- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Mastering Cryptocurrency: My Personal Exchange Platform Comparison

Top Cryptocurrency Exchanges

When diving into the world of digital assets, picking the right cryptocurrency exchange is a big deal. I’ve delved into the top platforms by looking at rankings, transaction volumes, and their overall market presence.

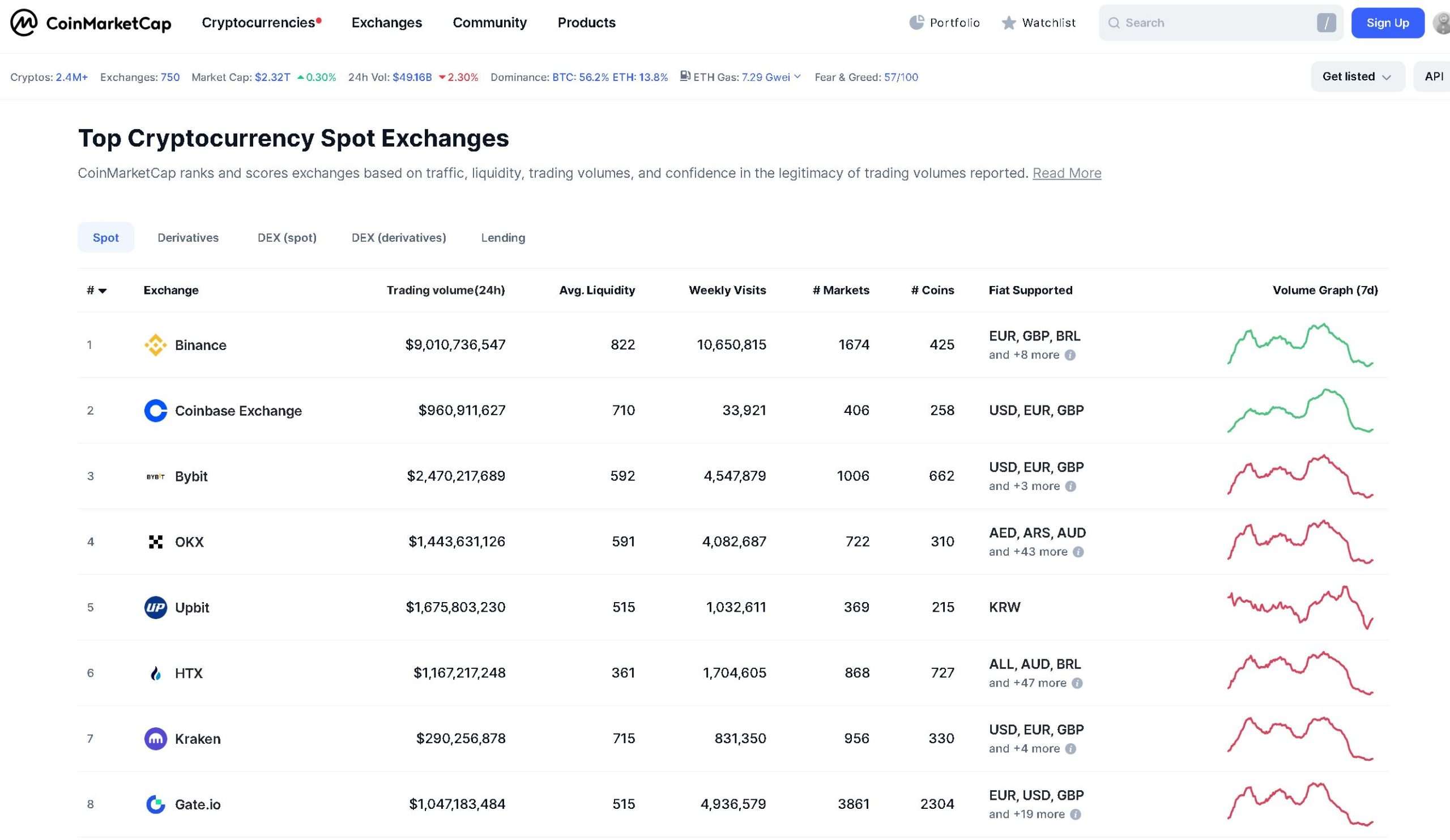

CoinMarketCap Rankings

According to CoinMarketCap, exchanges are ranked based on factors like traffic, liquidity, trading volumes, and the reliability of reported trading volumes. Right now, they’re keeping tabs on 253 spot exchanges with a total 24-hour trading volume hitting around $747.86 billion.

Here’s a quick breakdown of a few top exchanges:

| Exchange Name | 24-Hour Trading Volume (USD) |

|---|---|

| Binance | 36 billion (approx.) |

| Coinbase | 2 billion (approx.) |

| Gemini | 175 million (approx.) |

Binance: Leading the Industry

Binance is the big dog in the crypto exchange world, leading by trade volumes. It shot to the top, surpassing $36 billion in trades by early 2021 (CoinMarketCap). With a wide range of cryptocurrencies and advanced trading features, it’s a great choice for both newbies and seasoned traders.

Binance is famous for its low trading fees and vast selection of digital assets, making it easy for users to explore various investment options.

Gemini: A Growing Presence

Founded in 2014 by the Winklevoss twins, Gemini is making waves in the crypto market. With trading volumes over $175 million, it’s positioned itself as a reliable exchange as detailed by CoinMarketCap. Known for strong security, regulatory compliance, and a user-friendly interface, Gemini is a solid choice.

They even introduced the Gemini Dollar token, adding another layer to its ecosystem. For those just starting out, Gemini offers a straightforward and secure environment.

Coinbase: US Market Giant

Since its inception in 2012, Coinbase has dominated the U.S. market, boasting the largest trading volume among U.S. exchanges. With trading volumes over $2 billion in early 2021, it’s cemented its status as a market leader (CoinMarketCap).

