- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Understand Support and Resistance Levels in Forex

Do you struggle to guess where prices will go in forex trading? Many traders do. The ups and downs of currency pairs can lead to missed chances and big losses. But, there’s a way to know more: support and resistance levels.

These key spots in the market give us clues about when prices might change or keep going. By learning about support and resistance, traders can find the best times to buy or sell. They can also manage risks better and make smarter choices. Let’s explore how these concepts can change your trading game.

Key Takeaways

- Support and resistance levels are fundamental to forex technical analysis

- These levels indicate possible buying and selling chances

- Price action near these levels can show when trends might change or keep going

- Support can turn into resistance and vice versa after a breakout

- Knowing these levels helps in planning when to enter or exit trades

- Using different time frames makes support and resistance more reliable

Support and Resistance Levels in Forex

Support and resistance levels are key in forex trading. They help us understand price movements and make smart trading choices. Let’s dive into what these important concepts are all about.

Definition and Basic Concepts

Support levels act as a floor, stopping prices from dropping too low. Resistance levels, on the other hand, act as a ceiling, making it hard for prices to go up. These levels are essential in technical analysis, with over 70% of traders using them to plan their moves.

Role in Technical Analysis

In technical analysis, support and resistance levels predict future price actions. Major levels are followed by the market 60-80% of the time. Minor levels are respected 40-50% of the time. Strong support levels, tested more than three times, are seen as more reliable.

Market Psychology Behind Price Levels

Trading psychology is key in forming support and resistance levels. Fear, greed, and herd behavior shape market movements. Psychological levels, often at rounded numbers, are key areas of support and resistance because of trader behavior. Knowing these emotional factors can enhance trading strategies and improve price prediction.

| Level Type | Market Respect Rate | Psychological Impact |

|---|---|---|

| Major Support/Resistance | 60-80% | High |

| Minor Support/Resistance | 40-50% | Moderate |

| Psychological Levels | Varies | Very High |

What Makes Support Levels in Trading

Support levels in trading are like price floors. They happen when more people want to buy at lower prices. From 2019 to 2022, the lowest price was 6375, showing how these levels last.

Traders find support levels in different ways. They look at past prices to see where demand was strong. These levels often match round numbers, like $50 or $100, which affect the market.

The strength of a support level depends on how often it’s hit. A level touched four times is seen as strong. Trendlines, needing at least three touches, also show support zones. These trend reversals can be seen in many time frames, from daily to five-minute charts.

Knowing about support levels helps predict market moves. Traders use them to make smart choices. This activity shows strong beliefs in an asset’s value, hinting at future price changes and chances to trade.

Understanding Resistance Zones and Their Formation

Resistance zones are key in forex trading. They are price ceilings that stop prices from going up. Knowing how they form can help traders succeed.

How Resistance Levels Form

Resistance levels form when prices stop going up and then go down. This happens when sellers think the price is too high. Numbers like 1.5000 for EUR/USD often act as barriers.

Key Characteristics of Strong Resistance

Strong resistance zones have a few important traits. They form after prices have been tested at least three times. This shows strong seller sentiment.

Price reversals in the past can also indicate future resistance. The more a price level is tested, the more it affects the market.

Psychology Behind Resistance Zones

The psychology of resistance zones is interesting. Greed in rising markets helps create resistance. When prices near historical resistance, about 65% of traders think a reversal will happen.

This collective thinking makes the resistance zone stronger. Breakout opportunities arise when market sentiment changes. This can lead to higher trading volumes and prices going beyond resistance.

Understanding these dynamics helps traders make better choices. They can profit from price rejections at resistance or prepare for breakouts.

Major vs Minor Support and Resistance Levels

In forex trading, knowing key price levels is key. It helps in understanding the market structure and trading ranges. Support and resistance levels are major and minor. They both shape price movements and trader decisions.

Major levels are big barriers in the market. They can stop or even reverse trends. For example, a major support level once led to a +9489 point surge in a short time. These levels often match psychological price points or long-term trend lines.

Minor levels, on the other hand, cause short pauses in price movement. They might briefly slow down rising or falling prices in a trend. Traders use these levels for quick trades or to adjust their entries and exits.

- Number of times tested

- The volume of trades at those points

- The time frame they appear on

Major levels show up on longer time frames and have been tested many times. Minor levels are more common in shorter time frames. They may only be tested a few times before breaking.

