The Super Signals Channel V3 is revolutionizing forex trading by providing an advanced, data-driven approach to identifying market opportunities. This cutting-edge tool uses sophisticated algorithms to analyze vast amounts of market data and deliver high-quality signals that can guide traders towards potentially profitable trades. By removing much of the guesswork from trading decisions, the Super Signals Channel V3 enhances accuracy and efficiency, making it an indispensable asset for both novice and experienced traders. Its ability to distill complex market information into clear, actionable signals makes it a game-changer in the forex trading landscape.

Complementing this tool is the Mean Reversion Forex Trading Strategy, a highly effective method rooted in the principle that prices tend to return to their historical averages over time. This strategy is particularly powerful because it capitalizes on the natural ebb and flow of market prices, allowing traders to identify when a currency pair is trading at an extreme relative to its average. By anticipating a reversion to the mean, traders can position themselves advantageously to profit from price corrections. This method not only provides a structured approach to trading but also enhances the potential for capturing significant gains.

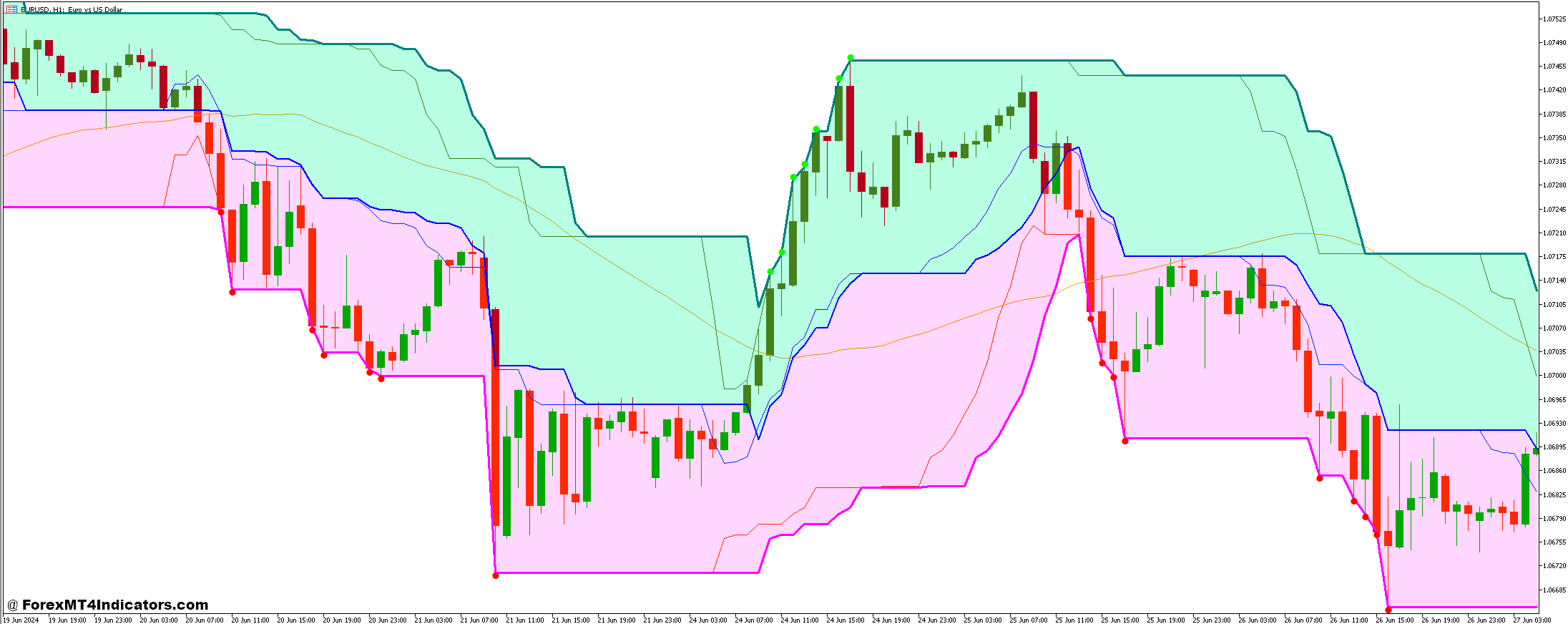

When the Super Signals Channel V3 is integrated with the Mean Reversion strategy, the result is a powerful trading framework that leverages the strengths of both tools. The Super Signals Channel V3 can provide precise signals that indicate when mean reversion opportunities are most likely to arise. This synergy allows traders to act on these signals with greater confidence, targeting trades that align with historical price behavior and expected corrections. The combination of accurate signal generation and strategic mean reversion enhances the overall effectiveness of the trading approach.