Recognized for its intuitive design and smooth onboarding, Coinbase is highly accessible for newcomers. Plus, it offers a variety of cryptocurrencies, supporting users as they diversify their portfolios.

Exploring different platforms is crucial for anyone interested in trading. Individual preferences for features, fees, and securities should guide the choice of exchange. For more insights, check out our cryptocurrency exchange reviews and explore decentralized cryptocurrency exchanges for more options.

Key Features of Exchanges

While exploring various cryptocurrency exchanges, I discovered that certain features can greatly enhance the trading experience. Here, I’ll highlight key offerings from four exchanges: Huobi Global, Kraken, Crypto.com, and KuCoin.

Huobi Global: Derivatives Trading

Huobi Global is well-known for its extensive derivatives trading options, allowing users to engage in futures and options contracts. These offerings enable traders to speculate on price movements without actually owning the asset. This is particularly appealing for those looking to hedge investments or amplify gains.

Key Features:

| Feature | Description |

|---|---|

| Derivative Options | Futures, options, and margin trading available |

| Advanced Tools | Analytical tools for informed trading decisions |

| User-Friendly Interface | Easier navigation for both beginners and experienced traders |

Kraken: Advanced Offerings

Kraken shines with its advanced trading features, offering a robust set of tools for those diving deep into the crypto market. From margin trading to futures and staking options, Kraken is perfect for advanced traders who appreciate a sophisticated trading environment.

Key Features:

| Feature | Description |

|---|---|

| Margin Trading | Up to 5x leverage available |

| Staking Options | Earn rewards on cryptocurrency holdings |

| Security Measures | Strong focus on securing user assets |

Crypto.com: Wide Cryptocurrency Selection

Crypto.com impresses with a vast selection of over 250 cryptocurrencies for trading. This extensive offering allows users to easily diversify their portfolios. The platform also provides unique perks and rewards for Crypto.com Visa Card users, adding extra incentives for regular traders. Users can also utilize Cronos (CRO), the platform’s utility token, to lower fees and earn benefits.

