- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

US Bitcoin ETFs surpass $100 billion, pose challenge to largest Bitcoin holders

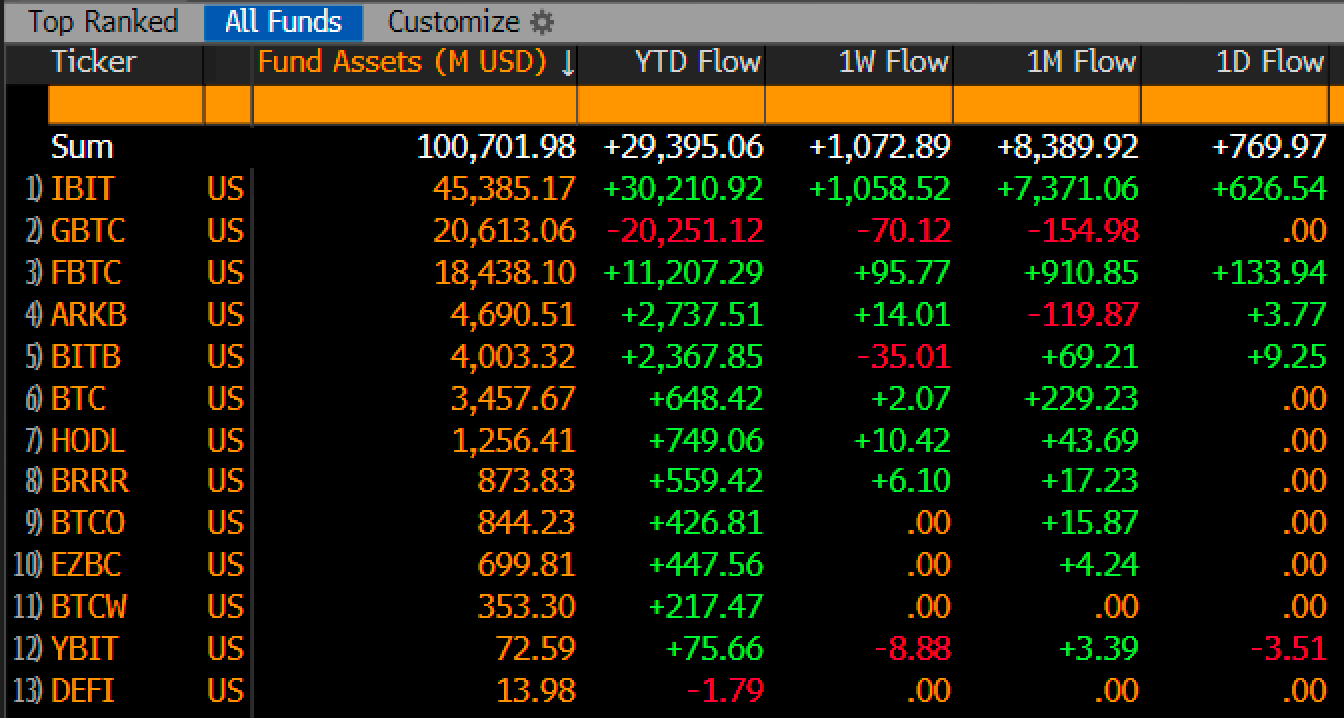

Spot Bitcoin exchange-traded funds (ETFs) have reached an impressive benchmark, crossing $100 billion in net assets. According to SoSoValue data, this achievement represents 5.4% of Bitcoin’s total market value.

The 12 Bitcoin ETFs, launched by prominent issuers such as BlackRock and Fidelity, have reached this milestone in just 10 months since their debut in January. Leading the pack is BlackRock’s iShares Bitcoin Trust (IBIT), which manages $45.4 billion in assets.

Grayscale’s GBTC takes the second spot with $20.6 billion, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows in third with $18.4 billion. Other notable contributors include the Ark 21 Shares BTC ETF (ARKB) at $4.6 billion and Bitwise BITB at $4 billion.