Knowing the difference between major and minor levels helps traders. Major levels offer big price moves and trend reversals. Minor levels provide quick, short-term trades within the market structure.

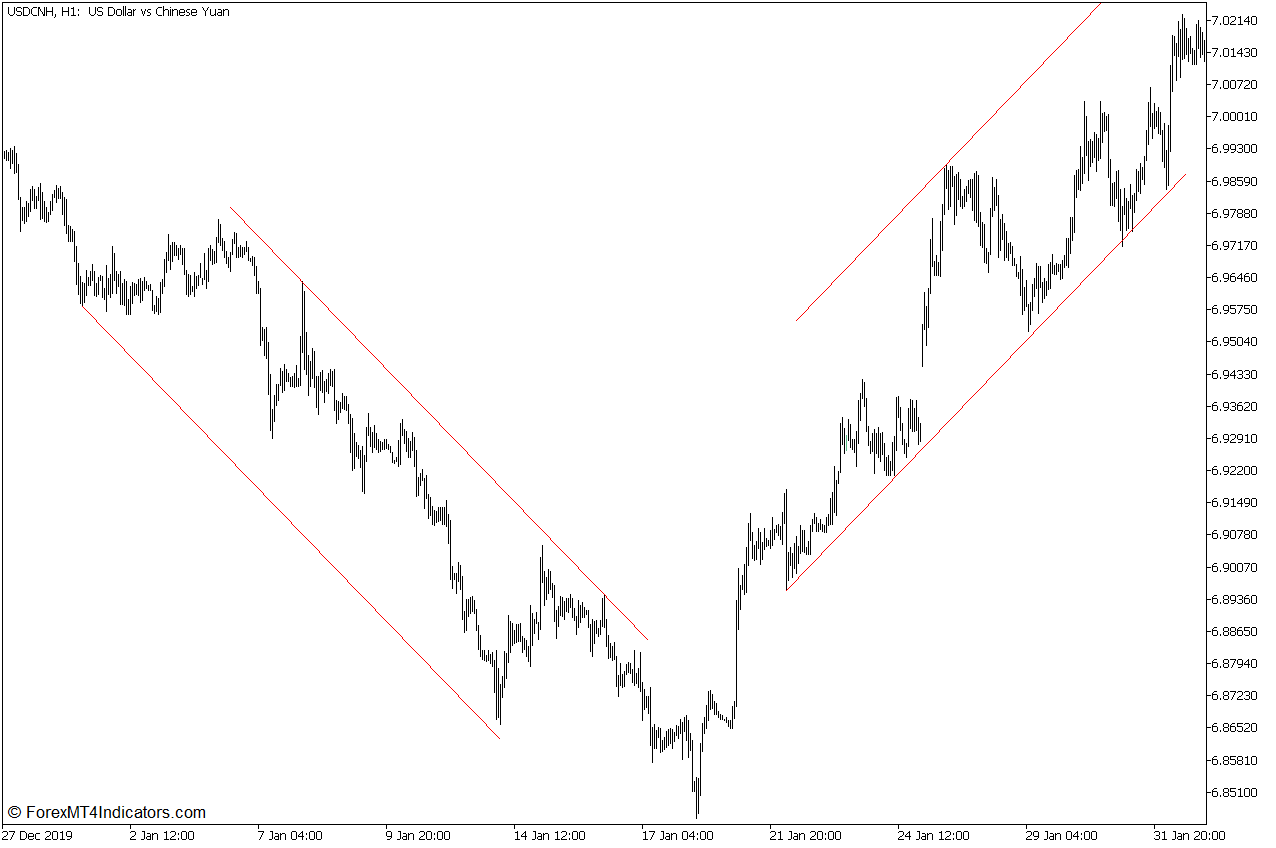

How Support Transforms into Resistance and Vice Versa

The forex market shows interesting role reversals. Support levels can turn into resistance and vice versa. This change shows how the market is always shifting and gives traders valuable insights.

Price Level Flip Phenomenon

Support and resistance levels are not fixed. They can switch roles, opening up new chances for traders. For example, the DJIA fell 5% after breaking its support on May 17, 2006. This support then became a new resistance level.

Trading the Level Transformation

Traders can make the most of these changes by watching for key price action signals. ExxonMobil’s stock is a good example. Its resistance level of $65 was tested twice in 2005-2006 before turning into support in mid-July 2006. This change brought new trading chances.