Key Features:

| Feature | Description |

|---|---|

| Variety of Cryptocurrencies | Over 250 cryptos available for trading (Forbes) |

| Rewards for Card Users | Extra benefits for using the Crypto.com Visa Card |

| Fee Reduction | Pay trading fees with CRO for lower costs |

KuCoin: Altcoin Access

KuCoin is recognized for its focus on providing access to a wide range of altcoins. This exchange gives users the opportunity to invest in lesser-known cryptocurrencies that may not be available on other platforms. KuCoin also caters to a global audience, offering various trading pairs and opportunities for individuals exploring alternative investments.

Key Features:

| Feature | Description |

|---|---|

| Extensive Altcoin Selection | Access to numerous altcoins for trading |

| Low Trading Fees | Competitive fee structure for various transactions |

| User-Friendly Design | Effortless usability for newcomers and experienced traders alike |

By examining these features, users can make an informed choice when selecting a cryptocurrency exchange based on their trading needs. Each platform serves different focuses, so it is essential to consider what aligns best with individual investment strategies.

Exchange Security Considerations

When I started my journey into cryptocurrency, one of my primary concerns was the security of the exchanges I considered. With numerous high-profile hacks in the past, it’s crucial to stay informed about the security landscape of cryptocurrency exchanges.

Historical Exchange Hacks

Many exchanges have experienced significant security breaches, impacting thousands of users and resulting in enormous financial losses. For instance, Coincheck was hacked in early 2018, losing over $534 million in NEM due to storing all tokens in one hot wallet without multisignature security. The infamous Mt. Gox hack saw the theft of 80,000 BTC in 2011 and another 850,000 BTC in 2014, combined losses amounting to around $29 billion in today’s value. Additionally, in 2018, Italian crypto exchange BitGrail lost 17 million NANO coins worth $170 million, attributed to vulnerabilities in its code.

Even exchanges that are often deemed secure, like Binance, faced attacks. In May 2019, hackers stole approximately 7,000 BTC and sensitive user data from around 60,000 accounts, revealing vulnerabilities even within robust platforms.

| Exchange | Year of Hack | Amount Lost | Cause |

|---|---|---|---|

| Coincheck | 2018 | $534 million | Hot wallet insecurity |

| Mt. Gox | 2011 & 2014 | $29 billion | Unencrypted wallet files |

| BitGrail | 2018 | $170 million | Code vulnerabilities |

| Binance | 2019 | $40 million | Malware and security flaws |

Importance of Security Audits

Regular security audits are essential for any cryptocurrency exchange. These audits help identify vulnerabilities and ensure that the latest security practices are being implemented. They can also instill confidence in users by confirming that an exchange has been thoroughly evaluated by a third party.

I always look for exchanges that have up-to-date security audits available for public review. Understanding their commitment to security can influence my choice significantly.

Secure Storage Methods

One of the critical factors in keeping cryptocurrency safe is where the assets are stored. Many exchanges offer custodial storage, where they manage user assets. According to Investopedia, storing cryptocurrency private keys on a reputable and regulated exchange can be as secure as using a cold wallet, especially if the exchange offers insurance against theft. Platforms like Coinbase and Gemini provide custodial storage along with insurance for their users’ assets.

| Storage Method | Security Level | Example Exchanges |

|---|---|---|

| Hot Wallet | Less secure, connected to the internet | Binance, BitGrail |

| Cold Wallet | More secure, offline storage | Ledger, Trezor |

| Custodial Storage with Insurance | Secure and insured storage | Coinbase, Gemini |

Risks of Exchange Wallets

Using exchange wallets carries inherent risks. While convenient, exchange wallets can be vulnerable to attacks. Even exchanges with strong security measures can experience breaches. Additionally, users do not have control over their private keys, which can lead to potential loss of funds if the exchange becomes insolvent or suffers a hack.

