- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Netflix Stock Price Forecast: Resilience and Growth Potential

Netflix Inc. is one of the leading entertainment service networks in the world, with approximately 231 million paying subscribers in over 190 countries. They enjoy TV series, documentaries, feature films, and mobile games of various genres and languages.

Netflix operates in a strong competitive environment. And this can affect the company’s revenue. Relative service levels, content offerings, competitors’ pricing, and related features can negatively impact the company’s ability to attract and retain customers.

Netflix Finance and Stock Performance

Netflix, Inc. (NFLX) has shown impressive financial performance over recent years. As of October 2024, Netflix’s stock price is around $755.35, with a market capitalization of $322.88 billion. The stock has nearly doubled over the past year, reflecting strong investor confidence. The company’s revenue for the twelve months ending June 30, 2024, was $36.3 billion, a 13% increase year-over-year.

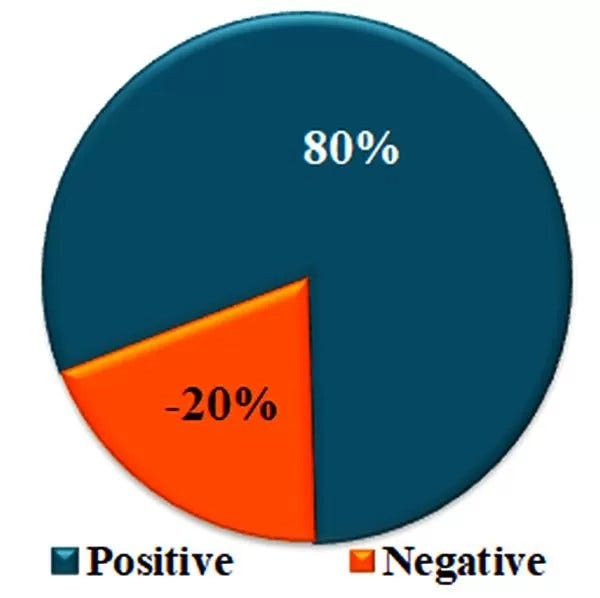

Investment Insight

The company’s investment rating has improved since our last review, underscoring its strength and resilience. This confirms that we’re dealing with a formidable company, making its shares an essential addition to our portfolio. We plan to increase our position as soon as the market experiences a correction, ensuring we capitalize on its potential growth.

Netflix stock forecast**

When to buy?

With the stock price hitting an all-time high, buying now would be imprudent. However, as Warren Buffett famously stated, rising markets tend to rise even higher, and falling markets plunge even deeper. Patience, therefore, could be key to acquiring stocks at a lower price than they are currently. This approach could yield a more favorable entry point and better investment returns in the long run.

Netflix Inc. Dividend Policy

Netflix does not currently pay dividends to its shareholders. Instead, the company focuses on reinvesting its earnings to fuel growth and expansion. This strategy aligns with Netflix’s long-term vision of dominating the streaming market and continuously improving its content offerings.

Conclusion

Netflix Inc. remains a dominant player in the entertainment industry, boasting a substantial subscriber base and strong financial performance. Despite operating in a highly competitive environment, Netflix continues to show resilience and growth. With the stock price currently at an all-time high, it may be prudent for investors to wait for a market correction before buying. Nonetheless, Netflix’s impressive financial results and strategic reinvestment make it a valuable addition to any portfolio, offering long-term growth potential.

A cup of coffee from you for this excellent analysis.

Company’s Site.

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on October 30, 2024.

Netflix Stock Price Forecast: Resilience and Growth Potential was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Recent Posts

Categories

Related Articles

Franklin Templeton Files for Solana ETF With Staking—Is SOL Set for Institutional Adoption?

Franklin Templeton has filed for a Solana ETF, aiming to track SOL’s...

ByglobalreutersFebruary 22, 2025Can we escape DeFi’s Ouroboros? Bridging real-yield in 2025

The following is a guest article from Mike Wasyl, CEO at Bracket....

ByglobalreutersFebruary 22, 2025Microsoft’s New Chip Could Speed Up Bitcoin’s Quantum-Resistance Timeline

Microsoft’s latest quantum computing chip, Majorana 1, might accelerate the need to...

ByglobalreutersFebruary 22, 2025Bitcoin Surges Past $99,000 Following Dovish Remarks From Atlanta Fed President Bostic

After spending more than two weeks trading in the mid-$90,000 range, Bitcoin...

ByglobalreutersFebruary 22, 2025

Leave a comment