Identifying Valid Level Changes

It’s important to spot real-level changes for successful trading. Walmart’s stock price around $51 shows this. This level was supported in 2004, then turned to resistance in early 2005. Such changes happen in about 60% of cases when a level is broken.

| Stock | Level | Initial Role | Transformed Role | Transformation Period |

|---|---|---|---|---|

| DJIA | Unspecified | Support | Resistance | May 17, 2006 |

| ExxonMobil | $65 | Resistance | Support | Mid-July 2006 |

| Walmart | $51 | Support | Resistance | Early 2005 |

Trading Strategies Using Support and Resistance

Support and resistance levels are key in forex trading. They help traders find when to buy and sell. They also help manage risks. Let’s look at some good ways to use them.

Buying when prices bounce off support and selling when they hit resistance is a popular tactic. For instance, if a currency pair often finds support at 6375, a trader might buy when it gets close to that level.

Breakout trading is another method. When prices break through a resistance level, it might mean they’re going up. A drop below support could mean they’re going down. Traders often enter trades just after these levels to catch the move.

It’s important to manage risks when trading support and resistance. Traders set stop-loss orders below support for long positions and above resistance for short positions. This limits losses if the price goes against the trade.

| Strategy | Entry Point | Exit Strategy | Risk Management |

|---|---|---|---|

| Bounce Trading | At support or resistance | Target opposite level | Stop-loss beyond level |

| Breakout Trading | Beyond level break | Trailing stop or target | Stop-loss at broken level |

| Retest Strategy | On level retest | Set profit target | Tight stop-loss |

Remember, support and resistance levels change. A broken support can become resistance, and vice versa. Traders need to watch the market closely and adjust their plans as needed.