For long-term investments, I prefer to transfer my assets to a cold wallet, ensuring that my funds remain safe from the vulnerabilities that come with using exchange wallets.

In summary, the security of a cryptocurrency exchange is paramount to protect one’s investments. Awareness of past hacks, the importance of security audits, secure storage methods, and understanding the risks associated with wallets will help me choose safer options in the volatile world of cryptocurrency. For further insights, I recommend checking out cryptocurrency exchange reviews.

Country Regulations and Legalities

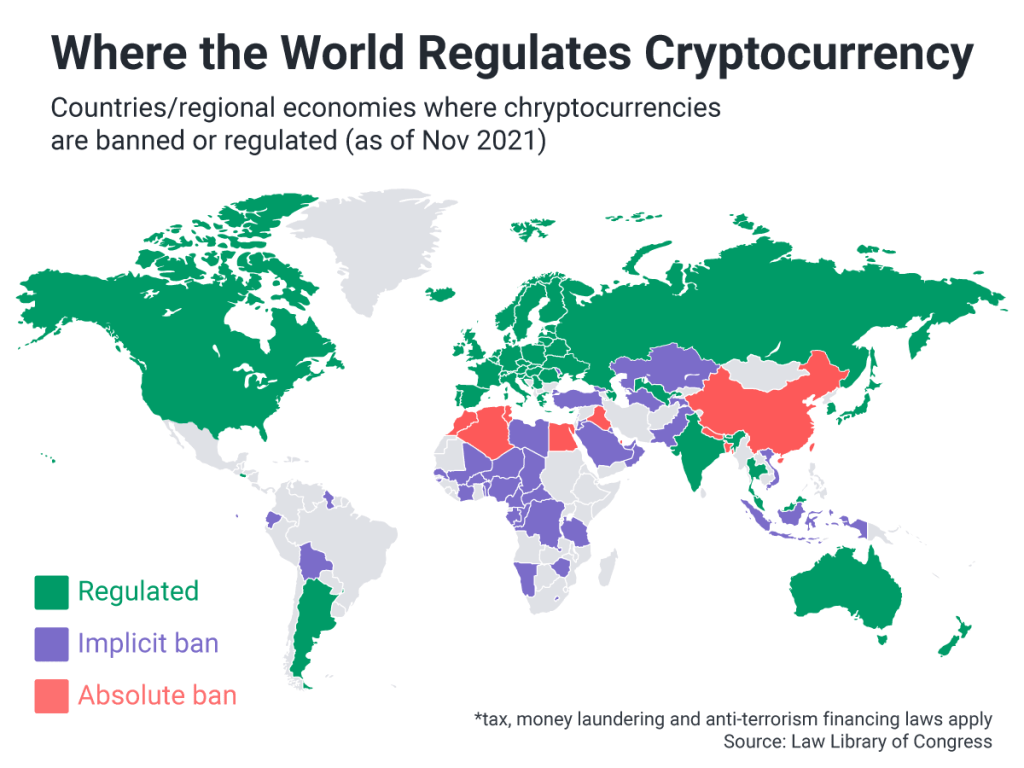

Understanding the legal landscape of cryptocurrency is crucial for anyone looking to invest or trade on various platforms. Regulations can greatly influence the functioning of exchanges and how cryptocurrencies are perceived in different jurisdictions.