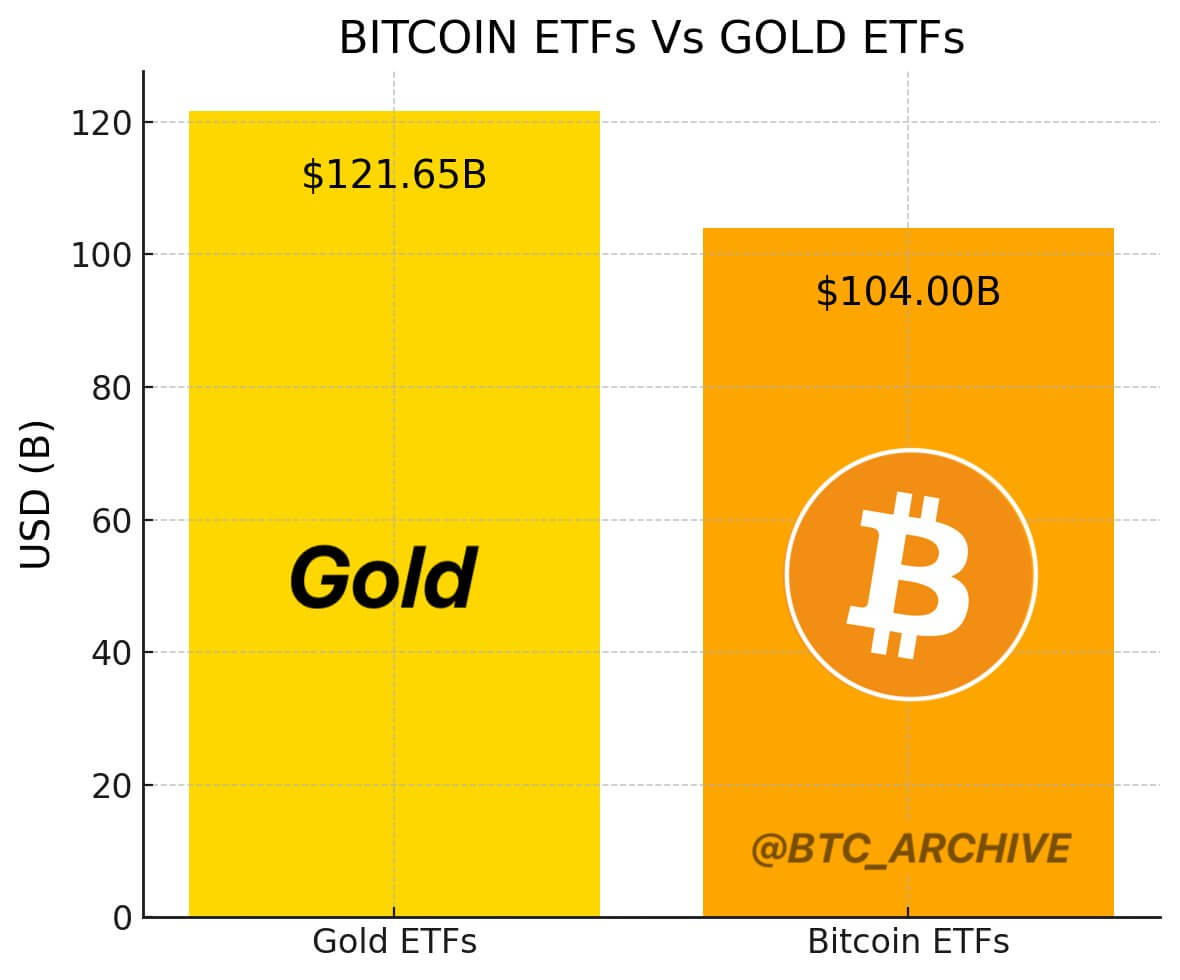

The rapid growth of spot Bitcoin ETFs makes them one of the most successful fund categories to date. Bloomberg ETF analyst Eric Balhcunas stated that the numbers show that the funds are close to overtaking Satoshi Nakamoto as the largest Bitcoin holder while advancing steadily toward surpassing gold ETFs in asset value.

The post US Bitcoin ETFs surpass $100 billion, pose challenge to largest Bitcoin holders appeared first on CryptoSlate.

Recent Posts

Categories

Related Articles

Study: 76% of X Influencers Promoted Now-Defunct Meme Coins

A Coinwire study reveals that most crypto influencers on X promote worthless...

ByglobalreutersNovember 22, 2024XRP Army Rejoice Ripple’s 26% Daily Price Surge With Predictions of Up to $30 Per Coin

XRP is above $1.4 for the first time since May 2021.

ByglobalreutersNovember 22, 2024Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin has shattered expectations once again, surging past the critical $93,257 level...

ByglobalreutersNovember 22, 2024XRP jumps 25% as SEC may not pursue appeal after Gensler’s departure

Gensler's departure may lead to a more favorable regulatory environment for crypto,...

ByglobalreutersNovember 22, 2024

Leave a comment