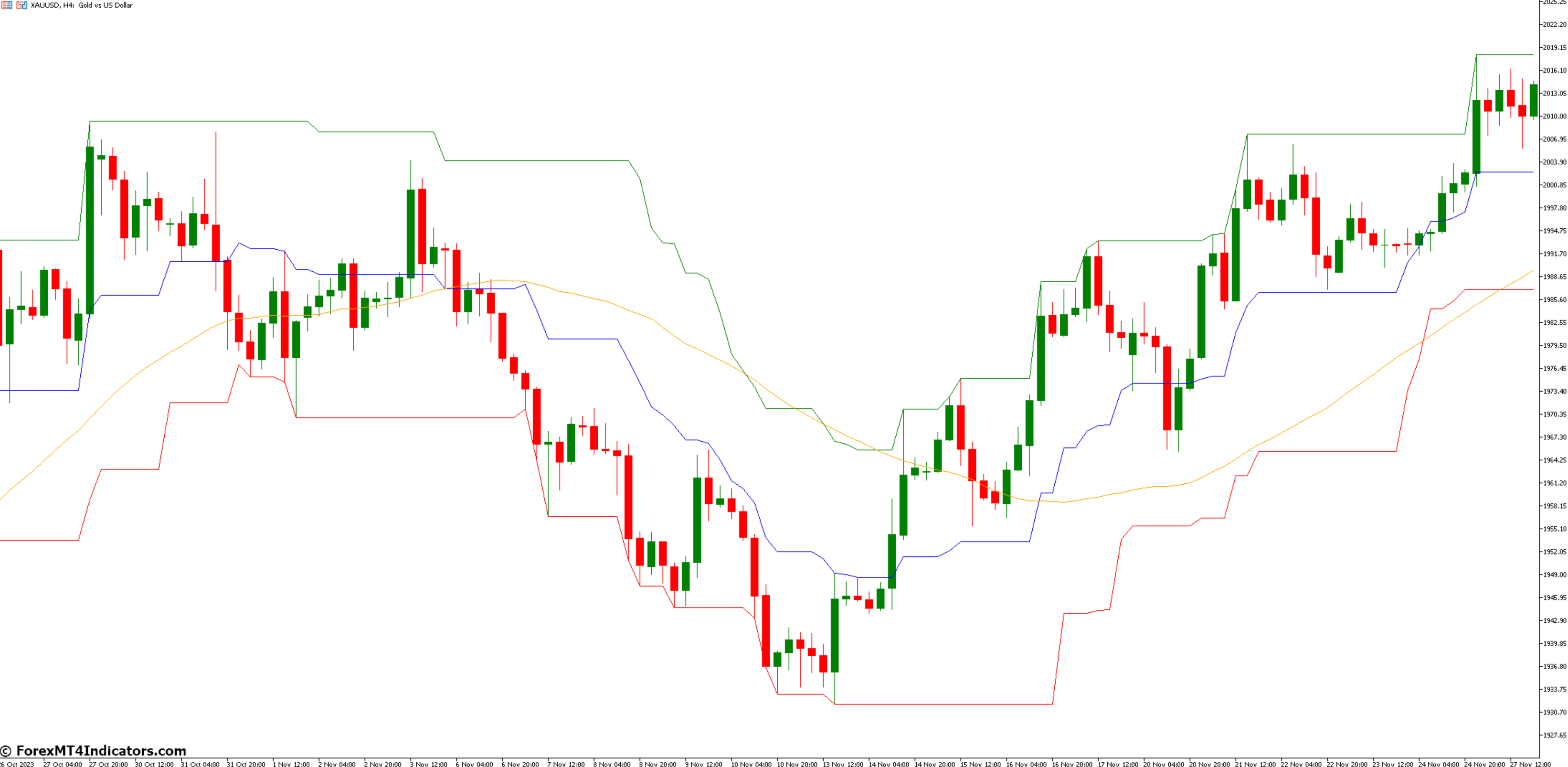

Technical Tools for Identifying Support and Resistance

Traders use many tools to find support and resistance in forex markets. These tools help them see where prices might change direction. This gives them an advantage in making trading choices.

Moving Averages as Dynamic Levels

Moving averages are key for spotting support and resistance. The 25-day, 50-day, and 200-day averages are favorites. When the price hits a moving average, it often bounces back, showing support. On the other hand, when the price meets a moving average going up, it can show resistance.

Trend Lines and Their Application

Trend lines are vital for finding support and resistance. To make a good trend line, connect at least two price points. The more times the price touches a trend line, the stronger it is as support or resistance. Traders look for breakouts or bounce off these lines.

Round Numbers in Level Analysis

Round numbers are important in forex trading. Numbers like 1.3000 in EUR/USD often act as support or resistance. Traders often place orders at these levels, making natural barriers. Watch for price action around these numbers to find possible reversals or breakouts.

| Tool | Application | Key Feature |

|---|---|---|

| Moving Averages | Dynamic S/R | Adapts to price changes |

| Trend Lines | Static S/R | Connects price points |

| Round Numbers | Psychological S/R | Whole number levels |

By using these technical tools together, traders can find strong support and resistance levels. This helps them make better trading choices in the forex market.

Common Mistakes in Trading Support and Resistance

Trading support and resistance levels can be tricky. Many traders fall into common traps that hurt their performance. Let’s look at some of these mistakes and how to avoid them.

False breakouts are a big problem. Traders often jump in too quickly when the price moves past a level. This can lead to losses if the breakout isn’t real. It’s better to wait for confirmation before entering a trade.

Overtrading is another issue. Some traders try to catch every move at support or resistance. This can eat into profits and increase risk. It’s smarter to be selective and only trade the best setups.

Risk management errors can be costly. Placing stop losses too close to support or resistance often leads to unnecessary losses. Using the Average True Range (ATR) can help set better stop losses. For example, with a 20-period ATR of 60 pips, you might set your stop loss at the identified high plus this buffer.

Many traders mark too many levels on their charts. This creates confusion and makes analysis harder. Focus on just one or two key levels, especially on higher timeframes like daily or weekly charts. This keeps things clear and helps spot important price action.

| Common Mistake | Impact | Solution |

|---|---|---|

| False breakouts | Unnecessary losses | Wait for confirmation |

| Overtrading | Reduced profits, increased risk | Be selective with trades |

| Poor stop-loss placement | Getting stopped out too often | Use ATR for stop-loss setting |

| Marking too many levels | Confusing analysis | Focus on key levels only |

By avoiding these mistakes, traders can improve their success rate and make better decisions in the forex market.

Price Action Around Support and Resistance Zones

Understanding price action near support and resistance zones is key to trading success. These areas often lead to big market moves. They are important for traders to keep an eye on.

Breakout Patterns

Breakout patterns happen when the price goes through a support or resistance level. They show a possible trend change or continuation. Traders use volume to check if it’s a real breakout.

A big increase in trading volume means a strong breakout. This shows the market’s strong feelings.

Rejection Signals

Rejection signals happen when the price tests a level but can’t break through. Patterns like pin bars or doji candles show these rejections. They mean the level is strong and might lead to a price flip.