The effectiveness of this integrated strategy lies in its ability to offer a comprehensive solution to market trading challenges. The Super Signals Channel V3 ensures that traders receive timely, actionable insights, while the Mean Reversion strategy provides a solid framework for making those insights actionable. Together, they create a robust trading approach that not only simplifies decision-making but also maximizes the potential for successful trades. For traders seeking to elevate their performance and achieve better outcomes, this powerful combination represents a significant advantage in the competitive forex market.

Super Signals Channel V3 Indicator

The Super Signals Channel V3 is an advanced forex trading indicator that stands out for its precision and reliability. This tool employs sophisticated algorithms to analyze market data and generate actionable trading signals. By processing large volumes of information in real time, the Super Signals Channel V3 helps traders identify potential entry and exit points with high accuracy. Its signals are designed to highlight optimal trading opportunities, making it easier for traders to execute well-timed trades and capitalize on market movements.

What makes the Super Signals Channel V3 particularly powerful is its adaptability to changing market conditions. Unlike static indicators, it continuously adjusts its parameters based on real-time data, ensuring that the signals it provides remain relevant and effective. This dynamic approach helps traders stay ahead of market trends and reduces the likelihood of false signals. By incorporating a range of technical factors and indicators, the Super Signals Channel V3 offers a comprehensive tool for improving trading decisions and enhancing overall performance.

Mean Reversion Indicator

The Mean Reversion strategy is a time-tested approach in forex trading, grounded in the principle that prices tend to revert to their historical average after experiencing significant deviations. This indicator focuses on identifying when a currency pair’s price strays too far from its mean, suggesting a forthcoming correction. The core idea is that extreme price movements are often followed by a return to more typical levels, creating opportunities for traders to profit from these reversions.

Utilizing the Mean Reversion strategy involves monitoring price trends and detecting when a currency pair is trading at an extreme level relative to its historical average. Traders look for signs that the price is likely to revert, such as overbought or oversold conditions. By anticipating these corrections, traders can enter or exit positions strategically, aiming to benefit from the price adjustments. This strategy offers a structured approach to trading that capitalizes on predictable market behavior, making it a valuable tool for managing risk and maximizing trading opportunities.

How to Trade with Super Signals Channel V3 and Mean Reversion Forex Trading Strategy

Buy Entry

- Identify Extreme: Check if the price is significantly below its historical average, indicating a potential mean reversion opportunity.

- Super Signals Confirmation: Wait for a buy signal from the Super Signals Channel V3 when the price is in an oversold condition.

- Entry Point: Enter a buy trade when the Super Signals Channel V3 indicates a buy signal and the price is near or below the lower boundary of the channel.

- Stop-Loss: Set a stop-loss just below the historical price extreme or the lower boundary of the channel to protect against significant adverse moves.

- Take-Profit: Set a take-profit level near the historical average or the upper boundary of the channel. Consider using a risk-reward ratio like 1:2 to guide your target.

Sell Entry

- Identify Extreme: Check if the price is significantly above its historical average, suggesting a potential mean reversion.

- Super Signals Confirmation: Wait for a sell signal from the Super Signals Channel V3 when the price is in an overbought condition.

- Entry Point: Enter a sell trade when the Super Signals Channel V3 indicates a sell signal and the price is near or above the upper boundary of the channel.

- Stop-Loss: Set a stop-loss just above the historical price extreme or the upper boundary of the channel to manage risk.

- Take-Profit: Set a take-profit level near the historical average or the lower boundary of the channel. Use a risk-reward ratio like 1:2 to determine your target.

Conclusion

Combining the Super Signals Channel V3 with the Mean Reversion Forex Trading Strategy offers a robust framework for making informed trading decisions. The Super Signals Channel V3 provides timely, data-driven signals that help pinpoint optimal entry and exit points, enhancing the precision of trades. When paired with the Mean Reversion strategy, which focuses on capturing price corrections as they revert to historical averages, traders gain a comprehensive approach that leverages both real-time market insights and established price behavior patterns. This synergy allows traders to identify high-probability trading opportunities, manage risk more effectively, and optimize their trading performance. By using these tools in combination, traders can enhance their ability to navigate the complexities of the forex market, improve their decision-making process, and potentially achieve more consistent and profitable results.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Save

Save

Leave a comment