- Home

- Features

- Business

- Active

- Sports

- Shop

Top Insights

Will Crypto Explode in January: Why is Crypto Down Today and Will it Recover in 2025?

Why is crypto down today? Well, not today, exactly. But it has been over the last few days. Santa Clause rally be damned!

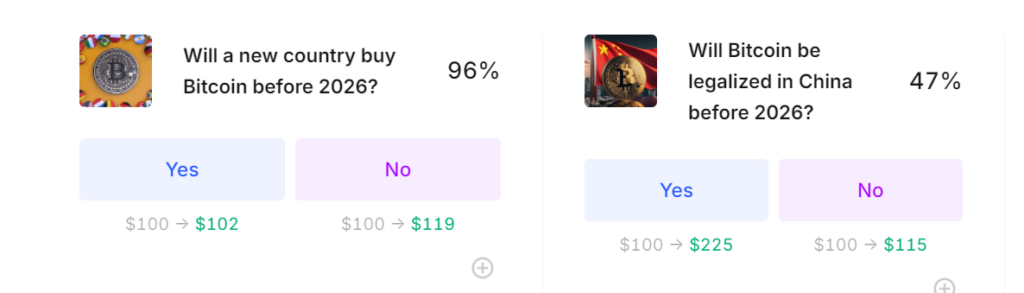

Crypto markets are bracing for a seismic shift, with platforms like Polymarket and Kalshi hinting that 2025 might redefine everything. Bitcoin (BTC)

![]()

![]()

Price

Trading volume in 24h

Last 7d price movement

and Ethereum (ETH)

![]()

![]()

Price

Trading volume in 24h

Last 7d price movement

are tipped to shatter records.

At the same time, anticipated regulatory overhauls could redraw the U.S. crypto landscape, shaking up how these assets are traded and secured.

Betting market Kalshi puts Bitcoin’s chances of soaring past $125,000 in 2025 at a solid 60%, with Ether trailing but still likely to clear $5,000. Polymarket players hold the line slightly lower but remain bullish, giving Bitcoin 50/50 odds of breaking $120,000 by March 2025.

With all-time highs of $108,300 for Bitcoin and $4,720 for Ether, these projected milestones could cement their roles as heavyweight contenders in the global financial arena.

Why is Crypto Down Today? Bitcoin and Ether Target New Records

The push for cryptocurrency-based ETFs is fueling bullish momentum. Polymarket odds show a strong chance that U.S. regulators will approve ETFs for XRP (75%), Solana (69%), and Litecoin (51%) by mid-2025, while Dogecoin lags behind with a modest 22% shot. These ETFs could lure traditional investors with regulatory safety nets, injecting fresh liquidity and speeding up adoption across the market.

One of the more intriguing developments is the speculation around a strategic Bitcoin reserve. Kalshi indicates a 59% probability that the incoming Trump administration could establish such a reserve during his presidency—though Polymarket places the odds at a more modest 29% for this occurring within his first 100 days in office.

2025 will be known as the "Bitcoin Trump Pump"

.

Enjoy your week off before blasting off. pic.twitter.com/69NRpe7DEf

— Bitcoin Munger (@bitcoinmunger) December 26, 2024

Should this happen, Bitcoin’s role could evolve into something far bigger, pushing nations to recognize it as a strategic reserve. It would mark a turning point, making digital assets a legitimate part of official financial frameworks globally.

EXPLORE: Biggest Meme Coin Of 2024! The Year’s Biggest Winners In Review

A Different Take in Futures Markets

While prediction markets paint a largely optimistic picture, more traditional financial instruments like futures markets are cautious.

Traders on the Chicago Mercantile Exchange (CME) predict Bitcoin’s spot price at $98,000 and Ether’s at $3,500 by March 2025—below the ambitious targets set by Kalshi and Polymarket but still reflecting substantial growth.

Futures markets, built on speculation and hedging, tend to cut through the noise, offering a tempered view that balances hype with market realities.

EXPLORE: 11 Best AI Crypto Coins to Invest in 2024

What’s Next for Crypto in 2025?

Skeptics aside, the 2025 crypto forecast remains sanguine, if not the most hyped year ever for Bitcoin. 2025 could usher in mainstream adoption, cutting-edge financial products, and heightened government engagement with digital currencies. For investors, the play is clear—stay informed and educated.

With Bitcoin aiming for mid-six figures and new ETFs dominating the narrative, the scene is anything but banal. 2025 might just rewrite the script for digital assets in global finance.

EXPLORE: Ukraine deems Bitcoin illegal, Coinbase fights for new $50 million founding round and more

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Will Crypto Explode in January: Why is Crypto Down Today and Will it Recover in 2025? appeared first on 99Bitcoins.

Recent Posts

Categories

Related Articles

Bahrain Digital Exchange ATME Introduces Tokenized Gold

Bahrain’s ATME, a regulated digital asset exchange, has launched gold-backed tokens, a...

ByglobalreutersMarch 9, 2025XRP Price Is Consolidating Within This Pattern — What’s Next?

The XRP price performance has been one of the bright spots in...

ByglobalreutersMarch 9, 2025The 5 Best Bitcoin Mining Pools in 2025: Complete Guide

A comprehensive breakdown of some of the best Bitcoin mining pools to...

ByglobalreutersMarch 9, 2025Trump, Bitcoin, memecoins and ETFs: Women in Crypto dive deep into regulation and the future of finance

Bitcoin price volatility, shifting narratives in crypto and U.S. President Trump’s executive...

ByglobalreutersMarch 8, 2025

.

.

Leave a comment