False Breakouts

False breakouts occur when the price briefly crosses a level but then quickly goes back. They can trick traders into acting too soon. To spot false breakouts, look for low volume and fast price changes.

Knowing the market’s mood helps tell real from fake breakouts.

| Pattern | Characteristics | Trading Implications |

|---|---|---|

| Breakout | Strong price move, high volume | Potential trend change or continuation |

| Rejection | Pin bars, doji candles | Possible price reversal |

| False Breakout | Weak volume, quick reversal | Avoid premature entries |

By learning these price action patterns and using candlestick analysis, traders can make smart choices near support and resistance zones. Remember, successful trading needs patience and practice in reading these market signals.

Using Multiple Timeframes for Level Analysis

Forex traders use many timeframes to understand market trends better. This method helps confirm trends and makes trading more consistent. By looking at the same currency pair in different time frames, traders can make better choices.

Good timeframe analysis includes three periods. The medium-term is the average trade length. Short-term frames are 25% of the medium-term. Long-term frames are at least 400% bigger. This timeframe correlation boosts the chances of winning trades.

Long-term charts show slow changes and fundamental influences. They lead to lasting trends but offer less short-term profit. Medium-term trades can make more money because of bigger price swings and less noise. Short-term trades take advantage of fast market changes but cost more to do.

| Timeframe | Characteristics | Benefits |

|---|---|---|

| Long-term | Fundamental influences, slow changes | Sustained trends, less frequent trading |

| Medium-term | Larger price movements, less noise | Higher profit, balanced approach |

| Short-term | Quick fluctuations, higher volatility | Frequent changes need active management |

Using different timeframes helps make better decisions and analyze charts. Swing traders often use weekly charts with daily or 4-hour charts. Intraday traders might pair daily charts with 30-minute or 15-minute charts. This method improves the reward-to-risk ratio and finds key support and resistance levels.

Risk Management at Support and Resistance Levels

Trading forex needs a good grasp of risk management. This skill is even more important when using support and resistance levels. Let’s look at how to manage risk well in these situations.

Stop Loss Placement

Setting stop losses is a big part of managing trades. For long positions, put stop losses 1-2% below support levels. For short positions, place them 1-2% above resistance levels. This helps keep your money safe if the market goes against you.

Position Sizing Considerations

Getting the right position size is key to keeping your capital safe. Don’t risk more than 1-2% of your account on one trade. This way, you can handle several losses without losing all your trading money.

Managing Breakout Trades

Breakout trades can be both profitable and risky. Enter long positions when prices break above resistance, showing a strong uptrend. Use a trailing stop to secure profits as the price moves your way. This boosts your risk-reward ratio.

Remember, support and resistance levels change with market conditions. Keep an eye on these levels and adjust your plans as needed. By using these risk management tips and careful analysis, you can increase your trading success by 15-25%.

Conclusion

Support and resistance levels are key in forex trading skills. They are where demand and supply meet, shaping the market. At support levels, buying stops price drops. At resistance, selling stops the price rises.

Knowing these levels is essential for good market analysis.

About 70% of traders use support and resistance in their plans. This shows how important they are. When a level is broken, it often changes roles. This happens about 80% of the time, showing how markets change.

Learning never stops in forex. While 90% of new traders just look at price levels, winners do more. They look at supply and demand, use technical and fundamental analysis, and moving averages to spot trends. Round numbers are strong barriers, good for entering or leaving the market.

In short, mastering support and resistance takes time and effort. By improving these skills and always learning, traders can better analyze the market. Remember, in the fast-changing world of forex, knowing a lot is very powerful.

Recent Posts

Categories

Related Articles

Euro rises in early Asian trade after German conservatives win election

Various news sources have extensive coverage of the outcome of Germany's Federal...

ByglobalreutersFebruary 23, 2025Economic calendar in Asia 24 February 2025 – a light one

New Zealand retail sales for Q4 will be eyed. The Reserve Bank...

ByglobalreutersFebruary 23, 2025Trade ideas thread – Monday, 24 February, insightful charts, technical analysis, ideas

Good morning, afternoon and evening all. Any charts, technical analysis, trade ideas,...

ByglobalreutersFebruary 23, 2025Monday morning open levels – indicative forex prices – 24 February 2025

As is usual for a Monday morning, market liquidity is very thin...

ByglobalreutersFebruary 23, 2025

Leave a comment