rest.

— If you are delegating to a smaller indexer, it is more likely they will move 100% of their stake over to L2. This would mean you would get no rewards if you do not migrate over.

— Keep in mind the indexer rewards are being diverted from ETH to Arbitrum at staggered increments, per GIP-0052. The current amount on Arbitrum at the time of this article is 5%, but that should increase to 25% after Transfer Tools are officially out. With amount of interest in L2, it maybe beneficial to make sure 25% indexer rewards have increased to 25% prior to using transfer tools.

- Bump to 25% on L2 after releasing all L2 Transfer Tools as described in GIP-0046.

- Bump to 50% on L2 after at least two weeks of step 1, and some increase in L2 participation.

- Bump to 95% on L2 two months after step 2, as long as everything is working as expected and there is a considerable increase in L2 participation.

- Bump to 100% on L2 a month after step 3, as long as a large percentage of subgraphs have transferred to L2.

Also remember to set up your Web3 wallet 💰

Prior to using tools, its important to add Arbitrum network to your wallet and deposit some ETH because that is still used for gas fees on Arbitrum network. Many exchanges allow you to purchase ETH, then withdrawal directly to Arbitrum by choosing the chain.

Here is article on how to add Arbitrum to Metamask wallet:

How to Add Arbitrum to MetaMask | CoinGecko

Here is video showing on Coinbase how to send ETH to Arbitrum:

In conclusion, the Graph’s transition to Arbitrum Layer 2 brings a wave of excitement and promise to the decentralized ecosystem. By leveraging Arbitrum’s innovative technology, the Graph Protocol is poised to unlock new levels of scalability, speed, and cost-effectiveness. This move not only addresses existing limitations but also paves the way for a future where developers can create even more intricate and data-rich applications, without the constant worry of how much it will cost to publish a subgraph or transact on Ethereum. 🌟🔗

Do you have any questions?

Graphtronauts is the largest, unofficial community for long-term GRT holders who believe in The Graph’s web3 vision for the future. Our goal is to educate the broader crypto community and help them become contributing members within The Graph ecosystem.

If you have any questions, or concerns, or want to submit feedback, you can reach out to us using our social channels:

- App: graphtronauts.app

- Telegram: t.me/graphtronauts

- Twitter: twitter.com/graphtronauts_c

- YouTube: youtube.com/@graphtronauts

- Blog: blog.graphtronauts.com

- Warpcast: warpcast.com/~/channel/graphtronauts

- Reddit: reddit.com/r/Graphtronauts

- LinkedIn: linkedin.com/company/graphtronauts

Graphtronauts indexer is live on The Graph!

You can read our official launch announcement here.

If you want to delegate to us, you can go directly in Graph Explorer, using the link here.

You can contact us using our dedicated social channels for our Indexer operation:

- Twitter: @graphtronauts_x

- Discord: Join our Server

- Telegram: @GraphtronautsIndexer

- Delegate to us

GraphShift: Empowering Arbitrum Migration 🚀 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

Flat Tax Frenzy: Americans Debate Tax Code Overhaul on X

Conversations about adopting a flat tax in the United States are lighting...

ByglobalreutersNovember 24, 2024A Decade of BitMEX: Honouring Our Bitcoin OG Legacy

BitMEX turns 10 years old, celebrating a decade of Bitcoin OG legacy....

ByglobalreutersNovember 24, 2024Weekly ETF Recap: All Green Days for Bitcoin, But Not for Ethereum

The week marked a significant difference between investors' views of BTC and...

ByglobalreutersNovember 24, 2024WIF Shakes Off Setbacks As Bullish Resurgence Targets More Gains

WIF is making a powerful return to the market, as bullish momentum...

ByglobalreutersNovember 24, 2024

Leave a comment