Cryptocurrency Legal Status Worldwide

The legal status of cryptocurrency varies significantly across the globe. As of June 2024, El Salvador stands out as the only country that has officially accepted Bitcoin as legal tender for monetary transactions. Other countries have adopted varying approaches. For instance, Japan has clear regulations under the Payment Services Act, while China has imposed a ban on cryptocurrency exchanges, transactions, and mining, pushing for its Central Bank Digital Currency (CBDC) instead. In India, the legal framework remains pending; however, there is no current illegality, allowing exchanges to operate. The European Union has taken steps to legitimize cryptocurrencies, with regulations like the European Commission’s Markets in Crypto-Assets (MiCA) law set to standardize practices and protect users (Investopedia).

| Country | Legal Status | Noteworthy Points |

|---|---|---|

| El Salvador | Legal tender for Bitcoin | First country to accept Bitcoin legally |

| Japan | Recognized under Payment Services Act | Clear regulations in place |

| China | Ban on exchanges and mining | Focus on CBDC |

| India | No current illegality | Awaiting framework |

| European Union | Legal with regulations | MiCA implemented for standardization |

Impact of Regulations on Exchanges

Regulations play a pivotal role in shaping the operations of cryptocurrency exchanges. In July 2023, a U.S. court ruled that cryptocurrencies purchased by institutional buyers are considered securities, while those bought by retail investors on exchanges are not. This distinction represents a significant step forward for crypto enthusiasts, as it allows for more freedom in trading for the general public. However, exchanges are still subject to oversight by regulatory bodies such as the Securities and Exchange Commission (SEC), which governs coin offerings and sales to institutional buyers (Investopedia).

| Regulation Type | Impact |

|---|---|

| Institutional vs Retail | Different classifications can affect trading strategies and legal implications |

| SEC Oversight | Exchanges must comply with regulations for coin offerings, especially for institutional sales |

Legal Tender Acceptance

The acceptance of cryptocurrency as legal tender significantly impacts its use and legitimacy. El Salvador’s unique position sets it apart, as it allows Bitcoin to be used alongside the U.S. dollar for all transactions. This acceptance may contribute to greater adoption and understanding among its citizens.

In contrast, the lack of acceptance in countries like China limits the potential for day-to-day transactions and heavily restricts the market. Recognizing cryptocurrency as legal tender can enhance consumer confidence, influence trading volumes, and promote broader acceptance into the financial system (Investopedia).

| Country | Legal Tender Status | Implications |

|---|---|---|

| El Salvador | Accepts Bitcoin as legal tender | Enhanced adoption and consumer confidence |

| China | No legal tender status | Limits market potential and consumer use |

Understanding these regulations and their implications can help inform my choices when navigating through different cryptocurrency exchanges and ensures that I remain compliant while exploring the world of digital assets.

Transaction Fees Comparison

Understanding transaction fees is crucial when selecting a cryptocurrency exchange. The costs associated with buying, selling, and trading cryptocurrencies can greatly affect one’s overall investment strategy. Below, I’ll break down the fee structures of several popular platforms, including Binance, Coinbase, and Robinhood, as well as highlight various fee options across exchanges.

Binance Fee Structures

Binance, the largest cryptocurrency trading platform, employs a tiered fee structure based on trading volume over the past 30 days. They categorize users into “Makers” and “Takers.” Makers, who place limit orders, typically enjoy lower fees compared to Takers, who execute market orders.

| Trading Volume (30 days) | Taker Fee (%) | Maker Fee (%) |

|---|---|---|

| Less than $50,000 | 0.10 | 0.09 |

| $50,000 – $1,000,000 | 0.08 | 0.07 |

| $1,000,000 – $10,000,000 | 0.06 | 0.05 |

Additionally, users can opt for a 25% discount on fees by paying with Binance Coin (BNB) holdings (The Motley Fool).

Coinbase Fee Models

Coinbase features a similar fee structure to Binance, where transaction fees vary depending on the user’s trading volume over the past 30 days. Their fees are also split between Takers and Makers, with Takers usually paying a higher percentage.

| Trading Volume (30 days) | Taker Fee (%) | Maker Fee (%) |

|---|---|---|

| Less than $10,000 | 0.50 | 0.00 |

| $10,000 – $50,000 | 0.40 | 0.00 |

| Over $50,000 | 0.25 | 0.00 |

Unlike Binance, Coinbase does not offer discounts for trading fees through its own cryptocurrency (The Motley Fool).

Robinhood Commission Setup

Robinhood adopts a unique approach by offering commission-free cryptocurrency trades. This means users pay 0% fees regardless of the order type. However, Robinhood generates revenue through transaction rebates rather than executing trades directly. This can lead to slightly inflated buying prices and lower selling prices for its customers (The Motley Fool).

Varied Fee Options Across Exchanges

The landscape of cryptocurrency exchanges also features platforms with varied fee structures catering to different user preferences. For instance:

- BitMEX and FTX: These exchanges typically charge transaction fees below 0.1% for both Takers and Makers.

- eToro, ShakePay, and BlockFi: These platforms feature fee-free cryptocurrency trading options, appealing to users who prioritize minimal costs in their trading.

When considering different exchanges, it’s vital to take transaction fees into account. A fee that seems small can add up quickly, especially with high trading volumes. For further comparisons, you can check our detailed cryptocurrency exchange reviews for more insights into fee structures and other important features.

Cryptocurrency Availability

When evaluating the availability of cryptocurrencies across different exchanges, I find that the selection offered can significantly influence my trading decisions. Here, I compare four notable platforms based on their cryptocurrency offerings.

Crypto.com’s Diverse Selection

Crypto.com is known for its impressive diversity in cryptocurrency offerings. The platform supports an extensive number of cryptocurrencies, providing access to both popular and emerging digital assets. This wide selection makes it a suitable choice for traders looking to explore beyond mainstream options and diversify their portfolios. For specific numbers regarding available currencies, I recommend checking Crypto.com’s official website.

Coinbase’s Extensive Cryptocurrency List

Coinbase stands out with its user-friendly interface and offers over 240 cryptocurrencies for trading (NerdWallet). This extensive list includes major players like Bitcoin and Ethereum, as well as numerous altcoins. For beginners, Coinbase’s straightforward design facilitates easy navigation through various cryptocurrencies, making it an attractive option for newcomers to the market.

| Exchange Platform | Number of Cryptocurrencies |

|---|---|

| Crypto.com | Vast selection |

| Coinbase | 240+ |

| Kraken | 200+ |

| Gemini | Limited but specialized |

Kraken’s Wide Range of Offerings

Kraken provides over 200 cryptocurrencies, appealing to both beginner and advanced traders. As I explored its platform, I noticed that Kraken offers notably low fees for advanced trading options. The combination of a wide cryptocurrency selection and competitive fees makes Kraken an appealing choice for those looking to maximize returns.

Gemini’s Crypto Trading Specializations

Gemini has carved a niche for itself by focusing on a more limited selection of cryptocurrencies. While it may not have as many options as some of the other exchanges, Gemini’s offerings are carefully curated. This specialization allows for a more secure and reliable trading experience, particularly for established coins.

In summary, the cryptocurrency availability across these exchanges highlights the diverse options available for those interested in trading cryptocurrencies.

The post Mastering Cryptocurrency: My Personal Exchange Platform Comparison appeared first on Crypto Genius™.

Recent Posts

Categories

Related Articles

Crypto Comeback: VC Investments Soar 46% in Q4 2024

In Q4 2024, venture capital (VC) firms invested $3.5 billion into crypto...

ByglobalreutersJanuary 18, 2025Bitcoin Price Forecast Of $150,000 ‘Too Low’ Amid Rising Adoption, Crypto Trader Says

As Bitcoin (BTC) surges past $100,000 once again, edging closer to a...

ByglobalreutersJanuary 18, 2025These 5 altcoins are set to outshine Bitcoin’s rally

Analyzing 5 altcoins with the potential to outshine Bitcoin’s recent rally. #partnercontent

ByglobalreutersJanuary 18, 2025Dogecoin Price Confirms Bullish Pennant Breakout, Can DOGE Break $1 In The Coming Days?

The Dogecoin price is showing signs of a rally following a confirmed...

ByglobalreutersJanuary 18, 2025

Leave a comment